A Subtle but Ominous Signal: FIIs Build New Bearish Positions in a Stagnant Market

On the surface, the activity in the Bank Nifty Index Futures on November 11, 2025, appeared muted. A small net short of 561 contracts by Foreign Institutional Investors (FIIs) might be easily dismissed. However, the most critical data point of the session fundamentally changes this interpretation: the net Open Interest (OI) increased by 289 contracts.

This is a subtle but profoundly bearish signal. It tells us that despite the quiet price action, the market is not finding a bottom. Instead, new, high-conviction bearish positions are being built, absorbing any residual buying pressure and adding to the potential energy for a future decline.

Decoding the Data: The Grind Before the Storm

The combination of modest shorting with a rise in open interest reveals a critical market dynamic:

-

FIIs: The Methodical Bears: The FIIs are no longer in a phase of aggressive, panicked selling. Their action is now methodical and deliberate. By adding a small number of new shorts, they are using the market’s apparent stability not to exit their positions, but to add to their bearish bets at favorable prices. This is not a sign of fear; it is a sign of quiet, calculated conviction that the current price levels are temporary and a move lower is coming.

-

The Open Interest Signal: This is the key to the entire analysis. An increase in OI means that brand-new contracts were created. For this to happen while FIIs added only 561 new shorts, it means that the market is in a phase of bearish consolidation. Old positions are being squared up, but the new positions entering the market are more powerful and are decidedly bearish. This is the opposite of an exhausted trend; it is a trend that is quietly reloading and building energy for its next leg.

Key Implications for Traders

-

Bearish Consolidation, Not a Bottom: The rising OI is a clear red flag against interpreting any range-bound price action as a bottoming process. It shows that new supply (short positions) is entering the system, capping any potential rallies.

-

Rallies Remain Highly Vulnerable: Any attempt by the bulls to stage a relief rally is likely to be met with this methodical FII selling. The FIIs are demonstrating that they are happy to absorb buying pressure and initiate fresh shorts.

-

A Market Coiling for a Move Down: A trend that consolidates on rising open interest is often a sign of a market that is building cause for a powerful continuation move. The current price action is likely a pause to build energy, not a reversal. The pressure is building to the downside.

-

The Absence of Powerful Buyers: The small size of the activity suggests there are no significant institutional buyers stepping in to challenge the FIIs’ bearish stance. The bears are facing little opposition, allowing them to patiently build their positions.

Conclusion

Do not mistake the small size of the FIIs’ selling for a lack of bearish conviction. The concurrent increase in Open Interest is the more powerful and truthful indicator, and it signals that the market is in a bearish reloading phase. The trend is not exhausted; it is consolidating and building energy for its next major move. This subtle activity suggests that the Bank Nifty remains in a precarious and vulnerable state, with the underlying dynamics favoring a continuation of the downtrend after this period of consolidation concludes.

Bank Nifty Nov Futures Open Interest Volume stood at 19.5 lakh, with liquidation of 0.11 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closeure of SHORT positions today.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 58114 for a move towards 58353/58592. Bears will get active below 57636 for a move towards 57396/57157

Bank Nifty Advance Decline Ratio at 05:07 and Bank Nifty Rollover Cost is @58357 closed above it.

Bank Nifty Gann Dynamic Levels 56507-56984-57462-57943-58425

Sentiment Shifts Decisively as Bears Retreat, Bank Nifty Locked in 58,000 Orbit

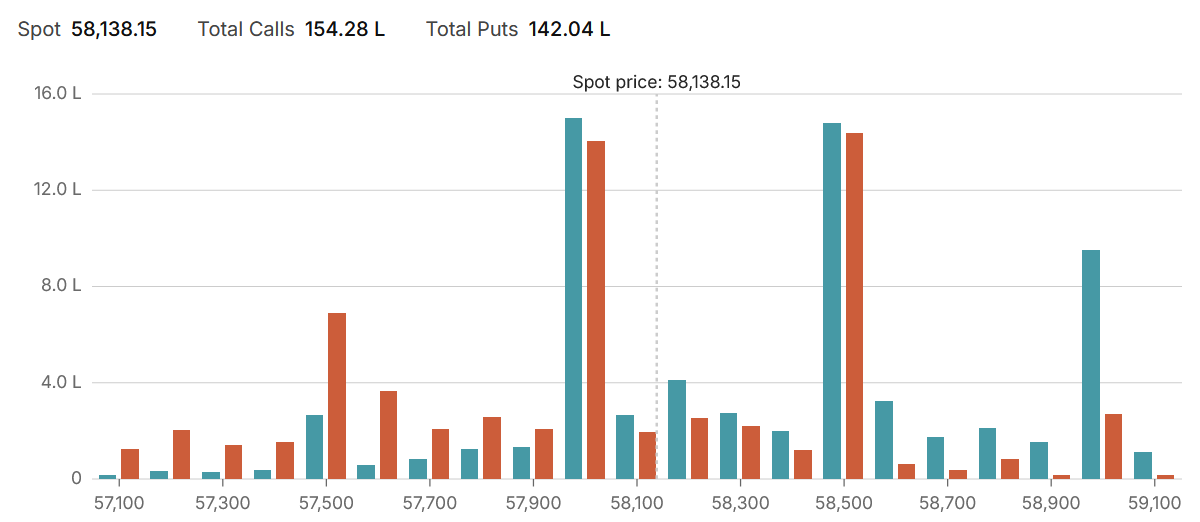

The Bank Nifty options market is undergoing a crucial and decisive shift in sentiment. The narrative of fear and bearish control has been thoroughly erased, replaced by a tense but stable neutrality. The Put-Call Ratio (PCR) has climbed to a robust 0.92, its highest level in recent sessions, indicating that bearish bets are being rapidly unwound and the market is now in a state of near-perfect equilibrium. However, this newfound stability comes with a major caveat: the market remains firmly trapped in the immense gravitational field of the 58,000 strike price, which continues to act as the Max Pain point.

The Story of the Soaring PCR: Fear Capitulates

The most significant development is the sharp rise in the PCR to 0.92. This is a clear signal that the sellers who were previously dominating the market have lost their conviction. This numerical shift is the result of two powerful underlying forces:

-

Bearish Profit-Taking: Put sellers who bought protection at lower levels are now closing their positions as the fear of a market crash subsides.

-

Renewed Bullish Confidence: A new wave of put writers has emerged, confident enough to sell puts (a bullish-to-neutral strategy), creating a stronger support floor under the market.

This evaporation of fear means that the intense downward pressure has been neutralized. The market has moved from a defensive, bearish posture to a stable, range-bound environment.

The Unchanged Center of Gravity: The 58,000 Fortress

While the mood has improved, the physical landscape of the options chain remains dominated by the colossal positions at the 58,000 strike. As referenced in the visual structure, this level holds a massive concentration of both Call and Put Open Interest. This “short straddle” built by institutional writers acts as a powerful magnet. These sellers have a vested financial interest in the market expiring as close to this level as possible, and they will likely defend it with immense force, selling into any rally that moves too far above it and buying into any dip that moves too far below it. The Max Pain remaining steadfastly at 58,000 confirms that this remains the market’s inescapable focal point.

Defining the Battleground: Key Support and Resistance

Based on the market’s structure, the key levels are now very well-defined:

-

Ultimate Resistance and Pivot: 58,000. This level is the primary ceiling. The massive Call OI here will absorb immense buying pressure, making it the most significant hurdle for bulls.

-

Secondary Resistance: The 58,500 strike continues to hold a significant block of Call OI, marking the next major barrier if the market manages a breakout.

-

Immediate Support: 57,500. This level has a strong concentration of put writers who will act to defend it.

-

Ultimate Support: The 57,000 strike remains the final line of defense, a formidable wall of Put OI that represents the market’s ultimate floor. A break below this is now highly improbable given the improved sentiment.

Conclusion

The Bank Nifty has successfully navigated its period of high risk. The bears have retreated, and a floor has been established under the market. However, freedom remains elusive. The market is now a prisoner of the option writers at 58,000. The most probable outcome is a continued, low-volatility grind within the 57,500 – 58,000 range as the index is inexorably drawn towards its Max Pain point. While the threat of a major decline has passed, a significant rally is equally capped, leading to a classic market stalemate.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 58271 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 58155 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 58352 Tgt 58566, 58729 and 58945 (BANK Nifty Spot Levels)

Sell Below 58150 Tgt 58008, 57850 and 57700 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators