FIIs and Clients Take Opposing Views in a Divided Market

On November 26, 2025, the Nifty Index Futures market saw a notable divergence in the activity of Foreign Institutional Investors (FIIs) and retail clients. This has led to a market where the two main participants are positioned against each other, suggesting a period of potential disagreement on the market’s next direction.

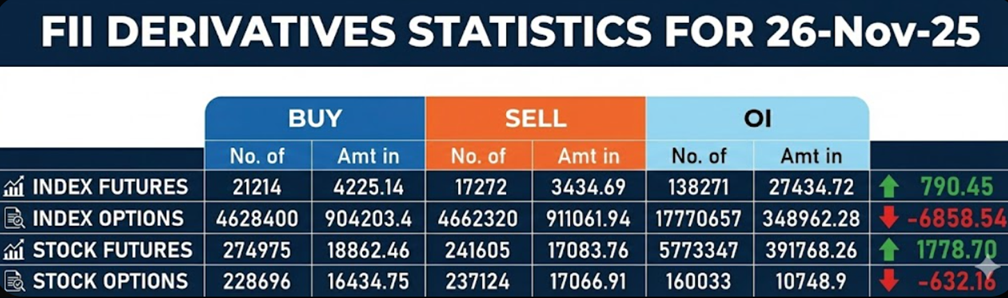

Foreign Institutional Investors (FIIs):

The FII data shows a moderately bullish day on the surface. They were net buyers of 1,200 contracts, which is not an exceptionally large number. However, the more important detail is that this activity was accompanied by a significant open interest (OI) increase of 2,582 contracts. This tells us that new positions are being created.

Looking deeper into their activity, FIIs added 3,342 new long contracts, while closing a smaller number of shorts. This shows that the FIIs who were active on this day were primarily building new bullish positions, suggesting a degree of positive conviction from this group.

Retail Client Behavior:

In complete contrast, retail clients took a strong bearish stance. While they did add some long contracts, their primary and much larger action was to add 4,529 new short contracts. This is a significant move that shows a clear expectation of a market decline from this segment of traders. They are now positioned with more short contracts than long ones for the day’s activity.

Current Positioning and Conclusion:

This has created a classic standoff in the market’s positioning. FIIs have improved their long ratio slightly to 0.20 (17% long vs. 83% short), indicating a small shift towards a less bearish view, driven by their new long positions.

At the same time, the retail clients have shifted to a more cautious stance, with their ratio now at 1.64 (62% long vs. 38% short).

In summary, the market is now divided. The FIIs showed a clear preference for adding long positions, while retail traders showed an even stronger preference for adding shorts. This disagreement means that the market could see some back-and-forth price action until one of these two groups is proven right.

Last Analysis can be read here

The Nifty 50 is near its all-time high of 26277 This powerful advance, which kicked off the December F&O series with a massive single-day rally, was not a random event. It was a textbook and anticipated outcome, driven by a powerful astrological and cyclical timing signal that we have been closely monitoring.

The bulls are now firmly in command, having successfully translated a major timing catalyst into a new price reality. The key now is to identify the critical levels that will determine whether this is just a fleeting peak or the beginning of a sustainable new up-leg.

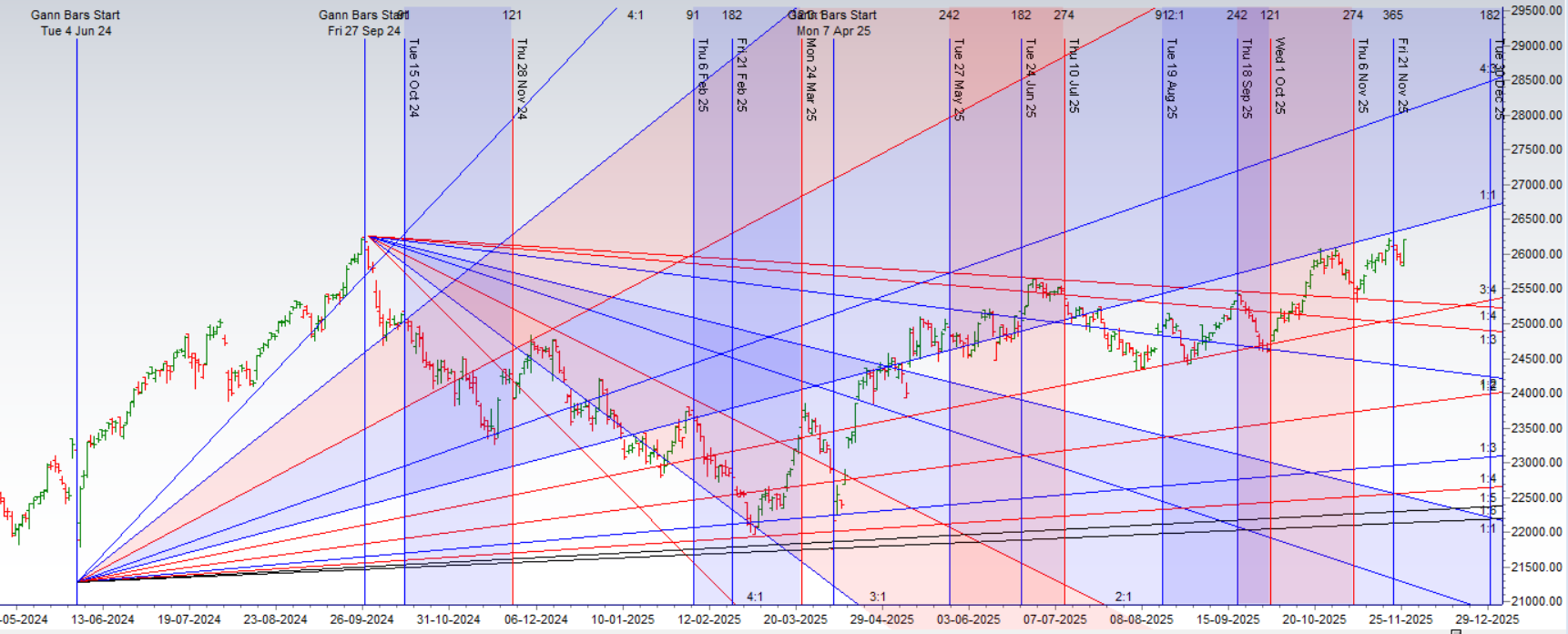

The Foundation: A Perfect Launch from a Powerful Timing Rule

It is crucial to understand that the market’s explosive launch into the December series was the direct manifestation of a key timing rule:

Bayer Rule 21 (variation C): Strong moves within 5-8 days are when retrograde Venus makes a conjunction with retrograde Mercury.

This potent astrological aspect, known for initiating “strong moves,” provided the temporal and energetic foundation for the recent rally. The market absorbed the energy of this conjunction and has now delivered the powerful effect that was anticipated. This serves as a powerful reminder that significant market moves are often governed by the hidden harmony of planetary cycles.

The Road Ahead: Bulls in Control, But Key Levels Must Be Defended

With a new peak established, the market has also created a new and critical floor of support that the bulls must now defend to maintain their control. The entire bullish structure for the immediate future now rests on one key level: 26110.

-

The Bullish Mandate: This level is now the bulls’ primary line of defense. As long as the Nifty holds above 26110 on a closing basis, the upward momentum remains firmly intact and validated. Any minor dips towards this level should be viewed as potential buying opportunities, representing a test of the market’s new support base.

-

The Next Objective: With the bulls successfully defending this support, the path is open for a continuation of the rally towards the next logical target of 26392. In a market that is in “blue-sky” territory, such calculated levels become critical milestones for the trend.

Conclusion:

The market’s explosive move to a new all-time high was perfectly aligned with our cyclical analysis, driven by the powerful Bayer Rule 21. The momentum is now firmly with the bulls, but the trend’s sustainability hinges on their ability to defend the new support they have carved out.

The strategy is now clear and precise: as long as the bulls maintain a close above 26110, the journey towards 26392 remains the path of least resistance. A break below this key support, however, would be the first major red flag, signaling that the energy from the timing signal is exhausted. The bulls have a clear roadmap; now it is a matter of execution.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 26258 for a move towards 26338/26419. Bears will get active below 26177 for a move towards 26097/26017

Traders may watch out for potential intraday reversals at 09:25.11:30,12:21,02:00 How to Find and Trade Intraday Reversal Times

Nifty Dec Futures Open Interest Volume stood at 1.40 lakh cr , witnessing addition of 3.1 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closuer of SHORT positions today.

Nifty Advance Decline Ratio at 45:05 and Nifty Rollover Cost is @26320 closed above it.

In the cash segment, Foreign Institutional Investors (FII) bought 4778 cr , while Domestic Institutional Investors (DII) bought 6247 cr.

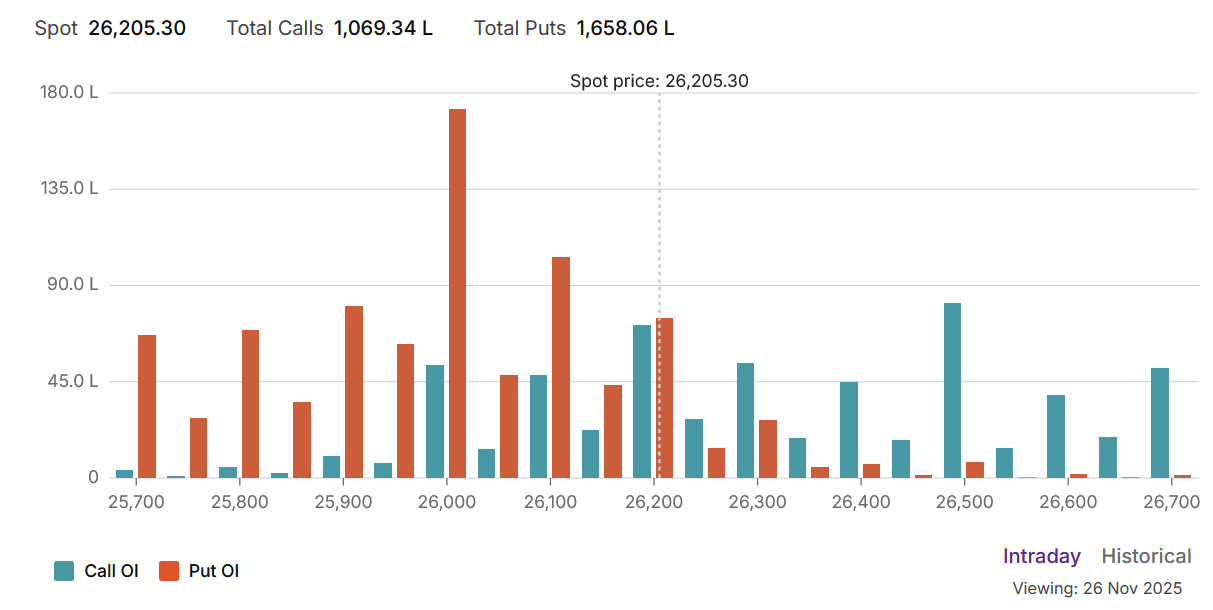

Today’s massive 300+ point rally in the Nifty was a direct consequence of the market’s extremely cautious positioning. The most telling sign was the very high Put-Call Ratio (PCR) of 1.55, which indicated that far more Put options were open than Call options, signaling widespread fear or heavy hedging against a potential decline.

The most significant activity of the day was the aggressive selling of Put options by all participants. Both Foreign Institutional Investors (FIIs) and retail traders were major net sellers of Puts, with retail alone shorting nearly 900,000 contracts. By selling Puts, these traders were essentially betting that a major fall would not happen, and in doing so, they created a very strong and well-defended support level for the market.

At the same time, both FIIs and retail were also significant net sellers of Call options, indicating a belief that the upside was limited.

The 300-point rally was the market moving in the direction that caused the most pain to this setup. The rally put the massive number of Call writers under extreme pressure, likely forcing them to buy back their short positions, which in turn added more fuel to the upward move in a classic short squeeze.

Support and Resistance as per the Option Chain:

-

Support: An enormous support base has now been firmly established around the 26,000 and 26,100 strikes, where the most aggressive Put selling occurred. The Max Pain at 26,150 confirms this zone as the market’s new floor.

-

Resistance: The rally is now challenging the major wall of Call writers. The next significant resistance is located at the 26,300 and 26,500 strikes, which is the new battleground for the bulls.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 26193 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 26286 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 26222 Tgt 26270, 26300 and 26350 ( Nifty Spot Levels)

Sell Below 26175 Tgt 26130, 26100 and 26050 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators