A Bullish Tsunami: FIIs Unleash Unprecedented Buying as New Money Floods the Bank Nifty

On February 3, 2026, the Bank Nifty Index Futures market witnessed an event of extraordinary bullish force, signaling a major acceleration and a massive vote of confidence in the ongoing trend. Foreign Institutional Investors (FIIs) unleashed a tidal wave of buying, accumulating a colossal 11,084 contracts worth an immense ₹2,003.74 crore.

This unprecedented buying spree was made even more powerful by the underlying market dynamic it revealed: a massive surge in net Open Interest (OI) of 4,968 contracts. This is not a rally fueled by the forced covering of old shorts. This is a high-quality, high-conviction breakout, driven by a torrent of fresh, institutional capital flooding into the market.

Decoding the Data: The Mechanics of a Power Move

This combination of overwhelming institutional buying and a substantial expansion in market participation is the textbook signature of a market igniting a new, powerful leg of its bull run.

-

The FIIs: The Undisputed Engine of the Rally: An 11,000-contract net buy is not a subtle move; it is a declaration of intent. This is a major strategic allocation to the long side, demonstrating an unequivocal and powerful belief that the Bank Nifty has significant further upside. By stepping in with such overwhelming force, FIIs have ceased to be mere participants; they have become the primary engine of the rally, creating a formidable “institutional bid” under the market that will absorb any profit-taking and provide a strong foundation for higher levels.

-

The Open Interest “Stamp of Approval”: This is the crucial element that validates the entire bullish thesis. A rally on falling OI is weak and suspect. A rally on rising OI, especially on this scale, is a sign of immense health and broadening conviction. It proves that new, confident money is actively entering the market to take long positions. The FIIs’ tidal wave of demand was so immense that it not only swallowed all available sellers but also forced the creation of nearly 5,000 new, active contracts. This is the sign of a vibrant, liquid, and expanding market where the bulls are in absolute and total command.

Key Implications for the Market

-

A New, High-Momentum Phase Has Ignited: The period of quiet accumulation is over. This data signals the beginning of a high-momentum, public participation phase of the bull market, led by the market’s most powerful players.

-

The “Buy the Dip” Mentality is Now Absolute: With this level of institutional commitment, any market weakness or intraday dip will be viewed by a growing army of participants as a prime buying opportunity. The psychology of “sell the rally” has been completely extinguished.

-

The Path of Least Resistance is Powerfully Upward: The sheer force of the institutional flow has created a powerful tailwind. Fighting this trend is now the equivalent of standing in front of a tidal wave.

-

The Potential for a Major Trend Acceleration: Days with such high-volume, high-conviction buying often mark the start of an acceleration in the trend, as the remaining bears are forced to capitulate and momentum-chasing traders jump on board.

Conclusion

This is an A++ grade, unambiguously bullish signal. The sheer scale of the FII buying, combined with the powerful confirmation from the surge in Open Interest, signals that the Bank Nifty is not just in an uptrend; it is in the grip of a powerful, institutionally-driven bull run with a clear and undeniable mandate for significantly higher levels.

Last Analysis can be read here

The market has delivered a classic “bull trap,” a powerful lesson that positive news alone cannot sustain a trend. The big gap-up opening on the US-India Trade Deal was brutally sold into, leaving a trail of trapped buyers. This failed breakout now serves as the critical backdrop for a day of immense complexity, driven by a powerful sectoral tug-of-war and two major, conflicting astrological events.

1. The Inter-Sector Battle: A Uranian Shock in IT vs. a Bullish Haven in Banks

Today’s session is being defined by a powerful rotation between the market’s two biggest heavyweight sectors, a dynamic triggered by a major astrological event:

-

The IT Sector Shockwave (Uranus Turns Direct): As forecast, the direct motion of Uranus, the planet of technology and disruption, is manifesting with precision. The sell-off in Infy and Wipro ADRs, triggered by the disruptive “Uranian” threat of a new AI tool, has created a cloud of pessimism over the entire IT sector. However, this creates a fascinating contrarian setup: if IT stocks fail to break their first 15-minute low, it could signal peak pessimism and trigger a sharp recovery.

-

The Flight to Strength (Bank Nifty): In a classic market rotation, the capital fleeing the uncertainty in IT is likely to seek a haven in the banking sector. This sets the stage for a potential morning rally in Bank Nifty, as it temporarily benefits from being the strongest alternative.

2. The Overarching Bearish Timer: Bayer Rule 2 and the “Big Move”

While a short-term rally in banking stocks is a high probability due to rotation, a far more powerful and ominous cycle is looming over the entire market. Bayer Rule 2 has been activated, signaling that a “Trend goes down within 3 days” is a high probability. With Mars and Mercury involved, a “Big Move” to the downside is now on the clock.

This creates the day’s core conflict: a potential, mechanically-driven morning rally in Bank Nifty is running headfirst into a powerful, pre-calculated catalyst for a major decline.

3. The Definitive Battleground: The Bank Nifty’s “Super-Confluence” Pivot

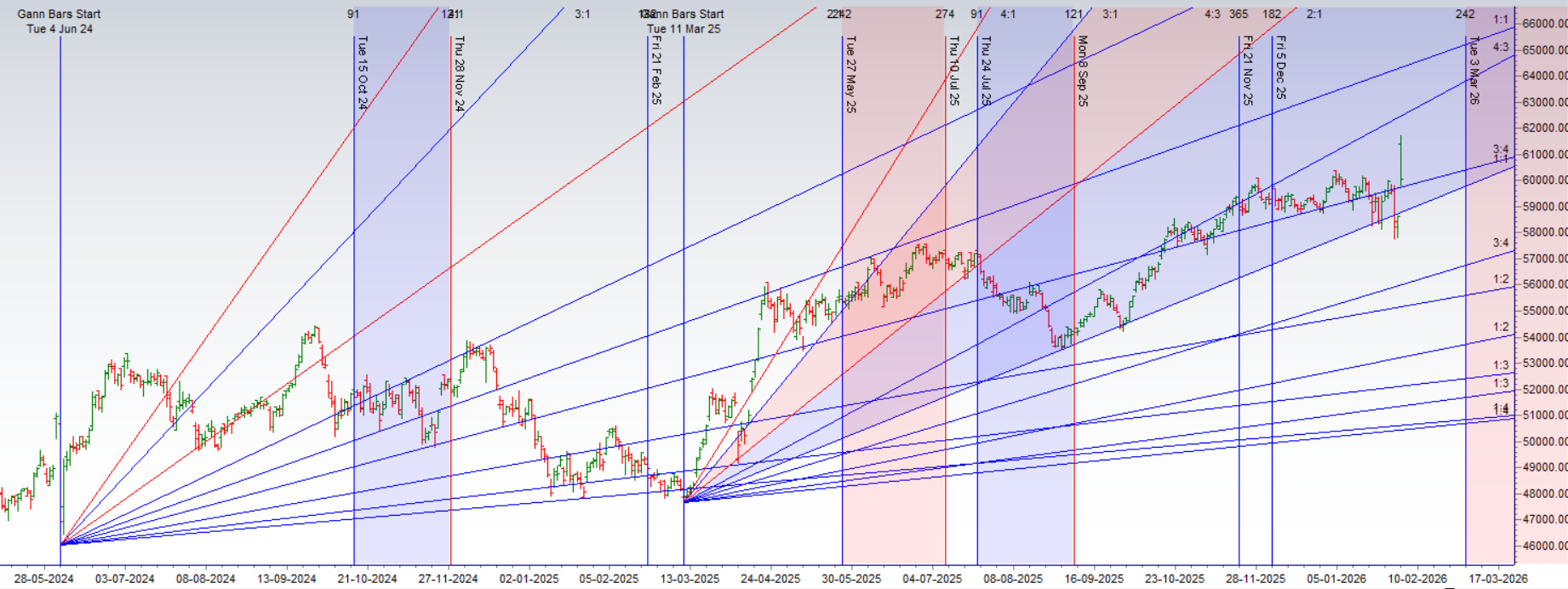

This immense conflict of forces will be decided at one of the most significant technical zones on the chart. An exceptionally rare “super-confluence” has formed a structural line in the sand for the market’s entire trend:

-

The Semi-Annual Pivot: 59,639

-

The Gann Monthly Trend Change Level: 59,629

This 10-point zone is the ultimate fulcrum. The bulls must hold this range on any dips to keep their pre-RBI policy rally hopes alive, with an eventual target of 60,500. However, a decisive break of 59,600 would signal a catastrophic failure, validating the bearish Bayer Rule and unleashing a powerful decline towards 59,225 and 59,000.

Conclusion

The market is in a state of extreme and complex tension. A short-term flight of capital may drive Bank Nifty higher in the morning, but a powerful bearish cycle has been activated, and its verdict will be delivered at the critical 59,629-59,639 pivot zone. This level will decide whether the bulls can stage a final stand before the RBI policy or if the bears will seize control and initiate the next major leg down. Prepare for a session of extreme volatility and tactical complexity.

Trading is The Ultimate Spiritual Journey: Why Your P&L is a Mirror of Your Character

Bank Nifty Dec Futures Open Interest Volume stood at 13.7 lakh, with liquidation of 2.5 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closuer of SHORT positions today.

Bank Nifty Advance Decline Ratio at 14:00 and Bank Nifty Rollover Cost is @59457 closed above it.

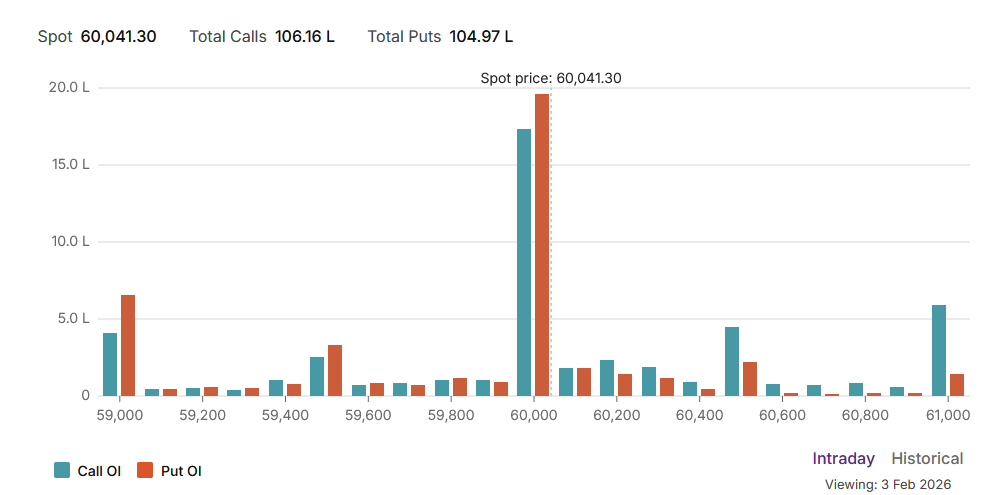

The Bank Nifty options market is signaling a state of perfect and profound indecision, a classic high-stakes stalemate at a major psychological milestone. An exceptionally neutral Put-Call Ratio (PCR) of 0.98 indicates that the open interest in put and call options is almost perfectly balanced. This is the signature of a market at a major crossroads, where both bulls and bears have built formidable positions and neither side has a clear advantage.

This delicate equilibrium is being forcefully dictated by the Max Pain point, which sits squarely at the crucial 60,000 level. With the current price trading almost exactly at this point (60,041.30), the market is experiencing a powerful “pinning” action. This is a clear sign that large institutional option sellers have taken control, creating a “short straddle” environment where their maximum profit is achieved if the index expires precisely at 60,000. This is a battle for inches, not miles, with sellers incentivized to crush any significant deviation from this pivot.

This setup has created a well-defined and heavily defended trading range:

-

Resistance: The 60,000 strike itself acts as a massive wall of call writers, representing the primary ceiling. A break above this would face the next major resistance level at 60,500.

-

Support: The 60,000 strike is also a formidable support floor due to the huge number of put writers. The first major support level below this is at 59,500, with the ultimate support at 59,000.

In conclusion, the Bank Nifty is a prisoner of the option sellers, locked in a state of perfect neutrality at 60,000. The path of least resistance is sideways, with a high probability of a low-volatility, range-bound grind. A major catalyst will be required to break this powerful pinning effect.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 59599. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 60387, Which Acts As An Intraday Trend Change Level.

Bank Nifty Spot – Intraday Technical Setup

Market Observation: The index is currently trading within a defined range. Traders should watch the following pivot zones for potential directional moves:

-

Strength (Upside): If the index sustains above 60108 , it indicates bullish momentum. The immediate resistance levels to watch are 60287, 60512 and 60777.

-

Weakness (Downside): Selling pressure is likely to intensify if the index breaks below 60000. In this scenario, the next support zones are 59800, 59666 and 59450.

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators