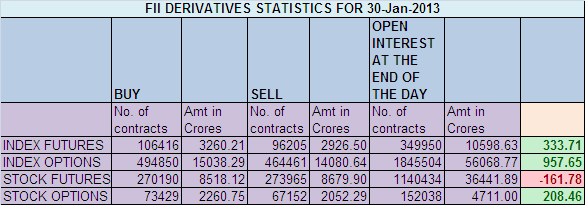

1. FIIs bought 10211 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 333.71 cores with net Open Interest increasing by 44721 contracts. How to Build Self Discipline in trading?

2. As CNX Nifty Future was up by 11 points with Open Interest in Index Futures increasing by 44721 so FIIs again went long in Nifty and Bank Nifty. Traders do remember Mini Nifty Future will stop trading from tommrow and no rollovers can be made in Mini Nifty.

3. NS closed at 6056 after making high of 6072 and low of 6044.No follow up move was seen in Nifty after yesterday’s RBI cut in interest rates.Tomorrow we have the January month Expiry,Nifty is up just 2.5% for Jan series with 21110 cores buying in cash by FII which shows supply pressure coming at higher levels.CNX Mid cap is down 2% and Nifty Junior is down 1.5% for the Jan series so eventhough Nifty has given positive return broader market has felt the brunt of bears. Although sensex is just 5% away from making a life high but many favorite traders stock are still down 90-95% from the highs seen in 2007 so retail stock traders are still in pain and still avoiding stock market. Nifty is consolidating in range of 6100-6007 from past 9 trading sessions and i expect expiry also to happen in this range only. We have Monthly closing tommrow and Nifty has reacted from the Monthly chart trendline at 6120 as discussed in weekly analysis.

4. Resistance for Nifty has come up to 6072 and 6090 which needs to be watched closely ,Support now exists at 6041 and 6022.Trend is Sell on Rise till 6100 is not broken on closing basis.

5. Nifty Future January Open Interest Volume is at 0.88 cores with liquidation of 6.5 lakh in Open Interest, liquidation of long in Nifty future.Cost of Carry of Nifty Future increased to to 25 as expiry is just 1 day away.Rollovers have started in Nifty Future and 6.5 lakhs got rollovered to Feb Series and 10 lakhs of fresh addition.We have seen 72 lakh addition in range of 6014-6120 as of now.

6. Total Future & Option trading volume at 1.68 lakh Cores with total contract traded at 1.52 lakh, PCR (Put to Call Ratio) at 0.91 and VIX at 14.38. Again a dull day in Nifty futures and stock specific action.

7. 6200 Call Option is having highest Open Interest of 1.21 lakhs with liquidation of 6.6 lakhs in Open Interest, 6100 Nifty CE is having second highest OI at 7.98 lakh liquidation of 3.8 lakhs in OI,with Option premium at Rs 6 we discussed yesterday short got added in 6100 CE ,6000 CE saw liquidation of 3.3 lakhs in OI .5700-6300 Call Options liquidated 20 lakhs in OI. Bulls are unable to break 6100 and Bears unable to break 6000. So Fight will go till expiry.Looking at Option Data Expiry should happen in range of 6100-6010.

8. 6000 Put Option is having highest Open Interest of 83 lakhs with addition of 0.03 lakhs in OI so base building strike price has moved to 6000.6100 Put Option liquidated 1.75 lakhs with OI at 27.9 lakhs so bulls were forced to liquidate there shorts in 6100 PE .5700-6300 Put Options liquidated 13.2 lakhs in OI.

9. FIIs buying in Equity in tune of 906 cores and DII sold 1095 cores in cash segment,INR closed at 53.2 Live INR rate @ http://inrliverate.blogspot.in/).FII has bought 21110 cores in cash and DII sold 16399 cores.

10. Nifty Futures Trend Deciding level is 6057(For Intraday Traders), Trend Changer at 6033 NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). Bank Nifty Future Trend Changer Level 12740.

Buy above 6070 Tgt 6085,6101 and 6112

Sell below 6041 Tgt 6021,6000,6015,5968(Nifty Spot Levels)

Upper Range of Expiry:6101

Lower Range of Expiry:6010

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.