Disclaimer: This is the highest probability forecast derived from an expert, multi-decade historical analysis of the provided astrological signatures and their direct correlation with market psychology and price action. This is not a guarantee. The market is influenced by numerous real-world factors, and all trading involves significant risk. This analysis is for informational and educational purposes only.

Theme for Gold & Silver: The Flight to Hard Assets: From Fear Trade to Systemic Hedge

For Gold and Silver, this week is a transformational event. The narrative is a powerful confirmation of their ultimate role as a crisis hedge, moving far beyond a simple reaction to fear. The week begins with a quiet accumulation, as the initial bearish pressure on the broader market (Venus YOD Saturn) forces sophisticated capital to build a defensive position in hard assets. This is the calm before the storm. When the Mars-Uranus shockwave hits, the “fear trade” ignites in a violent, explosive rally. But the story doesn’t end there. As the week progresses and the focus shifts to a deeper crisis involving currency, debt (Venus-Pluto), and banking solvency (Jupiter Extreme), Gold’s role evolves. It becomes less about hedging a stock market drop and more about hedging the system itself—a flight to sovereign money in the face of a potential fiat crisis. This narrative will propel precious metals into a new, powerful, and sustainable uptrend born not of speculation, but of necessity.

High-Conviction Summary: Gold and Silver are set to begin the week with deceptive quiet before a catastrophic shock event triggers a violent, multi-day rally, culminating in a crisis-driven breakout to establish a major new bull trend.

For a Detailed Day by Day Forecast with Neural Analysis Please watch the below video

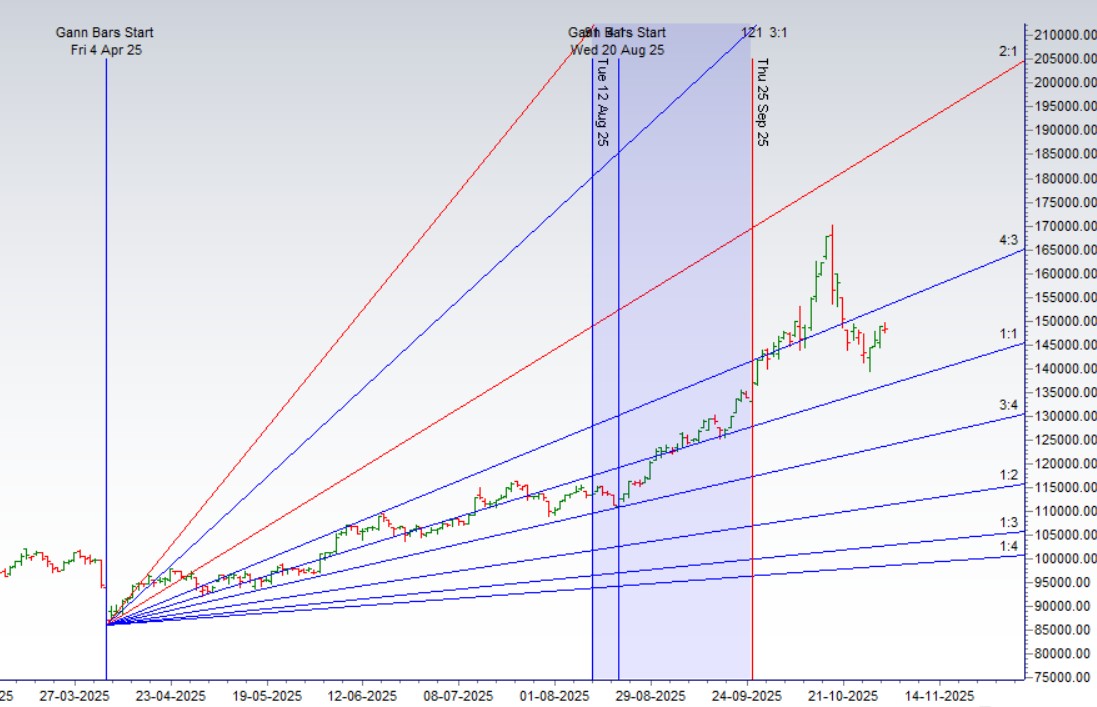

MCX Silver Gann Angle Chart

Silver has broken its 4×3 gann angle resistance zone break of 144 K can see a sharper pullback

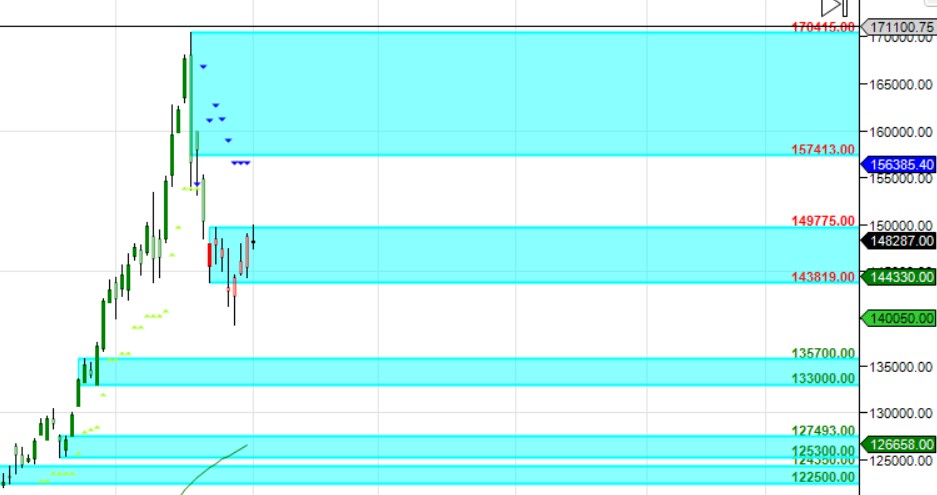

MCX Silver Supply Demand Zone

MCX GOLD Supply Demand Chart : Demand in range of 143819-144000, Supply in range of 149750-150000

MCX Silver Harmonic Analysis

Price is near its C Leg Break of 146 K can lead to bigger decline towards 144-140-136 K

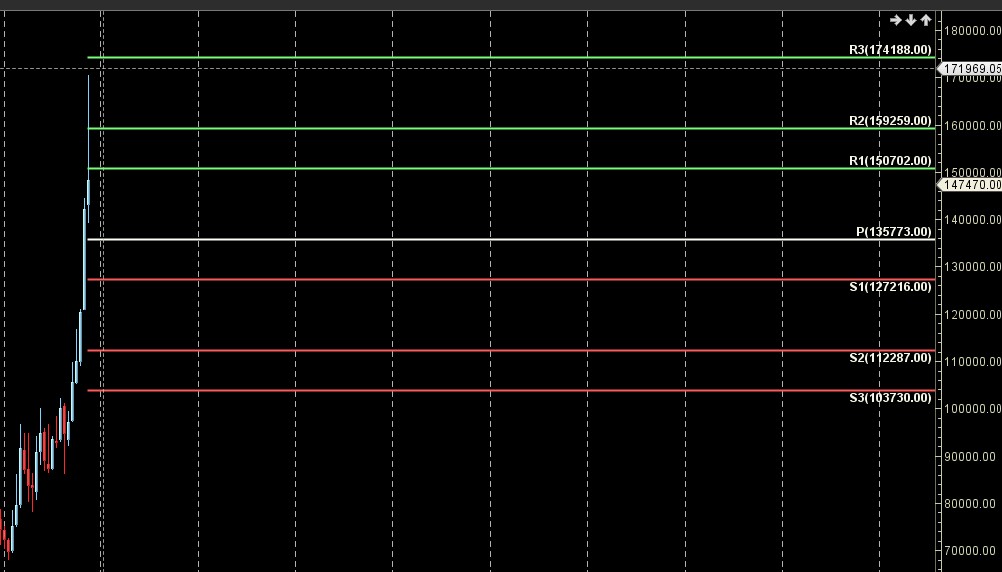

MCX Silver Weekly

Price has formed Weekly Lower Low

MCX Silver Monthly

150702 Monthly Resistance and 144000 Monthly Support.

Silver Astro/Gann Trend Change Date

Key Pivot Dates: Watch 04 November

Silver Weekly Levels

Weekly Trend Change Level:146871

Weekly Resistance: 147638,148408,149179,149953,150729,151505

Weekly Support: 146105,145342,144580,143821,143063,142308

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.