Disclaimer: This is the highest probability forecast derived from an expert, multi-decade historical analysis of the provided astrological signatures and their direct correlation with market psychology and price action. This is not a guarantee. The market is influenced by numerous real-world factors, and all trading involves significant risk. This analysis is for informational and educational purposes only.

Theme for Sensex: The Complacency Peak and The Structural Break

The story for the indices is a textbook complacency-to-panic cycle. The week will open under the influence of the stabilizing Sun-Saturn trine, fostering a low-volatility rally or a firm consolidation near recent highs. This is the peak of confidence, where risk is ignored and the structure feels solid. This is a high-probability bull trap. The structural break occurs on Wednesday with the Mercury-Uranus shock. An unexpected event or piece of negative news will shatter the market’s composure, triggering a high-velocity liquidation that violates key technical support levels. This is not a dip; it is a change in character. Thursday’s trend change signature (Bayer Rule 22) confirms the high is in, turning any bounce attempts into shorting opportunities. Friday’s Sun-Uranus opposition will unleash a final wave of panic selling, confirming that the structural integrity of the market has failed.

For Day by Day Forecast Please watch the below video

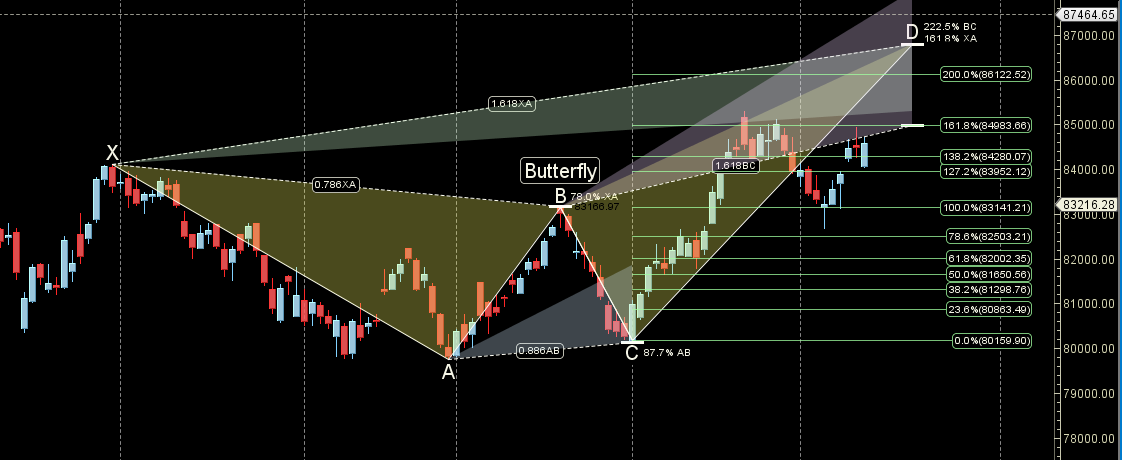

SENSEX Harmonic Pattern

Sensex is back its its Buttefly pattern PRZ zone of 85100-85200 crossing this range is very important to invaldiate the pattern.

SENSEX Gann Angles

Sensex is between its 4×3 and 1×1 gann angle.

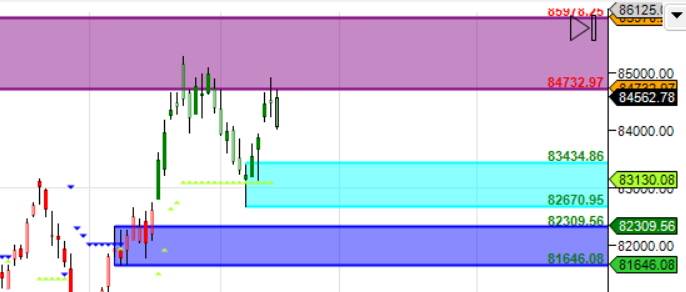

SENSEX Supply and Demand

Self Explanatory Chart

SENSEX Time Analysis Pressure Dates

Key Pivot Dates: Watch 19 Novemeber

SENSEX Weekly Chart

Weekly Bullish Engulfing after 3 weeks of fall.

SENSEX Monthly Charts

85431 is Monthly resistance zone 83182 is Support zone.

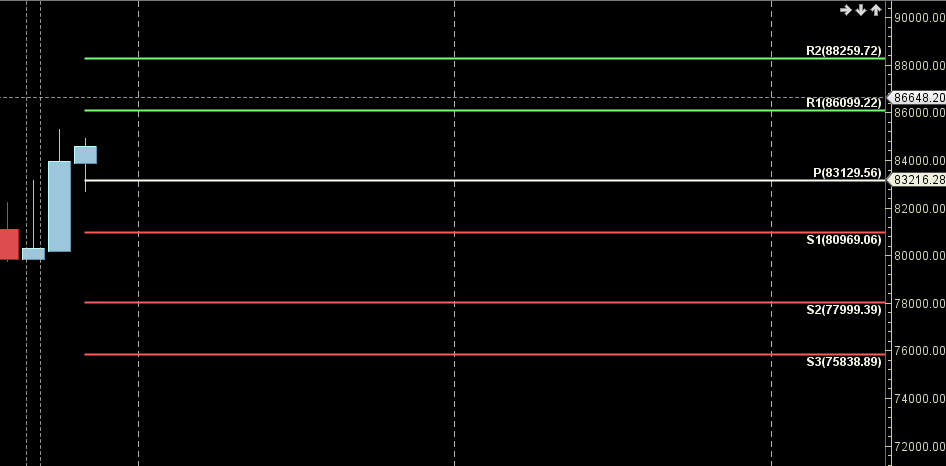

SENSEX Weekly Levels

SENSEX Trend Deciding Level: 84565

SENSEX Resistance: 84853,85142,85430,85729

SENSEX Support: 84277,83989,83700,83412,83124

Levels mentioned are SENSEX Spot

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.

Call: 09985711341

Email: bhandaribrahmesh@gmail.com