Climactic Capitulation: FIIs Take Colossal Profits as Retail Bulls Surrender En Masse

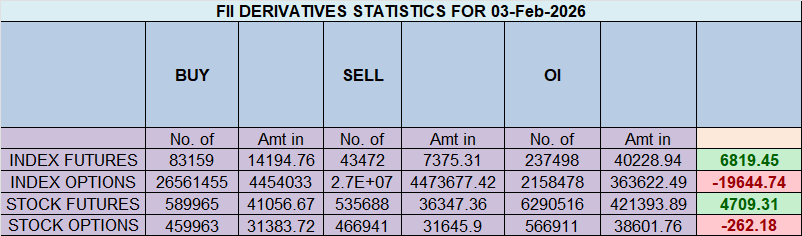

On February 3, 2026, the Nifty Index Futures market witnessed a seismic event that will likely be remembered as the definitive end of the recent bearish trend. While the headline number showed a spectacular net buy of 39,687 contracts by Foreign Institutional Investors (FIIs), this figure is profoundly deceptive. The real, earth-shattering story of the day was a two-part epic: a masterclass in institutional profit-taking, facilitated by the complete and total surrender of retail bulls, who liquidated a stunning 39,344 long contracts.

This was not the birth of a new bull run. This was the textbook data signature of a climactic, end-of-trend capitulation event, confirmed by a colossal collapse in Open Interest of 19,651 contracts.

Decoding the Data: The Anatomy of a Market Bottom

1. The Main Event: The Mass Surrender of Retail Bulls

The single most important event of the day was the behavior of the client segment. The covering of over 39,000 long contracts is not a strategic adjustment; it is a full-scale, fear-driven surrender. This is the classic signal of maximum pain, where the pressure on the longs becomes unbearable, triggering a massive wave of forced selling. This wave of panic-selling provided the perfect, deep liquidity for the FIIs to execute their exit strategy.

2. The FIIs’ “Bullish” Mask: A Masterclass in Profit-Taking

The granular FII data reveals their brilliant and brutally effective strategy. Their massive “buy” number was not a new vote of confidence in the market. It was an exit.

-

They covered (bought back) a staggering 29,669 short contracts, taking enormous profits off the table from their winning bearish campaign.

-

They only added a modest 10,018 new longs.

This was a profit-taking operation, not a new bullish initiative. The FIIs used the panicked retail selling to buy back their own shorts at favorable prices. The definitive proof is in their final positioning: they remain profoundly bearish at 12% long versus 88% short (ratio 0.20). They have not flipped their view; they have simply cashed in their winnings.

3. The OI Collapse: The Battlefield Empties

The massive drop in Open Interest is the final, irrefutable proof that this was a mass exodus. The market experienced a huge deleveraging event as the primary participants fled:

-

The retail longs panic-sold to get out.

-

The institutional shorts bought back to take profits.

The net result is a market that has been “hollowed out,” leaving a fragile and unstable structure.

Key Implications for the Market

-

The Bear Trend has Climactically Ended: The fuel for the decline—the massive base of hopeful retail longs—has just been exhausted in a single, catastrophic event. The primary engine of the decline, aggressive FII shorting, is now reversing.

-

The Risk has Inverted: A Violent Short Squeeze is Now the Primary Threat: With the natural sellers (the retail bulls) having capitulated, and a huge number of shorts still in the system, any positive catalyst can now ignite a ferocious rally as the remaining shorts scramble to exit in a market that has a sudden vacuum of sellers.

-

The Bottoming Process is Underway: This type of event typically signals that the price low of a major move is in. The market will now enter a volatile and chaotic “bottoming” phase, characterized by sharp rallies and deep retests as a new equilibrium is sought.

Conclusion

Disregard the headline FII number. The only story that matters is the historic capitulation of nearly 40,000 retail longs. This allowed the institutions to masterfully exit their profitable bear campaign. The aggressive, one-sided selling trend is over, and the market is now in a highly unstable state where the risk of a violent short squeeze is exceptionally high.

Last Analysis can be read here

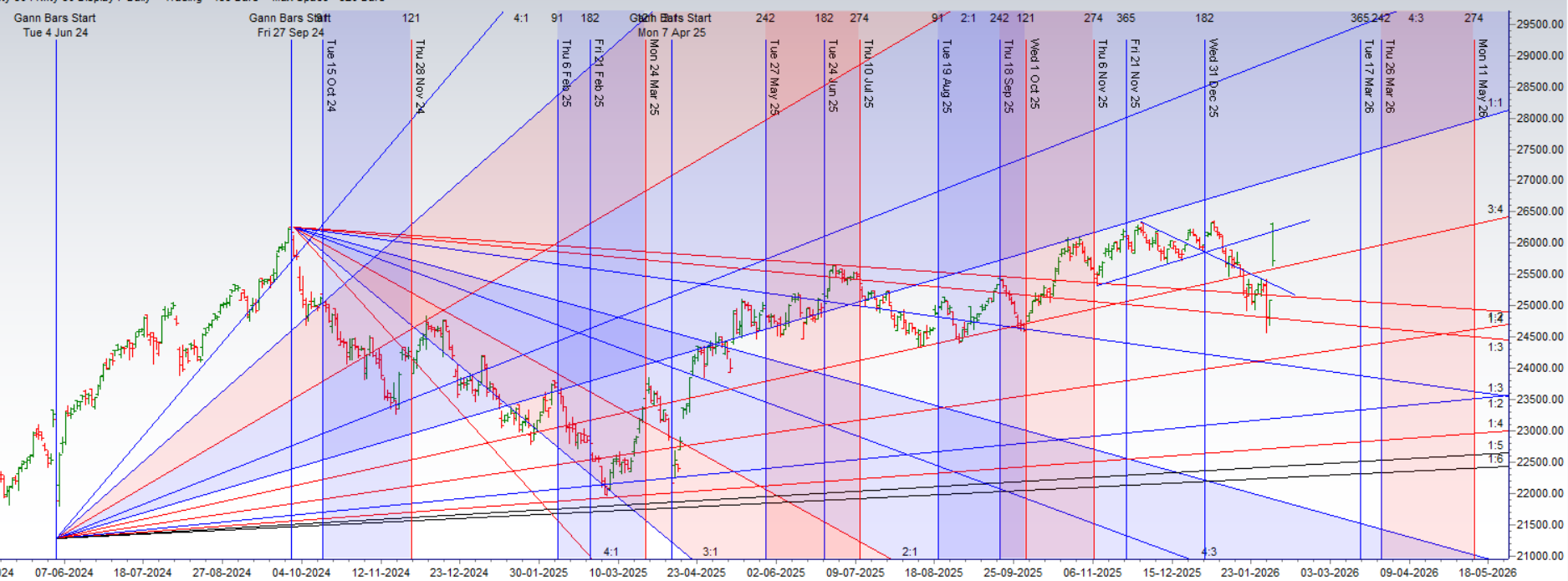

The market has delivered a classic and painful “buy the rumor, sell the news” event. The overwhelmingly positive news of the US-India Trade Deal produced the expected big gap-up opening, but the bulls’ victory was short-lived. The rally was brutally sold into, fueled by weekly expiry pressure, culminating in a decisive failure to close above the critical 26,000 level. This is not just a failed rally; it is a textbook bull trap, signaling a potential major reversal of trend.

This technical weakness is now set to be amplified by a perfect storm of two powerful and volatile astrological events.

1. The Uranian Shockwave and the IT Litmus Test

Today’s first major catalyst is Uranus turning Direct. Uranus is the planet of technology, shocks, and sudden, unexpected events. As forecast, its energy is already manifesting in the Technology stocks, with the sell-off in Infy and Wipro ADRs being a direct reaction to the “Uranian” shock of a disruptive new AI tool from Anthropic.

However, your analysis provides the professional’s trading plan: this news has created an environment of peak pessimism in the IT sector. Therefore, the first 15 minutes’ low of IT stocks will be a critical litmus test. A failure to break this low could signal that the worst of the news is priced in, potentially triggering a sharp, contrarian recovery rally in the sector.

2. The Bearish Timer: Bayer Rule 2 and the “Big Move”

Adding a layer of direct bearish pressure is the activation of Bayer Rule 2. This historically significant rule states that a “trend goes down within 3 days” when the speed difference between Mars (aggression) and Mercury (trading) reaches a specific point. With both planets involved, this is a clear warning for a “Big Move” with a distinct downward bias. The market is now on a timer, with a pre-calculated catalyst for a decline.

3. The Definitive Battleground: The Last Stand for the Bulls

This powerful confluence of a failed breakout and multiple bearish catalysts has pushed the market to a critical and final support zone. The entire session, and potentially the entire trend, will now be decided by the battle at this level.

-

The Bullish Last Stand (25,472 – 25,500): This is the fortress that the bulls must defend. A successful hold of this range would be a major victory, absorbing all the bearish pressure and creating the potential for a powerful relief rally back to 25,900.

-

The Bearish Knockout Blow (A Close < 25,450): For the bears, their objective is to press their advantage. A decisive close below 25,450 would signal that the bulls’ final line of defense has been shattered. This would be a major technical breakdown, confirming the bull trap and likely unleashing a rapid fall towards 25,300 and 25,225.

Conclusion

The market is in a precarious and dangerous state. A major bullish catalyst has failed, creating a technical bull trap. Two powerful astrological events are now providing the fuel for a potential trend reversal. The battle lines are drawn with absolute clarity at the 25,472-25,500 support zone. A hold here could stage a recovery, but a break below will likely trigger the next major leg down. Prepare for a high-volatility session where these critical levels will be tested with force.

Trading is The Ultimate Spiritual Journey: Why Your P&L is a Mirror of Your Character

Traders may watch out for potential intraday reversals at 09:39,10:51,12:25,01:28,02:26 How to Find and Trade Intraday Reversal Times

Nifty Dec Futures Open Interest Volume stood at 1.59 lakh cr , witnessing liquidation of 14.4 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closeuer of SHORT positions today.

Nifty Advance Decline Ratio at 47:03 and Nifty Rollover Cost is @25405 closed above it.

In the cash segment, Foreign Institutional Investors (FII) bought 5236 cr. , while Domestic Institutional Investors (DII) bought 1014 cr.

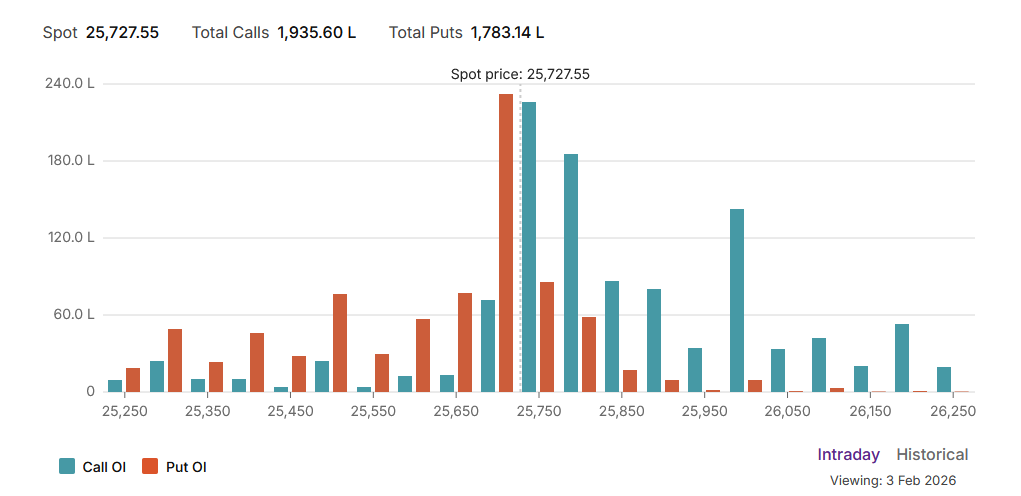

The Nifty options market is in a state of high-tension, near-perfect equilibrium, with a distinctly neutral-to-cautious undertone. A Put-Call Ratio (PCR) of 0.92 signifies a market where neither bulls nor bears have a clear upper hand, though the slight tilt below 1.0 suggests that call writers are a bit more active, subtly capping the upside.

The market’s price action is being completely dictated by the Max Pain point, which sits squarely at 25,700. With the spot price trading almost exactly at this level (25,727.55), the index is pinned at the point of maximum financial pain for option buyers. This is a classic signature of a market being controlled by large institutional option sellers who are incentivized to keep the price anchored in this zone to maximize their profits from theta decay. This creates a high-stakes, range-bound environment.

The options chain clearly outlines the boundaries of this battlefield, which are currently very narrow and well-defended:

-

Resistance: A massive wall of Call Open Interest is located at the 25,800 strike, which serves as the immediate and most formidable ceiling. Beyond this, the major psychological resistance at 26,000 remains a huge barrier.

-

Support: The first significant line of defense for the bulls is located at the 25,700 strike itself, reinforced by its status as the Max Pain level. The ultimate support floor for the current trading range is the massive wall of Put OI located at 25,500.

In conclusion, the Nifty is trapped in a classic “pinning” scenario. The neutral PCR and the spot’s proximity to Max Pain signal a period of continued, volatile consolidation. The market is caught in a tight grip between the powerful support at 25,500 and the immense resistance at 25,800, and a major catalyst will be required to break this deadlock.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25364. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25909 , Which Acts As An Intraday Trend Change Level.

Nifty Spot – Intraday Chart Observation

Technical Setup: The index is approaching critical breakout levels. Watch these zones for price action confirmation:

-

Strength (Upside): Momentum is expected to pick up if Nifty sustains above 25750. In this scenario, the immediate resistance levels are 25800, 25848, and 25900.

-

Weakness (Downside): The trend technically weakens if the index slips below 25700. This could open the path towards support levels at 25666, 25612, and 25555.

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators