The Great Capitulation: FIIs Take Profits as Retail Bulls Finally Surrender

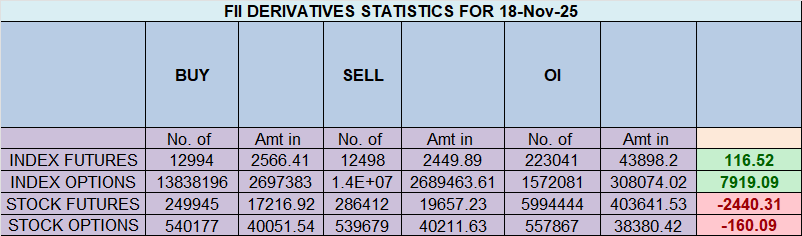

On November 19, 2025, the Nifty Index Futures market witnessed what can only be described as a climactic capitulation event. While the headline deceptively shows Foreign Institutional Investors (FIIs) as net buyers of 2,042 contracts, this masks the true, dramatic story of the day: a mass exodus of retail longs and a strategic, profit-taking exit by the institutional bears, all confirmed by a colossal collapse in Open Interest (OI) of 1,156 contracts.

This is not the beginning of a new FII-led bull run. This is the data signature of the exhaustive, painful end of the recent bearish campaign.

Decoding the Data: The Anatomy of a Market Bottom

1. The Main Event: The Mass Surrender of Retail Longs

The single most important piece of data from this session is the client behavior. They covered a staggering 6,825 long contracts. This is not a tactical adjustment; it is a full-scale surrender. This wave of panic-selling is a classic, end-of-trend signal for several reasons:

-

It signifies that the financial and psychological pain for the bulls who held on during the decline has reached its absolute breaking point.

-

This panicked selling provides the perfect, high-volume liquidity for the large institutional bears to begin buying back their profitable short positions without pushing the price up against themselves.

2. The FIIs’ “Deceptive” Buy: This is Profit-Taking, Not Bullishness

The granular FII data reveals their true strategy. They did not initiate a new bullish campaign. Instead, they covered 1,191 short contracts. This is a classic profit-taking maneuver. They used the massive wave of retail selling to close out their winning bearish bets.

Critically, their overall positioning remains at an extremely bearish 12% long versus 88% short (ratio 0.13). They have simply cashed in some of their chips; they have not flipped their view. They are taking profits from the panic, not leading a new charge.

3. The OI Collapse: The Battlefield Empties

The significant drop in Open Interest is the final piece of the puzzle. It confirms that this was a session of mass deleveraging. Both sides were aggressively closing their positions:

-

The retail bulls were panic-selling to get out of their losing longs.

-

The institutional bears were buying to close their winning shorts.

The net result is a market that is “hollowing out.” The players who defined the previous trend have left the field. This creates a vacuum and an extremely unstable market structure.

Key Implications for the Market

-

The Bearish Trend has Reached Climactic Exhaustion: The primary fuel for the downtrend—a large base of hopeful longs to sell to—has been exhausted through this mass capitulation.

-

The Risk has Inverted: A Violent Short Squeeze is Now the Primary Threat: With the natural sellers (the bulls) having capitulated, the market is now dangerously short. Any positive news or buying pressure can now ignite a ferocious short squeeze, as the remaining shorts scramble to exit in a market that has a sudden vacuum of sellers.

-

The Bottoming Process has Begun: This event marks the likely low point of the recent decline. The market will now enter a volatile “bottoming” phase. This is rarely a clean “V” reversal but is often a chaotic period of sharp rallies and deep retests as a new equilibrium is found.

-

A Fundamental Shift in Psychology: The dominant market narrative has just shifted from fear and trend-following to reversal and bottom-picking.

Conclusion

This data signals a major, climactic turning point for the Nifty. The story of the day is not the deceptive FII “buy” figure, but the massive capitulation of retail bulls, which allowed institutional bears to begin taking profits. The aggressive selling pressure is over. The market is now in a fragile, hollowed-out state where the risk of a violent, painful rally for the remaining bears is exceptionally high.

Last Analysis can be read here

Yesterday, the market provided a perfect and invaluable lesson in trading discipline. While our astro-analysis pointed to the bearish potential of the Mercury Sign Change, the market’s price action chose a different path. The bulls took charge from the open, decisively breaking both the first 15-minute high and the weekly open, signaling a clear upward trend for the day. This event was not a failure of analysis; it was a triumphant validation of a core trading principle: Levels are the ultimate authority.

The Crucial Lesson: The Art of Adaptive Trading

Your strategic thinking provides the key to navigating such complex scenarios:

-

The Plan: A clear, unbiased trigger was set: the first 15-minute high and low.

-

The Bias: The astro-analysis provided a bearish bias, a potential tailwind.

-

The Execution: When the price action diverged from the bias (breaking the high, not the low), the plan dictated following the level, but with adjusted conviction. A smaller trade size was warranted because the celestial and technical forces were not aligned.

Had the 15-minute low broken, in perfect alignment with the Mercury transit, a high-conviction trade with a larger size would have been the logical play. This ability to adapt position sizing based on the confluence of evidence is the hallmark of a professional trader. As you wisely noted, this is a skill forged over years of practice, discipline, and a commitment to personal accountability.

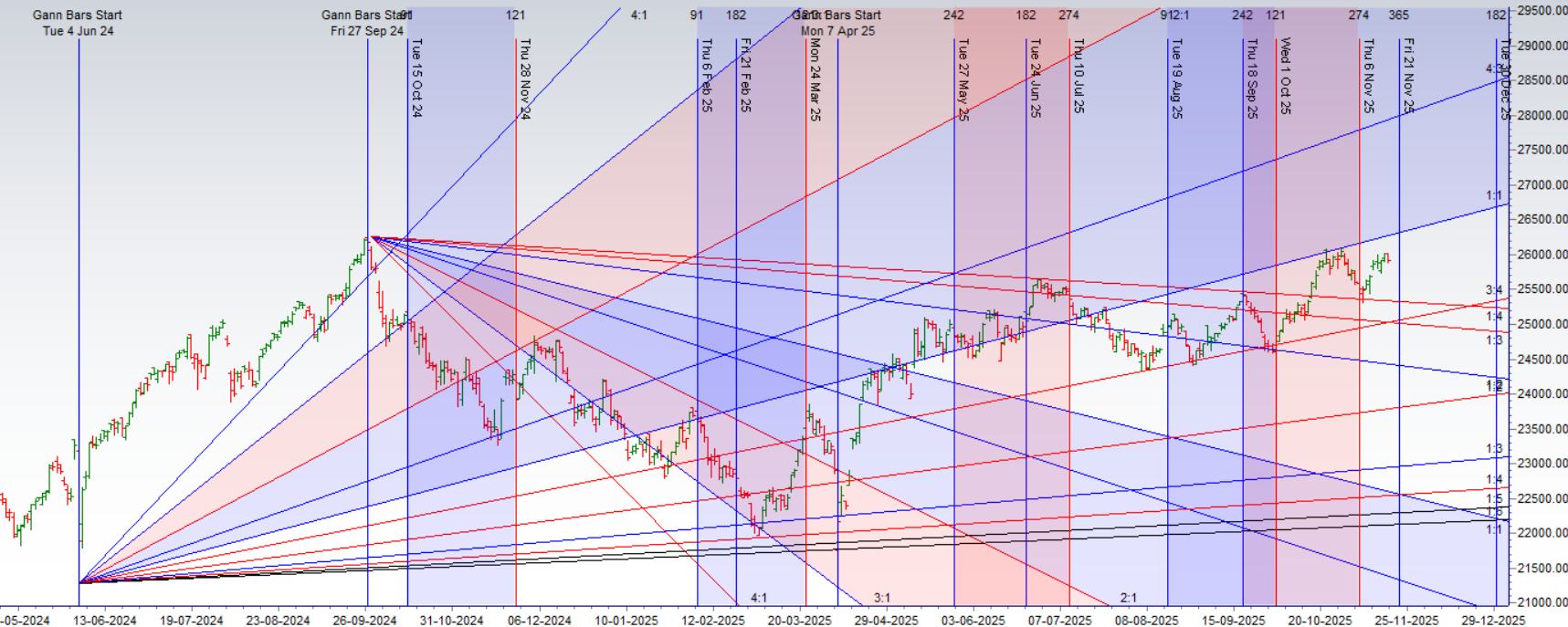

Today’s Catalyst: The “Double Lunar Date”

Now, the market faces another, potentially even more powerful, astrological event: a “Double Lunar Date.” This signifies a day of heightened emotional energy, where sentiment can reach a peak, and the probability of a major turning point or a significant acceleration of the existing trend is exceptionally high. This celestial setup guarantees that today’s session will not be quiet. It will provide the raw energy for another major move.

The Unwavering Game Plan: The 15-Minute Compass

Despite the powerful new astrological catalyst, the core trading strategy remains unchanged because it is proven and effective. The market’s opening moves will provide the ultimate guide through the expected volatility.

The first 15-minute high and low will once again serve as our compass.

-

This range will reveal the market’s immediate reaction to the “Double Lunar” energy.

-

A break of the high signals a continuation of the bullish momentum.

-

A break of the low signals that the lunar event is triggering a reversal or a significant profit-booking event.

Conclusion

Yesterday’s session was a priceless lesson in prioritizing price action and adapting to real-time market information. Today, we face a new, powerful catalyst in the “Double Lunar Date.” The potential for another large, volatile move is extremely high. The plan, however, remains rooted in the simple, disciplined, and effective strategy of watching the opening 15-minute range. This unwavering process will guide us in capturing today’s trend, whichever direction it may take.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25927 for a move towards 26007/26087. Bears will get active below 25848 for a move towards 25768/25688

Traders may watch out for potential intraday reversals at 10:26.11:45,01:00,02:35 How to Find and Trade Intraday Reversal Times

Nifty Oct Futures Open Interest Volume stood at 1.67 lakh cr , witnessing liquidation of 8.1 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closuer of LONG positions today.

Nifty Advance Decline Ratio at 30:20 and Nifty Rollover Cost is @26104 closed below it.

In the cash segment, Foreign Institutional Investors (FII) bought 1580 cr , while Domestic Institutional Investors (DII) bought 1360 cr.

A Colossal Divergence: Institutions Turn Powerfully Bullish as Retail Bets Against the Rally

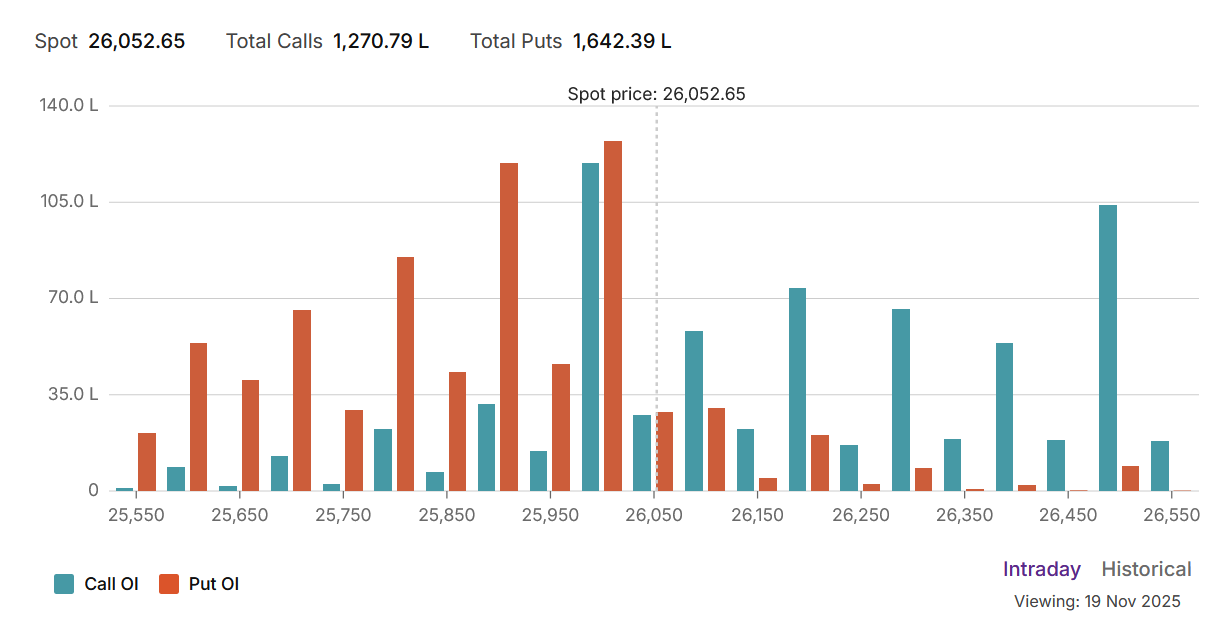

The Nifty options market has undergone a violent and decisive bullish reversal, a story told emphatically by an extremely strong Put-Call Ratio (PCR) of 1.29. This signifies a complete capitulation of the bears and the emergence of a new, powerfully confident market environment. The entire trading range has been dragged higher, with the Max Pain point now firmly established at the key psychological level of 26,000.

However, the most compelling story lies beneath the surface, in the stark and classic divergence between the “Smart Money” of Foreign Institutional Investors (FIIs) and the “Retail Money” of the broader market.

The Bullish Engine: FIIs Build a Fortress of Support

The FIIs have executed a textbook bullish strategy with immense conviction. Their actions were twofold and perfectly synergistic:

-

They were net buyers of call options (+36K contracts), a clear, direct bet that the market’s rally has further to run.

-

More significantly, they were massive net sellers of put options (-74K contracts). This is a powerful display of confidence. By selling puts on such a large scale, FIIs are effectively creating a colossal support floor beneath the market. They are signaling to the market that they are willing to absorb any dips and are collecting premium from those who are still fearful of a decline.

This combined strategy of buying upside exposure while aggressively building downside support is the hallmark of institutional conviction.

The Retail Reaction: Cautious and Disbelieving

In a complete mirror image, retail traders have reacted to the rally with caution and disbelief. Their actions reveal a deeply bearish-to-neutral bias:

-

They were significant net sellers of call options (-140K contracts). This is a bet that the rally is exhausted and will fail at the overhead resistance levels.

-

They were net buyers of put options (+105K contracts), a classic sign of fear or hedging against a potential fall.

Critically, the FIIs are very likely the ones selling the puts that the retail traders are buying. This is a direct transfer of premium from a fearful retail segment to a confident institutional one.

Defining the New Battlefield:

This powerful institutional-led move has completely redrawn the market’s map:

-

Resistance: The primary resistance is now the territory being defended by the retail call sellers, located at 26,200 and, more significantly, 26,500. These are the next hurdles for the bulls.

-

Central Pivot / Major Support: The 26,000 strike is now the most critical level. As the new Max Pain point and home to a burgeoning wall of puts, it has transformed into a major support zone.

-

Ultimate Support: The former battlegrounds of 25,800 and 25,500 now stand as the ultimate support floors, heavily fortified by the new wave of institutional put writing.

Conclusion

The Nifty is now in a state of powerful, institutionally-driven bullish momentum. The divergence between the confident FIIs and the fearful retail segment is stark and telling. The market is being fueled by FIIs who are simultaneously buying the rally and building a massive support structure beneath it. While retail call selling may create some congestion at higher levels, the immense support floor created by the FIIs suggests that any dips are likely to be bought aggressively. The path of least resistance is now firmly to the upside, and the market has transitioned to a “buy on dips” environment.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25906. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 26011 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 26100 Tgt 26133, 26166 and 26225 ( Nifty Spot Levels)

Sell Below 26050 Tgt 26008, 25970 and 25920 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

sir

is this still applicable….?

Theme for Nifty : The Complacency Peak and The Structural Break

The story for the indices is a textbook complacency-to-panic cycle. The week will open under the influence of the stabilizing Sun-Saturn trine, fostering a low-volatility rally or a firm consolidation near recent highs. This is the peak of confidence, where risk is ignored and the structure feels solid. This is a high-probability bull trap. The structural break occurs on Wednesday with the Mercury-Uranus shock. An unexpected event or piece of negative news will shatter the market’s composure, triggering a high-velocity liquidation that violates key technical support levels. This is not a dip; it is a change in character. Thursday’s trend change signature (Bayer Rule 22) confirms the high is in, turning any bounce attempts into shorting opportunities. Friday’s Sun-Uranus opposition will unleash a final wave of panic selling, confirming that the structural integrity of the market has failed.

regards

h.mehta

Wednesday did not work as per expectation