A Market at War: FIIs Build Bearish Fortress Against Unprecedented Retail Euphoria

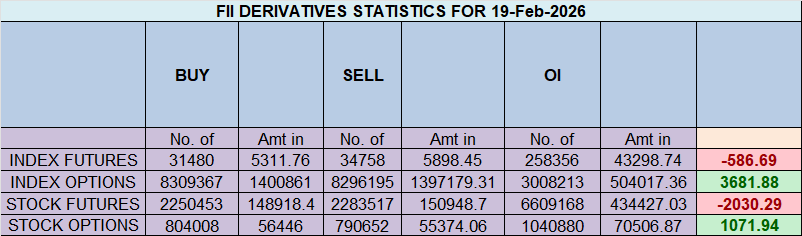

On February 20, 2026, the Nifty Index Futures market gave one of its most potent signals of an impending volatility explosion. While the headline figure showed a modest net short of 1,702 contracts by Foreign Institutional Investors (FIIs), the real, earth-shattering story was the colossal surge in net Open Interest (OI) of 9,664 contracts.

This is not the signature of a trending or consolidating market. This is the definitive footprint of a market at war, with two powerful, opposing armies bringing massive new capital to the battlefield in a direct, high-stakes confrontation.

Decoding the Data: Two Armies with Absolute, Opposing Convictions

This data reveals a market stretched to its breaking point by one of the most extreme divergences between institutional and retail sentiment on record.

1. The FII Bears: Building for Conflict, Not Just a Trend

The FIIs’ actions were a masterclass in professional, bearish positioning.

-

They aggressively added 7,013 new short contracts, building a formidable wall of supply.

-

Simultaneously, they also added 3,735 new long contracts. This is not a sign of confusion; it is a sign they are positioning for a massive, two-sided battle, with a clear and overwhelming bearish bias.

-

This has cemented their positioning at an extreme 23% long versus 77% short (ratio 0.30), a clear, institutional bet on a significant decline.

2. The Client Bulls: A Tidal Wave of Peak Euphoria

In a stunning display of defiant optimism, the retail clients did not just meet the institutional selling—they overwhelmed it with bullish fervor.

-

They added a colossal 9,355 new long contracts, willingly and fearlessly absorbing the entire institutional supply and then some.

-

In a move of supreme confidence, they also covered 4,621 short contracts, completely abandoning their downside protection at a potential market top.

-

Their positioning has now peaked at a euphoric 67% long versus 33% short, with a sky-high ratio of 2.26. They are all-in on a continued rally.

Key Implications for the Market

-

An Imminent Volatility Supernova: The massive OI surge is the definitive proof that new, high-conviction money is pouring in to fuel this conflict. This level of tension is unsustainable and will be resolved by a violent, high-velocity move.

-

The Ultimate Contrarian “Red Alert”: This is a textbook “smart money vs. dumb money” setup at its most extreme. The combination of peak retail euphoria and extreme institutional bearishness is historically one of the most reliable signals of a major market top.

-

A Historic Divergence: The positional chasm between the institutions and retail is now at a maximum. The market cannot prove both right.

-

The “Pain Trade” is Obvious: The path of maximum financial pain is a sharp decline that would trigger a devastating liquidation cascade from the massive and highly exposed base of retail longs.

Conclusion

Ignore any small, choppy price movements. The only story that matters is the colossal, high-stakes battle being waged beneath the surface, confirmed by the explosive surge in Open Interest. The FIIs have built a bearish fortress, and retail has launched an all-out bullish assault. This is a powder keg, and a major, violent resolution is no longer a question of “if,” but “when.”

Last Analysis can be read here

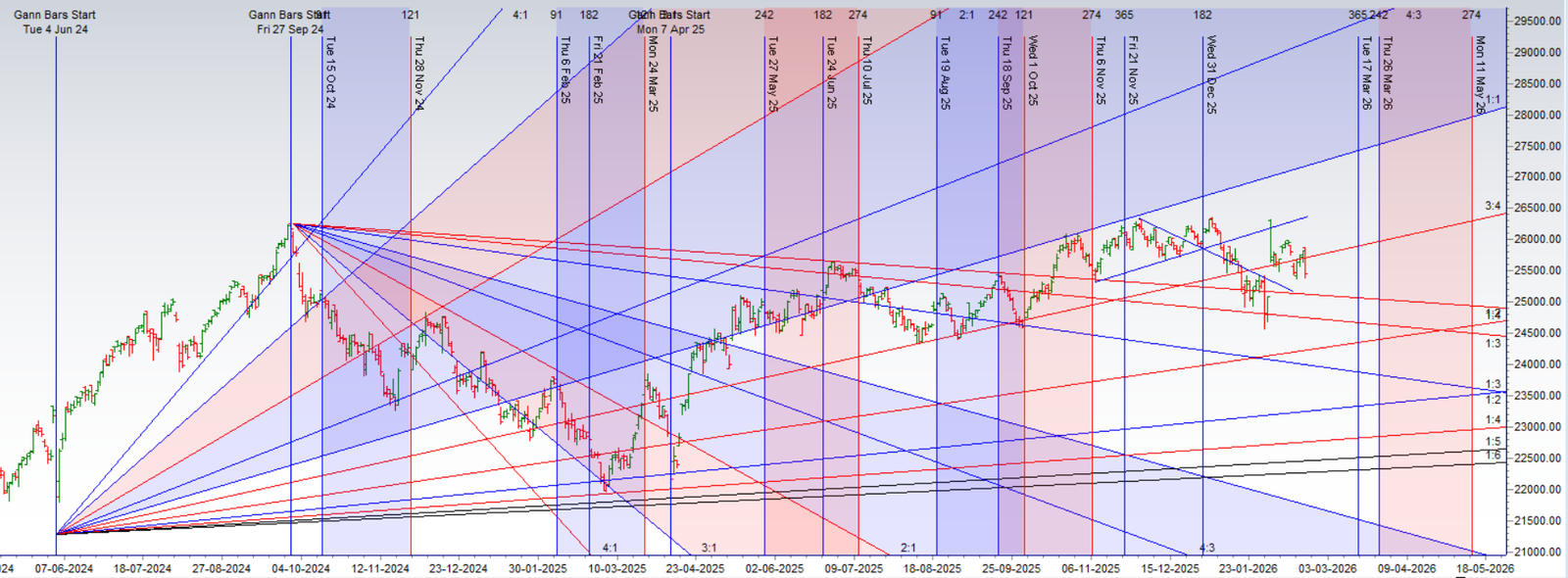

The market continues to move with uncanny precision, flawlessly adhering to our astro-technical model. As forecast in our weekly analysis for members, the Nifty saw a decent decline, with the prevailing bearish energy correctly identifying weakness. This successful validation of our forecast now brings us to an even more critical juncture: a high-stakes weekly close that will be directly influenced by a new, potent astrological event.

1. The High-Voltage Catalyst: Venus Square Mercury HELIO

Today’s session is charged with a powerful, fast-acting astrological aspect known to be very important for short-term trading: a Venus-Mercury square. This is the celestial equivalent of a tense argument between the planet of finance/value (Venus) and the planet of trading/communication (Mercury). This aspect is notorious for creating:

-

Sharp, conflicting price swings.

-

High intraday volatility and “whipsaw” action.

-

A market struggling to find a clear, agreed-upon value, leading to a fierce battle between buyers and sellers.

This planetary conflict ensures that a quiet, drifting session is highly unlikely. It will force the market to a decision point.

2. The High-Stakes Verdict: The Battle for the Weekly Close

This intense cosmic energy is being unleashed upon the market at the most crucial time: the weekly closing session. The price action today is not just about intraday direction; it is a strategic battle to “paint the weekly chart” and set a powerful psychological and technical tone for the entire week ahead. The final 30 minutes of trading will be the ultimate arbiter, delivering the final verdict.

Both sides have clear, unambiguous objectives:

-

The Bullish Counter-Offensive: The bulls are on the defensive, but they have a clear path to reclaiming control of the trend. Their mission is to invalidate the bearish momentum and stage a powerful recovery.

-

The Trigger: A decisive move and hold above 25,531.

-

The Targets: A successful breakout would signal a renewed rally towards 25,611 / 25,691.

-

-

The Bearish Continuation: The bears have the clear momentum from the recent decline. Their goal is to press their advantage and secure a decisive, weak weekly close.

-

The Trigger: A decisive break below the 25,372 support.

-

The Targets: A breakdown here would unleash a new wave of selling, targeting a swift fall towards 25,313 and ultimately 25,256.

-

Conclusion

Today is a day of decision. The market is being forced out of its indecision by a potent short-term astrological aspect, and its verdict will be sealed in the final moments of the crucial weekly close. The battle lines are drawn with military precision at 25,531 on the upside and 25,372 on the downside. The outcome of this high-volatility fight will not only determine the winner of today’s session but will also likely set the market’s primary trend for the week to come.

Nifty Dec Futures Open Interest Volume stood at 1.61 lakh cr , witnessing addition of 9 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of SHORT positions today.

Nifty Advance Decline Ratio at 06:44 and Nifty Rollover Cost is @25405 closed above it.

In the cash segment, Foreign Institutional Investors (FII) sold 880 cr , while Domestic Institutional Investors (DII) sold 596 cr

The Nifty options market is signaling a state of extreme bearish control and capitulation. A profoundly negative Put-Call Ratio (PCR) of just 0.57 is the definitive evidence of this, indicating that call open interest is nearly double that of puts. This is the classic signature of a market overwhelmed by aggressive call writers who have built a colossal wall of resistance, reflecting their supreme confidence that any attempt at a rally will be brutally suppressed.

This heavy bearish sentiment has pushed the market decisively below its financial center of gravity, the Max Pain point of 25,600. With the spot price trading significantly lower at 25,454, the index is in a position of extreme technical weakness, confirming the complete dominance of the sellers.

The participant data reveals a critical story of institutional positioning:

-

Foreign Institutional Investors (FIIs) were the primary drivers of the negative sentiment, acting as massive net sellers of call options. They were the architects of the resistance wall that is now capping the market.

-

The broader market, particularly retail, seems to have capitulated, showing a massive unwinding of put positions as they abandoned hope for any downside protection, feeding into the bearish momentum.

This has forged a clear and formidable battlefield:

-

Resistance: A “Great Wall of Calls” is located at the 25,600 strike, which now acts as the primary and most formidable ceiling.

-

Support: On the downside, a significant support floor has been built by put writers at 25,300. The ultimate line of defense and psychological support is located at 25,000.

In conclusion, the Nifty is in a deep bear grip. The path of least resistance is firmly to the downside. The market is trapped, and any relief rally is likely to be sold into aggressively at the 25,500-25,600 zone.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25617. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25607, Which Acts As An Intraday Trend Change Level.

Nifty Spot – Intraday Chart Observation

Technical Setup: The index is approaching critical breakout levels. Watch these zones for price action confirmation:

-

Strength (Upside): Momentum is expected to pick up if Nifty sustains above 25531. In this scenario, the immediate resistance levels are 25576, 25610 and 25666

-

Weakness (Downside): The trend technically weakens if the index slips below 25424 This could open the path towards support levels at 25400, 25372 and 25313.

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators