As we stand on the eve of the 2026 Union Budget, we look back at the “Budget of Consumption” presented by FM Nirmala Sitharaman on February 1, 2025, to decode the patterns that will likely play out tomorrow.

📊 How the Market Moved: The 2025 Reality Check

The 2025 Budget was a masterclass in intraday volatility. While the headlines focused on tax relief, the indices told a story of “sell-on-news” followed by a late-session recovery.

Nifty 50 Performance

-

Open: 23,528

-

Close: 23,482 (-0.11%)

-

The “V” Shape: During the speech, Nifty initially plunged nearly 980 points due to uncertainty over capital gains, before recovering almost all losses by the closing bell.

Bank Nifty: The Volatility King

Bank Nifty lived up to its reputation in 2025, recording an intraday range of over 1,000 points.

-

Laggards: HDFC Bank and SBI dragged the index initially.

-

Leaders: Axis Bank and ICICI Bank provided the late-day cushion.

🔍 Key Highlights from the 2025 “Consumption” Budget

Understanding what moved the needle last year helps us spot the sectors to watch tomorrow:

-

Personal Income Tax: The 2025 Budget raised the zero-tax limit to ₹12 Lakh under the new regime. This sparked a massive rally in FMCG (ITC, HUL) and Auto (Maruti, Tata Motors).

-

The “Dhan Dhanya” Scheme: A major push for rural skilling and agri-tech provided long-term support for the rural economy.

-

Infrastructure Capex: The government earmarked ₹11.21 Lakh Crore (3.1% of GDP), which initially saw a “profit-booking” dip in cement and steel stocks before they stabilized.

-

Fiscal Discipline: The fiscal deficit target was set at 4.4%, which soothed the bond markets and prevented a spike in yields.

⚡ Historical Volatility: 1999–2025

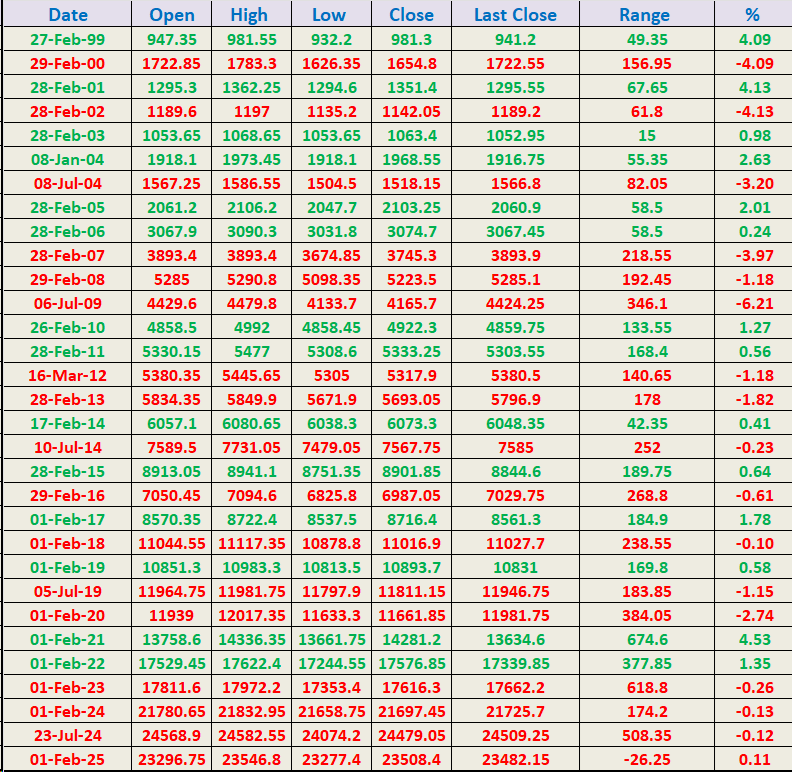

Data shows that Budget Day is rarely a “one-way street.” Over the last 25 years, the average intraday range for Nifty has been approximately 2.65%.

🎯 Strategic Roadmap for Budget Day 2026

Based on the 2025 data and current technical setups, here is your playbook for tomorrow:

-

Mind the Gap: Since the 2026 Budget falls on a Sunday, expect a non-standard opening. Liquidity may be thinner than usual during the pre-speech hour.

-

Support & Resistance: * Nifty Support: 25,150 (200-day EMA). A break here could trigger a deep correction.

-

Nifty Resistance: 25,500. A sustained move above this level signals a “Post-Budget Rally.”

-

-

The “Wait-and-Watch” Rule: Historically, the most profitable trades on Budget Day are taken after 1:30 PM, once the FM has concluded the speech and the market has fully digested the tax implications.

Gann Note: The 2026 Budget falls within a critical “Time Cluster.” Do not ignore the 1,000-point swing potential in Bank Nifty. Protect your capital first; profits will follow.

Dear Sir,

Hope for good recovery in all aspect for brutality ahead,

Thx