Disclaimer : This analysis represents the highest-probability forecast derived from expert, multi-decade historical evaluation of astrological signatures and their documented correlation with market psychology and price action.

No Guarantee: This is not a guarantee of future market performance. Financial markets are influenced by numerous dynamic and unpredictable real-world factors. All trading and investment activities carry significant risk, including the potential loss of principal.

Educational Purpose Only :This content is strictly for informational and educational purposes and should not be construed as financial advice or a recommendation to buy, sell, or trade any financial instrument.

Consult a Professional :We strongly advise you to consult a qualified financial advisor before making any investment decisions. Any actions you take based on this analysis are solely your responsibility. We assume no liability for any financial profits or losses that may occur.

Theme for Silver: The High-Beta Metal: From Hero to Zero

Silver’s theme is an amplified, higher-beta version of Gold’s narrative, “From Hero to Zero.” Its dual nature as both a precious metal and an industrial commodity will cause extreme swings. Initially, its precious metal side will react explosively to the geopolitical fear, causing it to rally with even greater velocity than Gold. However, as the powerful, greed-driven “risk-on” rally in equities takes hold, Silver’s industrial component will make it more attractive to hold than pure-haven Gold, causing its decline to be less severe at first. This is a trap. The final parabolic phase of the equity rally will trigger a complete collapse of the safe-haven trade, causing a waterfall decline in Silver that erases its early-week gains. Its higher volatility makes it the most dangerous metal to trade this week without a clear plan.

For a Detailed Day by Day Forecast with Neural Analysis Please watch the below video

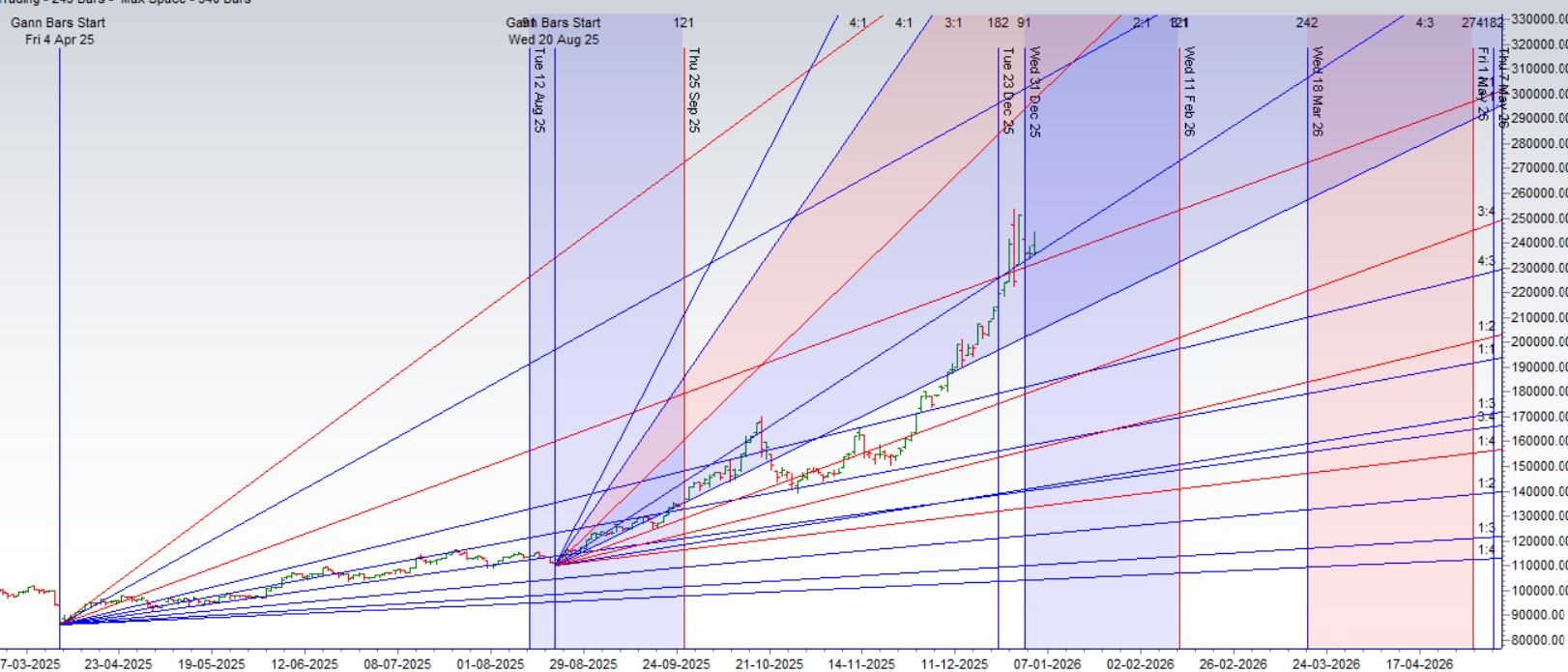

MCX Silver Gann Angle Chart

Silver is back to its gann angle support and holding same rally back to 250 K

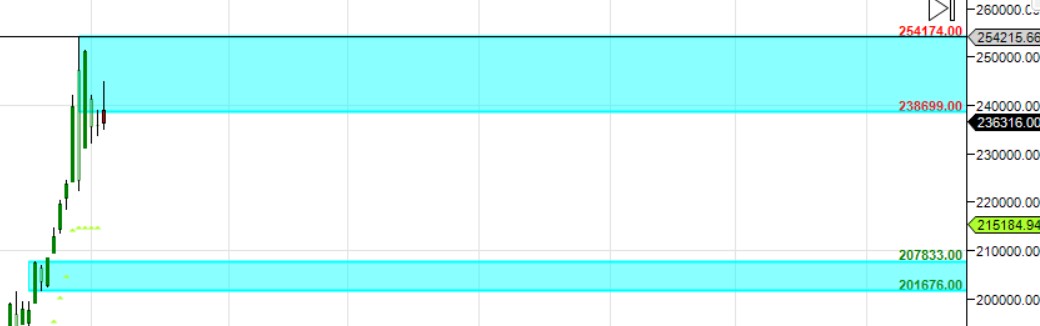

MCX Silver Supply Demand Zone

MCX SILVER Supply Demand Chart : Demand in range of 225-226 K , Supply in range of 250-252 K

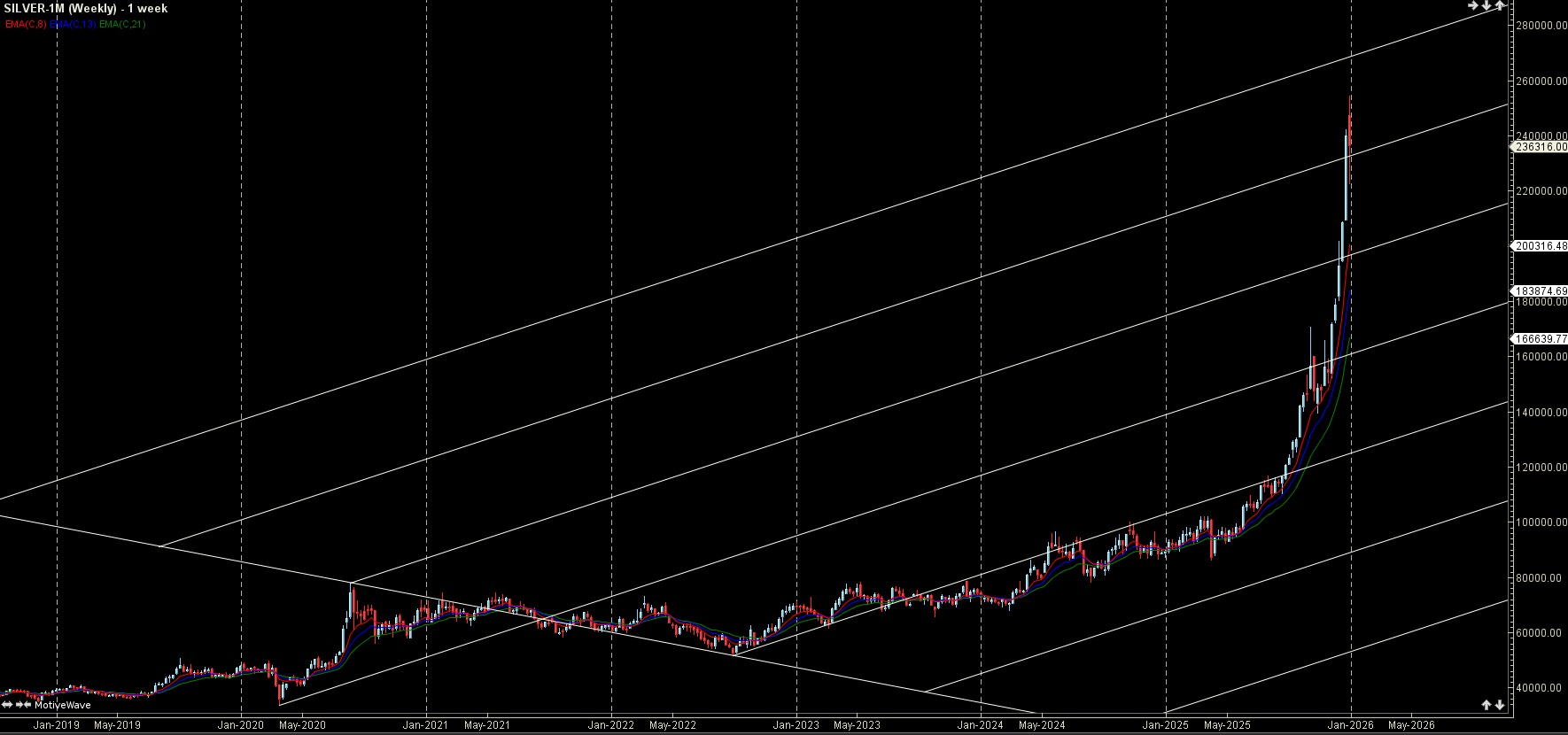

MCX Silver Harmonic Analysis

D leg can rally can extend towards 250/266 K till holding 225 K

MCX Silver Weekly

Weekly candel breakout above AF

MCX Silver Monthly

250 K Monthly Resistance and 225 K Monthly Support.

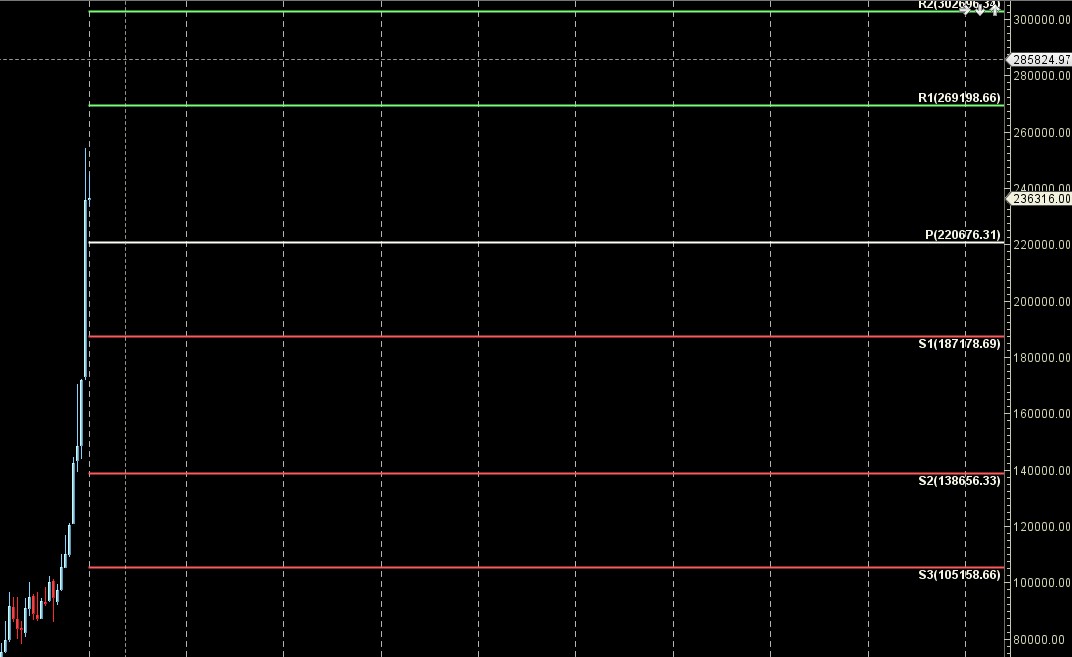

Silver Astro/Gann Trend Change Date

Key Pivot Dates: Watch 05 Jan

Silver Weekly Levels

Weekly Trend Change Level:238047

Weekly Resistance: 240002,241996,243938,245905,249900

Weekly Support: 236099,234160,232228,230000,227077

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.