Disclaimer: This is the highest probability forecast derived from an expert, multi-decade historical analysis of the provided astrological signatures and their direct correlation with market psychology and price action. This is not a guarantee. The market is influenced by numerous real-world factors, and all trading involves significant risk. This analysis is for informational and educational purposes only.

Theme for Gold & Silver: The Setup and The Safe-Haven Detonation

For Gold, the narrative this week is a classic “bear trap leading to a short-squeeze.” The structured, risk-on environment created by the Sun-Saturn trine at the start of the week is fundamentally bearish for safe havens. Gold is therefore engineered to look weak, likely grinding lower and testing key technical support. This price action is designed to wash out weak longs and attract aggressive shorts. This is the setup. The detonation occurs mid-week. The Mercury-Uranus information shock is the precise catalyst that triggers a frantic flight from risk and a desperate bid for the safety of Gold. Thursday’s Bayer Rule 22 will confirm a major swing low has been established, flipping the technical bias from bearish to decisively bullish. Friday’s chaos (Sun-Uranus) will be the fuel that turns the initial rally into an accelerating, high-momentum trend. The week is defined by this dramatic pivot from weakness to overwhelming strength.

For a Detailed Day by Day Forecast with Neural Analysis Please watch the below video

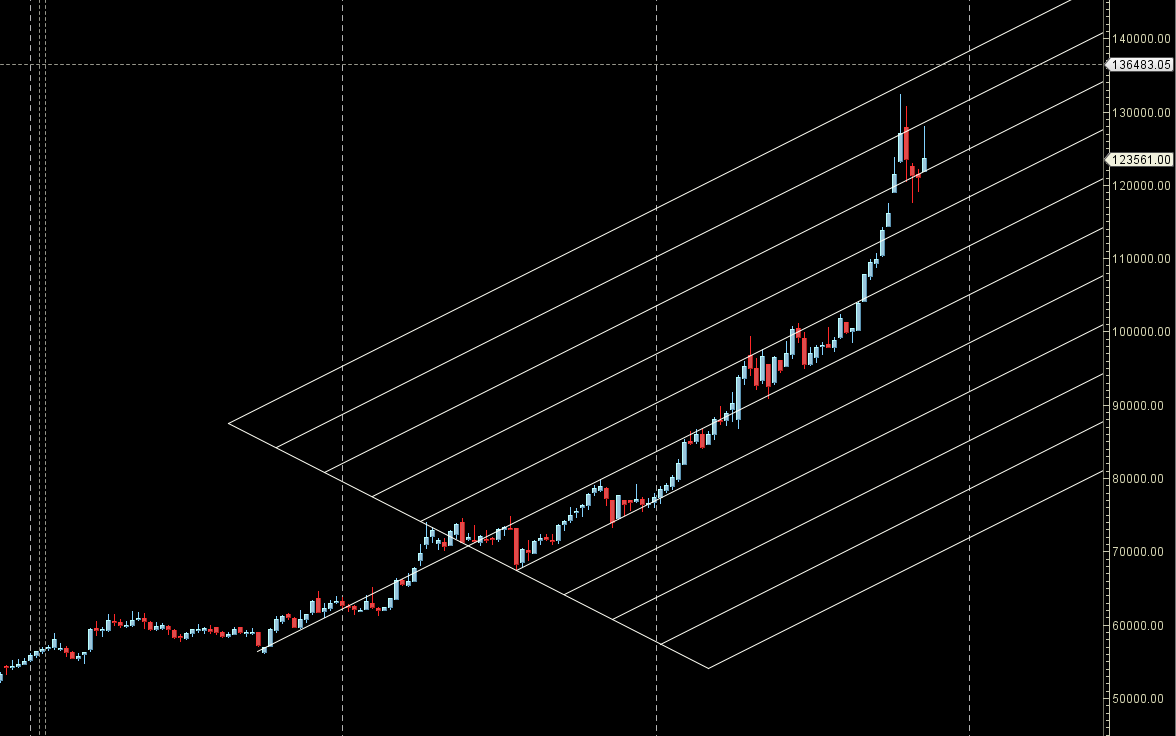

MCX GOLD Gann Angle Chart

Gold is heading towards 120K at 1×1 gann angle and break of the same will lead to decline towards 117 K

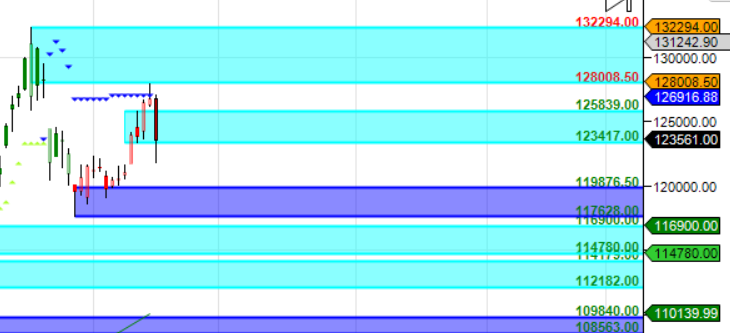

MCX GOLD Supply Demand Zone

MCX GOLD Supply Demand Chart : Demand in range of 119876-120023 , Supply in range of 12500-125500

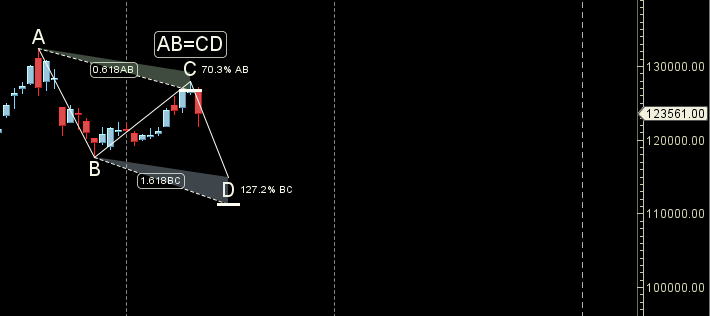

MCX GOLD Harmonic Analysis

Price did 125 K as per bullish shark now Bearish ABCD forming break of 120K can lead to decline towards 117-115 K

MCX GOLD Weekly

Gold reacted from Weekly AF resistance

MCX GOLD Monthly

125126 Monthly Resistance and 120496 Monthly Support.

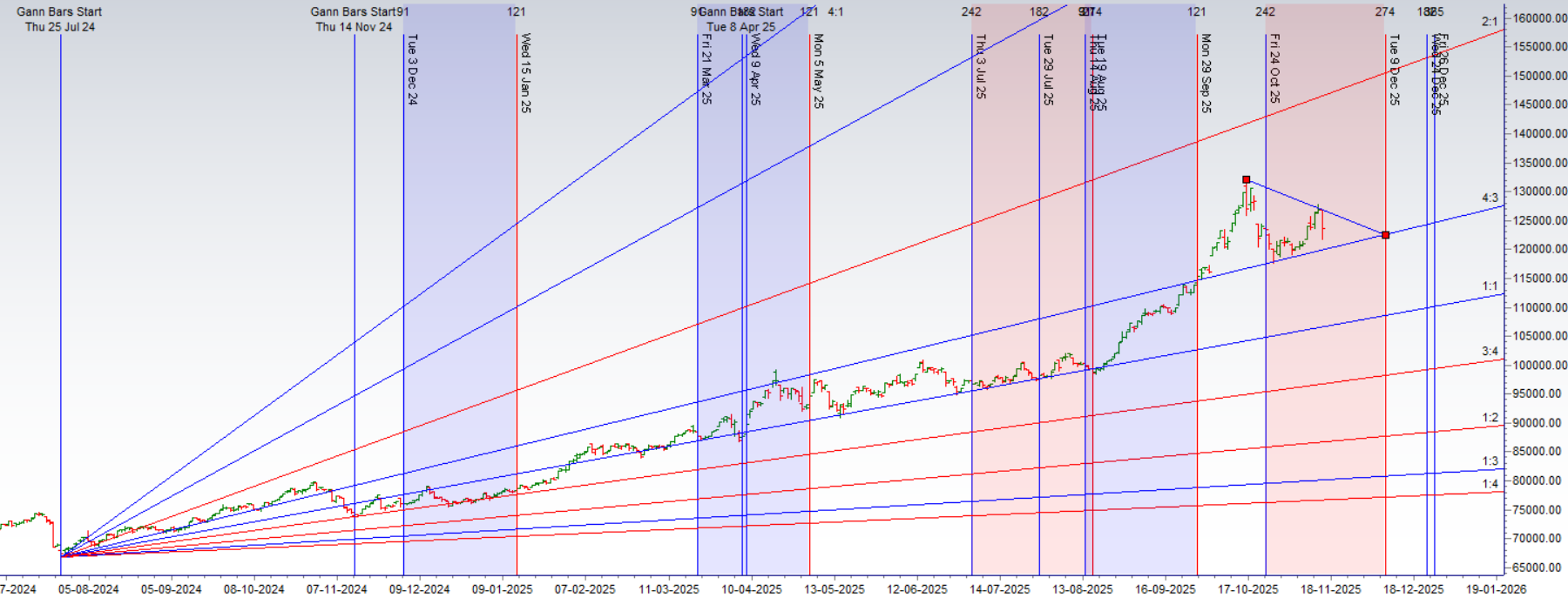

GOLD Astro/Gann Trend Change Date

Key Pivot Dates: Watch 19 November

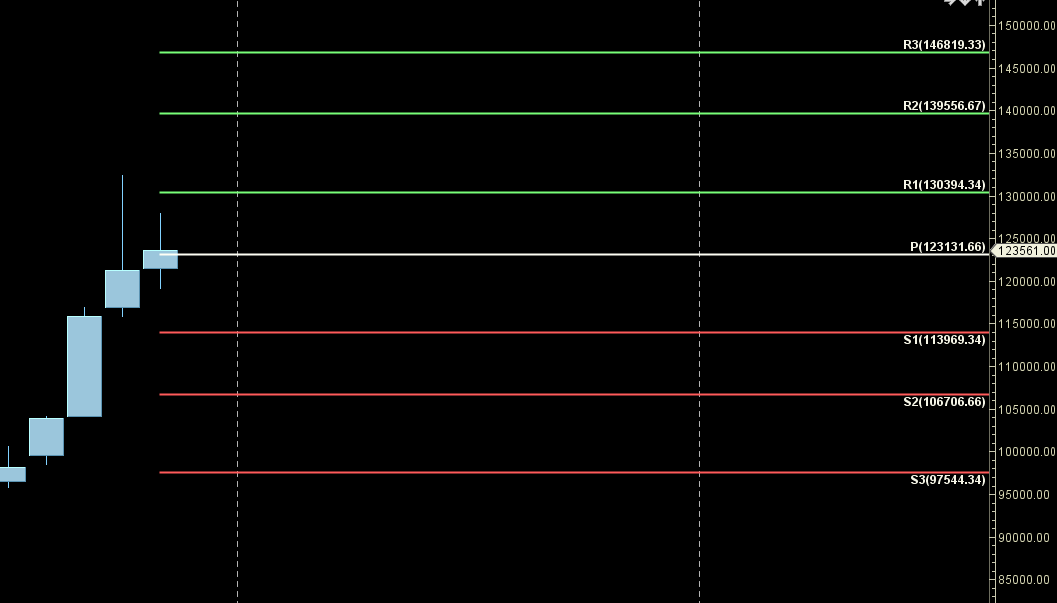

GOLD Weekly Levels

Weekly Trend Change Level:122982

Weekly Resistance: 123685,124389,125095,126514

Weekly Support: 122282,121584,120887,120193,119500

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.