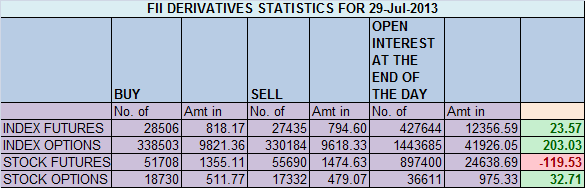

- FIIs bought 1071 Index Future worth 23 cores with net Open Interest decreasing by 4199 contracts.FII’s went for short covering in Nifty Futures and in Bank Nifty futures. FII’s are going neutral for RBI event. Secret for Successful trading

- Nifty closed below its 200 DMA, before the crucial RBI Policy. Nifty opened with a gap down of 30 points , trading was dull throughout the trading sessions but the effect of Three Black crow bearish candlestick pattern was seen today. As discussed in Weekly analysis Nifty Spot till it trades below 5900 bears will be in power. Today Nifty made High of 5886 and turned back to close below 200 DMA. Now Nifty is entering the support zone of 5776-5810 where we can see bounce back so traders carrying short can book profit in the range. Bank Nifty traders can read the Weekly analysis

- Nifty Future July Open Interest Volume is at 1.81 cores with addition of 1.23 lakhs in Open Interest, more shorts getting added in the system with increase in CoC.

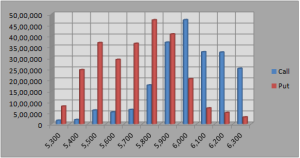

- Total Future & Option trading volume at 0.75 lakh with total contract traded at 52 week low of 1.47 lakh , PCR (Put to Call Ratio) at 0.95, .VIX formed a bullish engulfing rising 8% with options premium and IV’s rising. If RBI policy turns out to be non event,Option sellers will make merry as premiums were quiet high in both call and put options.

- 6000 Nifty CE is having highest OI at 47.3 lakhs with addition of 3.1 lakhs in OI, is wall of resistance. 5900 CE added 5.4 lakh in OI and having second highest OI at 37.4 lakh. 5600-6200 CE added 10 lakh in OI.

- 5800 PE OI at 47.2lakh remain the highest OI , remains strong support for market, dips near 5800 can be bought by intraday traders for rise till 5840 odd levels .5600-6200 PE added 3.3 lakh in OI.

- FIIs sold in Equity in tune of 231 cores ,and DII sold 101 cores in cash segment ,INR closed at 59.38.

- Nifty Futures Trend Deciding level is 5779 (For Intraday Traders).Nifty Trend Changer Level 5938 and Bank Nifty Trend Changer level 10867.

Buy above 5850 Tgt 5869,5900 and 5945(Nifty Spot Levels)

Sell below 5810 Tgt 5790,5765 and 5749(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863