Retail Takes the Bait as FIIs’ Short Covering Creates a Bull Trap

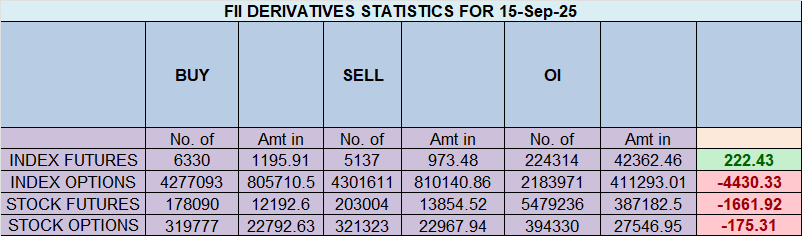

The trading session of September 15, 2025, provided a masterclass in market deception, where a seemingly bullish headline number masked a tactical retreat by institutional players. Foreign Institutional Investors (FIIs) were recorded as net buyers of 299 contracts, a modest figure worth ₹56 crores. However, the real story, as is often the case, was told by the open interest, which plummeted by 1,049 contracts. This stark divergence is an unambiguous signal of short covering, not genuine bullish conviction.

The FIIs’ Strategic Exit

A breakdown of the FIIs’ activity confirms this narrative with precision. They were not building new positions; they were aggressively closing old ones. The data shows they covered 1,275 short contracts. This was the dominant activity of the day. The buying pressure seen in the market was not from FIIs betting on a future rally; it was the mechanical buying required for them to close out and take profits on their highly successful bearish bets. The small net buying figure is merely a mathematical artifact of this large-scale profit-taking. This is a classic “relief rally” scenario, where the upward price action is fueled by exiting bears, not entering bulls.

Retail Chases the Rally

In a stark and telling contrast, the Client (retail) segment completely misinterpreted this technical bounce. Seeing the price rise, they jumped in with conviction, adding 1,361 fresh long contracts. This is a classic case of retail traders chasing a rally that is built on a weak foundation. They were, in effect, providing the very liquidity that the FIIs needed to exit their short positions at favorable prices. While the FIIs were cashing in their winning tickets, retail traders were buying into the top of a temporary, technically-driven move.

The Unchanged, Dangerous Divergence

Despite this significant short covering, the most critical takeaway is that the FIIs’ strategic outlook remains overwhelmingly bearish. Their positioning barely changed, with their Long/Short ratio holding at a deeply pessimistic 0.13. This means that even after locking in profits, they are still positioned 88% short. They have taken money off the table, but they have not abandoned their core bearish thesis.

Meanwhile, the retail segment has doubled down on its bullishness, with its positioning at a highly optimistic 72% long. This dangerous divergence between smart money and the retail crowd persists. The large pool of vulnerable retail longs remains the “fuel” for the next potential leg down, should the FIIs decide to re-initiate shorts after this relief rally concludes.

Conclusion

The net buying from FIIs on September 15th was a facade. The real story was a massive short-covering operation, a tactical move to realize profits. The resulting rally was eagerly bought by retail traders, who have now positioned themselves even more precariously against the institutional tide. The market’s upward move is built on a fragile foundation, and the risk of a sharp reversal remains exceptionally high once this short-covering impulse is exhausted.

Why Trading is So Hard: The Unseen Psychological Battle for Success

Last Analysis can be read here

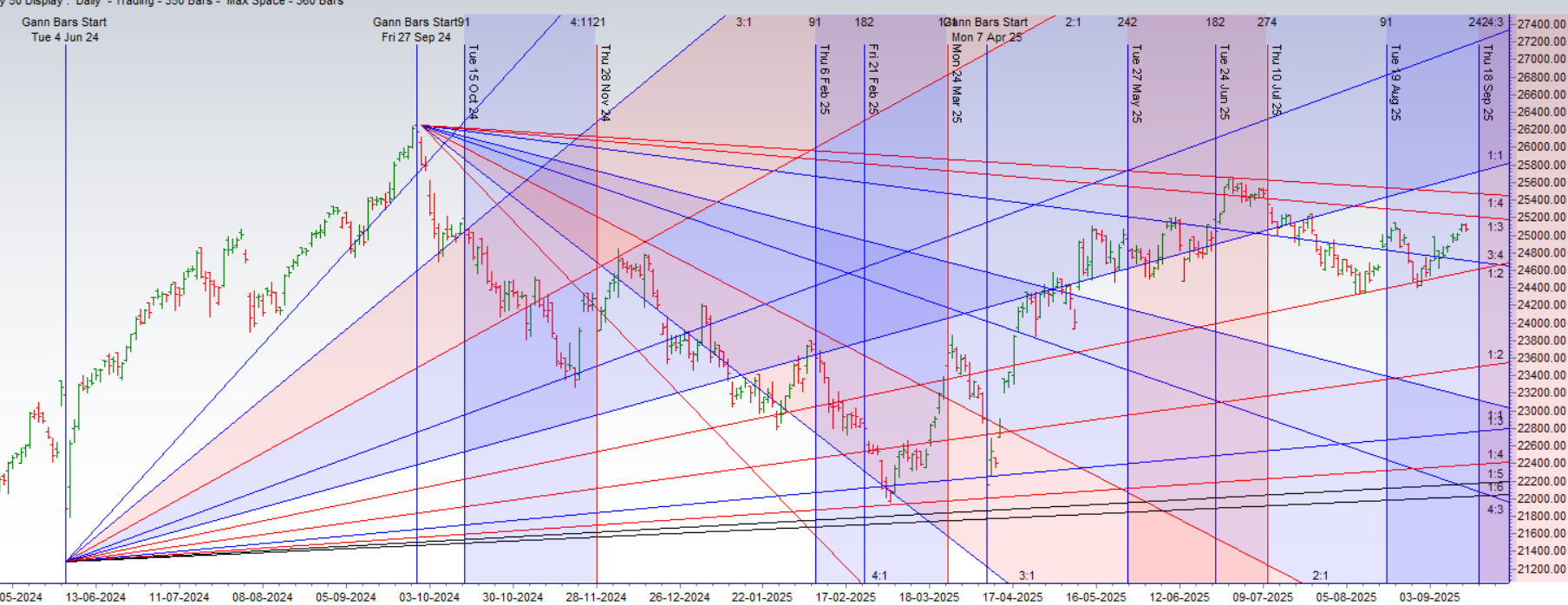

The Nifty index has come to a near-perfect standstill, forming a classic Inside Bar candlestick pattern in today’s session. This pattern, where the entire day’s trading range is contained within the high and low of the previous day, is a textbook sign of consolidation, equilibrium, and a significant contraction in volatility. The market is effectively coiling like a spring, building up potential energy for its next directional move.

This pause in momentum is not occurring in a vacuum. It is a direct reflection of rising market anxiety, which is visibly confirmed by the concurrent rise in the India VIX. Traders are becoming increasingly cautious and are reducing their risk exposure ahead of the highly anticipated US Federal Reserve policy outcome on Wednesday. This major global event is a known catalyst for significant market movements, and the current price action is the market holding its breath in anticipation.

What makes this particular setup especially noteworthy is its timing. The formation of a clean Inside Bar on a key astro date is, as you noted, a welcome development for technical traders. These specific dates often act as temporal pivot points, and a clear consolidation pattern forming on such a day enhances the signal’s reliability.

For traders, this creates a high-probability and strategically advantageous scenario. The primary benefit of an Inside Bar setup is the clearly defined and relatively small stop-loss. The high and low of the “mother bar” (the bar preceding the inside bar) now act as the definitive battle lines:

-

A bullish breakout will be triggered on a decisive move above the mother bar’s high.

-

A bearish breakdown will be confirmed on a decisive move below the mother bar’s low.

Given the context of the rising VIX and the impending Fed decision, the breakout or breakdown from this consolidation is expected to be a significant and directional expansion of volatility. The market has provided a clear, low-risk entry point to participate in the move that will likely follow Wednesday’s global announcement. Traders should be on high alert, as the period of quiet consolidation is about to end.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25140 for a move towards 25228/25309. Bears will get active below 25045 for a move towards 24994/24915

Traders may watch out for potential intraday reversals at 10:15,11:30,12:25,01:30.02:40 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.66 lakh cr , witnessing addition of 0.16Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of LONG positions today.

Nifty Advance Decline Ratio at 15:35 and Nifty Rollover Cost is @24980 closed above it.

Nifty Gann Monthly Trend Change level 24678 closed above it.

Nifty has closed above its 50 SMA @ 24903 Trend is Buy on Dips till above 24900

A Market Divided: FIIs Build Defensive Wall as Retail Bets on a Breakout

The options market has drawn a clear line in the sand, revealing a stark and compelling divergence between the strategies of Foreign Institutional Investors (FIIs) and retail traders. While the market hovers at elevated levels, the data shows a high-stakes battle of positioning, with the Max Pain level at 25100 acting as the central pivot point for this conflict. A Put-Call Ratio (PCR) of 1.08, slightly above the neutral 1.0 mark, hints at underlying caution and significant hedging activity, a sentiment largely driven by the institutional players.

The Retail Position: Unwavering Optimism

Retail traders have positioned themselves with aggressive and almost unwavering optimism. Their activity was heavily skewed towards a bullish outcome. They were significant net buyers of Call options, adding a net 153,000 long contracts. This is a direct and leveraged bet that the Nifty will continue its upward trajectory and break through immediate resistance levels.

Simultaneously, their activity in the Put options reinforces this bullish conviction. They were net sellers of Puts, indicating a strong belief that the downside is limited and that the market will not experience a significant decline. By selling Puts, they are collecting premium with the confidence that the market will stay above key support levels. This dual strategy—buying Calls and selling Puts—is one of the most overtly bullish stances a trader can take.

The FII Strategy: Professional Skepticism and Capped Upside

In stark contrast, the FIIs, or “smart money,” have adopted a far more cautious and defensive posture. They were significant net sellers of Call options, establishing a net short position of over 35,000 contracts. By writing Calls, FIIs are betting that the market’s upside is capped. They are effectively building a wall of resistance, collecting premium from optimistic retail buyers with the belief that the market will struggle to advance further.

Their activity in the Put options completes this picture of strategic caution. They were net buyers of Puts, a classic move to purchase insurance or hedge against a potential market decline. While retail is confidently selling this insurance, FIIs are actively buying it, signaling they see a tangible risk of a downward move.

Option Chain Support and Resistance

This divergent activity is directly reflected in the option chain’s structure:

-

Resistance: The highest concentration of Call open interest, built largely by institutional writers like the FIIs, is now firmly lodged at the 25200 strike, with significant OI also present at 25100. This zone, from 25100 to 25200, represents the formidable supply wall that the bulls must overcome.

-

Support: Conversely, significant Put open interest at the 25000 and 24900 strikes forms a formidable support base for the market, largely built by retail Put writers.

Conclusion

In essence, a high-stakes standoff is underway. Retail traders are betting aggressively on a bullish breakout above 25100. The FIIs, however, are positioned for a range-bound market at best, or a potential decline at worst, having sold the upside and bought downside protection. The Max Pain at 25100 is the fulcrum of this battle, representing the point of maximum profitability for the institutional option sellers if the market stays contained. The slightly elevated PCR of 1.08 is a direct reflection of the FIIs’ cautious Put buying. The outcome of the week will likely be determined by which side blinks first: the retail bulls trying to break resistance, or the institutional bears defending it.

In the cash segment, Foreign Institutional Investors (FII) sold 1269 cr , while Domestic Institutional Investors (DII) bought 1933 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134-25860 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24901 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25171 , Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 25205

Lower End of Expiry : 24933

Nifty Intraday Trading Levels

Buy Above 25095 Tgt 25122, 25175 and 25205 ( Nifty Spot Levels)

Sell Below 25035 Tgt 25005, 24970 and 24933 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

Hi,

The ratio you mentioned, long/short contracts, is about 0.12% for FIIs, but how do we know which levels they have shorted. They could have shorted 25000 as well, right? Which could mean, even FIIs believe market wouldn’t come down.

Can you please clarify this?

yes thats correct