Disclaimer : This analysis represents the highest-probability forecast derived from expert, multi-decade historical evaluation of astrological signatures and their documented correlation with market psychology and price action.

No Guarantee: This is not a guarantee of future market performance. Financial markets are influenced by numerous dynamic and unpredictable real-world factors. All trading and investment activities carry significant risk, including the potential loss of principal.

Educational Purpose Only :This content is strictly for informational and educational purposes and should not be construed as financial advice or a recommendation to buy, sell, or trade any financial instrument.

Consult a Professional :We strongly advise you to consult a qualified financial advisor before making any investment decisions. Any actions you take based on this analysis are solely your responsibility. We assume no liability for any financial profits or losses that may occur.

Theme for Gold: The Geopolitical Spike into a Risk-On Collapse

Gold’s theme this week is a classic “spike and fade,” driven by a powerful but temporary fear bid. The geopolitical news is the immediate catalyst, which will be amplified by the Full Moon’s emotional panic. This is engineered to trigger a sharp, front-loaded rally in Gold as capital seeks an immediate safe haven from the equity market turmoil. However, this rally is built on a fragile foundation. Once the equity markets find their footing at the powerful Bayer Rule 6 bottom and begin their ferocious “risk-on” rally, the reason to hold Gold will evaporate. Capital will aggressively rotate out of safety and into the high-beta equity chase, causing Gold’s rally to stall and then reverse, leading to a breakdown of its initial gains by mid-week.

For a Detailed Day by Day Forecast with Neural Analysis Please watch the below video

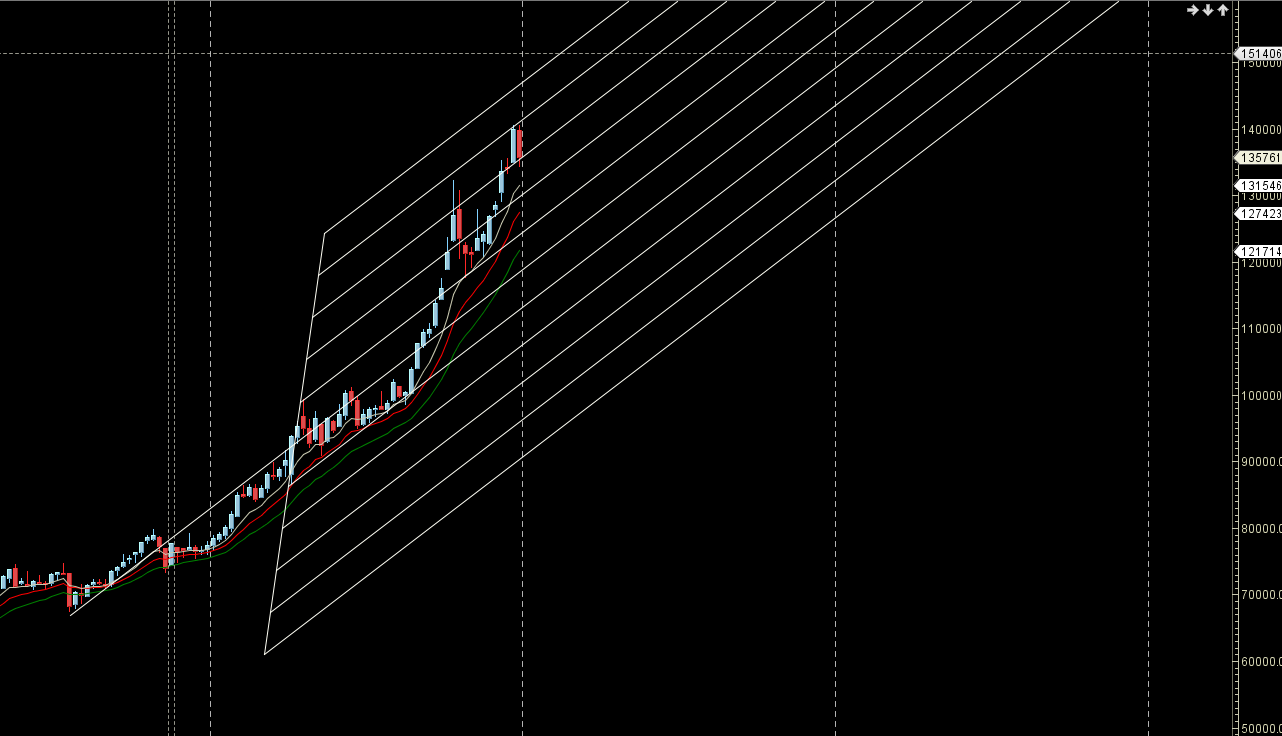

MCX GOLD Gann Angle Chart

Gold consolidation will give a breakout above 136000 as Full Moon Impact will be seen,

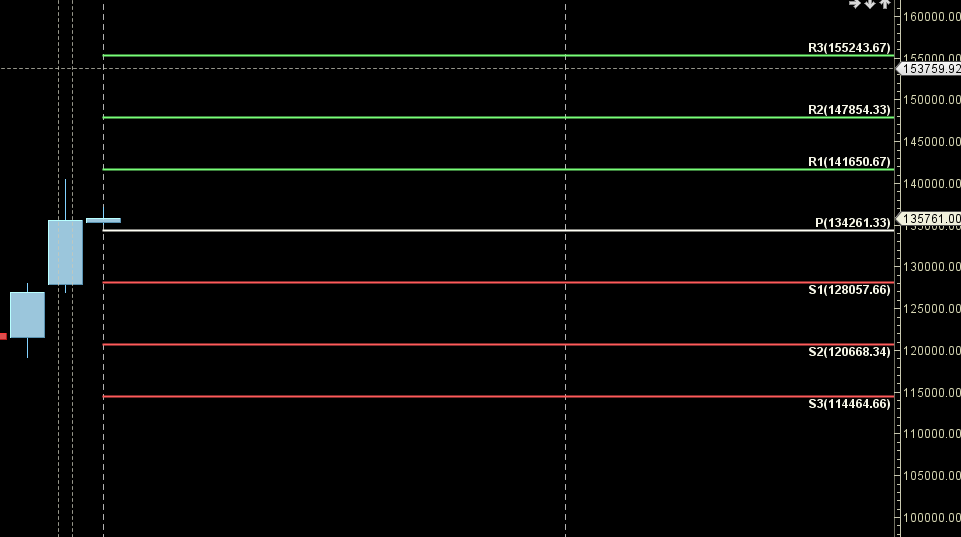

MCX GOLD Supply Demand Zone

MCX GOLD Supply Demand Chart : Demand in range of 137450-137500 K , Supply in range of 135469-135500

MCX GOLD Harmonic Analysis

Heading towards the final target of 139-140 K

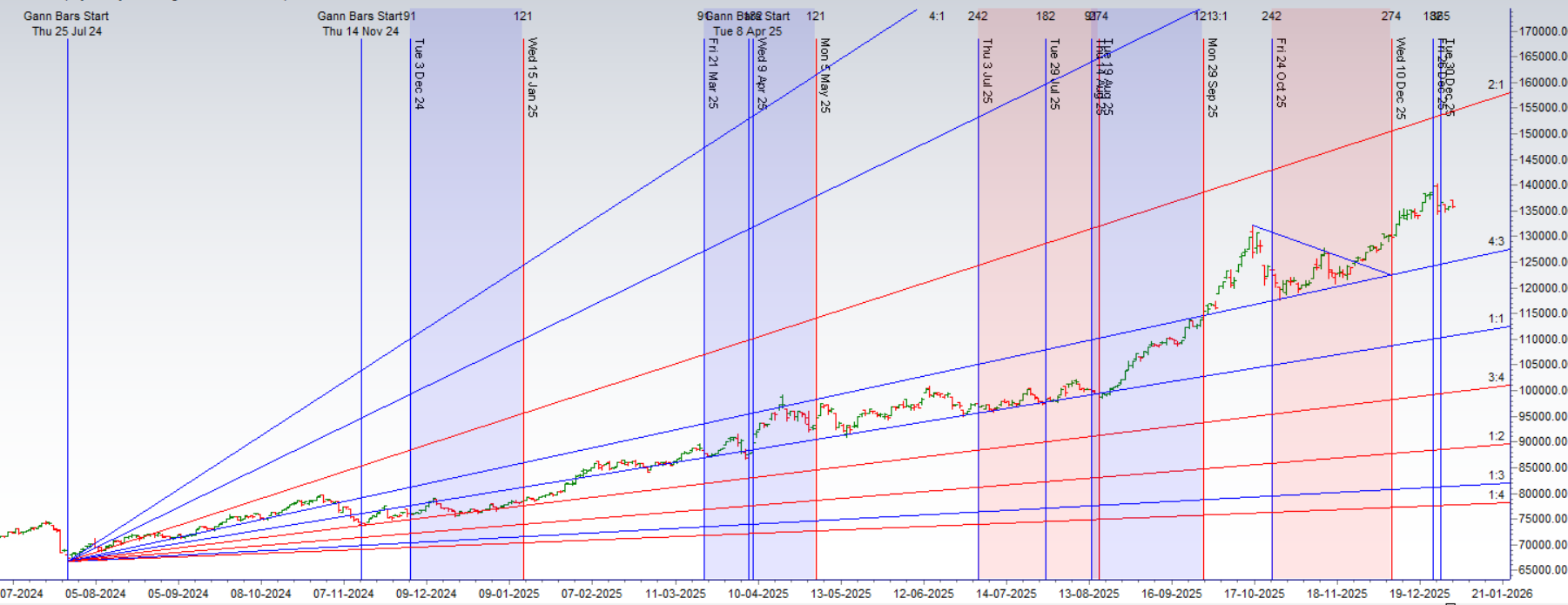

MCX GOLD Weekly

Gold reacted from Weekly AF resistance zone and back to its AF support zone.

MCX GOLD Monthly

140 K Monthly Resistance and 134261 Monthly Support.

GOLD Astro/Gann Trend Change Date

Key Pivot Dates: Watch 05 Jan

GOLD Weekly Levels

Weekly Trend Change Level:136742

Weekly Resistance: 137483,138225,138970,139716,140465

Weekly Support: 136004,135267,134532,133800,133069

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.