Market Analysis: FIIs Launch Aggressive Bearish Assault on Bank Nifty, Signaling Major Weakness Ahead

The derivatives data for August 5th reveals a significant and aggressive bearish attack on the Bank Nifty by Foreign Institutional Investors (FIIs). Their net shorting of 6,490 contracts, worth a substantial 1,263 crore, is a powerful statement of negative conviction. Crucially, this activity was accompanied by a surge in Open Interest, confirming that this was not merely position-squaring but a large-scale, fresh build-up of bearish bets. This action positions the Bank Nifty as a key target for institutional bears and serves as a major red flag for the entire market.

1. Decoding the FII Action: A High-Conviction Bearish Bet

The FII activity was clear and aggressive, leaving little room for interpretation.

-

Significant Volume and Value: Shorting nearly 6,500 contracts with a notional value exceeding 1,200 crore is not a minor adjustment or a simple hedging activity. It represents a substantial capital allocation and a strong directional bet by institutional players that the banking index is poised for a significant decline.

-

Active Short Building: The data specifies that FIIs were “shorting,” which means they were initiating new bearish positions. This is far more significant than just selling existing long contracts. It shows a proactive, aggressive belief that prices are headed lower.

This action signals that FIIs see considerable downside risk in the banking sector, which is often a proxy for the health of the entire economy and a leader in broad market trends.

2. The Critical Confirmation: Soaring Open Interest (OI)

The most compelling piece of evidence in this data is the sharp increase in net open interest.

-

OI Increased by 6,698 contracts: An increase in OI signifies that new contracts were created and fresh money entered the market. The fact that the OI increase is almost identical to the number of FII short positions strongly implies that FIIs were the primary force behind this new activity.

-

The Bearish Formula: In market analysis, a combination of falling (or pressured) prices and rising Open Interest is a classic confirmation of a strong bearish trend. It indicates that new sellers are entering the market aggressively, and these new positions are being absorbed, making the market “heavier” and more vulnerable to a sharp fall. It is a sign of distribution and bearish accumulation.

3. Strategic Implications and Market Outlook

This aggressive institutional shorting in the Bank Nifty has several critical implications.

-

Bank Nifty as the Weakest Link: FIIs appear to be targeting the high-beta Bank Nifty as the most vulnerable index, expecting it to lead the market on the way down. This suggests that any broad market weakness could be amplified in banking stocks.

-

Extreme Risk for Bulls: Anyone holding long positions in the Bank Nifty is now fighting a powerful tide of institutional money. Rallies are likely to be short-lived as they will provide FIIs with opportunities to add to their short positions at better prices.

-

A Precursor to a Breakdown: Such a large and sudden build-up of short positions often precedes a technical breakdown below key support levels. A breach of the nearest major support could trigger a wave of accelerated selling as stop-losses are hit and the FIIs’ bearish thesis is validated.

Conclusion:

The FII data from August 5th is an unambiguous and powerful bearish warning for the Bank Nifty and, by extension, the broader market. The combination of massive fresh short-selling by institutions, confirmed by a corresponding surge in open interest, creates a highly precarious situation. The risk of a significant downturn in the banking index has increased dramatically, and traders should treat any bullish position with extreme caution. The bears have clearly signaled their intent.

Last Analysis can be read here

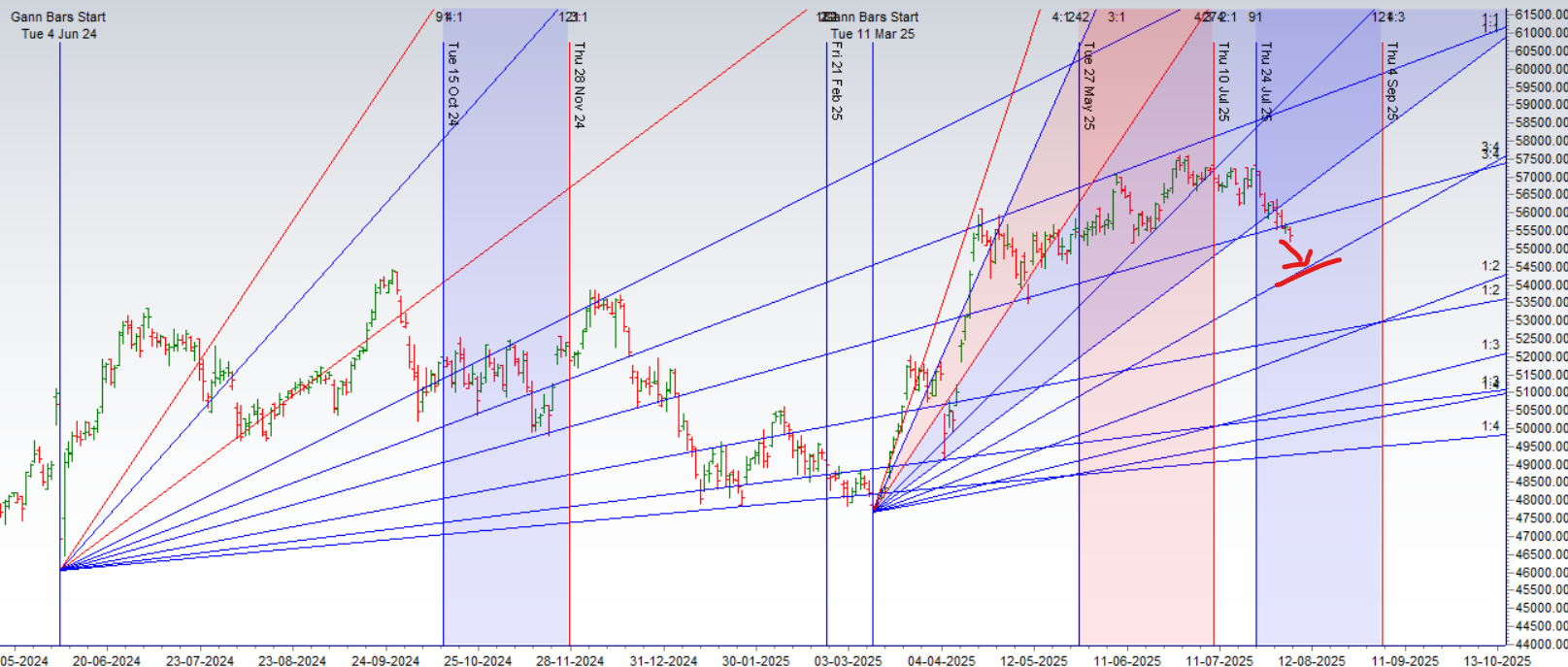

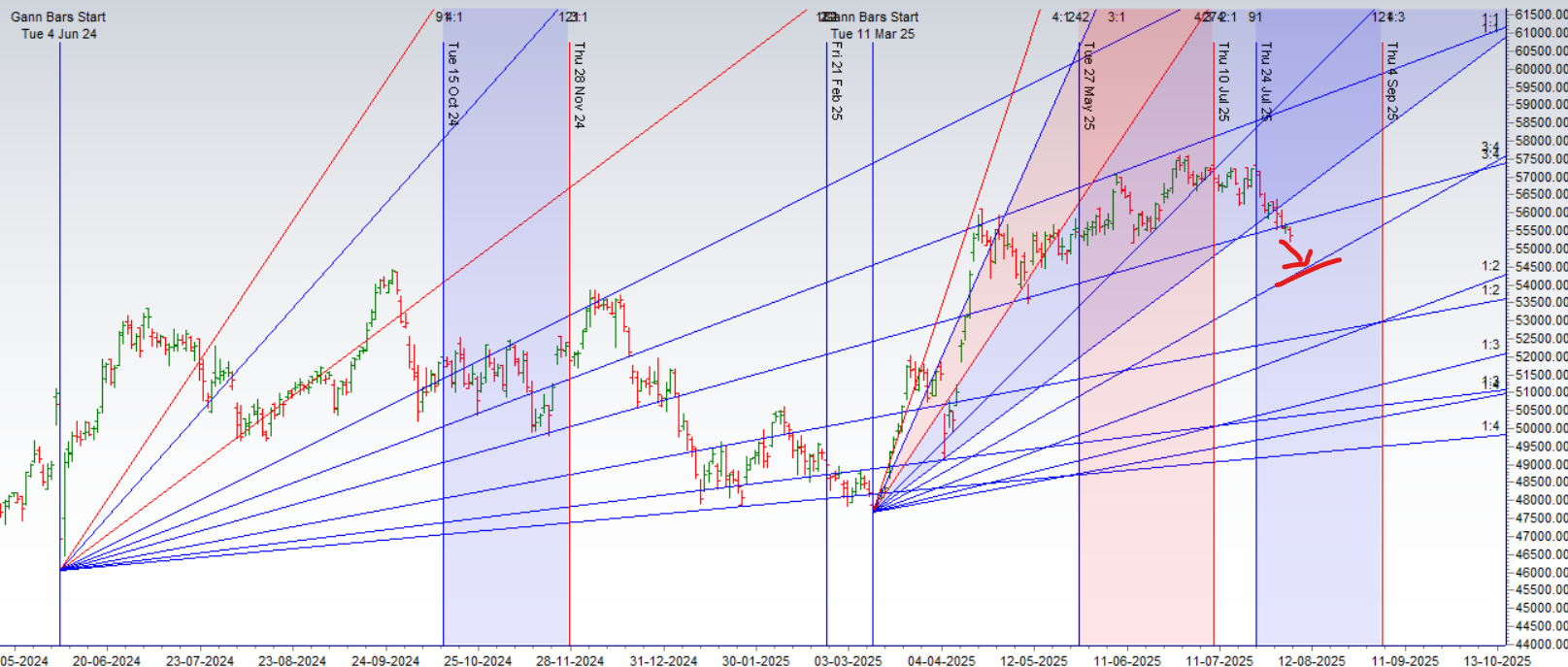

The Bank Nifty has suffered a significant technical blow, breaking below the crucial 3×4 Gann angle, a clear signal that bearish momentum is accelerating. This breakdown, fueled by fears surrounding US tariff threats, has put the bears firmly in the driver’s seat. The market is now precariously poised, with its fate hanging on tomorrow’s Reserve Bank of India (RBI) policy outcome. This single event will act as the ultimate arbiter, with the potential to either trigger a violent short-covering rally on a surprise rate cut or unleash a fresh wave of selling towards the critical Gann level of 54872.

1. The Technical Damage: Breakdown of the 3×4 Gann Angle

The breach of the 3×4 Gann angle is not a minor event; it is a serious technical breakdown.

-

Loss of Key Support: Gann angles provide dynamic support and resistance. A break below a key angle like the 3×4 indicates that the prevailing uptrend’s support has failed and the downtrend is now gaining significant strength and velocity.

-

Confirmation of Bearish Control: This technical event validates the recent price action, confirming that the sellers have overpowered the buyers. The market’s structure is now overtly bearish, and the path of least resistance is downwards until a powerful counter-force emerges.

-

The Tariff Catalyst: The breakdown was fueled by tangible, real-world fears of US tariffs, giving fundamental weight to the technical weakness. This is not a random move; it is a reaction to significant risk-off sentiment.

2. The RBI Policy: The Ultimate Binary Event

With the technical picture clearly bearish, the market’s entire focus now shifts to the RBI’s monetary policy announcement tomorrow. This single event holds the key to the next major directional move.

-

The Bearish Scenario (The Path of Least Resistance): Given the current momentum and technical damage, a hawkish or even a neutral “pause” from the RBI will likely be interpreted negatively by the market.

-

The Trigger: Any commentary from the RBI expressing concerns about inflation or adopting a cautious, “wait-and-watch” approach would disappoint market participants hoping for relief.

-

The Target: A hawkish tone would serve as the green light for bears to launch a fresh assault, with the next logical and critical target being the major Gann support level at 54872. A swift decline towards this level would be expected.

-

The Bullish Scenario (The Contrarian Hope): The only viable path to a recovery for the bulls lies in a significant dovish surprise from the central bank.

-

The Trigger: An unexpected rate cut. In the current environment, this is the only catalyst powerful enough to reverse the deep-seated negative sentiment.

-

The Outcome: A surprise rate cut would catch the heavily positioned bears off guard, forcing them to rapidly close their profitable short positions. This would ignite a violent short-covering rally, as the rush to buy-to-cover creates its own powerful upward momentum.

Conclusion:

The Bank Nifty is in a fragile and dangerous state. The technical damage is done, and the bearish case is strong. The market is now purely reactive, waiting for its marching orders from the RBI.

-

If the RBI delivers anything other than a surprise rate cut, the bearish trend is likely to accelerate towards the 54872 target.

-

If the RBI delivers a shock rate cut, a powerful short-covering rally is on the cards.

Traders must be prepared for extreme volatility post-announcement. The battle lines are clearly drawn, and tomorrow’s RBI policy will be the event that breaks the stalemate and unleashes the market’s next major trend.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 55456 for a move towards 55693/55931. Bears will get active below 55218 for a move towards 54981/54743

Bank Nifty July Futures Open Interest Volume stood at 26.5 lakh, with liquidation of 4.1 lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a additon of SHORT positions today.

Bank Nifty Advance Decline Ratio at 05:07 and Bank Nifty Rollover Cost is @56344 closed below it.

BANK Nifty Gann Monthly Buy Level : 56242

BANK Nifty Gann Monthly Sell Level : 55555

Bank Nifty closed Below its 100 SMA @56400 ,Trend is Sell on Rise till below 56400

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 53548-55141-56734-58422. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 55500 strike, followed by the 56000 strike. On the put side, the 55000 strike has the highest OI, followed by the 54500 strike.This indicates that market participants anticipate Bank Nifty to stay within the 55000-56000 range.

The Bank Nifty options chain shows that the maximum pain point is at 56000 and the put-call ratio (PCR) is at 0.77 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Don’t trade on emotion. Trading is a numbers game, and it’s important to make decisions based on logic and analysis, not emotion.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 55897. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 55600, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 55300 Tgt 55555, 55729 and 55900 (BANK Nifty Spot Levels)

Sell Below 55200 Tgt 55055, 54843 and 54666 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

Related