Nearly ₹1000 Crore in FII Shorts: A Red Alert for the Banking Sector

In the vast, often chaotic ocean of daily market data, some waves are just noise, while others are tidal. Today, in the Bank Nifty Index Futures market, the “smart money” just created a tidal wave, signaling a profound and aggressive shift in sentiment that every serious trader needs to understand.

Foreign Institutional Investors (FIIs) have moved beyond simple caution. They have unleashed a massive, high-conviction bearish attack, shorting a colossal 4,930 Bank Nifty contracts and deploying nearly a billion rupees—a staggering ₹984 crore—to back their negative view.

This is not a subtle hint; it is a blaring siren. The size, value, and nature of this move indicate that institutional players are not just hedging; they are actively positioning for a significant downturn in the Indian market’s most critical sector. To ignore this signal is to ignore the footprints of the market’s most powerful players.

Let’s dissect this data to understand the gravity of the situation and why this is a red alert for the bulls.

Decoding the Data: The Three Pillars of a Bearish Thesis

To grasp the full weight of this move, we must look at the three key components of the data, which together form a powerful bearish narrative.

-

The Sheer Volume: FIIs were net sellers, shorting 4,930 contracts. This is a significant number, indicating a coordinated and decisive action rather than a series of small, unrelated trades.

-

The Monumental Capital Deployed: The value of these short positions was a jaw-dropping ₹984 crore. This elevates the move from a simple trading action to a strategic institutional allocation. FIIs do not risk nearly a thousand crore of capital on a whim. This level of deployment reflects a deeply researched, well-founded thesis that the banking sector is facing significant headwinds.

-

The Decisive Clue: The Increase in Open Interest: This is the most critical piece of the puzzle. The FIIs’ shorting activity resulted in a net open interest (OI) increase of 484 contracts.

The fact that Open Interest increased while FIIs were aggressively shorting is profoundly important. It tells us that this was not a simple case of FIIs selling their existing long positions to take profit. If that were the case, OI would have decreased.

Instead, the increase in OI proves that FIIs were creating brand new bearish positions. They were not just folding their bullish hands; they were walking up to the poker table, putting down a fresh stack of nearly a thousand crore in chips, and betting heavily that the next card would be a bad one for the market. This is the difference between caution and conviction, and the FIIs have just shown their hand with overwhelming conviction.

Last Analysis can be read here

The fragile truce has shattered. The market’s brief, hopeful pause, represented by a classic Doji candle, has been decisively broken to the downside. The Bank Nifty, which had tantalized bulls with a potential breakout, saw its momentum evaporate, failing once again to conquer the formidable Saturn Retrograde high.

This is more than just a day of selling; it’s a significant technical failure that puts the bears firmly back in the driver’s seat. But this is no simple downtrend. The market is now a coiled spring, wound to an extreme by a rare weekly pattern and poised to explode as it heads into a weekend packed with market-moving bombshells and a chaotic astrological catalyst.

Let’s dissect the components of this perfect storm to understand why the Bank Nifty is balanced on a knife’s edge.

The Technical Breakdown: The Bull Trap is Sprung

Today’s price action was a textbook example of a failed breakout. After teasing a rally, the market reversed, and the bears achieved two critical objectives:

-

They broke the low of the previous day’s Doji candle, confirming the bearish reversal signal.

-

The market failed to close above the Saturn Retrograde high, solidifying that level as a powerful resistance ceiling. The attempted rally was a classic “bull trap,” luring in buyers only to reverse and stop them out.

This action has shifted the entire technical landscape. The focus is no longer on upside targets but on a single, critical line of defense for the bulls.

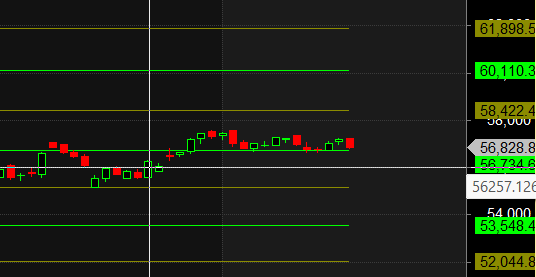

The Bulls’ Last Stand: The Saturn Retrograde Low at 56780

With the high now acting as a ceiling, all eyes turn to its counterpart: the Saturn Retrograde low of 56780. This level is now the ultimate line in the sand. It is the last structural support holding the market together.

A decisive break and close below 56780 would be a catastrophic failure for the bulls. It would signal that the entire support structure has collapsed, likely triggering a wave of panic selling and a rapid, cascading decline. The bulls must defend this level at all costs.

The Weekly Time Bomb: Consecutive NR21 Patterns

Zooming out to the weekly timeframe reveals the true scale of the tension building within the market. Bank Nifty is in the process of forming consecutive NR21 patterns.

NR21 stands for the “Narrowest Range of the last 21 weeks.” It is one of the most powerful volatility compression patterns a trader can identify. When a market’s energy is squeezed into such a tight range for a prolonged period, it almost invariably leads to a violent volatility expansion—a massive, high-momentum, trending move.

To see this pattern form in consecutive weeks is exceptionally rare and signifies that the market is a pressure cooker waiting to explode. The current indecision is not a sign of calm; it is the sign of immense energy being stored, waiting for a catalyst to be unleashed.

The Weekend Juggernauts: The Fundamental Catalysts

And the catalysts are lined up and ready to go. The market is coiled so tightly because it is waiting for the earnings results of the two titans of the banking sector this weekend:

Combined, these two giants account for over 22% of the entire Bank Nifty index. Their results will not be a minor influence; they will be the primary driver of the breakout.

Adding a fascinating twist to this scenario is the news that HDFC Bank’s board will also consider a special dividend and bonus shares. This introduces a powerful, potentially bullish “wildcard.” Even if the earnings are neutral, news of a bonus or a special dividend could trigger a massive short-squeeze, creating a violent whip-saw against the prevailing bearish technicals.

The Cosmic Wildcard: Mercury Retrograde Begins Tomorrow

As if this perfect storm of technical pressure and fundamental event risk wasn’t enough, the astrological backdrop adds another layer of chaos. Mercury Retrograde begins tomorrow.

In financial astrology, these periods are notorious for bringing:

-

Extreme Volatility: Sharp, unexpected swings in both directions.

-

Confusion and Misinterpretation: The market may react illogically to news, with good news causing sell-offs and vice versa.

-

Reversals: Trends that seem established can suddenly and violently reverse.

It is the perfect cosmic environment for the market to digest the complex news from the banking giants, ensuring that the reaction will be anything but predictable and straightforward.

Conclusion

The Bank Nifty is more than just bearish; it is critically poised for an explosive move. The technical breakdown of the Doji has put the bears in control, with their sights set on shattering the last line of bullish defense at 56780. The rare and powerful consecutive NR21 pattern on the weekly chart guarantees that the subsequent move will be significant.

This immense stored energy is about to be unleashed by the combined force of the HDFC Bank and ICICI Bank earnings, the surprise potential of a bonus share announcement, and the chaotic volatility of Mercury Retrograde.

The period of quiet indecision is over. Brace for impact. The breakout is coming, and it will be massive.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 57337 for a move towards 571575/57813/58051. Bears will get active below 57148 for a move towards 56908/56666