A High-Conviction Start to the New Year: FIIs Lead as New Money Validates Bank Nifty Rally

On the first trading day of the new year, January 2, 2026, the Bank Nifty Index Futures market sent a powerful and unequivocally bullish signal, suggesting a new phase of accumulation and a healthy, sustainable trend is taking root. Foreign Institutional Investors (FIIs) decisively set a positive tone, buying a solid 969 contracts worth ₹174 crore.

However, the session’s most significant and telling piece of data was the concurrent increase in net Open Interest (OI), which expanded by an even larger 1,033 contracts. This is the market’s definitive stamp of approval on the rally. It is the classic signature of a healthy, expanding bull trend, fueled not by the nervous covering of old shorts, but by the confident initiation of new longs.

Decoding the Data: The Mechanics of a Healthy Bull Run

This combination of institutional buying and rising overall market participation is a textbook signal for a new, sustainable trend.

-

The FIIs as the Engine: The FIIs’ buying action on the first day of the year is strategically significant. It’s often the time for new capital allocation, and their immediate move to the buy-side signals a clear institutional bias for the period ahead. They are not chasing an old trend; they are methodically establishing new long positions, creating a strong “institutional bid” or support floor under the market.

-

The Open Interest “Tell”: A Sign of Expanding Conviction: This is the crucial element that validates the entire bullish thesis. A rally on falling OI is weak and signals trend exhaustion. A rally on rising OI, as seen here, is a sign of immense underlying health. It means that new, confident capital is flowing into the market.

The fact that the OI increased by more than the FIIs’ net buy volume is particularly powerful. It means that the FIIs’ strong demand not only absorbed all available sellers but also encouraged even more new participants to enter the market on both sides, creating a net expansion of 1,033 new contracts. This is a sign of a vibrant, liquid, and broadening market where the bullish momentum is strong and well-supported.

Key Implications for the Market

-

A New, Sustainable Trend is Forming: This is not a fragile, short-covering bounce. The rising OI is proof that the rally is built on the solid foundation of new long positions. This makes the trend far more durable.

-

The Prevailing Psychology is Now “Buy the Dip”: With the market’s most influential players leading a buying charge that is attracting fresh capital, the strategic imperative has shifted. Any market weakness is likely to be viewed as a buying opportunity, not a reason for fear.

-

The Path of Least Resistance is Up: The combination of institutional leadership and broadening participation creates a powerful tailwind for the bulls. The path of least resistance is now clearly to the upside.

Conclusion

The data from the first session of 2026 is a high-quality, bullish signal. The FIIs are providing clear leadership, and the robust growth in Open Interest offers undeniable proof that the market is attracting new, confident capital. The Bank Nifty has started the year not with a continuation, but with a healthy and powerful expansion, laying a strong foundation for a sustained move to higher levels.

The Bank Nifty is currently in a state of extreme and profound consolidation, a quiet before an impending storm. The market has just formed a classic NR21 pattern, signaling that the trading range on January 2nd was the narrowest it has been in the last 21 sessions. This is a powerful technical signature of a market in a state of perfect equilibrium and peak indecision—a “coiled spring” that is building immense potential energy.

This technical compression is not occurring in a vacuum. It is aligning perfectly with a significant astrological catalyst, the recent Mercury sign change. This confluence of a powerful price pattern with a key timing event creates a classic “price-time meeting,” a high-probability setup that strongly suggests a major, high-velocity breakout is not just possible, but imminent.

The market has given its final warning that the period of quiet consolidation is over and is now preparing to unleash the stored energy in a significant, directional move either today or on Monday.

The Definitive Battleground: The 59,579 Fulcrum

This powerful setup has created an unambiguous and critical battleground. The entire future direction of the market’s next trend now hinges on a single, pivotal price level.

-

The Bullish Scenario (Control > 59,579): The bulls have a clear and direct mission: they must hold the line at 59,579. As long as this crucial support level is maintained, they are in control, and the high probability is that the pent-up energy of the NR21 pattern will be unleashed to the upside. A successful defense of this level targets a powerful, trending move towards 60,108 and potentially 60,323.

-

The Bearish Scenario (Breakdown < 59,579): The bears’ objective is to break this critical support. A failure by the bulls to maintain the 59,579 level would be a decisive technical failure. It would signal that the energy is resolving to the downside, likely triggering a quick, cascading fall towards the initial support at 59,319 and a more significant decline towards 59,008.

Conclusion

The Bank Nifty is at a major inflection point. An exceptionally rare pattern of extreme range compression (NR21) has converged with a potent cyclical timing signal. This is one of the most reliable setups for forecasting a major expansion in volatility. The battle lines are drawn with mathematical precision at 59,579. The side that wins control of this level will likely dictate the market’s trend for the coming days and weeks. Prepare for a significant and directional breakout.

Bank Nifty Dec Futures Open Interest Volume stood at 13.1 lakh, with addition of 0.69 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closuer of SHORT positions today.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 59750 for a move towards 59977/60191. Bears will get active below 59464 for a move towards 59222/58980

Bank Nifty Advance Decline Ratio at 07:06 and Bank Nifty Rollover Cost is @58357 closed above it.

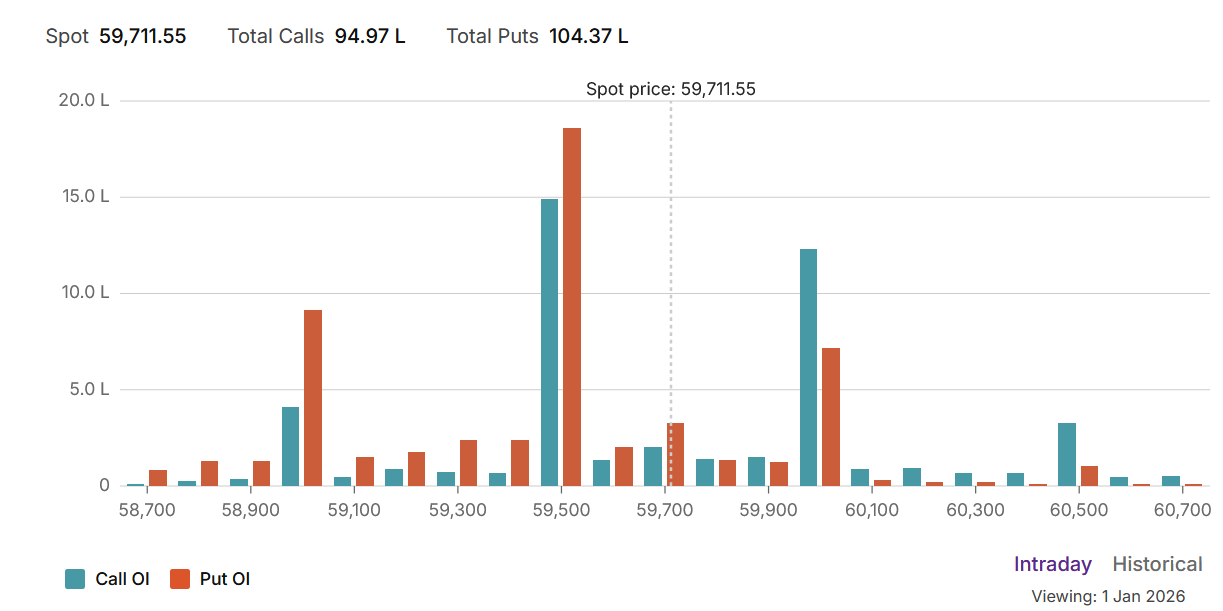

The Bank Nifty options market is projecting a state of strong and confident bullish control. A powerful Put-Call Ratio (PCR) of 1.09 has pushed the market firmly into bull territory, indicating that the total open interest in put options is significantly higher than in calls. This is the definitive signature of a market operating with minimal fear, driven by aggressive put writers who are confidently selling downside protection. This activity has created a formidable support structure beneath the index, signaling a widespread belief that a firm floor is in place.

This bullish sentiment is strongly reinforced by the market’s high structural pivot. The Max Pain point is firmly anchored at 59,500, acting as the new center of gravity for the index. This indicates that the most influential players, the large option sellers, are building their positions around this elevated level, incentivized to keep the market pinned in this new, higher trading range as expiry approaches.

This bullish setup has clearly defined the key battlegrounds for the current series:

-

Resistance: The primary and most significant ceiling is the massive psychological and open interest wall at the 60,000 strike. This is the ultimate target for the bulls and the main line of defense for call sellers.

-

Support: The 59,500 Max Pain level itself now serves as a major pivot and the first line of support. Below this, a very strong support floor has been established at 59,000, which holds a significant concentration of Put OI.

In conclusion, the Bank Nifty is in a powerful “buy on dips” environment. The overwhelming evidence from both the PCR and the high Max Pain level shows the bulls are in command. The path of least resistance is upwards, with the market likely to consolidate around 59,500 before staging an attempt to conquer the 60,000 fortress.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 59725. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 59932 , Which Acts As An Intraday Trend Change Level.

Bank Nifty Spot – Intraday Technical Setup

Market Observation: The index is currently trading within a defined range. Traders should watch the following pivot zones for potential directional moves:

-

Strength (Upside): If the index sustains above 59750, it indicates bullish momentum. The immediate resistance levels to watch are 59848, 59953, and 60108.

-

Weakness (Downside): Selling pressure is likely to intensify if the index breaks below 59666. In this scenario, the next support zones are 59510, 59377, and 59108.

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators