FIIs Aggressively Short into a Wave of Long Unwinding, Signaling a Critically Weak Market

On December 4, 2025, the Bank Nifty Index Futures market sent a powerful and unambiguous signal of extreme weakness and participant capitulation. While the headline action shows Foreign Institutional Investors (FIIs) pressing their bearish advantage by shorting a significant 3,119 contracts worth ₹650.04 crore, the truly critical piece of the puzzle is the concurrent decrease in net Open Interest (OI) by 667 contracts.

This combination is a classic and profoundly bearish signal. It reveals a market that is not engaged in a healthy, two-sided conflict, but is instead in the throes of a rout. This is the signature of a market where convinced bears are aggressively attacking, while defeated bulls are fleeing in droves.

Decoding the Data: The Vicious Cycle of Capitulation

The mechanics behind this data are crucial to understand. The situation is not merely one of FII selling; it’s a negative feedback loop creating intense downward pressure from two distinct sources.

-

The FIIs: The Aggressors with Conviction: The FIIs are acting with clear conviction. They are not tentatively selling; they are aggressively initiating fresh short positions. This indicates they view the current market price not as a potential bottom, but as a prime opportunity to escalate their bearish bets. Their actions are proactive, supplying a steady stream of selling pressure to the market.

-

The Story of Collapsing OI: The Great Unwind: The decrease in Open Interest is the smoking gun. For the total number of open contracts to fall by 667 while FIIs were actively adding 3,119 new short contracts, it means that a colossal number of old positions were closed out by other traders. The math implies that a staggering 3,786 contracts (3,119 + 667) were closed. In a falling market, this is the unmistakable signature of mass “long unwinding.” This means thousands of traders who had held long positions were forced to capitulate and sell to prevent further losses. These are not new bears; these are defeated bulls.

Key Implications for the Market

-

A Critically Weakened Foundation: The very participants who would normally provide buying support are now liquidating their positions, becoming sellers themselves. This erodes the market’s structural integrity from within.

-

The Path of Least Resistance is Sharply Down: The market is now being hit by two waves simultaneously: fresh, confident selling from institutions and forced, panicked selling from capitulating retail. This creates an environment where the path of least resistance is firmly to the downside.

-

A Warning of an Aging Trend: While immediately bearish, a trend that continues on falling open interest is often a sign of a late-stage move. It means the “fuel” for the downtrend (the pool of hopeful longs) is running out. This can make the market brittle and highly susceptible to a sudden and violent reversal (a “short squeeze”) once the last of the longs have capitulated.

-

Rallies are Likely to be Sold Into Aggressively: Any attempt at a relief rally will be seen as a gift. It will be an opportunity for the remaining trapped longs to exit with less pain and a fresh opportunity for the confident FII bears to add to their positions at a better price.

Conclusion

The data paints a grim short-term picture for the Bank Nifty. The key takeaway is not the FII selling alone, but the massive long liquidation confirmed by the sharp drop in Open Interest. The market is controlled by the bears and is being weakened by a wave of capitulation. While this is a sign of a trend in its later stages, the immediate risk is of an accelerated and potentially cascading decline until this painful unwinding process is complete.

The Bank Nifty is currently in a state of perfect and perilous equilibrium. After a period of intense, sideways consolidation, the market has forged a perfect Doji candlestick—a monument to indecision and the sign of a pitched battle between bulls and bears with no clear winner. This technical state of a coiled spring is now set to be struck by a trifecta of high-impact catalysts, creating the perfect storm for a major, volatility-driven breakout.

1. The Powerful Catalysts Converging on the Market

The current state of calm is deceptive and will not last. The market is about to be hit by a wave of energy from three distinct and powerful sources:

-

The Cyclical Peak (Full Moon & Gann Time Cycle): Today marks a confluence of a Full Moon and a Gann time cycle. Full Moons are known to bring heightened emotional energy to the market, often marking a peak in sentiment and a turning point. When combined with a pre-calculated Gann cycle, the probability of a major, trend-defining event rises exponentially. The time for a decisive move is now.

-

The Fundamental Trigger (The RBI Policy): The “known unknown” of the RBI’s policy decision will act as the fundamental trigger to unleash the energy built up by the cycles. The announcement will inject a massive dose of volatility, providing the necessary force to break the market out of its state of indecision.

-

The Astrological Signature (Mercury & Venus Aspect): Critically, this is all happening under a very important Mercury-Venus aspect. For the Bank Nifty, this is the most potent combination possible, directly linking the planet of money and banking (Venus) with the planet of trading and news (Mercury). This ensures the market’s reaction to the RBI news will be sharp, swift, and significant.

2. The Leading Indicator: Watching the Rupee (USD/INR)

As your analysis astutely points out, in a complex environment like this, traders must look for a “tell” or a leading indicator. For the Bank Nifty, that is the USD/INR. A weakening Rupee acts as a significant headwind for the banking sector, impacting profitability and foreign investment flows. Therefore, a sharp move higher in the USD/INR today could be a powerful bearish signal for the Bank Nifty, while a strengthening Rupee could give the bulls the ammunition they need.

3. The Unwavering Game Plan: The 15-Minute Rule

In a market facing this level of explosive and unpredictable potential, a disciplined trading strategy is not just important; it is essential for survival. The first 15-minute high and low will be the ultimate compass to navigate the chaos.

-

This opening range will absorb the initial, chaotic, knee-jerk reactions to the policy announcement.

-

A decisive break above the 15-minute high will signal that the bulls have won the day and are in control.

-

A decisive break below the 15-minute low will signal that the bears have seized the momentum and a significant downtrend is underway.

Conclusion

The stage is set for a truly significant market event. A perfect technical pattern of indecision (the Doji) is about to be shattered by a powerful trifecta of cyclical, fundamental, and astrological catalysts. The direction of the Rupee will provide a critical clue, but the ultimate verdict will come from the price itself. By waiting for the opening 15-minute range to form and then trading the breakout, traders can let the market absorb the chaos and then align themselves with the day’s true, confirmed trend. Prepare for a session of extreme volatility and conviction.

Bank Nifty Dec Futures Open Interest Volume stood at 16.2 lakh, with addition of 0.79 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 59378 for a move towards 59623/59869. Bears will get active below 59133 for a move towards 58888/58643

Bank Nifty Advance Decline Ratio at 06:06 and Bank Nifty Rollover Cost is @58357 closed above it.

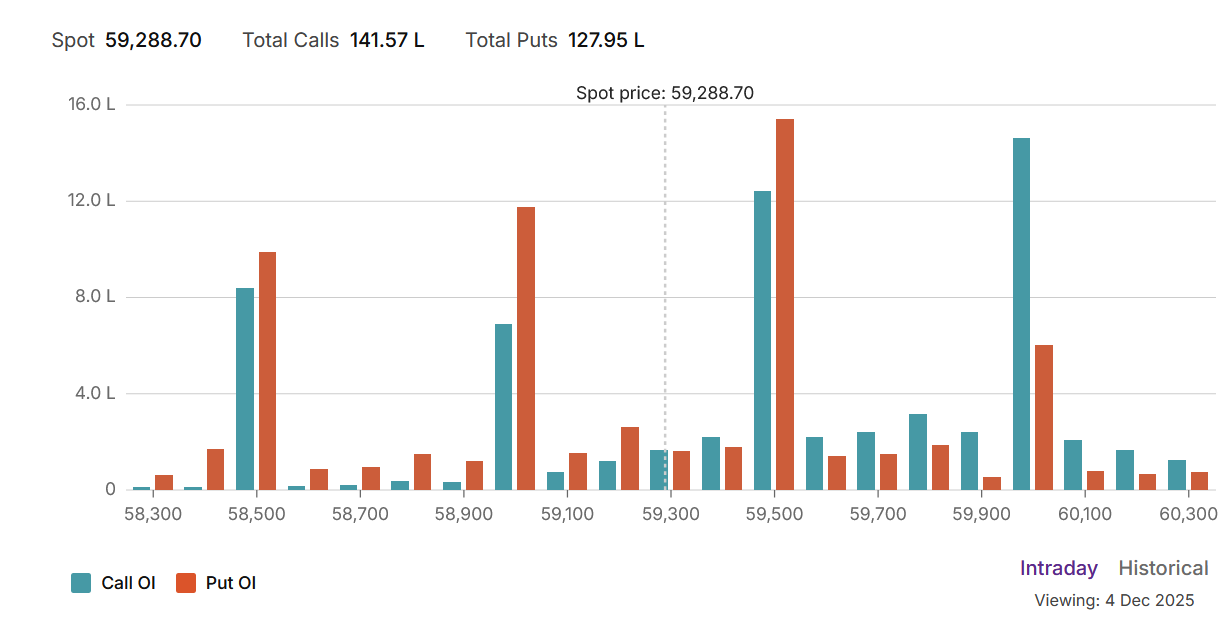

The Bank Nifty options market is in the throes of a high-stakes battle, with a clear and growing caution among participants. This is immediately evident from the Put-Call Ratio (PCR), which stands at a neutral-to-bearish 0.90. A PCR below 1.0 indicates that more call options are open than puts, signaling that call writers are aggressively creating a resistance ceiling, betting that the market’s recent rally has run out of steam.

This bearish tilt is unfolding around a critical and powerful pivot point. The Max Pain level is located at 59,500, acting as the primary financial center of gravity for this expiry. With the spot price currently trading below this at 59,288, this level represents a formidable immediate resistance. Option writers have built a massive fortress here, and the market is struggling under its weight.

The Open Interest chart maps out this battlefield with clear defensive lines for both bulls and bears:

-

Resistance: The 59,500 strike is the most critical immediate battleground, holding a massive concentration of Call OI. Should the bulls breach this, their final and most formidable challenge lies at the “Great Wall” of 60,000, which has the single largest bar of open call interest.

-

Support: The first line of defense for the bulls is located at 59,000, which holds significant Put OI. Below this, the ultimate support floor for the current structure stands at 58,500, which boasts the highest concentration of open put interest.

In conclusion, the Bank Nifty is locked in a classic standoff. The bullish momentum has been decisively halted by aggressive call sellers. The market is now caught in a tight, volatile range between the powerful support at 59,000 and the formidable resistance at 59,500. The most likely outcome is a continued, choppy battle as the index gravitates towards its 59,500 Max Pain level.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 59729. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 59633, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 59300 Tgt 59484, 59729 and 59920 (BANK Nifty Spot Levels)

Sell Below 59200 Tgt 59066, 58800 and 58666 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators