A Healthy Trend Confirmed: FIIs Lead the Charge with New Long Positions in Bank Nifty

On November 18, 2025, the Bank Nifty Index Futures market delivered a textbook signal of a healthy, strengthening, and sustainable uptrend. Foreign Institutional Investors (FIIs) continued their new bullish regime, buying a solid 1,687 contracts worth ₹349.88 crore.

However, the session’s most powerful and profoundly bullish signal was the concurrent increase in net Open Interest (OI) of 533 contracts. This is the market’s definitive confirmation that the rally is no longer being fueled by the weak buying of retreating bears, but by the strong, confident buying of new bulls initiating fresh positions.

Decoding the Data: The Transition from Recovery to a Real Trend

This combination of institutional buying and rising open interest is the classic signature of a budding, healthy bull run. The market has now officially graduated from its bottoming and reversal phase into a new, accumulation-driven trend.

-

FIIs’ Growing Conviction: The FIIs’ continued buying demonstrates that their initial pivot to a bullish stance was not a one-off event. They are now in a phase of methodical accumulation. This proactive buying shows that they view current price levels not as a selling opportunity, but as a chance to build a larger long position in anticipation of higher prices. Their consistent presence on the buy-side establishes a powerful institutional floor under the market.

-

The Unmistakable Signal of Rising Open Interest: This is the most crucial element of the analysis. A rally on falling OI is weak and signals short-covering (old bears exiting). A rally on rising OI, as seen here, is a sign of immense strength. It means that new capital is entering the market with conviction. The FIIs’ buying was so strong that it not only absorbed all the sellers who were closing old positions but also met new, willing sellers to create brand-new contracts. This is a sign of a vibrant, healthy market where participation is increasing, and the bullish force is overwhelming the bearish force. It is the difference between an echo and a new voice.

Key Implications for Traders

-

A Solid Foundation for the Rally: The trend is no longer just a “short squeeze.” It is now built on the solid foundation of new, institutional long positions. This makes the rally far more durable and less susceptible to sudden collapses.

-

The Definitive Shift in Market Psychology: The market’s character has fundamentally changed. The dominant strategy is no longer “sell the rally,” which defined the previous downtrend. It is now decisively “buy the dip.” Any market weakness is likely to be met with this methodical FII buying, creating strong support zones.

-

The Path of Least Resistance is Clearly Up: With the market’s most powerful players now consistently buying and new money flowing in to support the trend, the path of least resistance has firmly shifted to the upside. Fighting this trend is now fighting the primary institutional flow.

-

A Measured, Not Manic, Rally: The size of the buying is solid but not euphoric. This indicates a measured, confident accumulation phase rather than a panicked, “blow-off top” rally. This healthy pace suggests the trend has more room to run.

Conclusion

This session’s data is a high-quality, bullish signal. The FIIs have confirmed their commitment to the long side, and the rising Open Interest provides undeniable proof that the market is attracting new, convicted capital. The Bank Nifty has successfully transitioned from a fragile recovery to a healthy, institutionally-backed uptrend. The underlying dynamics are strong, suggesting that the rally has both the power and the foundation to continue.

Bank Nifty Nov Futures Open Interest Volume stood at 16.9 lakh, with liquidation of0.24 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closeure of SHORT positions today.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 59013 for a move towards 59254/59495/59736. Bears will get active below 58772 for a move towards 58531/58290/58050

Bank Nifty Advance Decline Ratio at 04:08 and Bank Nifty Rollover Cost is @58357 closed above it.

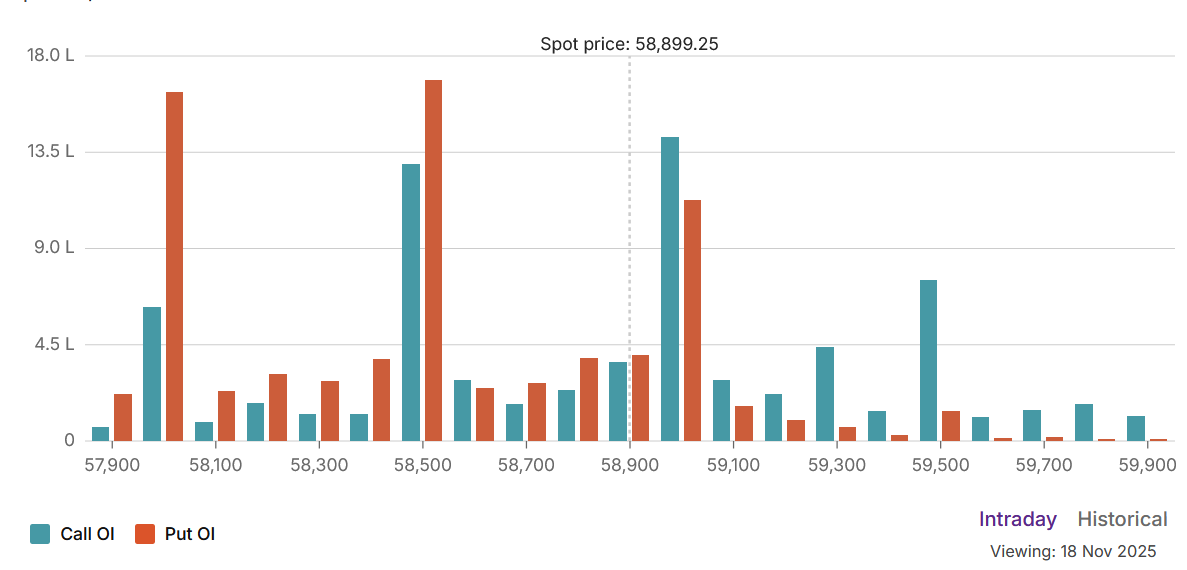

Bulls Seize Command: Bank Nifty Enters Confidently Bullish Territory as Max Pain Leaps to 58,500

The Bank Nifty options market is no longer in a state of neutrality or cautious optimism; it has decisively entered a new, confidently bullish phase. This is unequivocally confirmed by two powerful data points: the Put-Call Ratio (PCR) has surged into firmly bullish territory at 1.11, and the market’s structural center of gravity, the Max Pain point, has made a significant leap higher to 58,500. This dual confirmation signals a complete retreat by the bears and the establishment of a new, higher trading plateau.

The Psychology of a 1.11 PCR: A Market Without Fear

A PCR moving above 1.0 and climbing to 1.11 is a formidable bullish signal. It means that the total open interest of put options has substantially surpassed that of call options. This is the hallmark of a market that has shed its fear of the downside. The driving force behind this is aggressive put writing. Confident traders, believing a firm bottom is in place, are actively selling “insurance” (puts) to collect premium, thereby creating a massive, multi-layered support floor beneath the market. This is no longer a recovery; it is a display of confidence.

The Decisive Leap: Max Pain Shifts to a New High at 58,500

The most critical structural development is the upward surge of the Max Pain level to 58,500. This is the price point that exerts the strongest magnetic pull on the index, as it represents the point of maximum financial loss for option buyers. The move from ~58,200 to 58,500 signifies that the market’s most influential players—the large institutional option writers—have moved their entire fortress to a new high ground. They are no longer defending the 58,000-58,200 range; they are now actively building positions that imply a consolidation and expiry at this new, much higher level. The entire expected trading range has been fundamentally recalibrated upwards.

Defining the New Battlefield: The Bullish Re-Mapping of Support and Resistance

This powerful bullish shift has completely redrawn the market map, turning former ceilings into new foundations.

-

Ultimate Resistance: The next major psychological and structural barrier is now the 59,000 strike. This is the next “great wall” of Call OI that the bulls will have to conquer to unleash a new trending move.

-

Immediate Resistance / Central Pivot: The new Max Pain point of 58,500 is now the central battleground. It will act as a powerful magnet and the primary pivot around which the market will likely trade.

-

Major Support: The previous resistance fortress of 58,200 – 58,300 has now decisively flipped to become the new primary support zone. A huge number of put writers are now anchored here, ready to defend it.

-

Ultimate Support: The once-critical level of 58,000 now stands as the ultimate support floor for the current trading range. A break below this level is now considered a very low-probability event, given the market’s bullish structure.

Conclusion

The battle for control of the Bank Nifty is over, and the bulls have won a decisive victory. The evidence from both the PCR and the shift in Max Pain is overwhelming. The market’s psychology is confident, and its structure is strong. The immediate downside risk has been significantly neutralized. The most likely scenario is a period of healthy consolidation and accumulation in the new, higher range centered around 58,500, as the market builds energy for an eventual assault on the 59,000 resistance.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 58429. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 59011, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 58951 Tgt 59108, 59319 and 59444 (BANK Nifty Spot Levels)

Sell Below 58816 Tgt 58666, 58459 and 58225 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

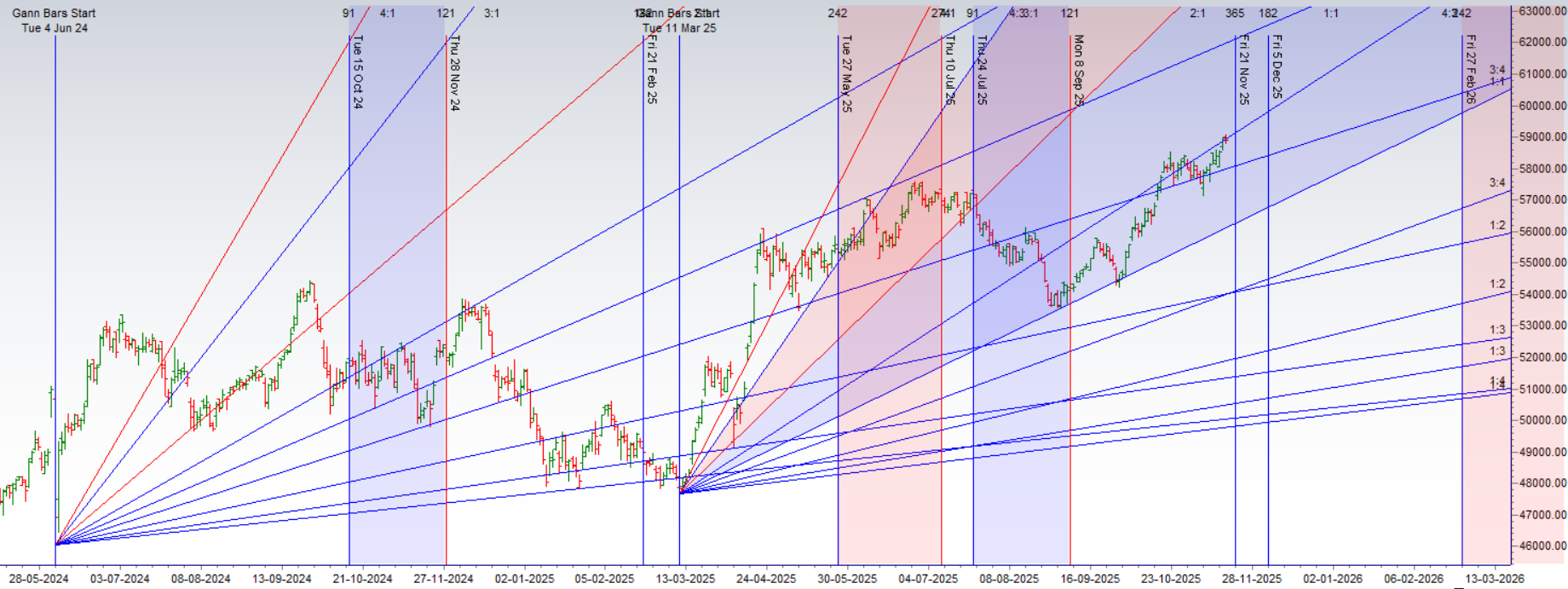

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators