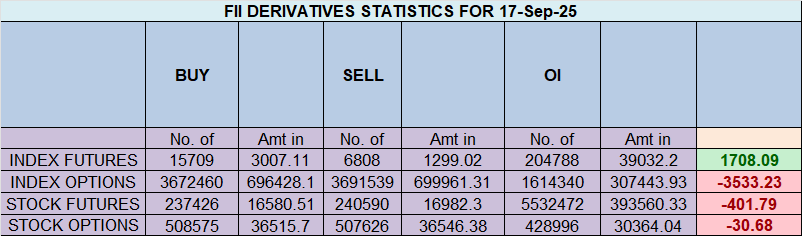

A Deceptive Surge: FIIs Engineer a Massive Short Squeeze, Cashing Out on Bearish Bets

The trading session of September 17, 2025, produced a spectacular but deeply misleading surge in the Nifty. On the surface, the data was overwhelmingly bullish, with Foreign Institutional Investors (FIIs) executing a colossal net purchase of 5,826 contracts, valued at a staggering ₹1,111 crores. However, this bullish facade is completely dismantled by the open interest data, which simultaneously plummeted by 4,760 contracts. This is the unambiguous and explosive signature of a massive short squeeze, not a genuine turn in market sentiment.

The Anatomy of a Violent Squeeze

The breakdown of FII activity provides a stunningly clear picture of the day’s events. The FIIs added a negligible 634 new long contracts. The real story, and the engine of the entire upward price thrust, was the covering of a monumental 8,267 short contracts. This was not a move driven by new confidence; it was a frantic, technically-driven exodus from bearish positions. The immense buying pressure was purely mechanical, as FIIs were forced to buy back contracts to close out their profitable shorts, creating a violent vacuum that pulled prices sharply higher.

Retail Capitulates into the Rally

In a classic and painful market dynamic, the Client (retail) segment was caught completely on the wrong side of this institutional maneuver. As the market surged upwards due to the FIIs’ short covering, retail traders were seen running for the exits. They covered a massive 4,754 long contracts, selling directly into the artificial strength. This behavior signifies weak hands being shaken out, likely taking small profits or exiting at breakeven after a period of anxiety. Crucially, they provided the exact exit liquidity that the FIIs needed to cash in their bearish bets at favorable prices, marking a significant wealth transfer from the crowd to the smart money.

The Unchanged, Overwhelmingly Bearish Posture

Perhaps the most critical and cautionary takeaway from this session is what didn’t change. Despite covering over 8,000 short positions, the FIIs’ strategic outlook remains profoundly bearish. Their Long/Short ratio only inched up to 0.15, meaning their positioning is still an overwhelming 87% short. They have taken a massive sum of money off the table, but they have not abandoned their core bearish thesis. This profit-taking maneuver may even be a prelude to reloading new short positions at the higher prices created by this very squeeze. Meanwhile, the retail segment remains structurally vulnerable at 70% long.

Conclusion

Do not be fooled by the massive net buying figure. The rally on September 17th was a technically-driven short squeeze of epic proportions, fueled by FIIs cashing in on their winning bets. The underlying sentiment from institutional players, as evidenced by their still-dominant short positioning, has not turned bullish. This rally is built on a fragile foundation, and the risk of a sharp reversal or “rug pull” is now exceptionally high once this forced buying is exhausted.

Why Trading is So Hard: The Unseen Psychological Battle for Success

Last Analysis can be read here

The Nifty index continued its powerful upward trajectory today, confidently charting new higher highs. The rally was fueled by the widely anticipated decision from the US Federal Reserve to cut interest rates by 25 basis points. While a rate cut is typically a bullish catalyst for equities, this particular move was so thoroughly expected and priced in by the market that it now presents a classic “buy the rumor, sell on news” risk.

When a major, market-moving event is perfectly anticipated, its actual occurrence often fails to provide new bullish fuel. Instead, it can become a trigger for smart money and early investors to lock in profits, leading to a sharp reversal. The market has climbed the wall of worry leading up to the announcement; now that the news is out, the primary reason for the recent rally has been fulfilled.

Adding a powerful layer of timing to this setup is the astrological event of Mercury’s ingress tomorrow. Historically, Mercury changing signs can correlate with a palpable shift in market sentiment, news flow, and short-term trading trends. When such a timing event coincides with a market that has just culminated a major run-up on a known news event, the probability of a trend change or, at the very least, a significant pause, increases dramatically.

This timing event is further amplified by the weekly Sensex expiry, a day often marked by increased volatility and strategic positioning by large players who may wish to influence the closing price.

For traders navigating this complex and high-stakes environment, the strategy for the day becomes exceptionally clear. The high and low of the first 15 minutes of trading will serve as the critical pivot points and will likely guide the market’s direction for the remainder of the session:

-

A break below the 15-minute low would act as the first confirmation of the “sell the news” scenario, signaling that profit-takers are in control and a potential reversal is underway.

-

A break above the 15-minute high would suggest that there is still enough bullish momentum to absorb the profit-taking, though traders should remain cautious of a “false breakout” given the overhanging risks.

In conclusion, while the trend is currently bullish, the market is at a precarious peak. The combination of a fully priced-in news event and a significant astrological timing point creates a textbook environment for a reversal. The opening range tomorrow will be the key to confirming whether the bulls can maintain control or if the “sell on news” crowd will take over.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25388 for a move towards 25467/25549. Bears will get active below 25309 for a move towards 25230/25151/25072

Traders may watch out for potential intraday reversals at 09:51,10:48,12:31,01:42,02:45 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.56 lakh cr , witnessing liquidation of 3.8 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closeure of SHORT positions today.

Nifty Advance Decline Ratio at 32:18 and Nifty Rollover Cost is @24980 closed above it.

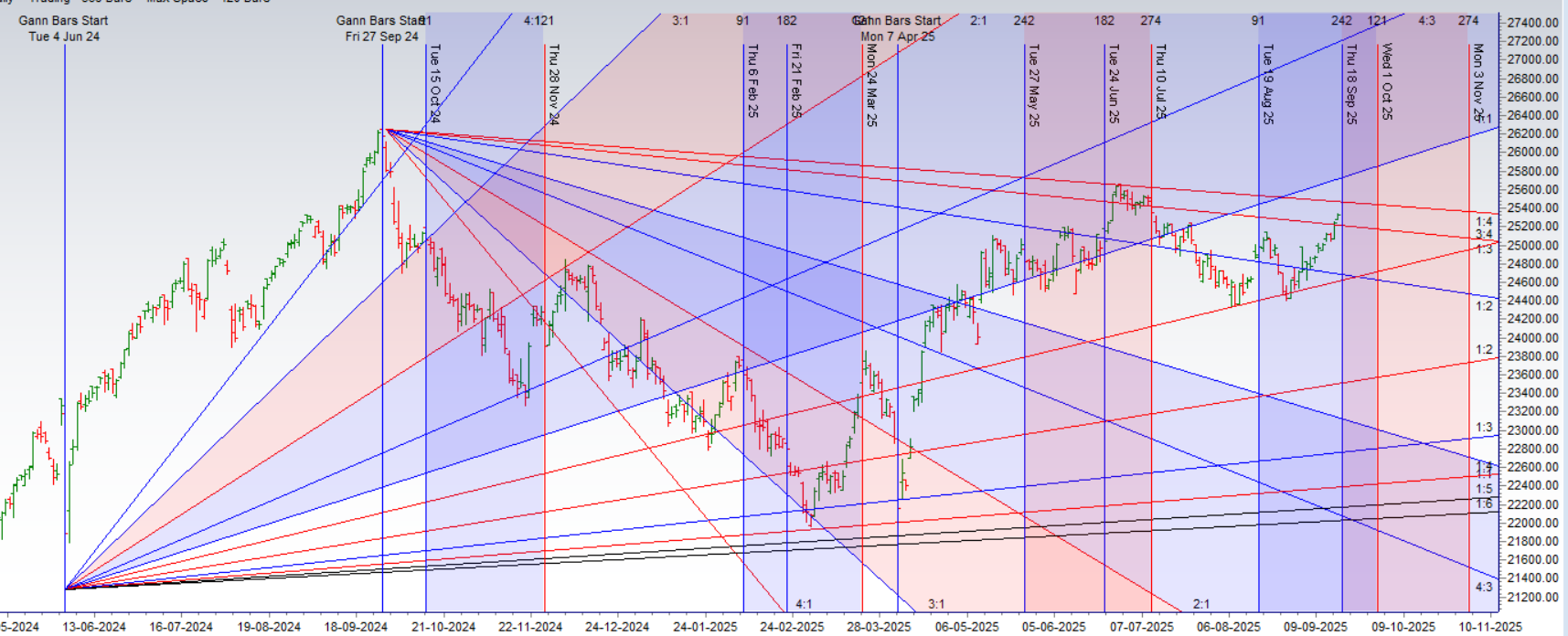

Nifty Gann Monthly Trend Change level 24678 closed above it.

Nifty has closed above its 50 SMA @ 24903 Trend is Buy on Dips till above 24900

A Market in Stalemate: FIIs Sell Insurance as Retail Bets on a Contained Range

The options market is painting a clear picture of a market in a state of cautious equilibrium, caught between hope and fear. The key metrics confirm this standoff: the Max Pain level is currently pegged at 25250, acting as a powerful magnet for the price as we approach expiry. Meanwhile, the Put-Call Ratio (PCR) stands at a moderately elevated 1.16. This figure, being above 1.0, suggests that the volume in Put options is outpacing Calls, signaling underlying caution and a significant amount of hedging activity in the system.

The Retail Strategy: Betting on Low Volatility

Retail traders have positioned themselves for a range-bound market, betting decisively against any significant directional move. In the Call options, they were net sellers, establishing a net short position of over 58,000 contracts. This is a clear bet that the market’s upside is limited and that the immediate resistance levels will hold firm. They are collecting premium with the belief that a powerful rally is not on the cards.

Interestingly, they mirrored this strategy in the Put options, where they were also net sellers. This dual approach of writing both Calls and Puts is a classic “short strangle” or range-bound strategy. It signifies a strong conviction that the market will remain contained within a well-defined channel, allowing them to profit from time decay as long as volatility remains subdued.

The FII Strategy: Cautious Neutrality with a Bullish Tilt

The Foreign Institutional Investors (FIIs), or “smart money,” have adopted a more sophisticated and nuanced stance. Their activity in the Call options was perfectly balanced, adding and shorting the exact same number of contracts. This indicates they are not placing any directional bets on the upside; this is likely the execution of delta-neutral spreads or hedging activity, signaling complete neutrality on a potential rally.

However, their conviction becomes clear in the Put options. The FIIs were significant net sellers of Puts, establishing a net short position. This is a subtly bullish-to-neutral signal. By selling Puts, FIIs are effectively acting as the “insurance house,” collecting the premium that cautious traders are willing to pay for downside protection. This is a high-conviction bet that the market will not experience a significant decline. They are comfortable taking on the obligation to be buyers at lower levels, which helps to establish a firm floor under the market.

Option Chain Support and Resistance

This divergent positioning carves out clear battle lines on the option chain:

-

Resistance: The heavy Call writing from the retail segment has created a formidable wall of supply. The highest concentration of Call open interest is now found at the 25300 and 25400 strikes, making this the primary resistance zone.

-

Support: The Put writing from both retail and, more importantly, the FIIs, has built a strong support base. The highest concentration of Put open interest is located at the 25200 and 25100 strikes, forming a solid floor.

Conclusion

The market is coiled in a tight range. Retail is betting on this range holding, while FIIs are specifically positioned against a downside break. The Max Pain at 25250 is the focal point where both of these strategies find a comfortable equilibrium. The elevated PCR of 1.16 is a direct result of the cautious sentiment driving Put option volumes, but the FIIs are gladly taking the other side of that trade, which is a sign of underlying stability. The market is likely to remain pinned between the heavy support below 25200 and the stiff resistance above 25300 until a new catalyst can break this well-defended stalemate.

In the cash segment, Foreign Institutional Investors (FII) sold 1124 cr , while Domestic Institutional Investors (DII) bought 2293 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134-25860 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24960 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25411 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25388 Tgt 25430, 25464 and 25505 ( Nifty Spot Levels)

Sell Below 25309 Tgt 25285, 24245 and 24212 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

Absolutely NOT a good commentary..Bramesh looks trapped on short side so he is in a HOPE MODE for reversal.

sir we have been in market in last 20 years so even if we are trapped we know how to manage positions.. commentary is based on data where we cannot put bias..