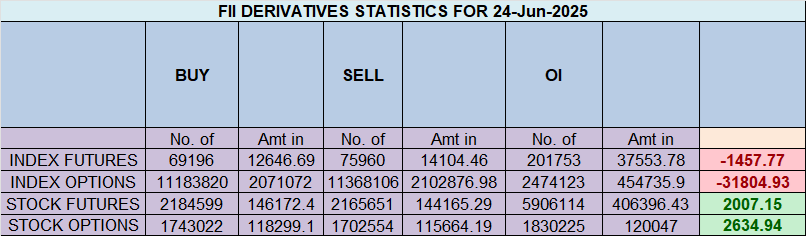

FIIs Unleash Shorts in Index Futures, Clients Remain Bullish | 24 June 2024 Data Analysis

As per the end-of-day data, Foreign Institutional Investors (FIIs) maintained a strong Bearish instance in the Nifty Index Futures. They ended up shorting 11,400 contracts worth a significant ₹2154.96 crores.

Crucially, this activity led to a net open interest increase of 17,864 contracts, signaling that these are not just closing of old long positions but aggressive creation of fresh short positions in the system. This is a clear sign of bearish conviction from the FII desk.

Breaking Down FII Activity

To understand the conviction, we need to look at the gross numbers. The FII activity for the day was as follows:

-

✅ FIIs added 6,968 long contracts

-

✅ FIIs added a whopping 19,477 short contracts

The key takeaway here is the sheer aggression on the short side. The number of new short contracts created is nearly three times the number of new long contracts. This isn’t hedging; this is a directional bearish bet being placed by the smart money.

Client Behaviour

The Client segment, which primarily consists of retail traders, showed a mixed but ultimately bearish action on the day, likely in reaction to the price movement:

-

✅ Clients covered 2,981 long contracts (Closing out bullish positions)

-

✅ Clients added 10,926 short contracts (Adding new bearish positions)

While on the surface this looks bearish, the real story is in the cumulative positioning, which we will discuss next.

Current Positioning in Index Futures: The Big Picture

This is the most critical part of the data. It shows the cumulative open positions and highlights the classic market conflict.

-

FII Positioning: Long:Short ratio stands at 23:77. The calculated ratio is 0.29. A ratio below 0.5 is considered extremely bearish. This shows FIIs are heavily positioned for a downside move in the index.

-

Client Positioning: Long:Short ratio stands at 62:38. The calculated ratio is 1.65. This indicates that despite their bearish actions today, the retail segment as a whole is still overwhelmingly positioned on the long side, hoping for a market bounce.

Conclusion and Way Forward

The data presents a classic and powerful divergence: Smart Money (FIIs) is aggressively short, while Retail Money (Clients) is cumulatively long.

How to Become a Professional Trader: A Step-by-Step Guide

Last Analysis can be read here

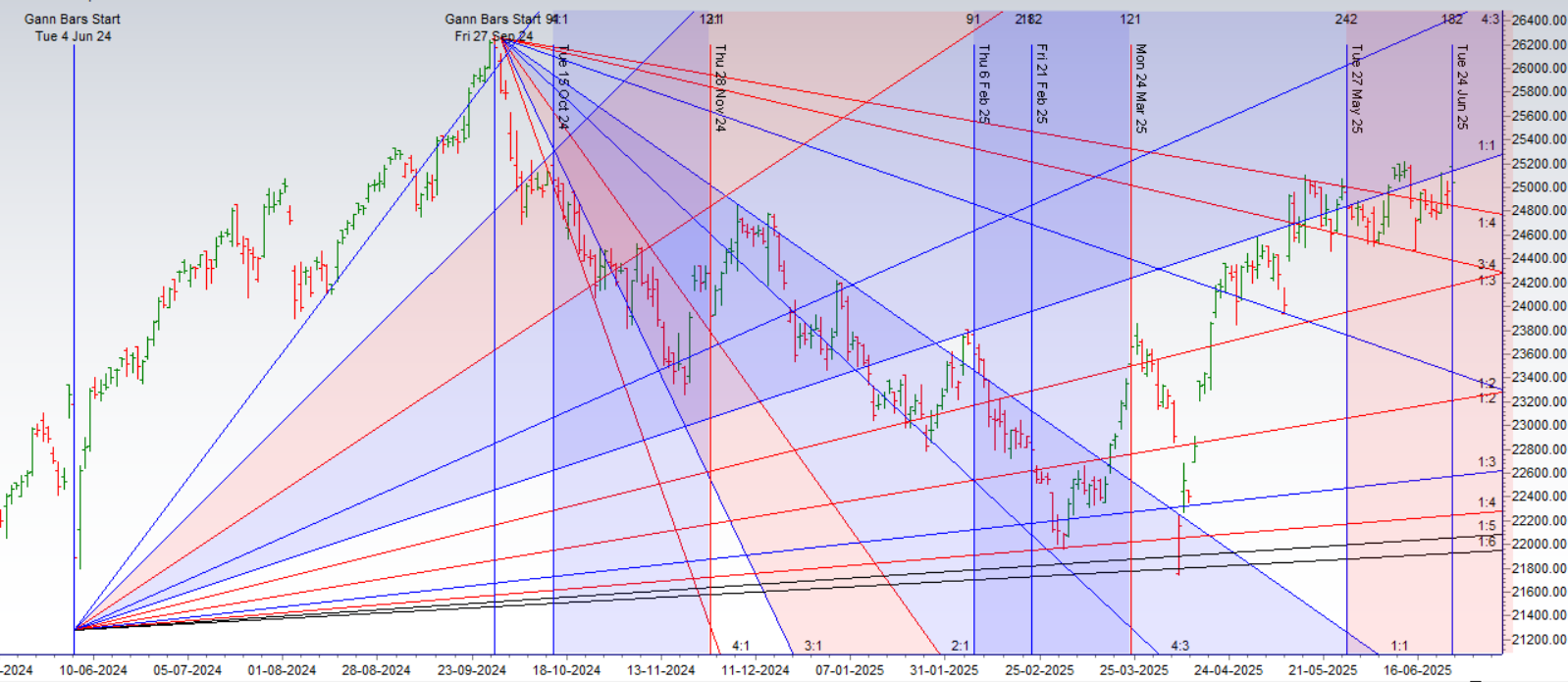

Traders, the market provided a masterclass in technical and Gann analysis yesterday. As anticipated, the Nifty opened with a significant gap up, fueled by positive global cues from the Iran-Israel ceasefire talks and a sharp 15% fall in crude oil prices from the top.

However, the bulls failed to capitalize. As we have often seen, we saw a strong supply emerge at higher levels, and the entire opening gap was filled by the end of the day. This price action is a warning sign. The rejection was not random; it happened precisely from a key technical resistance.

The price, once again, got rejected perfectly from the 1×1 Gann angle, as shown in the chart we have been tracking. This is the third time the price has honored this angle, confirming its immense power as a line of resistance.

A Rare Confluence of Gann, Astro, and Market Events

Now, the market is coiled for an even bigger move. We are standing at a rare and powerful confluence of multiple cycles:

-

Astro Time Cycle: Today is a Double Lunar Date, which is a very powerful date for trend initiation. As our historical studies show, these dates often trigger a trending move of 300-400 points in the Nifty over the next two trading sessions.

-

Gann Time Cycle: To add to the conviction, yesterday was a Gann 182-day cycle, a key harmonic of the yearly cycle. We are therefore seeing a powerful confluence of both Gann and Astro time cycles converging.

-

Expiry Volatility: This entire setup is occurring right at the monthly expiry, which will act as a force multiplier for the eventual directional move.

This confluence suggests an explosive move is imminent. However, there is one major headwind the bulls are facing.

Today, the HDFC Group IPO (HDB) worth a massive ₹12,500 crore will open. This will suck a significant amount of liquidity from the secondary market, which could be the reason why the market is struggling to sustain at higher levels despite positive news.

The Decisive Levels for the 300-400 Point Move

The battle is set: Bullish time cycles vs. Bearish liquidity drain. The winner will be decided by the market’s ability to break and sustain beyond the following sacred levels.

-

Bullish Trigger: The bulls will gain complete control only on a decisive move above 25,300. A sustained trade above this level will signal that the astro cycles have overpowered the IPO effect, paving the way for a sharp, trending move on the upside.

-

Bearish Trigger: The bears will seize control if the Nifty breaks and sustains below 25,000. This breakdown will confirm that the liquidity drain and supply at the Gann angle are the dominant forces, opening the doors for a swift move down.

Conclusion:

Traders, the setup is extraordinary. Do not get caught in the chop between 25,000 and 25,300. The real money will be made by trading in the direction of the breakout. Wait for these levels to be breached, as the resulting move is likely to be fast, furious, and decisive, delivering the 300-400 point move we are anticipating.

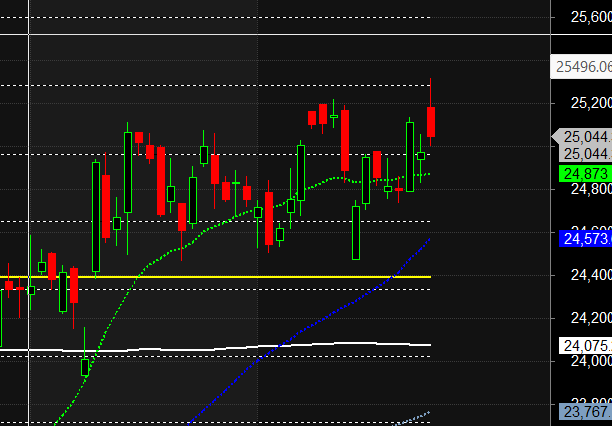

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25157 for a move towards 25236/25315. Bears will get active below 25078 for a move towards 25000/24920/24864.

Traders may watch out for potential intraday reversals at 09:33,10:29,12:30,02:20 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 0.73 lakh cr , witnessing liquidation of 1.85 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closure of SHORT positions today.

Nifty Advance Decline Ratio at 33:17 and Nifty Rollover Cost is @24321 closed above it.

Nifty Gann Monthly Buy Level : 24822

Nifty Gann Monthly Buy Level : 24669

Nifty has closed above its 20 SMA @ 24873 Trend is Buy on Dips till above 24900.

Nifty options chain shows that the maximum pain point is at 24800 and the put-call ratio (PCR) is at 0.80.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 25200 strike, followed by 25300 strikes. On the put side, the highest OI is at the 25000 strike, followed by 24900 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 25000-25300 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 5266 cr , while Domestic Institutional Investors (DII) bought 5209 cr.

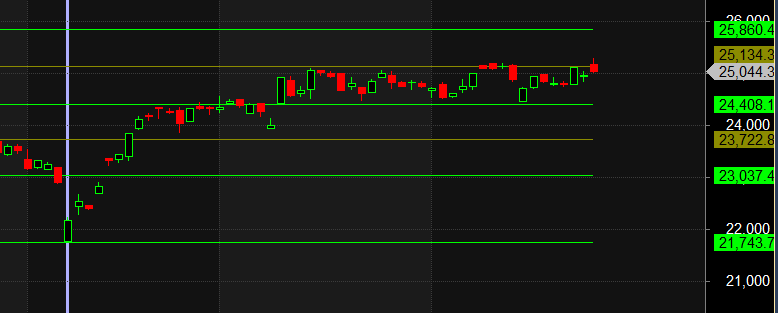

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134-25860 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Be patient. The market is constantly changing, and it’s important to be patient when trading. Don’t expect to make a lot of money overnight. Be patient and let the market work in your favor.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24941 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25197, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25125 Tgt 25170, 25208 and 25241 ( Nifty Spot Levels)

Sell Below 25080 Tgt 25030, 24990 and 24950 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators