The Great Unwinding: FIIs Execute a Historic Short Squeeze, Cashing In on Bearish Bets

The trading session of September 12, 2025, will be remembered not as a day of newfound bullish conviction, but as a masterclass in profit-taking on an epic scale. The headline numbers are staggering: Foreign Institutional Investors (FIIs) engaged in net buying of 10,278 Nifty Index Futures contracts, injecting a colossal ₹1,942 crores. On the surface, this appears to be one of the most bullish days in recent memory. However, the open interest data tells the real, explosive story: this was a historic short-covering rally, not the start of a new bull run.

The Anatomy of a Squeeze

The definitive proof lies in the net open interest, which plummeted by 6,272 contracts. When massive buying is met with a sharp decline in OI, it is the unambiguous signal of a massive short squeeze. The breakdown of FII activity confirms this with stunning clarity. While a negligible 1,542 new long contracts were added, the real action was the covering of an astronomical 8,909 short contracts.

This means the overwhelming majority of the FIIs’ buying was not a bet on the future, but a move to close out and cash in on the massive, profitable bearish positions they have been holding for weeks. This furious buying to cover shorts creates a powerful vacuum, pulling prices sharply higher as sellers become forced buyers. It’s a technically driven rally fueled by the capitulation of bears, not the conviction of new bulls.

Retail Caught on the Wrong Side

The behavior of the Client (retail) segment paints a painful picture of traders caught on the wrong side of this violent move. They rushed to exit their positions, covering a massive 5,651 long contracts. This indicates that as the market rallied sharply, retail traders—who were already holding long positions—used the opportunity to sell, likely taking small profits or exiting at breakeven. They effectively provided the shares that the FIIs desperately needed to buy to close their shorts. This is a classic wealth transfer, where the smart money’s profit-taking rally is fueled by retail selling.

The Unchanged, Overarching Bearish Posture

Perhaps the most critical and cautionary takeaway from this explosive session is what didn’t change. Despite covering nearly 9,000 short contracts, the FIIs’ strategic positioning remains overwhelmingly bearish. Their Long/Short ratio barely improved, moving to just 0.13. This means that even after this historic profit-taking event, they are still positioned 88% short and only 12% long.

They have taken a huge sum of money off the table, but they have not abandoned their core bearish thesis. This suggests they may view this short-covering rally as an opportunity to re-establish their short positions at more favorable, higher price levels. Meanwhile, the retail segment remains dangerously exposed with a 71% long position.

Conclusion

Do not misinterpret this rally. The buying frenzy on September 12th was the sound of FIIs cashing their winning lottery tickets, not buying new ones. The underlying market structure remains dangerously imbalanced, with smart money still heavily betting on a decline. This rally was a violent, technically driven event, and the risk of a “rug pull” is now exceptionally high if FIIs choose to reload their shorts at these new, elevated prices.

Why Trading is So Hard: The Unseen Psychological Battle for Success

Last Analysis can be read here

The Nifty index has entered a critical phase of consolidation after a bullish run met a formidable wall of supply. The battle lines for the market are now drawn with textbook clarity, and a period of heightened volatility appears imminent.

On Friday, the bulls made a valiant attempt to continue the uptrend, pushing the Nifty to a high of 25139. This briefly pierced the pre-identified and crucial resistance zone of 25125-25134. However, the inability of the index to sustain these levels and secure a close above this zone is a significant technical development. This failure confirms the strength of the sellers at this juncture and suggests that the upward momentum has, for now, been successfully halted.

With this powerful resistance capping the upside, the market has established a clear lower boundary at the 24900 level, which is now expected to act as strong support. As a result, the Nifty is likely to enter a period of range-bound activity, oscillating between the strong ceiling at 25134 and the solid floor at 24903. This period of sideways movement can be seen as the market building energy for its next major directional move.

What transforms this standard technical setup into a high-stakes scenario is the powerful influence of time-based cycles. Over the weekend, two major events occurred whose impact is expected to be felt in Monday’s trading session:

-

Sun Conjunct Mercury: This astrological aspect often correlates with shifts in communication, news flow, and market sentiment, sometimes leading to indecision followed by a sharp, decisive move.

-

Eclipse Degree Date: These are pre-calculated dates that have a high correlation with market reversals, trend culminations, or significant turning points.

When a market is testing a major price resistance at the same time a powerful time cycle is due, the probability of a significant trend reversal or a major breakout increases dramatically.

The forecast is therefore clear: as long as the Nifty fails to achieve a decisive close above the 25134 resistance, the path of least resistance will be downwards. The influence of the weekend’s time cycles is likely to act as a catalyst for a bearish reversal, pushing the price back towards the key support level of 24900. Traders must watch the 25134 level with extreme vigilance; a continued failure here will be a strong signal that the sellers are in control and a test of the lower end of the range is imminent.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25151 for a move towards 25230/25309. Bears will get active below 25072 for a move towards 24994/24915

Traders may watch out for potential intraday reversals at 09:20,10:46,12:05,01:57,02:31 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.66 lakh cr , witnessing liquidation of 4.2 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was covering of SHORT positions today.

Nifty Advance Decline Ratio at 29:19 and Nifty Rollover Cost is @24980 closed below it.

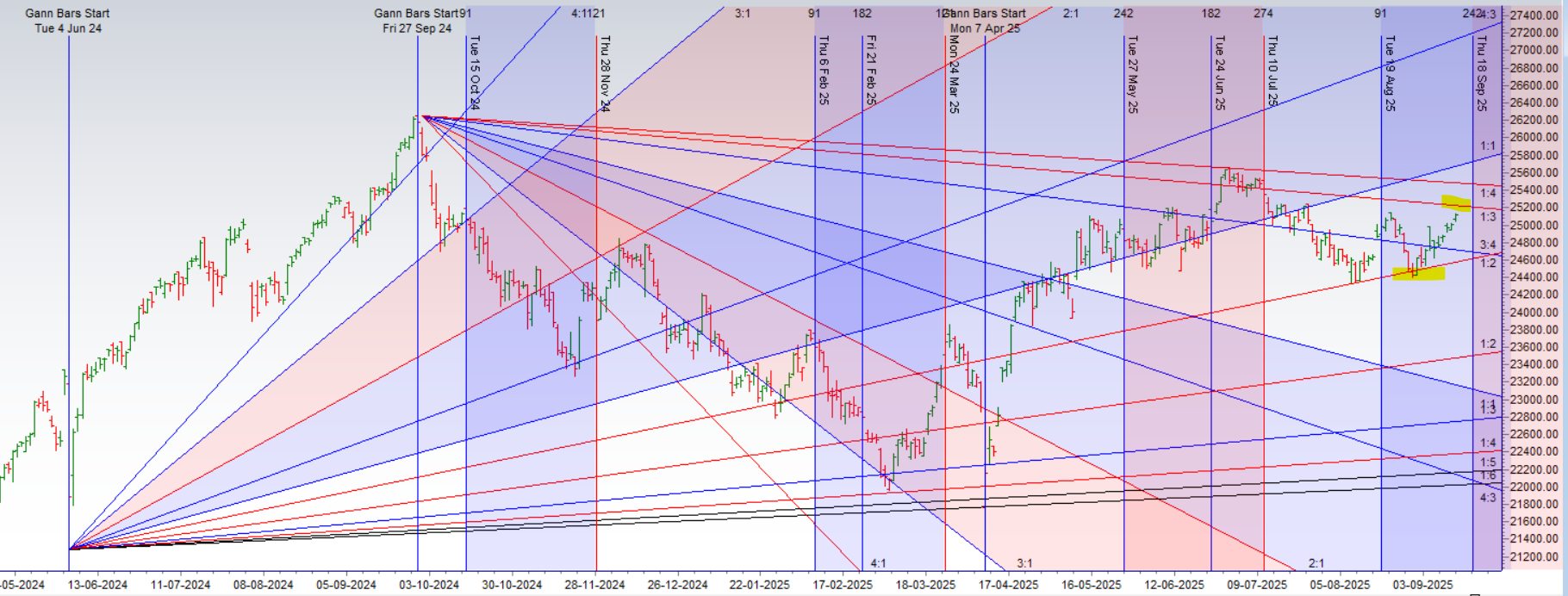

Nifty Gann Monthly Trend Change level 24678 closed above it.

Nifty has closed above its 50 SMA @ 24903 Trend is Buy on Dips till above 24900

Nifty options chain shows that the maximum pain point is at 25100 and the put-call ratio (PCR) is at 1.32.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

A High-Stakes Standoff: FIIs Bet on Breakout While Retail Defends Key Resistance

The Nifty index finds itself at a pivotal inflection point, poised on a knife’s edge after a week of bullish momentum met a formidable wall of resistance. The options data from Friday’s session reveals the precise positioning of the market’s key players, showing a dramatic and high-stakes divergence in strategy and expectation as they head into a volatile new week.

The retail segment has made its skepticism abundantly clear. Their most significant and high-conviction move was in the Call options, where they were massive net sellers. By shorting 110,000 contracts while only buying 47,000, they established a net short position of 63,000 Call contracts. This is a direct and substantial bet that the market’s upside is capped and that the crucial resistance zone around 25134 will hold firm. They are effectively acting as the “insurance sellers,” collecting premium with the belief that a further rally is unlikely to materialize.

Simultaneously, their activity in the Put options highlights an underlying anxiety. They were net buyers of 32,000 Put contracts (buying 368K vs selling 336K). This indicates that while they are selling the upside, they are actively buying protection against a potential downside move. This dual strategy paints a picture of a participant who is not confident in the market’s strength and is defensively positioned for a decline back towards the 24900 support level.

In a complete and telling contradiction, the Foreign Institutional Investors (FIIs) are aggressively positioning for a breakout. Their most significant move was being net buyers of 30,000 Call contracts (buying 78K vs selling 48K). They are taking the other side of the retail trade, buying the very “lottery tickets” for an upward move that retail is confidently selling. This action shows a clear belief that the current bullish momentum has enough force to shatter the overhead resistance.

The FIIs’ activity in the Put options is equally strategic but tells a different story. They were also net buyers of 17,000 Put contracts. However, unlike retail’s fear-based buying, this is more likely a professional hedge or a volatility play. Given the major time-cycle events over the weekend (Sun-Mercury conjunction and the Eclipse Degree Date), FIIs are preparing for a large move. By buying both Calls and Puts, they position themselves to profit from a significant expansion in volatility, regardless of the direction. However, their more aggressive net buying in the Call options reveals their preferred directional bias is to the upside.

In the cash segment, Foreign Institutional Investors (FII) bought 129 cr , while Domestic Institutional Investors (DII) bought 1556 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134-25860 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24878 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25188 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25140 Tgt 25190, 25225 and 25260 ( Nifty Spot Levels)

Sell Below 25085 Tgt 25054, 25012 and 24953 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators