A Market Hollows Out: FIIs Press to Extreme Levels as Clients Fracture

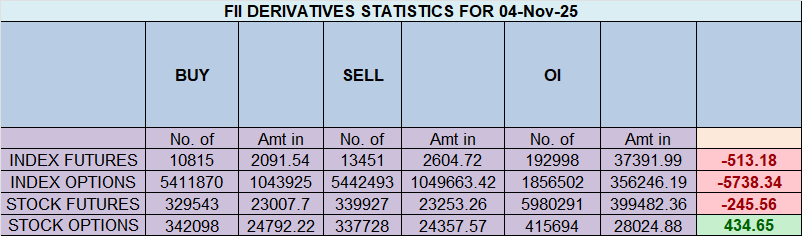

On November 6, 2025, the Nifty Index Futures market presented a picture of extreme divergence and growing instability. While Foreign Institutional Investors (FIIs) relentlessly pressed their bearish advantage, adding a net 3,046 short contracts worth ₹585 crore, the most crucial signal came from the underlying flows: the net Open Interest (OI) fell by 2,334 contracts.

This is a critical combination. An institutionally-led sell-off occurring in a market with shrinking overall participation is a classic sign of a trend reaching an exhaustive, final stage. The FIIs are displaying peak conviction, while the rest of the market is becoming fractured and starting to flee.

Decoding the Data: The Anatomy of a Late-Stage Move

1. FIIs: The Two-Pronged Bearish Attack

The FIIs’ actions were a masterclass in bearish conviction. Their strategy was two-fold and exceptionally aggressive:

-

They liquidated their remaining longs (covering 2,022 contracts), effectively signaling zero faith in any potential upside.

-

They simultaneously added fresh shorts (614 contracts), actively adding new pressure to a falling market.

This combination of giving up on the upside while pressing the downside has driven their positioning to a historic extreme of 14% long versus 86% short. A long-short ratio of 0.20 is at a level of maximum bearishness, indicating they are positioned for a significant, final leg down.

2. Clients: A House Divided and Confused

For the first time in this sequence, the client segment is no longer a monolithic bullish force. Their actions reveal deep conflict and confusion:

-

The Bottom-Fishers: One group of clients added 2,859 long contracts, attempting to catch a falling knife and bet on a reversal.

-

The Capitulators: A much larger group added 5,224 short contracts, either by capitulating on their existing longs and flipping short, or by hedging their portfolios against a further crash.

This internal fracturing is highly significant. It shows that the unified retail bullish sentiment is broken. While their overall positioning remains heavily long (68:32), the active flow shows a significant shift towards fear and bearishness.

3. The Critical Signal of Decreasing OI

Even with all this activity, the total number of open contracts fell. This means the number of traders closing their positions was greater than those opening new ones. This is the clearest sign of trend exhaustion. A market falling on decreasing OI is like an engine running out of fuel. It shows that the supply of panicked longs left to sell is dwindling, making the market vulnerable to a sudden reversal.

Key Implications for Traders

-

A Historic Divergence: The positioning is at an absolute extreme: “Smart Money” (FIIs) is at peak bearishness (14:86), while “Retail Money” (Clients) is still positioned with extreme bullishness (68:32). This is a textbook setup for a major, painful market resolution.

-

High Risk of a “Short Squeeze”: With FIIs this heavily short and the market running out of natural sellers, the risk of a violent short squeeze is now at its highest point. Any unexpected positive news could trigger a rapid chain reaction of FIIs being forced to buy back their shorts, fueling a ferocious rally.

-

A Brittle Market Structure: A market that is “hollowing out” (losing participation) becomes brittle and prone to high-velocity, erratic moves. With fewer participants, larger orders can move the price more dramatically.

-

The End-Game is Near: This is not the data of a healthy, trending market. It is the data of a market in the final, often chaotic, stages of a major directional move. The extreme positioning and falling OI signal that a significant turn or a climatic resolution is imminent.

Conclusion

This is a market on the brink. The FIIs have pushed their bearish conviction to its absolute limit. In response, the retail bullish consensus has finally cracked, leading to conflicted and panicky behavior. The entire structure is taking place within a market that is losing participants, signaling profound trend exhaustion. While the immediate pressure is still down, the conditions are now perfectly ripe for a sudden, violent, and dramatic reversal.

Last Analysis can be read here

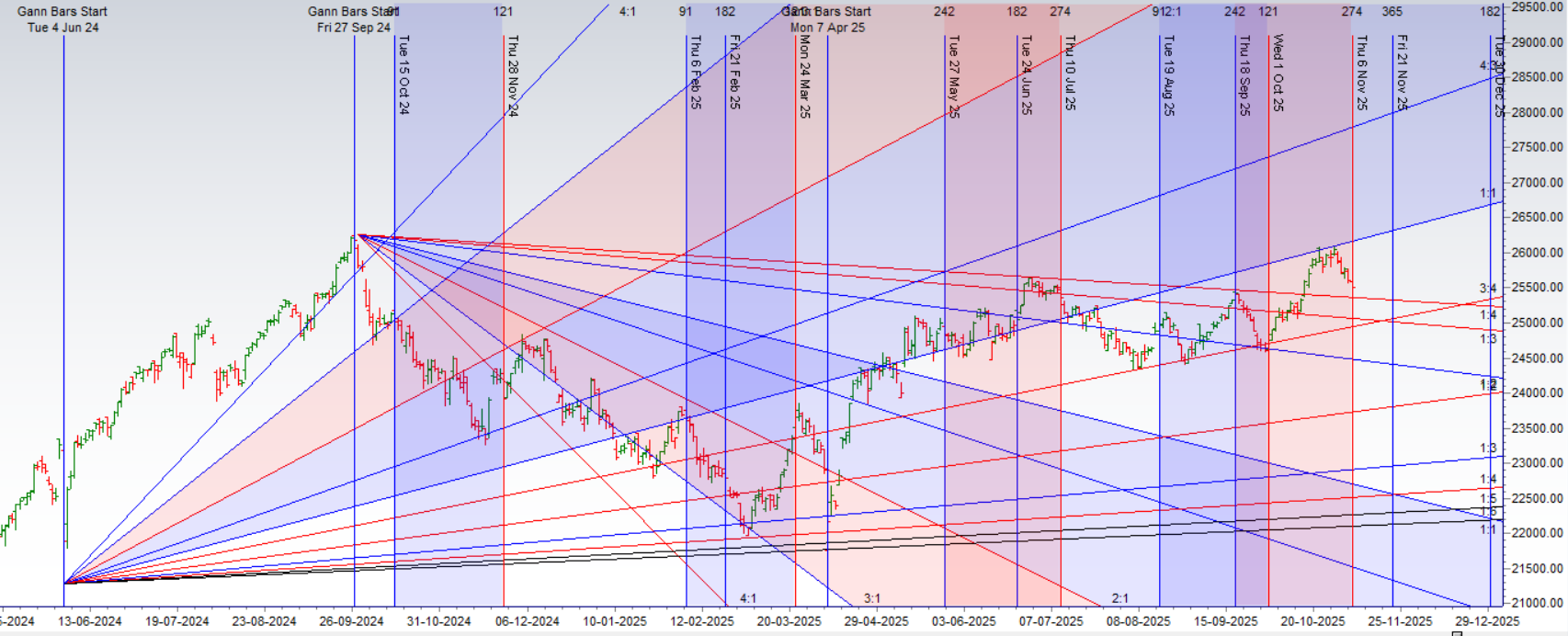

The market has moved with uncanny precision along the path forecast by our analysis. The potent confluence of Gann and astro cycles correctly identified the bearish pressure, leading to a perfect defense of the 25,700 resistance zone and pushing the Nifty down to the critical support at 25,500. The bears have successfully achieved their initial objective and have brought the market to the brink of its next major breakdown.

Now, as we enter the crucial weekly closing session, the stakes are raised exponentially. Today’s price action is not just about intraday gains; it is a strategic battle to set the tone for a major, high-velocity move anticipated for next week, which will be fueled by the powerful Jupiter declination.

The Immediate Objective: The Bearish Push for 25,345

The battle lines for today’s session are drawn with absolute clarity. The bears, emboldened by their recent success, have one primary goal:

-

The Breakdown Trigger (25,500): This is the key that unlocks the next phase of the decline. The bears’ objective is to break this support level decisively. A sustained move below this floor would validate their control and is expected to trigger a quick, accelerated move towards the immediate target of 25,345.

The High-Stakes Battle for the Weekly Close

The entire session will be a tug-of-war between two definitive price levels, which will determine the market’s psychological state heading into the weekend.

-

The Bullish Last Stand (A Close Above 25,711): For the bulls to salvage the situation, they must orchestrate a powerful short-squeeze rally and secure a weekly close above 25,711. This is their line in the sand. A close above this level would not only negate the immediate bearish threat but would also trap the bears who sold aggressively, turning a bearish setup into a potential reversal.

-

The Bearish Objective (A Close Below 25,500): For the bears, a close below this support level would be a resounding victory. It would confirm the breakdown, cement the bearish sentiment over the weekend, and perfectly position the market for a major downward expansion next week.

The Setup for Jupiter’s Expansion

Tomorrow’s Jupiter declination is not an isolated event; it is a catalyst awaiting a direction. Jupiter’s energy is one of expansion. Therefore, today’s close is the crucial setup that will prime the market for this energy.

-

A weak close (below 25,500) will channel Jupiter’s expansive energy into a high-velocity, cascading decline next week.

-

A strong close (above 25,711) would mean this expansive energy could fuel a surprisingly powerful reversal or short-squeeze rally.

Conclusion

Today’s session is far more than a simple weekly close; it is a tactical battle to define the market’s trajectory for the coming weeks. The bears are pressing their advantage, aiming to breach 25,500 and unlock the path to 25,345. The bulls are mounting a desperate last stand to reclaim 25,711. The outcome of this fight will set the direction for what promises to be a high-velocity, Jupiter-driven move in the coming week. Watch these levels with extreme focus.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25562 for a move towards 25642/25722. Bears will get active below 25481 for a move towards 25401/25321

Traders may watch out for potential intraday reversals at 09:16,10:45,11:23,12:20,01:30 How to Find and Trade Intraday Reversal Times

Nifty Oct Futures Open Interest Volume stood at 1.76 lakh cr , witnessing liquidation of 0.18 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closuere of SHORT positions today.

Nifty Advance Decline Ratio at 15:35 and Nifty Rollover Cost is @26104 closed below it.

In the cash segment, Foreign Institutional Investors (FII) sold 3263 cr , while Domestic Institutional Investors (DII) bought 5283 cr.

Nifty in the Bears’ Iron Grip: A Colossal Wall of Resistance Caps the Market

The Nifty options data for November 6, 2025, reveals a market under severe and overwhelming bearish pressure. An extremely low Put-Call Ratio (PCR) of 0.62 signifies a market heavily skewed by call writers, who are betting with immense size and conviction that any significant rally will fail. With the spot price languishing at 25,509.70, well below the Max Pain level of 25,600, the bears are not just in control; they are dictating the terms of engagement.

The Option Chain Landscape: A Formidable Ceiling and a Fragile Floor

The Open Interest (OI) chart paints a dramatic picture of a market pinned down. The most striking feature is the colossal “Wall of Calls” amassed at the 26,000 strike, which has the single largest OI concentration on the entire chart. This represents a massive barrier of supply where sellers have written an enormous number of contracts. This is not the only obstacle; significant secondary resistance walls are clearly visible at 25,600, 25,700, and 25,800, creating a formidable multi-layered ceiling.

On the downside, the bulls are fighting a defensive battle. A significant “floor” of support has been built at the 25,500 strike, which has the highest concentration of Put OI in the immediate vicinity. This level is absolutely critical, as the spot price is teetering directly upon it. If this floor breaks, the next and final major support stands far below at the psychological 25,000 level, which also holds a massive number of put contracts.

Participant Dynamics: FIIs Build the Wall, Retail is Divided

The story behind this structure becomes clear when looking at the participant activity:

-

FIIs as Architects of Resistance: Foreign Institutional Investors are the primary architects of the bearish structure. Their most significant action was net shorting calls (shorting 145K vs buying 113K). They are systematically selling calls at higher strikes, actively creating the resistance that is capping the market’s upside and collecting premium from optimistic buyers. Their neutral stance in puts suggests they are not betting on a total collapse, but are extremely confident that the upside is blocked.

-

Retail is Fractured and Confused: The retail segment is a picture of conflict. Their activity was nearly balanced on both sides, net shorting a minor number of calls and puts. This indicates a complete lack of conviction. They are simultaneously buying calls (hoping for a rally), selling calls (capping the rally), buying puts (fearing a fall), and selling puts (betting on support). This fractured activity shows retail traders are reacting to the price action rather than driving it.

Defining the Battleground:

-

Ultimate Resistance: 26,000. The Great Wall of Calls. Breaking this would require an extraordinary catalyst.

-

Immediate Resistance: 25,600. This is the Max Pain level and the first major hurdle.

-

Crucial Support: 25,500. The market is sitting on this knife’s edge. A break below this would be a major bearish victory.

-

Ultimate Support: 25,000. The final line of defense for the bulls.

Conclusion

The Nifty is firmly in the grip of bearish option writers, led by institutional players. The market’s upward mobility is severely restricted by a multi-layered wall of resistance, while its support at 25,500 is under immediate and intense pressure. The deeply negative sentiment, confirmed by the 0.62 PCR, suggests that the path of least resistance is sideways to down. Any attempt at a rally is likely to be sold into aggressively, and a definitive break below 25,500 would open the floodgates for a swift move towards 25,000.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25955. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25684 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25530 Tgt 25570, 25610 and 25666 ( Nifty Spot Levels)

Sell Below 25480 Tgt 25444, 25400 and 25345 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators