Disclaimer: This is a high-conviction forecast based on an expert interpretation of the provided astrological and cyclical data, which has historically shown a strong correlation with market behavior. This is not a guarantee. The market is influenced by numerous factors, and all trading involves significant risk. This analysis is for informational and educational purposes only and should not be considered financial advice.

General Astrological Theme for Gold & Silver (Oct 13 – 17, 2025)

This week, Gold and Silver are not just commodities; they are the primary barometers of fear. Their price action is forecast to be a near-perfect mirror image of the chaos expected in the equity markets. The week is a classic two-act play for precious metals: a powerful, fear-driven surge followed by an equally sharp, risk-driven pullback.

Phase 1: The Flight to Safety (Monday – Wednesday)

The week begins with the perfect storm of astrological catalysts for a powerful safe-haven bid. The Venus Opposition Neptune on Monday is a classic signature for the bursting of financial illusions and bubbles. As misplaced optimism evaporates from the stock market, capital’s first and most logical refuge is the tangible security of Gold and Silver.

This initial spark is then thrown onto a barrel of gasoline by Pluto Stationing Direct on Tuesday. Pluto’s energy, representing systemic debt, power structures, and deep, transformative crises, will be at its absolute maximum intensity. This is the single most potent astrological trigger for a flight to safety. Fears of financial contagion, credit events, or geopolitical power plays will be at a fever pitch, forcing capital to abandon risk assets and pour aggressively into the historical certainty of precious metals. During this phase, Gold and Silver are not just a hedge; they are a necessity. This period represents the primary upward thrust for the week.

Phase 2: The “Risk-On” Reversal (Thursday – Friday)

Just as the fear reaches its crescendo, the astrological drivers execute a dramatic handbrake turn. The Venus Zero Declination on Thursday, explicitly marked as the week’s “Most Important” event, is an unambiguous signal for a major reversal in market sentiment. This is powerfully confirmed by Bayer Rule 6, which signals a bottom in risk assets.

This marks the moment the “risk-on” switch is flipped back on. As capital begins to see a historic buying opportunity in the beaten-down equity markets, the reason for holding safe havens evaporates. The fear that drove the powerful rally in Gold and Silver will be replaced by the greed of chasing the stock market bounce.

This sentiment is then supercharged on Friday by the Sun Square Jupiter aspect, which will fuel an exaggerated, over-the-top wave of optimism in the general markets. This “risk-on” explosion is a major headwind for precious metals. The capital that rushed into Gold and Silver for protection at the start of the week will now rush out with equal speed to chase the recovery. This phase will be defined by sharp profit-taking and a significant pullback in the metals.

Highest Probability Outcome:

The highest probability forecast for Gold and Silver is a classic V-shaped week, but an inverted one compared to equities. The week is expected to begin with a strong rally, accelerating into Tuesday as fear grips the broader markets. A significant peak is likely to be formed mid-week at the point of maximum pessimism. This will be followed by a sharp and decisive reversal to the downside on Thursday and Friday as the safe-haven bid disappears and capital floods back into risk assets.

For Day by Day Forecast Please watch the below video

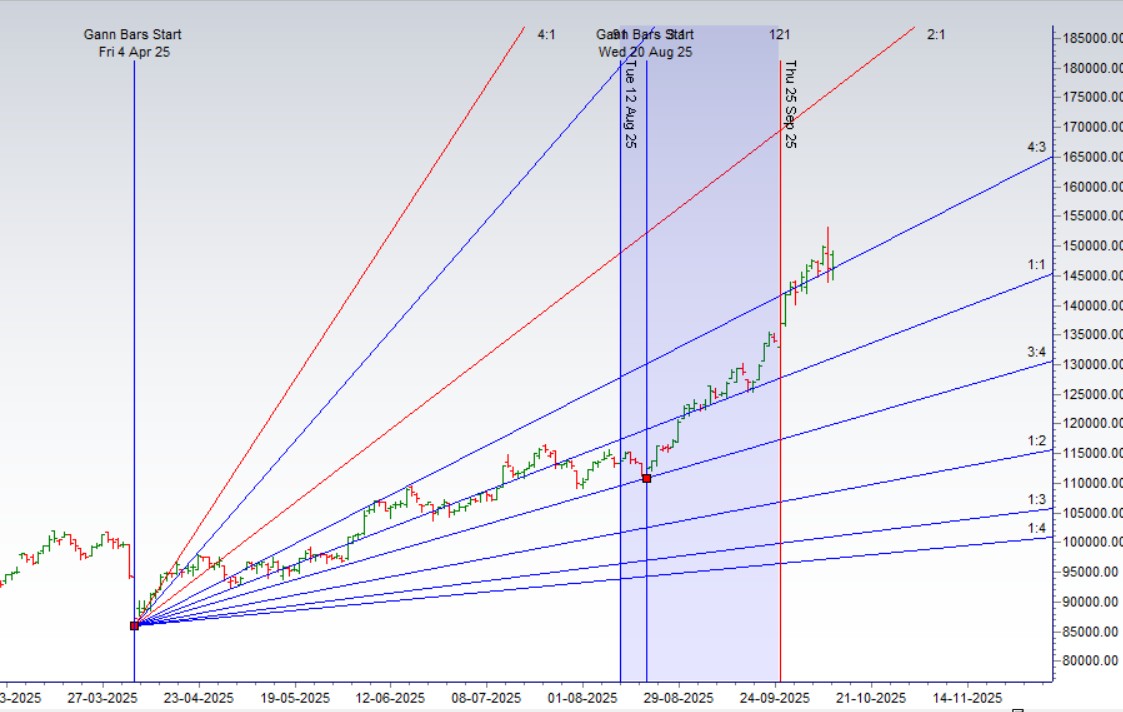

MCX Silver Gann Angle Chart

Silver continued with its rally taking resistance at gann 4×3 angle forming DOJI

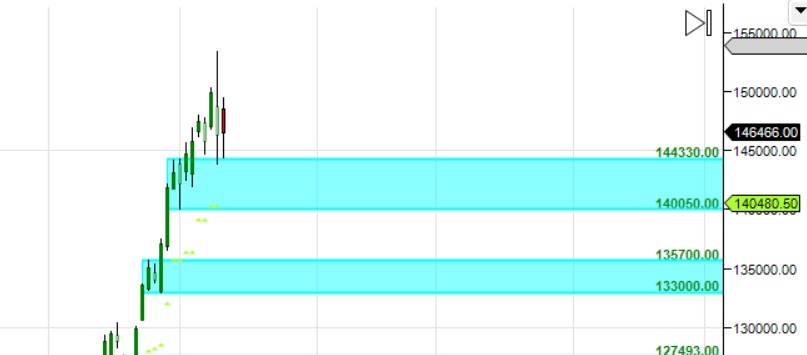

MCX Silver Supply Demand Zone

MCX GOLD Supply Demand Chart : Demand in range of 144330-144000 , Supply in range of 146500-147000

MCX Silver Harmonic Analysis

Price is approaching PRZ zone of ABCD Harmonic Pattern.

MCX Silver Weekly

Price has formed Weekly DOJI signalling trend reversal.

MCX Silver Monthly

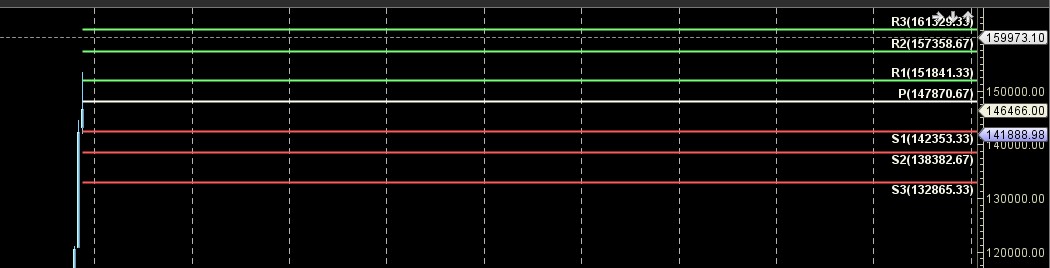

151844 Monthly Resistance and 142353Monthly Support.

Silver Astro/Gann Trend Change Date

Key Pivot Dates: Watch 14 October

Silver Weekly Levels

Weekly Trend Change Level:146419

Weekly Resistance:147186,147954,148724,149497,150271

Weekly Support: 145655,144893,144132,143374,142618

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.