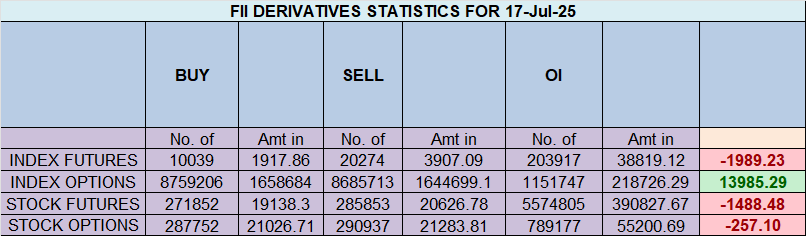

RED ALERT: FIIs Go All-In, Unleashing a ₹1069 Crore Shorting Onslaught on Nifty

Some days in the market are noise. Yesterday was a signal. Today was a declaration of war.

The simmering conflict between the institutional bears and the retail bulls has just erupted into a full-blown onslaught. Foreign Institutional Investors (FIIs), the so-called “smart money,” have thrown caution to the wind and launched one of the most aggressive, high-conviction bearish attacks seen in recent memory.

They net shorted a colossal 5,654 contracts in the Nifty Index Futures market, deploying a staggering ₹1,069 crore in fresh capital to bet against the index. This is not a hedge. This is not a cautious rebalancing. This is a clear and unambiguous statement that, in their view, a significant market downturn is imminent.

This seismic shift has pushed market positioning to a dangerous and unsustainable extreme. To understand the gravity of this situation, we must dissect the data and see why this is a five-alarm fire for anyone holding a bullish outlook.

The FII Playbook: A “Shock and Awe” Bearish Campaign

The headline number of ₹1069 crore is shocking enough, but the breakdown of the FIIs’ activity is where the true, terrifying conviction is revealed.

-

They added a monumental 8,359 new short contracts. This is an overwhelming wave of new bearish bets. It signifies a profound negative consensus among the institutional giants.

-

They covered a mere 1,876 long contracts. This is a critical detail. It shows that their primary action was not to simply de-risk by selling existing longs. Their main focus was a full-frontal assault on the short side, actively initiating new positions to profit from a potential fall.

This isn’t just a bearish tilt; it’s a strategic “shock and awe” campaign. And it has driven their overall positioning into historically bearish territory.

With a Long:Short ratio of just 17:83, the FII camp is now almost uniformly positioned for a fall. The positional ratio has plummeted to 0.20, a level of extreme pessimism that is rarely seen. This number is a stark warning: for every one contract an FII holds betting on a market rise, they now hold five contracts betting on a fall. This is an almost unprecedented level of institutional bearishness and signals that they see a clear and present danger on the horizon.

The Retail Wall of Worry: The First Cracks Appear

As this institutional tidal wave of selling hit the market, the Client segment (primarily retail traders) once again stepped up to be the primary buyer. However, the data shows that their once-unbreakable bullish resolve is beginning to fracture under the immense pressure.

-

They added 4,649 new long contracts. Retail participants are still buying the dip, stubbornly holding the line against the institutional onslaught. Their overall positioning remains bullish, with a Long:Short ratio of 64:36 and a positional ratio of 1.77.

-

However, they also added a significant 1,685 new short contracts. This is the crucial crack in their armor. While the majority are still buying, a growing number of retail traders are either flipping bearish or are so spooked by the institutional selling that they are hedging their new long positions.

The retail camp is no longer a unified bullish army. It is a fragmented group where fear and doubt are starting to creep in. This internal conflict weakens their ability to absorb further selling and makes the market’s support structure increasingly fragile.

The market is now saturated with high-conviction positions on both sides. This creates an incredibly tense and unstable environment. The pressure is building to an extreme, and when a key technical level finally breaks, the subsequent move is likely to be violent and unforgiving as one side is forced into a panic-driven liquidation of their positions.

We are at a critical juncture. The FIIs have drawn their line in the sand, and they have backed it with over a billion dollars. The stage is set for a major confrontation. Either the retail bulls will absorb this historic selling pressure and trigger a legendary short squeeze against the FIIs, or the institutional weight will finally break the market’s back, leading to a swift and brutal decline.

The fuse has been lit. Extreme caution is not just advised; it is essential for survival.

The Silent Account Killer: How Stress Sabotages Your Trading and the Strategies to Fight Back

Last Analysis can be read here

The market is holding its breath. Today’s session was a masterclass in confusion, volatility, and ultimately, bearish control into the close. The Nifty chart is now a coiled spring, wound tight by conflicting news, immense event risk, and a rare weekly pattern that screams one thing: a massive, high-momentum move is imminent.

The bullish hope that ignited earlier this week was brutally extinguished today under the weight of weekly expiry pressure. After briefly breaking the key Saturn Retrograde high—a move that looked like a bullish confirmation—the market reversed with force, closing below yesterday’s crucial low of 25121. This “failed breakout” is a classic bull trap, a painful reversal that signals the bears have seized control, at least for now.

But the story is far more complex than a simple bearish close. The market is being pulled in multiple directions by a powerful confluence of forces, setting the stage for an explosive week ahead.

The Conflicting Crosscurrents: A Market at War with Itself

To understand today’s indecision, one needs to look no further than the contradictory news flow hitting the terminals:

-

The Bearish Jab (Axis Bank): Axis Bank delivered a disappointing set of quarterly numbers, casting a shadow over the banking sector and providing fuel for the sellers.

-

The Bullish Counter (Wipro & SBI): On the other hand, IT major Wipro came out with a good set of numbers. More significantly, State Bank of India’s massive ₹25,000 crore QIP (Qualified Institutional Placement) was oversubscribed four times over. This is a monumental signal. It screams that despite the surface-level volatility, there is an ocean of institutional liquidity. This is the market coiling into one of its tightest compressions in recent memory, right before a weekend packed with market-moving bombshells and the arrival of a chaotic astrological catalyst.

The question is no longer if a big move is coming, but when and in which direction. Let’s break down the complex forces at play that are setting the stage for a period of extreme volatility.

The Bearish Victory: How the Bull Trap Was Sprung

Today’s price action was a textbook lesson in failed breakouts. The bulls, who had valiantly defended the Saturn Retrograde high of 25151 for two days, saw their fortress crumble. Not only did the Nifty fail to hold the gains, but it also suffered a critical technical breakdown by closing below yesterday’s low of 25121.

This sequence is profoundly bearish in the short term. It signals that the breakout was false, trapping the buyers who chased the move. These trapped bulls are now a source of potential selling pressure as they are forced to liquidate their positions at a loss.

Adding fuel to this bearish fire were the mixed corporate results. While Wipro delivered a good set of numbers, the negative results from banking heavyweight Axis Bank sent a chill through the financial sector, validating some of the recent bearish sentiment.

The Bullish Counterpoint: A Roaring Fortress of Liquidity

But just as the bears began to celebrate, a stunning piece of news from the public sector banking space threw a wrench in their plans. State Bank of India’s (SBI) massive ₹25,000 crore Qualified Institutional Placement (QIP) was oversubscribed by a staggering four times.

This cannot be overstated. It is a resounding signal of abundant liquidity and immense institutional confidence in the Indian growth story, specifically within its largest public sector bank. It tells us that despite the short-term chart weakness, there is a wall of money on the sidelines, ready and willing to be deployed into Indian equities at scale. This creates a powerful bullish undercurrent that can absorb significant selling pressure and provides a strong argument against a market collapse.

The Weekend Juggernauts: The Reason for the Paralysis

This brings us to the core of the market’s current state: a tense, coiled paralysis. The reason for this is the event risk packed into this weekend, featuring the quarterly results of the three undisputed titans of the Indian market.

-

Reliance Industries (Weight: ~8.91%)

-

ICICI Bank (Weight: ~8.79%)

-

HDFC Bank (Weight: ~13.19%)

Combined, these three stocks account for nearly 31% of the Nifty 50’s total weight. Their earnings will not just influence their own stock prices; they will single-handedly set the tone and direction for the entire market next week. No large institution is willing to place a major directional bet ahead of such a concentrated blast of fundamental data.

The Grand Finale: An NR21 Pattern and the Mercury Retrograde Wildcard

This institutional paralysis and anticipation are perfectly reflected in the weekly chart, which is forming two incredibly powerful patterns simultaneously:

-

A Doji Candle: A classic sign of indecision and a perfect equilibrium between bulls and bears.

-

An NR21 Pattern: This stands for the “Narrowest Range of the last 21 weeks.” This is a rare and potent volatility compression pattern. It signals that the market’s energy is being squeezed into an incredibly tight range, and waiting to be deployed into high-quality Indian assets. This is the primary force preventing a market collapse.

This push-and-pull between negative earnings and abundant liquidity is why the market is trapped, unable to commit to a direction.

The Weekend Juggernauts: The Reason for the Paralysis

The market isn’t just undecided; it’s paralyzed by anticipation. This weekend, the three undisputed titans of the Indian stock market are set to announce their quarterly results:

-

HDFC Bank (13.19% of Nifty)

-

Reliance Industries (8.91% of Nifty)

-

ICICI Bank (8.79% of Nifty)

Together, these three companies account for nearly 31% of the entire Nifty 50 index. Their earnings will not just influence their own stock prices; they will set the fundamental tone for the entire market. No large trader, bull or bear, is willing to place a significant bet ahead of an event with this much binary risk. The market is in a holding pattern, waiting for the results from its three biggest players.

The Cosmic Wildcard and the Weekly Chart’s Secret

As if a ~30% index-weighted earnings weekend wasn’t enough, we have two other critical factors converging to guarantee volatility.

-

Mercury Retrograde Begins Tomorrow: In financial astrology, these periods are notorious for bringing volatility, confusion, miscommunication (in how the market interprets news), and sharp, unexpected reversals. It’s the perfect astrological storm for the market to react to the weekend’s earnings news.

-

The Weekly Chart is Forming an NR21 + Doji Pattern: This is the technical confirmation of everything we are seeing.

-

NR21: This means the Nifty has just formed its Narrowest Range week of the last 21 weeks. Volatility compression of this magnitude is almost always followed by a violent volatility expansion—a massive, trending move.

-

Doji: The weekly candle is a Doji, signifying perfect equilibrium and extreme indecision.

-

A Doji candle inside an NR21 pattern is one of the most powerful signs of an impending explosive move. The market has coiled itself as tightly as possible, and it is ready to uncoil with tremendous force.

The Actionable Game Plan: The Levels That Matter

This confluence of factors has given us a crystal-clear range to watch for the breakout. The market is currently trapped between two key levels, and a break of either will likely unleash the stored energy.

-

The Downside Trigger: A decisive break and close below 25000. If this floor gives way, the selling pressure is likely to accelerate rapidly, with an initial target of 250+ points on the downside.

-

The Upside Trigger: A move that reclaims and closes above 25255. This would invalidate the bearish close and signal that the market has absorbed the news positively, likely leading to a similar 250+ point rally.

Conclusion:

The market is perfectly poised at a critical inflection point. The bearish close from expiry pressure is battling against the immense underlying liquidity. The entire market is holding its breath for the earnings of the three Nifty juggernauts. And overseeing it all is the impending chaos of Mercury Retrograde and a rare, explosive weekly chart pattern.

The message is clear: the period of frustrating, range-bound indecision is over. The fuse has been lit. Be prepared for a massive, trending move next week. Watch the levels of 25000 and 25255—the breakout is coming.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25124 for a move towards 25204/25284. Bears will get active below 25081 for a move towards 25001/24920

Traders may watch out for potential intraday reversals at 09:56,11:29,12:53,01:59 How to Find and Trade Intraday Reversal Times

Nifty July Futures Open Interest Volume stood at 13.8 lakh cr , witnessing liquidation of 0.38 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closure of LONG positions today.

Nifty Advance Decline Ratio at 19:31 and Nifty Rollover Cost is @24321 closed above it.

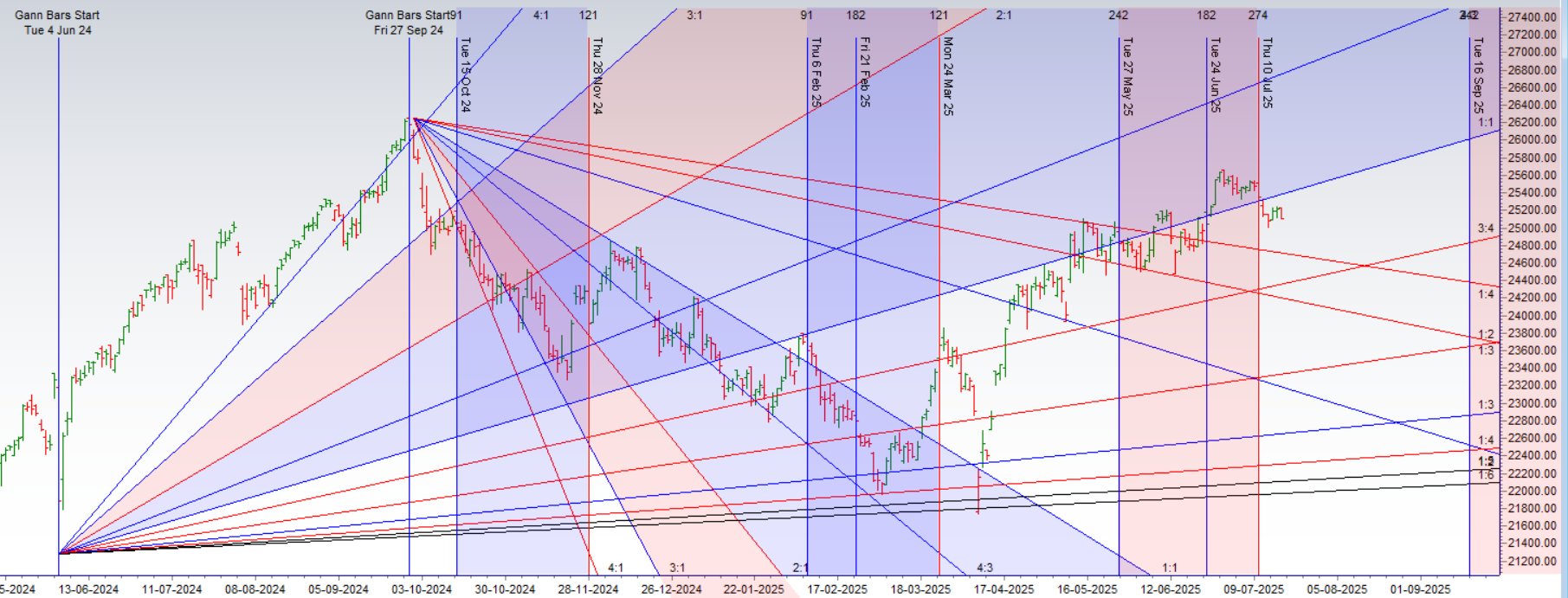

Nifty Gann Monthly Buy Level : 25709

Nifty Gann Monthly Sell Level : 25393

Nifty has closed below its 20 SMA @ 25299 Trend is Sell on Rise till below 25393.

Nifty options chain shows that the maximum pain point is at 25150 and the put-call ratio (PCR) is at 0.64 .Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 25200 strike, followed by 25400 strikes. On the put side, the highest OI is at the 25100 strike, followed by 25000 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 25000-25300 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 3694 cr , while Domestic Institutional Investors (DII) bought 2820 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134-25860 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Don’t trade on emotion. Trading is a numbers game, and it’s important to make decisions based on logic and analysis, not emotion.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25211 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25463 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25150 Tgt 25188, 25225 and 25285 ( Nifty Spot Levels)

Sell Below 25100 Tgt 25060, 25033 and 25000 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators