A Market in Full Retreat: FIIs Press Bets as a Mass Exodus Signals Trend Exhaustion

On December 9, 2025, the Bank Nifty Index Futures market witnessed a major deleveraging event, signaling a potential climax to the recent bearish trend. While Foreign Institutional Investors (FIIs) maintained their negative stance by shorting a net 866 contracts, the day’s overwhelming and dominant story was the colossal collapse in net Open Interest (OI), which plummeted by 4,098 contracts.

Decoding the Data: The Story of a Great Unwinding

The key to this analysis is understanding the powerful divergence between the FII action and the change in OI.

-

The FIIs: The Last Bears Standing: The FIIs’ action, while modest in size, is significant in its conviction. By adding new short positions, they are signaling that they believe the downtrend is not yet over. They are pressing their bets, showing no signs of covering their profitable positions. They are the immovable object of bearish resolve.

-

The Main Event: The Mass Exodus: The enormous drop in OI is the most critical market signal. For the total number of open contracts to fall by over 4,000 while the FIIs were actively adding 866 new shorts, it means that a staggering number of other participants—totaling nearly 5,000 net contracts—closed their positions and exited the market. This mass departure is almost certainly composed of two groups acting at once:

-

The Final Capitulation of Bulls: The last of the trapped bulls, who had held on through the decline, were finally forced to sell and liquidate their long positions at the point of maximum pain.

-

Widespread Profit-Taking by Bears: A large number of non-FII bears, who had successfully ridden the trend down, were aggressively buying back their short positions to lock in profits.

-

Key Implications for Traders

-

Climactic Trend Exhaustion: A trend that is still falling but on the back of a massive collapse in participation is a trend that is critically exhausted. The supply of panicked sellers needed to fuel the decline is drying up rapidly.

-

The Risk has Inverted to a Violent Short Squeeze: This is a classic setup for a brutal short squeeze. The market has been cleared of a huge number of participants, leaving it illiquid and brittle. With the FIIs still heavily short, any positive catalyst could ignite a ferocious rally as they (and the remaining shorts) rush to cover their positions in a market that has a sudden vacuum of sellers.

-

The Beginning of a Bottoming Process: This type of mass deleveraging event often marks the chaotic final phase of a downtrend. The aggressive, one-way move is likely over, and the market will now enter a volatile bottoming period, characterized by sharp rallies and retests as it seeks a new equilibrium.

-

A Fragile Market Structure: A “hollowed-out” market is a dangerous one. With fewer active participants, larger orders can move the price disproportionately, leading to an increase in erratic price swings and gapping moves.

Conclusion

Disregard the small FII shorting figure as the main story. The overwhelming takeaway is the massive collapse in Open Interest, signaling a full-scale market retreat and profound trend exhaustion. While the most convicted bears (FIIs) remain, their bets are now being placed in an increasingly empty theater. The market has become extremely fragile, and the risk of a continued decline is now overshadowed by the much larger risk of a sudden, violent, and painful rally for the remaining bears.

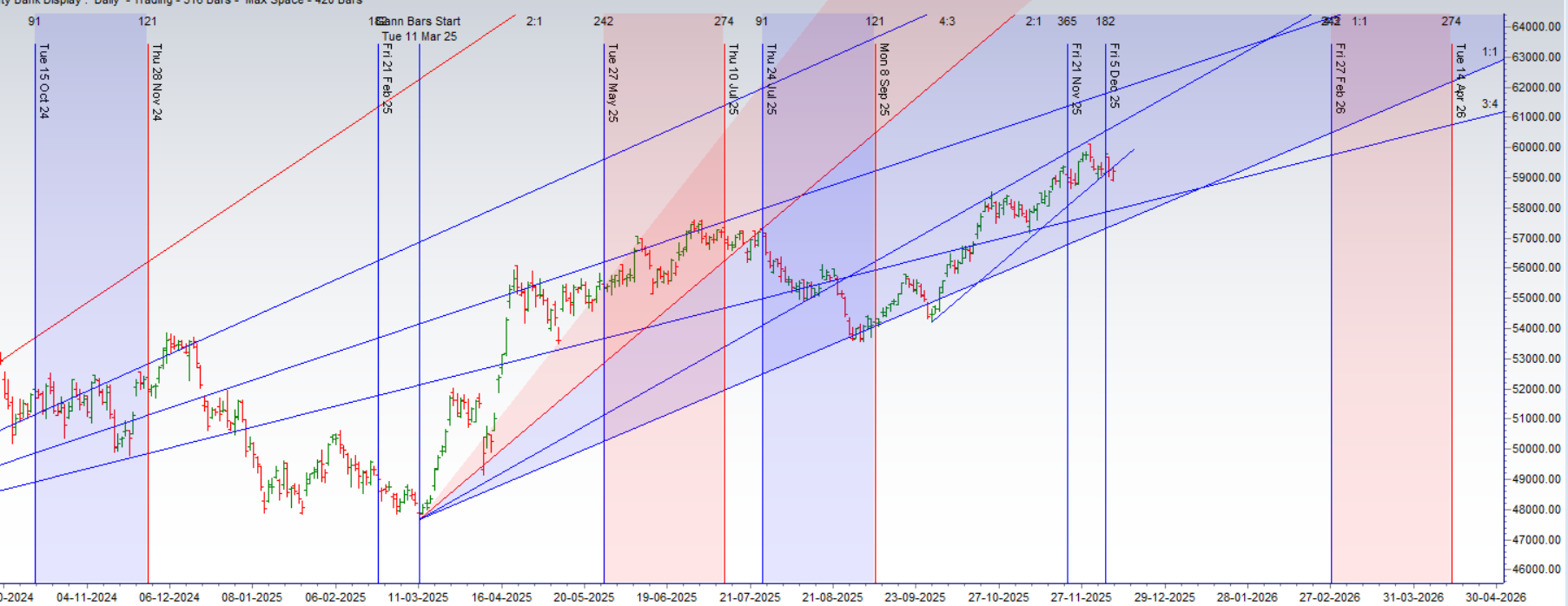

The Bank Nifty delivered another session of high-stakes volatility, confirming a fierce, two-sided battle for control. After an initial sharp decline to 58,878, a powerful recovery was staged by the bulls. However, the most critical takeaway from the session was not the recovery itself, but where it failed. The bulls were decisively rejected at the important Gann level of 59,319 and were unable to secure a close above it.

This failure is a significant victory for the bears. It confirms that the 59,319 level is not just a minor resistance point but a formidable bearish fortress. Despite the impressive intraday rally, the inability to conquer this level signals that the sellers still hold the strategic high ground.

The Impending Catalyst: The Federal Reserve Decision

The market is now pausing at this critical technical juncture, holding its breath for the day’s main event: the US Federal Reserve’s policy decision. This is a major global macro catalyst with the power to render the current technical picture irrelevant and dictate the market’s next major trend.

As your analysis astutely warns, the market’s reaction to the Fed’s announcement will almost certainly result in a significant gap opening in tomorrow’s session. This introduces a substantial overnight risk, making unhedged directional positions exceptionally dangerous. The prudent, professional approach is to hedge positions to protect against an adverse, high-velocity move.

The Defining Level: The 59,319 Line in the Sand

Until the Fed’s decision is digested by the market, the technical outlook remains clear and unchanged. The entire battle for trend control hinges on a single, powerful Gann level:

-

As long as the price remains below 59,319, the bears have the undeniable upper hand. The failure of the recent “smart recovery” at this very level has only strengthened its importance as the primary resistance and bearish control point. The path of least resistance from here is down.

Conclusion

The market is in a state of high alert and coiled tension. A powerful intraday recovery was decisively checked at a critical Gann resistance, confirming that the bears still control the prevailing trend. This technical stalemate is now awaiting a powerful fundamental catalyst from the Federal Reserve, which is guaranteed to produce a volatile gap opening. The tactical advice is clear: hedge your risk. The strategic level is even clearer: 59,319. This is the line that will continue to define the market’s trend.

Bank Nifty Dec Futures Open Interest Volume stood at 17.5 lakh, with liquidation of 0.25 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closuer of SHORT positions today.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 59378 for a move towards 59623/59869. Bears will get active below 59133 for a move towards 58888/58643

Bank Nifty Advance Decline Ratio at 09:03 and Bank Nifty Rollover Cost is @58357 closed above it.

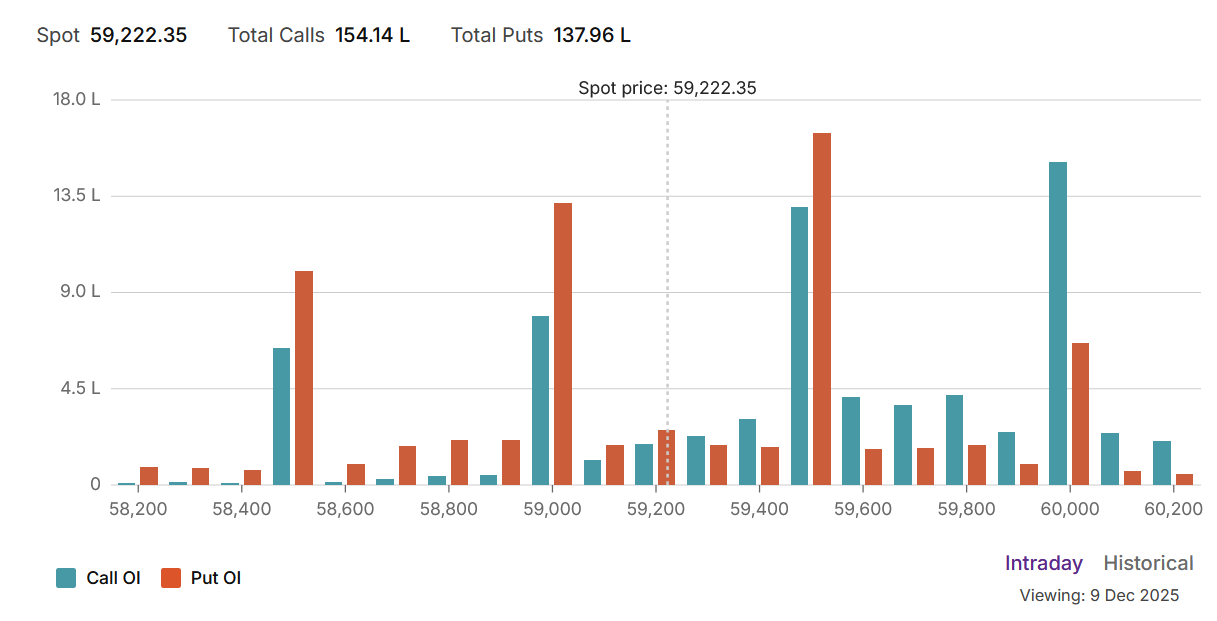

The Bank Nifty options data signals a significant shift in market sentiment, with the recent bullish euphoria giving way to a more cautious and bearish-leaning environment. A Put-Call Ratio (PCR) of 0.89 indicates that call writers have seized the initiative, betting with conviction that the market’s upside is now limited. This creates a supply overhang at higher levels, suggesting that any rally attempts will be met with selling pressure.

This cautious sentiment has trapped the index in a high-stakes battle around the Max Pain point of 59,500. This level is now the market’s undisputed center of gravity, acting as a powerful magnet that pins the price. The significant open interest built around this strike suggests that large institutional players are incentivized to keep the market contained within a narrow range, leading to a period of volatile, sideways consolidation.

The options chain clearly defines the current battlefield:

-

Resistance: The primary and most formidable resistance is located at the major psychological milestone of 60,000, which holds a massive wall of Call Open Interest. The 59,500 Max Pain level itself acts as the immediate ceiling.

-

Support: The first significant line of defense for the bulls is the 59,000 strike, which has a strong concentration of put writers. The ultimate support floor for the current trading range is located at 58,500.

In conclusion, the market is locked in a tight, high-altitude tug-of-war. The bullish trend has been decisively checked, and the path of least resistance is now sideways to down. A major catalyst will be required to break the powerful stalemate between the support at 59,000 and the immense resistance at 60,000.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 59718 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 59472, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 59200 Tgt 59319, 59427 and 59630 (BANK Nifty Spot Levels)

Sell Below 59108 Tgt 58950, 58729 and 58555 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators