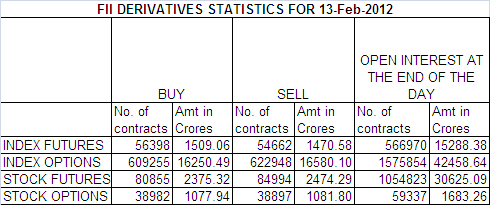

Below is my Interpretation of FII OI data Sheet for 13-Feb-12.

1. FII bought 1736 Contracts of NF worth 38.48 cores OI also decreased by 17784 contracts. On Friday FII sold 51,102 contracts worth 1400 Cores.

2. As Nifty Futures was up by 20 points and OI has decreased by 17785 contracts means profit booking was done by FII. Still No shorting signal

3. What Nifty has done from past 6 days. It has been consolidating in a tight range of 100 points from 5320-5428. Sideways market are followed by a trending market.This phase is worst phase for traders as they buy in anticipation of breakout and sell in anticipation of breakdown and gets whipsawed on both ends. Best Strategy let the market decide what it wants to do and than go with flow. Money Saved is money earned.

4.On daily Charts Nifty has formed a Double Doji pattern and INSIDE DAY pattern today.I am waiting for an explosive move to take place in next 2 trading days,As Tuesdays has a good history of Nifty making century so lets be prepared for next move in Nifty.

5. FII did lot of day trading today as there average SELL price is 4432 cores only so buying at SAR level and selling on upper end.

6. Nifty OI has increased by 5 lakh contract.Total OI stands at 2.47 cores contracts, As pointed out before 2.6 is maximum ceiling on upside and going by that fact we analyzed that 5435-50 range should not break easily and Nifty obliged us

7.Total F&O turnover was 1.13 Lakh cores and total number of contract traded were 2.79 lakhs which was lowest contract traded till date in Feb series. Volumes are getting less on upside.

8. One Interesting Observation it has been 6 day Nifty has closed above 200 DMA which is a good boaster for Bulls, Now the analogy market is overbought and should correct cannot be true every time. Do not believe my words See the 2009-10 Charts on Nifty with RSI and MACD it was overbought for most part of year so Do not short BLINDLY just looking at overbought nature of indicators.

9. In equity FII bought 469 cores DII sold 597 cores.Foreigners Keep buying Indian equity and Indian MF keeping selling them

10.5500 CE is having highest OI of 72 Lakhs whereas 5300 PE is having the highest OI 77 Lakhs,Below 5320 we will see the first sign of weakness.

10. Shorts were added in 5300-5500 PE worth 18 lakh Contracts. Once FII strated covering the Options we can see trending moves again

11. FII SAR has increased to 5393 and VWAP at 5305.

Buy above 5430 Tgt 5450,5476 ,5500 and 5520

Sell below 5385 Tgt 5354,5317 and 5294

All levels mentioned are SPOT levels.

Either be with trend or stay out but never be against the trend to be in market for long period of time.

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

SIR YOUR YAHOO ID PLEASE,THNKS

I dont understand “2.6 max ceiling on the upside”. please help me understand this

Any typo error in point 5 “avg sell price 4432 cores” ?? isnt it around 5380 considering number of contracts and amount on the sell side

Dear bramesh,

I would like to add one point. please add one point in this analysis about the performance of the levels given on last day. I think you must be maintaining the performane sheet so it would not take additional work. hope u will understand.

thanx

rahul

SIR FII SAR SHLD BE TKN AS INTRADY OR POSITIONAL & WT IS VWAP……THANX

Take it as Intraday for Time being I will update when to use it for positional trading on FB page

Rgds,

Bramesh

THANK SIR & VWAP.

SIR YOUR CALLS BUY OR SELL ARE POSITIONAL OR INTRADAY FOR EXAMPLE TODAY I HAVE BOUGHT BAJAJ AUTO WHICH HAVE NOT ACHIEVED FIRST TARGET OR BREACHED SUPPORT I AM STILL HOLDING PLEASE GUIDE. THANKS

Dear Sir,

Try not to carry forward the calls taken from intraday perceptive. If neither tgt has come or Sl jst square off the position you can always trade the next day.

Rgds,

Bramesh

Dear Sir,

SAR means Stop and Reverse below this level NF will be weak and Bears will become active.basically shorts should be taken below this level with a 20 point sl or Days high as SL depending on your risk profile.

SIR MAINLY SAR & VWAP,THANKS

SIR PLEASE CLEAR NO 11 IN SIMPLE & FULLFORM PLEASE. THANKS