Disclaimer: This is the highest probability forecast derived from an expert, multi-decade historical analysis of the provided astrological signatures and their direct correlation with market psychology and price action. This is not a guarantee. The market is influenced by numerous real-world factors, and all trading involves significant risk. This analysis is for informational and educational purposes only.

Theme for Silver: The Safe-Haven Reversal: A Failed Breakdown Ignites the Next Rally

The technical script for Silver this week is a classic failed breakdown pattern that triggers a sharp short-squeeze. The initial risk-on sentiment and the bearish pressure from Bayer Rule 2 will force Silver to test a critical weekly support level early on. This move is designed to wash out weak longs and attract aggressive shorts. However, the subsequent market-wide uncertainty generated by the Mercury and Jupiter retrograde stations is fundamentally bullish for non-correlated, safe-haven assets. As confidence in equities begins to crumble mid-week, the capital flow will reverse. Wednesday’s Mercury-Mars conjunction will act as the explosive intraday reversal point, breaking the bearish structure and trapping shorts. The week’s narrative for Silver is not about following the equity market, but about acting as the primary beneficiary of its failure. The latter half of the week is defined by upside continuation as risk aversion rises, establishing a new and durable swing low.

For a Detailed Day by Day Forecast with Neural Analysis Please watch the below video

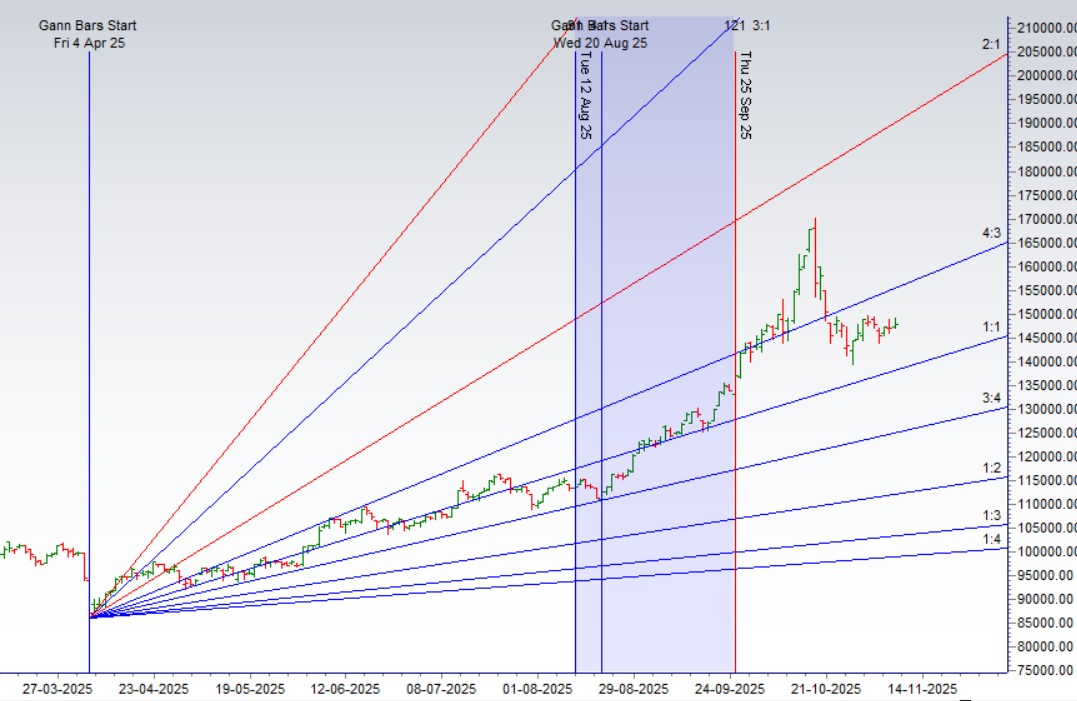

MCX Silver Gann Angle Chart

Silver has broken its 4×3 gann angle resistance zone break of 145 K can see a sharper pullback towards 140 K

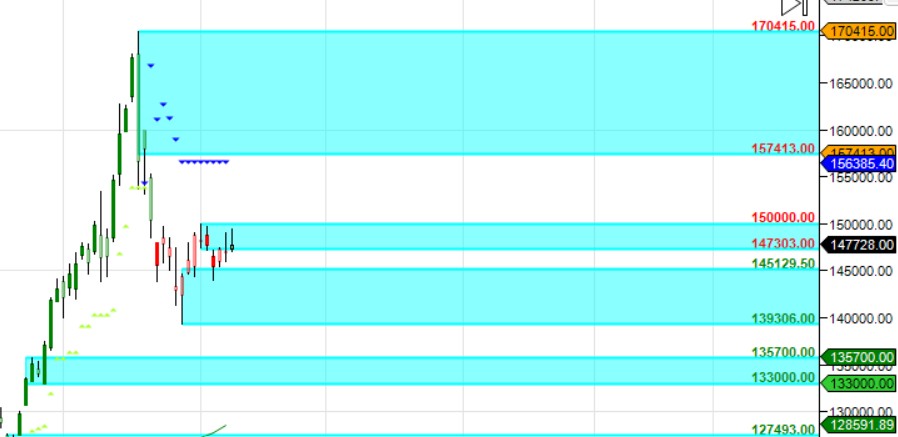

MCX Silver Supply Demand Zone

MCX GOLD Supply Demand Chart : Demand in range of 145129-145000, Supply in range of 149750-150000

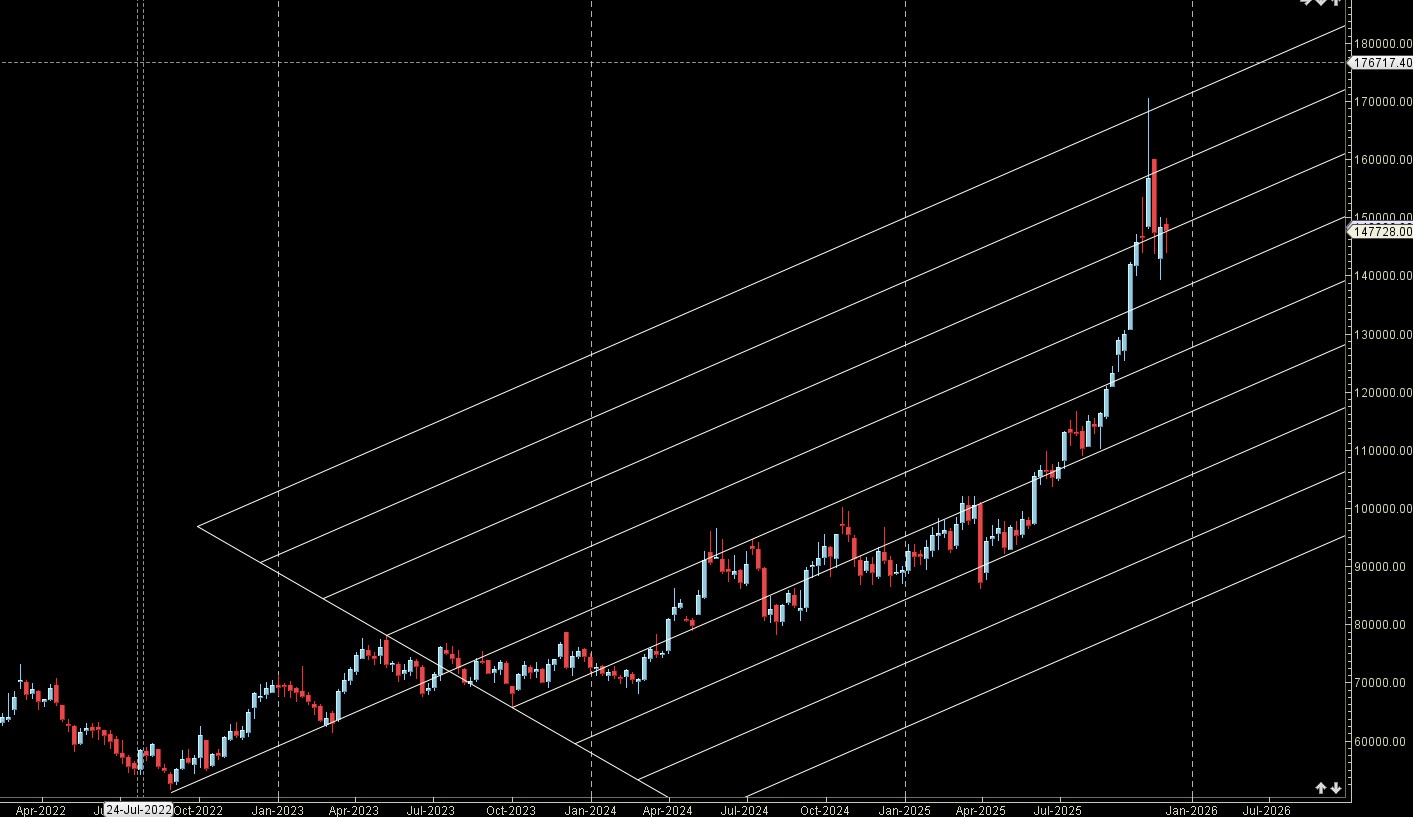

MCX Silver Harmonic Analysis

Price is near its C Leg Break of 146 K can lead to bigger decline towards 144-140-136 K

MCX Silver Weekly

Third Weekly Red Close after 9 Week of Rally and formed an Weekly Inside Bar.

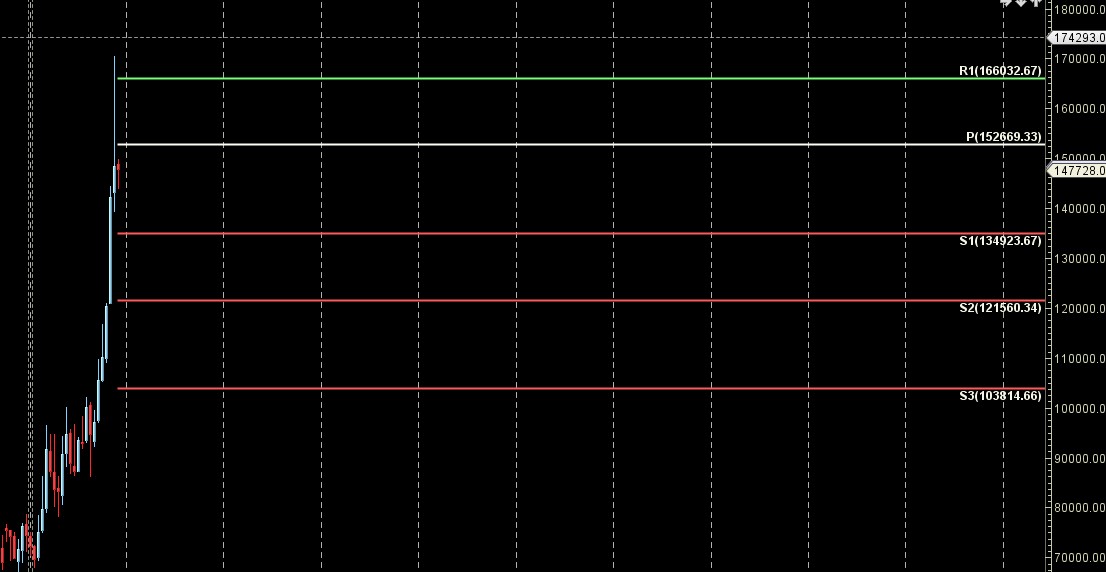

MCX Silver Monthly

152669 Monthly Resistance and 145000 Monthly Support.

Silver Astro/Gann Trend Change Date

Key Pivot Dates: Watch 12 November

Silver Weekly Levels

Weekly Trend Change Level:148408

Weekly Resistance: 149179,149953,150728,151506,152285

Weekly Support: 147638,146871,146105,145342,144582,143821

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.