FIIs Unleash a Torrent of Selling on Bank Nifty, Building Pressure for a Major Breakdown

On December 8, 2025, the Bank Nifty Index Futures market became the epicenter of an aggressive and high-conviction bearish assault. Foreign Institutional Investors (FIIs) unleashed a massive wave of selling, shorting a colossal 7,710 contracts worth a staggering ₹1,609.29 crore.

This immense selling pressure was met with enough new participation to cause a significant increase in net Open Interest (OI) of 3,764 contracts. This combination is a profoundly bearish signal. It reveals that the market is not simply drifting lower; it is being actively and forcefully pushed down by a wave of new, institutional-grade bearish positions.

Decoding the Data: The Mechanics of a High-Conviction Attack

This dataset tells a story of an impending storm, not a passing shower. The key is in understanding the relationship between the heavy selling and the rising participation.

-

The FIIs’ Overwhelming Force: The scale of the FII selling is a clear declaration of intent. A net short position of this magnitude is not a hedge or a minor portfolio adjustment; it is a full-scale, directional bet that the Bank Nifty is poised for a significant decline. The institutional “smart money” is not waiting for weakness—they are actively trying to orchestrate it with immense financial force.

-

The Critical Signal of Rising Open Interest: This is the most crucial element of the analysis. A rise in OI confirms that new capital is flooding into the market to establish fresh positions. It is the definitive sign that this is a high-conviction trend in its building phase, not an exhausted one at its end. The FIIs’ selling was so immense that it not only satisfied all existing buyers but also drew in new participants, leading to the creation of thousands of new contracts. This is a market that is expanding and loading up on bearish potential, not deleveraging.

Key Implications for the Market

-

A Bearish Trend with Strong Momentum: Unlike a trend on falling OI (which is weak), a downtrend powered by rising OI is a sign of immense underlying momentum and conviction. The bears are in absolute control, and their power is growing.

-

A Formidable “Wall of Supply” Has Been Created: This massive institutional shorting has created a powerful new layer of resistance above the market. Any attempt at a relief rally will likely be met with this fresh and formidable supply of sellers.

-

Increased Probability of a High-Velocity Decline: A market that coils with this much one-sided, high-conviction energy often resolves with a sudden and sharp move. The conditions are now ripe for a potential “waterfall” decline, where support levels break quickly and decisively.

-

The Path of Least Resistance is Firmly Down: With the market’s most powerful players pushing down with such force and the market’s overall participation expanding in that direction, the path of least resistance is now unambiguously lower.

Conclusion

The data from this session is a five-alarm fire for the bulls. The key takeaway is not just the aggressive FII selling but the concurrent surge in Open Interest, which confirms that this is a fresh, powerful, and building bearish trend. The Bank Nifty is being loaded like a spring with bearish potential, and the pressure is pointing squarely towards a significant and accelerated breakdown.

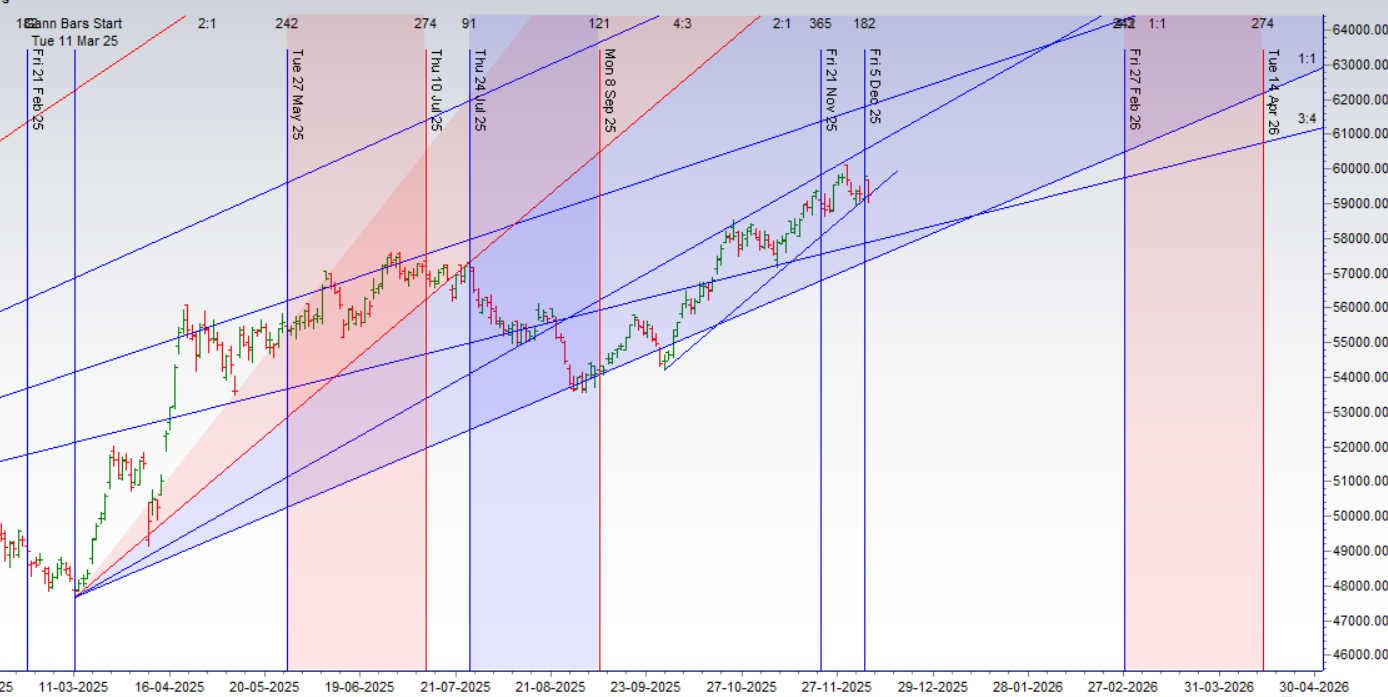

The Bank Nifty is performing with flawless precision, perfectly validating the sophisticated roadmap laid out by our astro-technical model. As forecast, the high-energy window created by the Bayer Rule 27 and the Gann lunar eclipse degree date provided the exact timing for a major top. The subsequent technical break below the 59,400 trigger was the starting gun for a swift and powerful decline, which successfully achieved its target of 59,000.

Having completed this initial bearish leg, the market has now bounced and has arrived at the most critical pivot point of the day: the 59,319 level. This is not just a random price; it is the key Gann level that capped the previous all-time high. The market’s reaction to this level now will determine the fate of the entire session.

The Bullish Counter-Attack: The Path to Recovery

For the bulls, the path to regaining control is steep but clearly defined. They are now challenging the breakdown level from below, and they must prove their strength with conviction.

-

The Bullish Trigger: A decisive break and, more importantly, an hourly close above the 59,319 Gann level. A brief touch is not enough; the bulls must demonstrate the power to hold this level.

-

The Outcome: A successful reclaim of this pivot would invalidate the immediate bearish pressure and signal a powerful short-covering rally. This would put the bulls back in control, with the next logical targets being a rally back to the 59,600 / 59,800 zone.

The Bearish Continuation: The Path of Least Resistance

Given that the major cyclical turn has already been confirmed as bearish, the path of least resistance remains to the downside. The current bounce is likely a temporary retest before the next wave of selling begins.

-

The Bearish Confirmation: A failure to break and hold above 59,319 on an hourly basis. A rejection from this level would confirm that the bears are still firmly in command and the bounce was simply a low-volume reprieve.

-

The Outcome: This rejection would be the trigger for the next bearish leg down, targeting a sharp fall towards the next major support level at 58,729.

Conclusion

The battle lines for today are drawn with mathematical clarity. After a perfectly executed move down, the market’s entire directional bias for the day now hinges on a single level: 59,319. This Gann pivot point is the fulcrum. The bulls must conquer it to have any chance of recovery. The bears must defend it to continue their downward campaign. Watch this level with extreme focus; the market is poised to give another clear, directional signal once the battle for this pivot is resolved.

Bank Nifty Dec Futures Open Interest Volume stood at 17.7 lakh, with addition of 2.9 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 59378 for a move towards 59623/59869. Bears will get active below 59133 for a move towards 58888/58643

Bank Nifty Advance Decline Ratio at 00:12 and Bank Nifty Rollover Cost is @58357 closed above it.

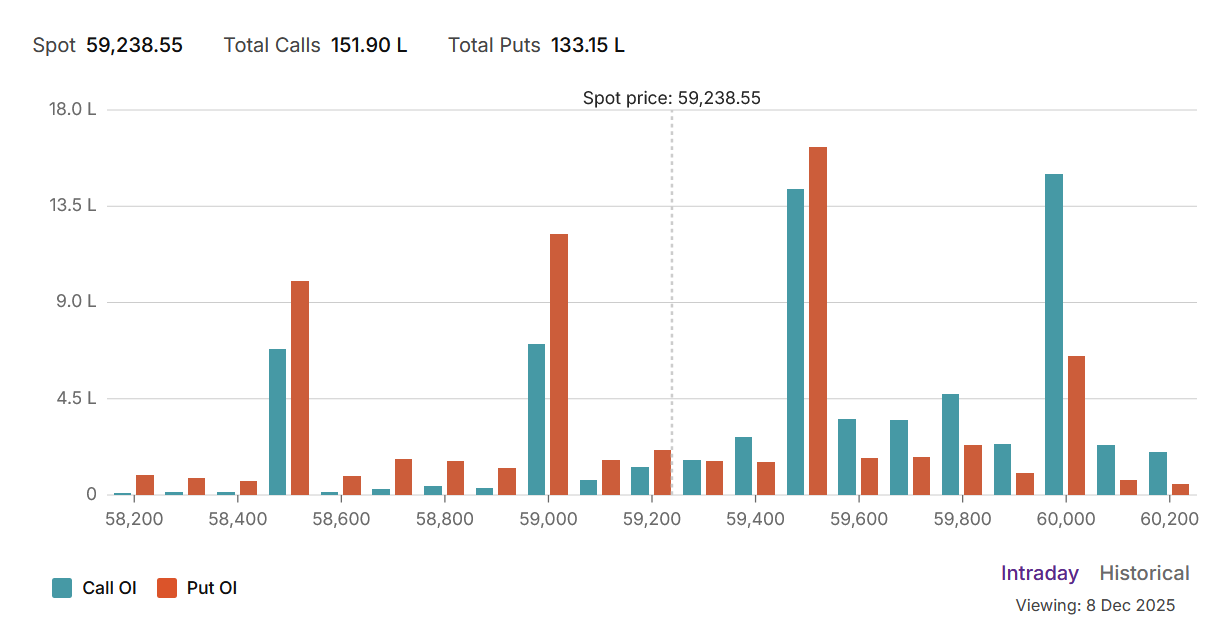

The Bank Nifty options data reveals a significant loss of bullish momentum and the emergence of a strong bearish defense at higher levels. A Put-Call Ratio (PCR) that has dropped to a cautious 0.87 signals that call writers have seized control, aggressively capping the market’s upside and reflecting a clear shift from confidence to caution. The market’s bullish fervor has been decisively checked.

This newfound caution has created a high-level stalemate, with the market’s entire focus now coalescing around the 59,500 strike, which has become the new Max Pain point. This level acts as a powerful magnet, pulling the index towards it and establishing the central battleground where both bulls and bears are building their largest positions. The fight has moved to a higher altitude, but the bears are now defending this territory with conviction.

The options chain structure clearly defines this new, contested range:

-

Resistance: The primary and most formidable resistance wall is located at the major psychological level of 60,000, which holds a massive concentration of Call Open Interest. The 59,500 Max Pain level itself serves as the immediate ceiling.

-

Support: A significant support floor has been built by put writers at the 59,000 strike. This is the first critical line of defense for the bulls. The ultimate support for the current range stands at 58,500.

In conclusion, the market has transitioned from a bullish trend into a volatile, sideways consolidation with a distinct bearish tilt. The path of least resistance is no longer upwards; it is now a choppy grind. The most probable outcome is for the Bank Nifty to remain pinned in a tight range between the powerful support at 59,000 and the formidable resistance at 60,000, with the 59,500 pivot point dictating the short-term directional swings.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 59743 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 59679, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 59000 Tgt 59108, 59283 and 59400 (BANK Nifty Spot Levels)

Sell Below 58941 Tgt 58800, 58666 and 58444 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators