Institutional Analysis: FIIs Maintain Bearish Grip Ahead of RBI Verdict

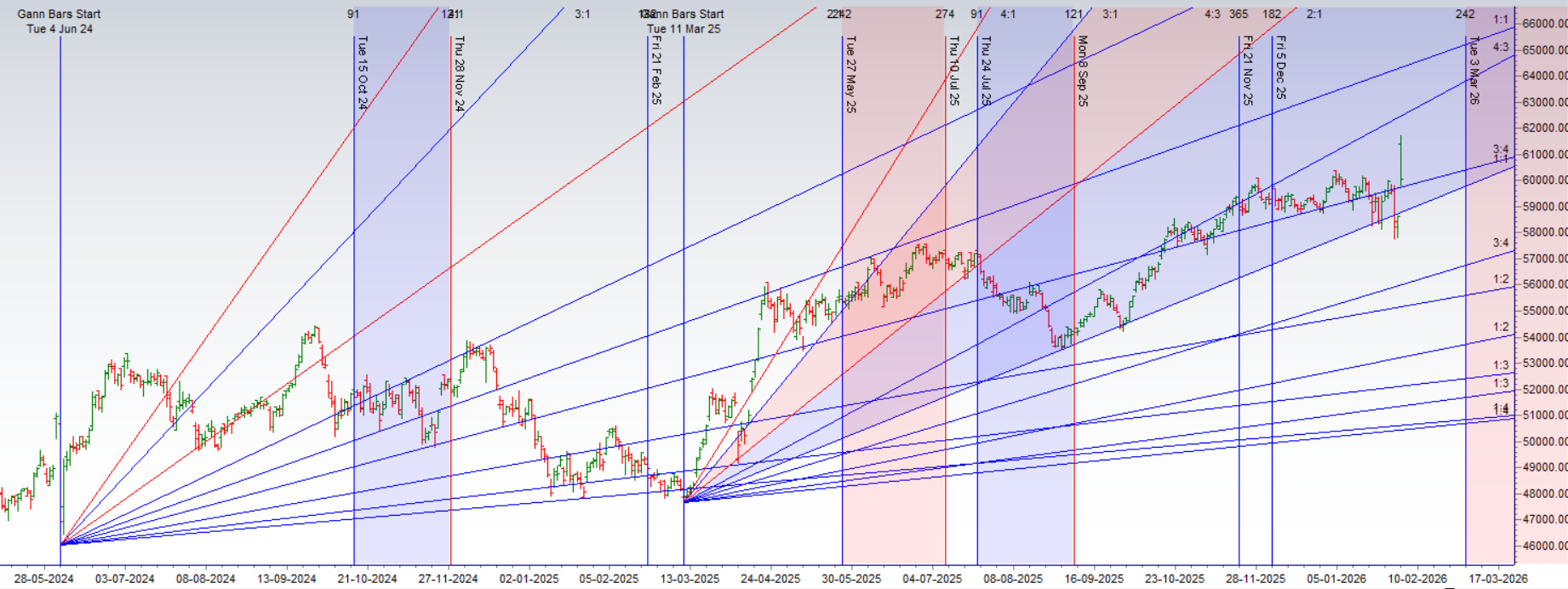

On February 05, 2026, the Bank Nifty Index Futures market continued to witness a deliberate bearish stance from Foreign Institutional Investors (FIIs). As the index coils in a tight range at a critical Gann Angle support, the institutional data reveals a lack of confidence in the immediate upside.

FIIs net shorted 921 contracts (valued at 166.43 crore), contributing to a total decrease in net Open Interest (OI) of 213 contracts. This combination of fresh shorting and a dip in OI is a classic signal of long liquidation—bulls are exiting their positions rather than new buyers stepping in to defend the support.

The “Coiled Spring”: Gann Levels & RBI Impact

The market is currently braced for the RBI Monetary Policy announcement (10:00 AM, Feb 6). With the Repo Rate currently at 5.25%, the street is widely expecting a pause after a cumulative 125 bps cut cycle. However, the technical and astrological setup suggests the “quiet” is about to end.

Last Analysis can be read here

Today’s RBI Monetary Policy announcement (Feb 6, 2026) arrives at a critical technical and astrological juncture for the Bank Nifty. With the index currently coiling in a tight range, we are witnessing a “coiled spring” setup that is typical before a major volatility expansion.

The Astrological Shift: Mercury in Pisces

Mercury has just transitioned into Pisces (effective today, Feb 6). In financial astrology, Mercury in Pisces is considered its “detriment,” often leading to ambiguous communication or market “noise.” This shift, occurring precisely during the RBI’s policy communication, suggests that the market’s initial reaction might be confusing or non-linear. However, as Mercury moves through Pisces, it invites a “break from logic,” which often coincides with sharp, sentiment-driven moves rather than purely fundamental ones.

Gann Technical Setup & Key Levels

The index is currently hovering at a Gann Angle Support level. The price action is defining a very clear “make or break” zone:

-

The Bearish Trigger (59,790): This is the “Line in the Sand” for the bulls. A decisive break below 59,790 signals that the Gann support has failed. This would likely trigger a rapid gap-filling move down toward the major Gann target of 59,319.

-

The Bullish Confirmation (60,300): On the upside, 60,300 acts as the immediate structural resistance. A breakout above this level would invalidate the current consolidation and open the doors for a rally toward the next Gann magnets at 60,666 and potentially the psychological hurdle of 61,000.

Market Outlook

The RBI is widely expected to maintain the status quo (5.25%), but the focus will be on the “neutral” stance and liquidity management.

Turning Trading Regrets into Tuition: How to Learn from Your Worst Decisions

Bank Nifty Dec Futures Open Interest Volume stood at 15.2 lakh, with liquidation of 1.4 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closeuer of LONG positions today.

Bank Nifty Advance Decline Ratio at 07:07 and Bank Nifty Rollover Cost is @59457 closed above it.

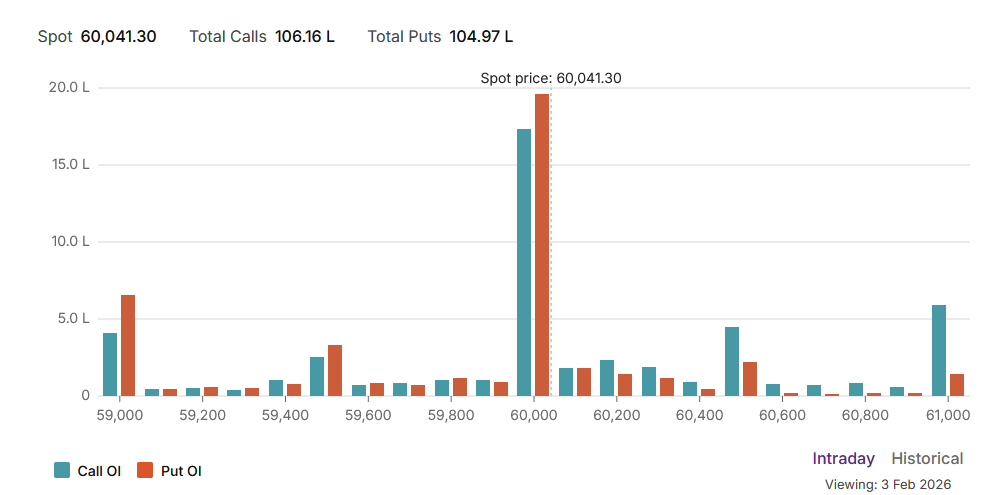

Sentiment Analysis

The current market sentiment is Neutral to Mildly Bearish.

-

Put-Call Ratio (PCR) – 0.99: A PCR near 1.00 indicates an almost perfectly balanced fight between the bulls and the bears. While a PCR above 1.0 is generally bullish and below 0.7 is bearish, 0.99 suggests that for every call sold, there is a corresponding put sold. This equilibrium often leads to range-bound movement or consolidation.

-

Total Open Interest (OI):

-

Total Calls: 113.87 L

-

Total Puts: 113.49 L The call writers (bears) have a very slight edge by approximately 38,000 contracts. This confirms that the upside is being heavily capped by resistance.

-

Price-Action & Max Pain

-

Current Market Price (CMP): 60,063.65

-

Max Pain – 60,000: The Max Pain level is the strike price where option writers stand to lose the least amount of money. Since the CMP (60,063) is trading extremely close to the Max Pain (60,000), it indicates that the index is “pinned.” Near-term movement is likely to gravitate back toward 60,000 as market makers attempt to keep the index at the point of least loss for themselves.

Support & Resistance Levels (Option Chain)

Based on the distribution of Open Interest across the strikes:

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 59758 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 60251, Which Acts As An Intraday Trend Change Level.

Bank Nifty Spot – Intraday Technical Setup

Market Observation: The index is currently trading within a defined range. Traders should watch the following pivot zones for potential directional moves:

-

Strength (Upside): If the index sustains above 60100 , it indicates bullish momentum. The immediate resistance levels to watch are 60225,60444,60666.

-

Weakness (Downside): Selling pressure is likely to intensify if the index breaks below 60000. In this scenario, the next support zones are 59851,59666 and 59319.

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators