This week is projected to be highly significant, with multiple indicators pointing to a major trend reversal or turning point, particularly in the second half of the week. The period from Tuesday (July 29) to Thursday (July 31) is marked as critical. An initial bearish sentiment at the start of the week may give way to a pivotal shift in market direction.

Key Themes for the Week:

-

Major Turning Points: The data explicitly identifies Tuesday and Thursday as an “Important Turning Date” and a “Key Turning Point,” respectively.

-

Mid-Week Volatility: The Mercury Halfway Retrograde on Wednesday (with a +/- 1 day influence) suggests the entire mid-week period will be prone to significant price action and potential reversals.

-

Initial Bearish Pressure: A “Bearish” signal is noted for early Tuesday, which could set a negative tone for the first part of the week before the major turning points take effect.

Day-by-Day Astrological Analysis

Monday, July 28, 2025:

-

The week begins with a Venus Semi Square Mercury aspect. This suggests a day of minor tension or adjustment as the market prepares for the more impactful events to follow. Trading could be choppy.

Tuesday, July 29, 2025:

-

Bearish Signal (04:04 AM): The Moon’s conjunction with Saturn indicates a potential for bearish sentiment or downward pressure, especially in the first half of the trading session.

-

Important Turning Date (07:30 PM): The Mercury-Venus conjunction is highlighted as an “Important Turning Date.” This strongly suggests that any trend seen during the day could face a reversal. The market may find a bottom from the earlier bearish pressure and begin to change direction.

Wednesday, July 30, 2025:

-

Mercury Halfway Retrograde (Rule No 44): This is a central event for the week. Its influence is noted to be active for +/- 1 day, placing Wednesday at the heart of the expected volatility. This reinforces the idea of a trend change initiated on Tuesday.

-

Chiron in Aries (S/R): This suggests that markets may test significant Support or Resistance levels today.

Thursday, July 31, 2025:

-

Key Turning Point (06:34 PM): The Sun conjuncts with a retrograde Mercury, which is labeled a “Key Turning Point.”

-

Trend Change Confirmed (Bayer Rule 22): This event is further clarified by Bayer Rule 22, which states, “The trend changes if retrograde Mercury passes over the Sun.” This is the strongest signal of the week, indicating a high probability of a confirmed trend reversal. Expect significant market moves and high volatility.

Friday, August 1, 2025:

-

No specific major events are listed for Friday. The market will likely be reacting to and digesting the pivotal events from Tuesday through Thursday. The new trend established during the mid-week turning points is expected to continue or consolidate.

Bank Nifty Forecast

As a high-beta index, Bank Nifty is likely to experience more exaggerated moves compared to the broader market.

-

Start of the Week (Mon-Tues): The “Bearish” signal on Tuesday (July 29) could lead to a sharper decline in Bank Nifty than in the Nifty 50. Financials may lead the market on the way down.

-

Mid-Week Turning Point (Tues PM – Thurs): The reversal will be highly pronounced. The “Important Turning Date” on Tuesday evening and the Venus-related aspects are particularly significant for this financial index. When the reversal begins, Bank Nifty could see a very sharp, V-shaped recovery.

-

End of the Week (Thurs-Fri): The “Key Turning Point” on Thursday (July 31) will likely trigger a strong rally in banking stocks. Bank Nifty could outperform the Nifty 50 during this upward move, showing strong momentum into the end of the week.

Summary for Bank Nifty: High volatility is expected. A sharp drop early in the week may be followed by an even more powerful and rapid trend reversal to the upside.

Dive Deeper Into Gann & Astro Trading:

W.D. Gann Trading Strategies

Trading Using Financial Astrology

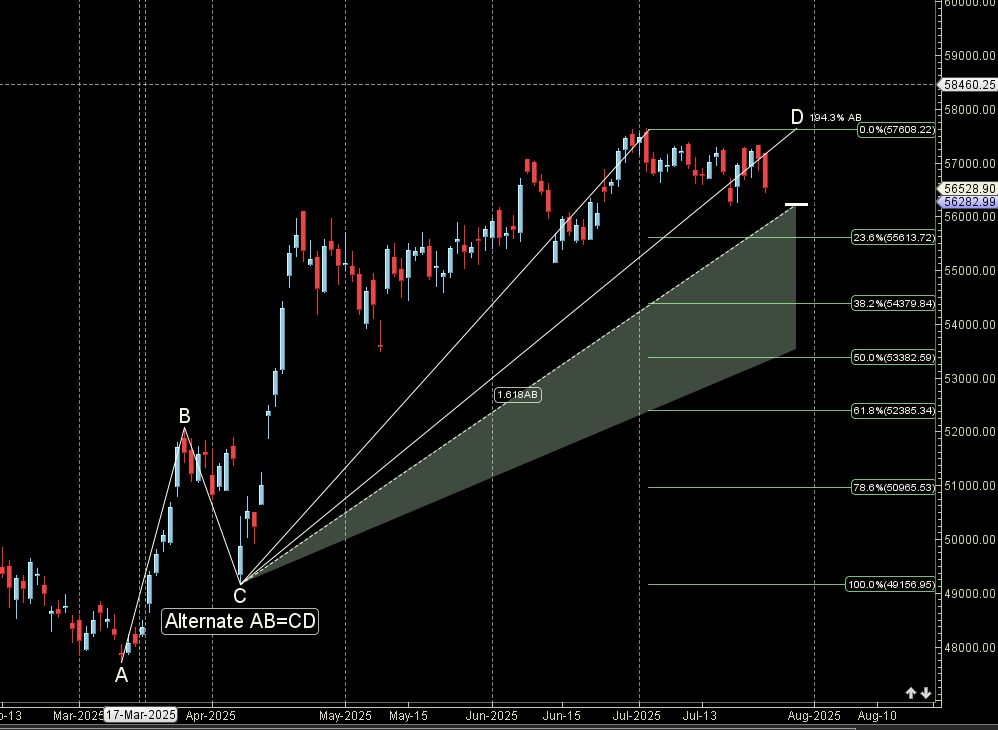

Bank Nifty Harmonic Pattern

Bank Nifty has reacted from its PRZ zone of 57000 Unable to cross fall towards 55600.

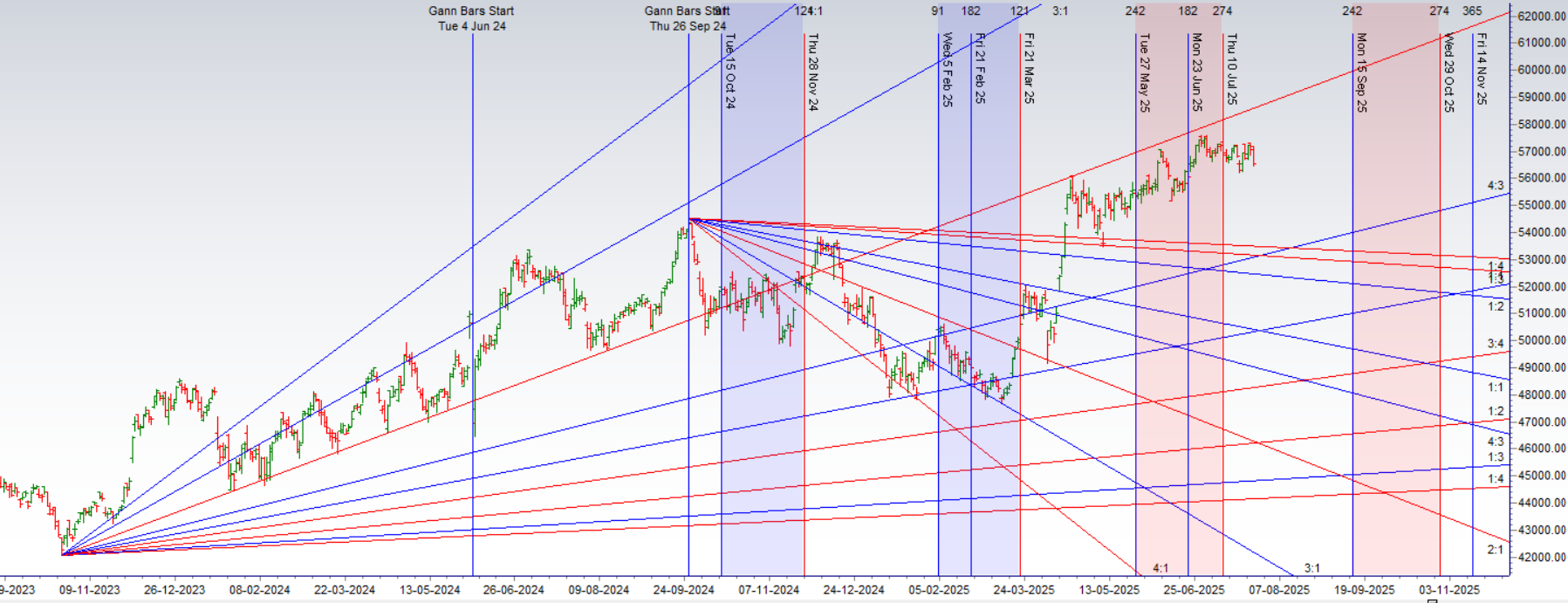

Bank Nifty Gann Angles

Bank Nifty has breakdown below 25 June time cycle low.

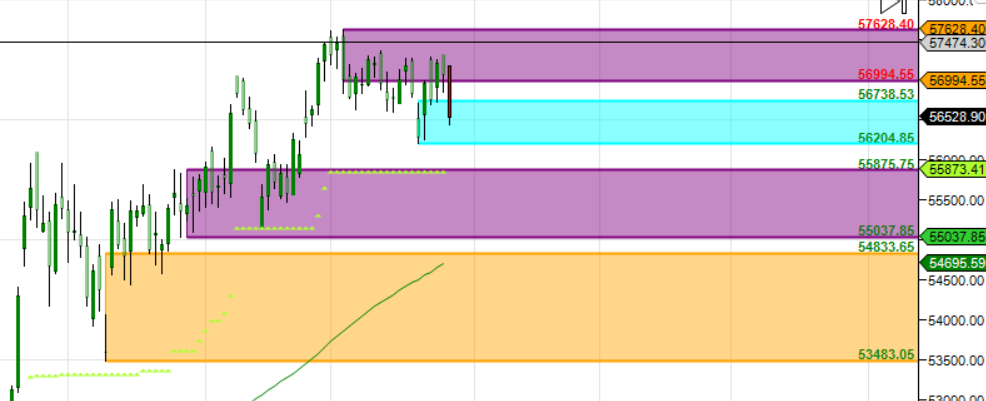

Bank Nifty Supply and Demand

Self Explanatory Chart

Bank Nifty Time Analysis Pressure Dates

Key Pivot Dates: Watch July 31

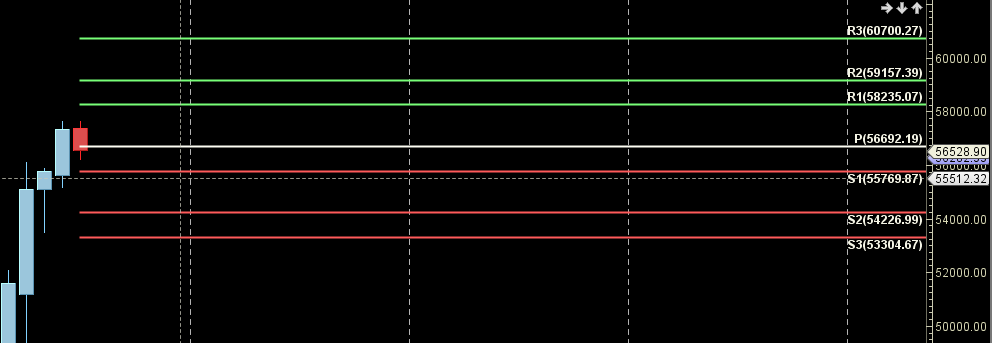

Bank Nifty Weekly Chart

Bank Nifty HAS FORMED 3 Black crows

Bank Nifty Monthly Charts

56692 is Monthly Resistance zone 55769 is Monthly Support zone.

Bank Nifty Weekly Levels

Bank Nifty Trend Deciding Level: 56545

Bank Nifty Resistance:56784,57023,57262,57555

Bank Nifty Support : 56302,56066,55827,55587

Levels mentioned are Bank Nifty Spot

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.

Call: 09985711341

Email: bhandaribrahmesh@gmail.com

As always I wish you maximum health and trading success

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.