Market Analysis: FIIs Double Down on Bearish Conviction, Building Fresh Positions as Retail Retreats

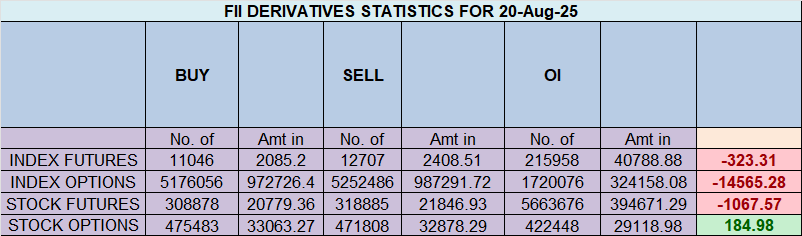

The derivatives data from August 20th reveals a methodical and deliberate escalation of bearish pressure by Foreign Institutional Investors (FIIs) on the Nifty. While the net shorting figure of 81 contracts appears deceptively small, the underlying activity tells a far more ominous story. FIIs aggressively added new short positions while simultaneously creating new long hedges, a classic strategy for bracing for significant volatility. This action, confirmed by a massive surge in Open Interest, signals that institutional players are not merely bearish but are actively positioning for a major market move, just as retail traders begin to unwind their own bearish bets.

This stark divergence in strategy is a critical warning, suggesting that the “smart money” sees a substantial risk of a decline that the broader market is currently ignoring.

1. Decoding the FII Action: Strategic Layering for a Downturn

The headline net figure is misleading; the real insight lies in the gross additions of new contracts.

-

Aggressive Short Building: The standout action is the addition of 2,362 new short contracts. This is a powerful, high-conviction move that significantly outweighs the addition of longs. It confirms that FIIs are deploying fresh capital to bet on a market fall, reinforcing their already extreme bearish stance.

-

Hedging for Volatility: Simultaneously, FIIs added 701 new long contracts. This is not a sign of bullishness but rather a sophisticated hedging maneuver. It indicates they are preparing for a sharp, volatile move and are layering their positions to manage risk. The overwhelmingly bearish Long-to-Short ratio of 0.11 (10% long vs. 90% short) confirms their core directional view remains firmly negative.

2. The Critical Confirmation: Explosive Rise in Open Interest (OI)

The most compelling evidence of a brewing storm is the substantial increase in Open Interest.

-

OI Surged by 2,301 contracts: This massive increase confirms that the market absorbed a large number of brand-new positions. This was not a simple transfer of contracts from one party to another; this was new money entering the system to fund a bearish view.

-

The Classic Bearish Formula Amplified: The combination of heavy FII short building and a sharp rise in Open Interest is a textbook indicator of a strengthening bearish trend. It shows that institutional conviction is growing, making the market “heavier” and far more vulnerable to a sharp decline.

3. The Contrasting View: Clients Grow Complacent

While FIIs were fortifying their bearish fortress, the Client segment was moving in the opposite direction.

-

Net Short Covering: Clients covered 1,469 short contracts, significantly reducing their bearish exposure. This action suggests a growing belief among retail traders that the worst is over and the market is set to stabilize or rise.

-

A Widening Chasm: With their Long-to-Short ratio at a very bullish 2.42 (71% long vs. 29% short), clients are positioned directly opposite the institutional players. This sets up a classic “Smart Money vs. Retail” conflict, where FIIs are actively selling into the optimism of the retail segment. Historically, such stark divergences often resolve in favor of the institutions.

4. Strategic Implications and Market Outlook

This deliberate institutional positioning has profound implications for the Nifty’s immediate future.

-

Elevated Risk of a Sharp Breakdown: The heavy build-up of fresh institutional shorts acts like a coiled spring. Any break of a key support level could trigger rapid, accelerated selling as these positions become profitable.

-

Resistance is Now a Fortress: FIIs are now even more incentivized to defend higher levels. Any rally will likely be met with aggressive institutional selling, reinforcing a “sell-on-rise” environment.

-

Volatility is Imminent: The addition of both long and short contracts by FIIs is a clear signal that they are not expecting a quiet market. They are positioned for a significant price swing, with a strong bias towards the downside.

Conclusion:

The data from August 20th is an unambiguous signal that FIIs are escalating their bearish campaign. Their aggressive addition of new short positions, confirmed by a surge in Open Interest, is a high-conviction bet on a market decline. The growing complacency and bullishness of the retail segment only adds fuel to this potentially explosive setup. This is not the time for bullish complacency; the institutional data is flashing a clear warning that the market is structurally weak and positioned for a significant downward move.

Avoiding Overtrading and Revenge Trading: Mastering Self-Control

Last Analysis can be read here

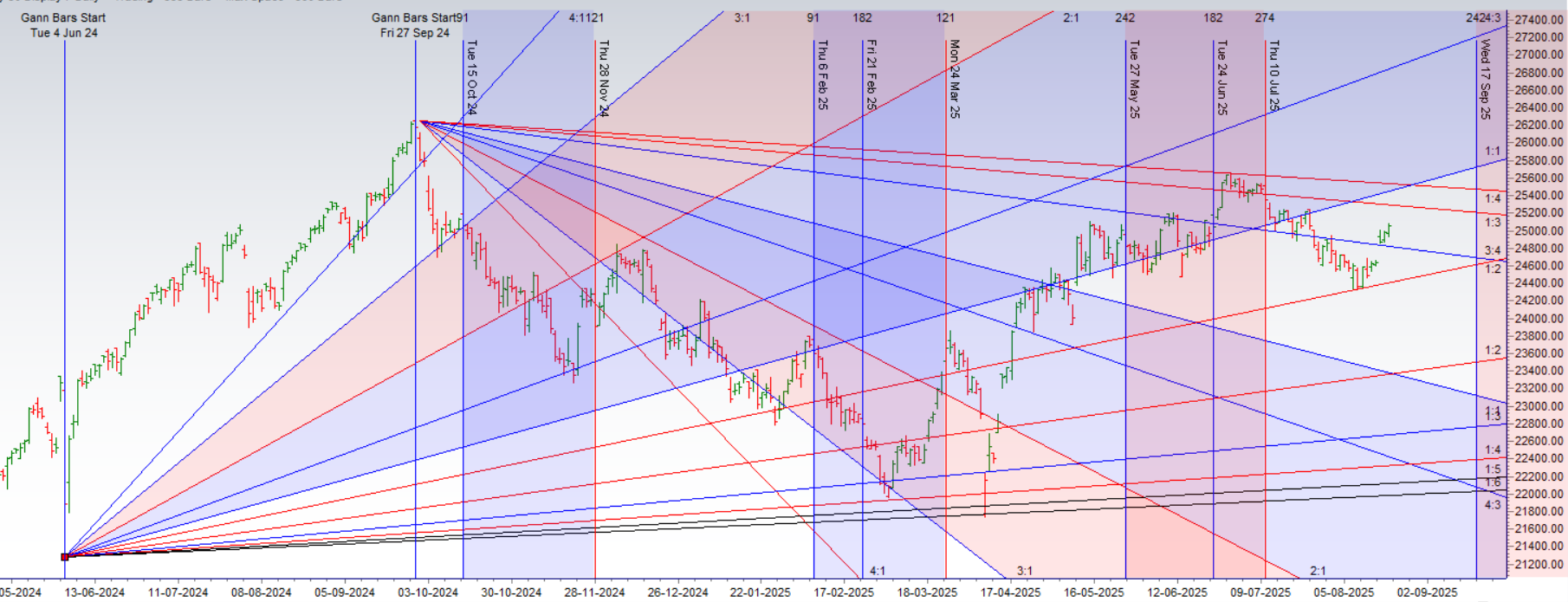

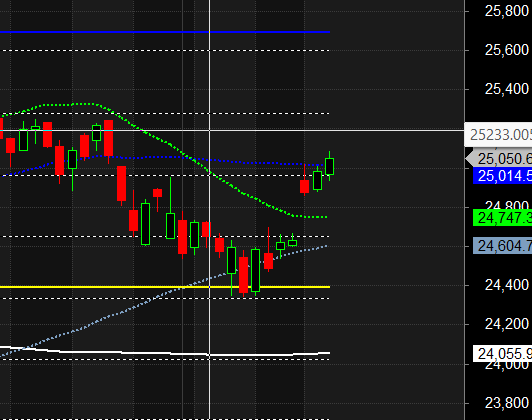

The Nifty has achieved a significant technical milestone by decisively closing above the 25,012 level, a key resistance marked by the recent Mercury Declination high. This bullish breakout, powered by strong momentum in the IT and FMCG sectors, signals that buyers have seized short-term control. However, this rally is built on a foundation of speculation—specifically, the market’s optimistic pricing-in of a potential GST rate cut. This makes the current strength exceptionally fragile, with major astrological dates on the horizon poised to act as a catalyst for significant volatility.

1. The Technical Victory: Conquering the 25,012 Level

The close above 25,012 is a clear win for the bulls and cannot be understated.

-

Resistance Turned Support: This level, previously a ceiling identified by a key astro event, has now flipped to become a critical support floor. As long as the Nifty holds above this mark, the bullish structure remains intact, and buyers will feel confident defending it on any dips.

-

Confirmation of Upward Momentum: Breaking a significant resistance level demonstrates the strength of the underlying buying pressure. It suggests that the market has absorbed the selling at this zone and has the force to continue its upward trajectory.

2. The Engine of the Rally: The Double-Edged Sword of Speculation

The driving force behind this breakout is concentrated in specific sectors, fueled by a single, powerful narrative.

-

IT & FMCG in the Limelight: These sectors have been the primary leaders, attracting strong buying interest. The catalyst is the widespread market chatter and expectation of a favorable GST rate cut.

-

The Risk of Disappointment: This is where the rally becomes precarious. It is a classic case of “buy the rumor.” If the anticipated GST announcement fails to materialize, or if the cut is less substantial than expected, the very foundation of this rally will crumble. The speculative capital that rushed into these sectors will exit just as quickly, leading to a sharp and brutal reversal.

3. The Impending Time Risk: Major Astro Dates Looming

The market is now entering a high-alert period, with the calendar itself acting as a potential trigger for a trend change.

-

A Window for Volatility (Aug 22-23): The upcoming major astrological dates are known to coincide with significant market pivots, reversals, or bursts of volatility. Their arrival while the market is in such a sensitive, news-driven state amplifies their importance.

-

A Potential Catalyst for News and Reversal: These dates could mark the timeline for the GST decision or simply act as an inflection point where the market’s psychology shifts. It creates a window where the risk of a sharp, unexpected move is significantly elevated. Traders must approach these dates with extreme caution, as established trends can be prone to sudden reversals.

Conclusion:

While the Nifty’s breakout above 25,012 is technically bullish, the market’s structure is dangerously fragile. The rally is heavily dependent on a speculative outcome—a favorable GST announcement. Any disappointment on that front will likely trigger a rapid and severe unwinding of the recent gains in the IT and FMCG sectors, dragging the entire index down.

For now, the bulls have the advantage as long as the 25,012 support holds. However, with the critical astro dates of August 22nd and 23rd fast approaching, the risk of a volatility shock is exceptionally high. This is a time for caution, not complacency. While the trend is currently up, the potential for a sudden and violent reversal has rarely been greater.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25013 for a move towards 25091/25055. Bears will get active below 24934 for a move towards 24856/24778

Traders may watch out for potential intraday reversals at 10:00,12:30,01:25,02:20 How to Find and Trade Intraday Reversal Times

Nifty Aug Futures Open Interest Volume stood at 1.58 lakh cr , witnessing addition of 3.4 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was covering of SHORT positions today.

Nifty Advance Decline Ratio at 26:24 and Nifty Rollover Cost is @24887 closed below it.

Nifty Gann Monthly Buy Level : 24887

Nifty Gann Monthly Sell Level : 24582

Nifty has closed below its 20 SMA @ 25012 Trend is Buy on dips till above 24750

Nifty options chain shows that the maximum pain point is at 25000 and the put-call ratio (PCR) is at 1.34 .Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Market Analysis: FIIs Construct a Volatility Trap, Betting on Market Paralysis as Retail Braces for a Breakout

The options data from August 20th reveals a fascinating and high-stakes strategic divergence, shifting the battleground from market direction to market volatility itself. Foreign Institutional Investors (FIIs) have aggressively positioned themselves as sellers of options premium on both sides of the market, a sophisticated bet that the Nifty will become trapped in a stagnant, range-bound state. In stark contrast, retail traders have loaded up on both calls and puts, a clear wager that a massive, decisive breakout is imminent. This sets the stage not for a bull vs. bear conflict, but for a showdown between market movement and market paralysis.

1. Decoding the FII Strategy: Selling Volatility and Betting on Theta Decay

The FIIs’ activity is a masterclass in institutional premium-selling. They are not making a strong directional bet; instead, they are betting that nothing significant will happen.

-

Aggressive Call Writing: FIIs were heavy net sellers of calls, shorting 47,000 contracts while only buying 22,000. This is a clear signal that they do not anticipate a significant rally. By selling calls, they are collecting premium with the expectation that the Nifty will fail to rise above key resistance levels, allowing these options to expire worthless.

-

Even More Aggressive Put Writing: The FIIs’ conviction is even more apparent in their put activity. They sold a staggering 87,000 new put contracts while simultaneously closing out 36,000 of their existing long put hedges. This dual action is powerfully indicative of a belief that the market has strong support and is unlikely to crash. They are effectively selling “insurance” to the market, confident that it will not be needed.

By selling both calls and puts, FIIs are constructing a “short strangle” or “short straddle” on a massive scale. Their primary profit source will be theta (time decay). For every day the market remains quiet, the value of the options they sold erodes, turning directly into their profit.

2. The Retail Position: A Desperate Plea for Volatility

Retail traders have positioned themselves for the exact opposite scenario, paying a significant premium for the chance of a large price swing.

-

Net Buyers of Puts: With 452,000 long puts added against 392,000 short, retail traders are net buyers of downside protection. This shows a prevailing fear of a market drop or a speculative bet on a sharp decline.

-

Net Buyers of Calls: Simultaneously, retail traders were also net buyers of calls (195,000 long vs. 173,000 short). This indicates that while they fear a drop, they are also positioning for a potential sharp rally.

By being net buyers of both calls and puts, the retail segment is collectively long volatility. They need a big move, in either direction, to make their positions profitable. A quiet, sideways market is their worst-case scenario, as the premium they paid for these options will bleed away each day.

3. Strategic Implications: The Path of Maximum Pain

This extreme divergence creates a clear dynamic where the “Path of Maximum Pain” is now a directionless, low-volatility grind.

-

The Theta Trap is Set: The FIIs have set a trap. If the market chops around within a defined range, the vast number of options bought by retail traders will decay in value, leading to significant losses for them and corresponding gains for the institutional sellers.

-

A Self-Fulfilling Prophecy? The heavy selling of calls and puts by FIIs can itself contribute to a range-bound market. The short call positions create strong resistance overhead, while the short put positions create solid support below, effectively boxing the market in.

Conclusion:

The options data paints a vivid picture of a market at a strategic crossroads. The FIIs, or “smart money,” are making a sophisticated, high-probability bet that volatility will collapse and the market will enter a period of frustrating consolidation. Their profit will come from the passage of time. Retail traders, on the other hand, are positioned for fireworks and need a major price shock to be proven right. Given this setup, the most probable outcome—and the one that would cause the most financial damage to the largest number of participants—is a dull, sideways market. The FIIs are betting on boredom, and in the game of options, boredom is often the most lethal weapon against the speculative retail crowd.

In the cash segment, Foreign Institutional Investors (FII) sold 1100 cr , while Domestic Institutional Investors (DII) bought 1806 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134-25860 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

If you condition your mind to lose without anxiety without emotional attachment and without desire to get even.. Things will start turning around for you..

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24744 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25041, Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 25213

Lower End of Expiry : 24881

Nifty Intraday Trading Levels

Buy Above 25055 Tgt 25099, 25136 and 25180 ( Nifty Spot Levels)

Sell Below 25012 Tgt 24865, 24824 and 24777 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators