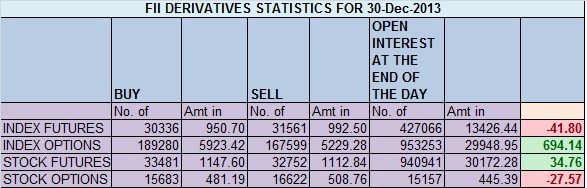

- FIIs sold 1225 contracts of Index Future worth 42 cores with net Open Interest increasing by 2603 contracts, so FII’s added shorts in today’s session.

- Nifty opened with a gap up made a high of 6344 and pulled back, as discussed in last analysis. 6259 still holds the key for bulls,Holding the same we can see a bounce back to 6344-57 levels. Tomorrow we have yearly closing so NAV adjustment hence we can see a move at closing time so cautious is advised on trades.

- Nifty Future January Open Interest Volume is at 1.92 cores with liquidation of 4.9 lakhs in Open Interest,with decrease in cost of carry signalling long liquidation and short addition.

- Total Future & Option trading volume at 0.66 lakh with total contract traded at 1.4 lakh, .PCR (Put to Call Ratio) at 0.89.

- 6500 Nifty CE is having highest OI at 43.9 lakhs , still remain resistance. 6300 CE added 2.1 lakh signalling call writers holding the base strong at 6300. 6200-6400 CE added 11.3 Lakh in OI.

- 6200 PE is having highest OI at 34.4 lakhs suggesting strong support at 6200 and will be short term bottom of the market. 6300 PE added 3 lakh suggesting fight on from 6300. 6200-6400 PE added 3.8 Lakh in OI.

- FIIs bought 116 cores in Equity ,and DII sold 207 cores in cash segment.INR closed at 61.89

- Nifty Futures Trend Deciding level is 6346 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6252 and BNF Trend Changer Level (Positional Traders) 11528.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6303 Tgt 6332,6352 and 6374 (Nifty Spot Levels)

Sell below 6280 Tgt 6262 ,6250and 6232 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

hi Bramesh,

thanks as usual. could you explain, what happnes during NAV adjustment and which side movement is expected at that time.

thanks

Tarun

Hi Tarun,

Again move will be based as per system. NF is trading below TC/TD level suggesting a downside move possible. Again we always ut SL to protect us if market goes against us.

Rgds,

Bramesh