Below are the Nifty Weekly Expiry Options Trading Levels for June 19, 2025 Trading .

Please see the Below Video How to Trade Levels.

Nifty Expiry Range

Upper End of Expiry : 24975

Lower End of Expiry : 24605

Nifty Intraday Trading Levels

Buy Above 24824 Tgt 24864, 24910 and 24975 ( Nifty Spot Levels)

Sell Below 24777 Tgt 24729, 24700 and 24666 (Nifty Spot Levels)

Traders may watch out for potential intraday reversals at 09:31,10:38,1:02,02:24

Key Takeaways for Nifty Expiry (June 19, 2025):

- Overall Bias: The market is showing a neutral to negative bias for today’s session. Global cues are weak, and geopolitical tensions in the Middle East are contributing to caution.

- Consolidation: Nifty has been in a consolidation phase, and this is expected to continue with potential volatility.

- US Fed Impact: The US Federal Reserve’s decision to keep interest rates steady, despite calls for cuts, is a significant global cue, suggesting continued vigilance on inflation.

Key Trading Levels (Based on Open Interest – OI Data):

- Maximum Call Open Interest: The highest Call OI is seen at 25,000. This suggests that 25,000 will act as a strong resistance level for today’s expiry.

- Maximum Put Open Interest: The highest Put OI is observed around 24,500 and 24,000. This indicates strong support at these levels.

- Some data also indicates significant Put OI at 24,700, suggesting immediate support there.

Put-Call Ratio (PCR):

- The Nifty PCR for today’s expiry (June 19, 2025) is indicating a bearish to sell bias. Recent PCR values have been below 1 (e.g., around 0.288 to 0.495 in the afternoon session yesterday), suggesting that Call writing is more aggressive than Put writing, which implies resistance at higher levels. A low PCR indicates a bearish sentiment.

Trading Strategy Considerations for Expiry Day:

Given the neutral to negative bias and expected volatility, traders should be cautious and focus on defined risk strategies.

- Range-bound trading: If Nifty remains within its broad range (e.g., 24,700 – 25,000), strategies like short straddles or strangles (selling options at key support and resistance levels) could be considered, but be aware of sudden spikes due to gamma risk closer to expiry.

- Directional Trades (with strict risk management):

- Bearish Outlook: If Nifty breaks below immediate support (e.g., 24,700), a long put strategy (buying out-of-the-money puts) or a bear put spread could be considered. For example, some analysts suggested buying 24,850 puts if Nifty moves below 24,738.

- Bullish Outlook (if resistance is breached): If Nifty sustains above significant resistance (e.g., 24,900-25,000), a long call strategy (buying out-of-the-money calls) or a bull call spread might be considered. For example, buying 24,800 calls if Nifty moves above 24,873.

- Theta Decay: Remember that options lose value rapidly due to time decay (theta) on expiry day, especially for out-of-the-money options.

- Avoid Overtrading: Due to high volatility and rapid premium changes, avoiding overtrading is crucial.

- News Flow: Keep a close eye on any fresh global or domestic news that could significantly impact market sentiment.

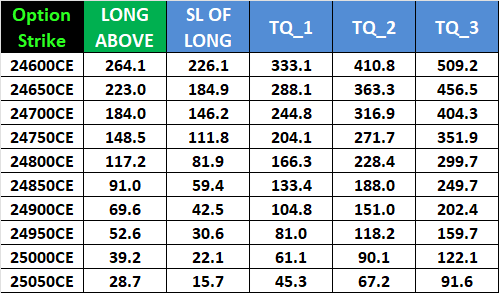

Nifty Call Options for LONG Trade

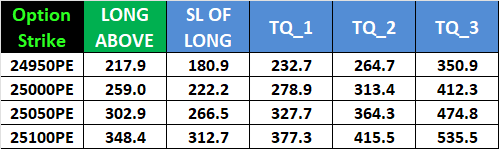

Nifty PUT Options for LONG Trade

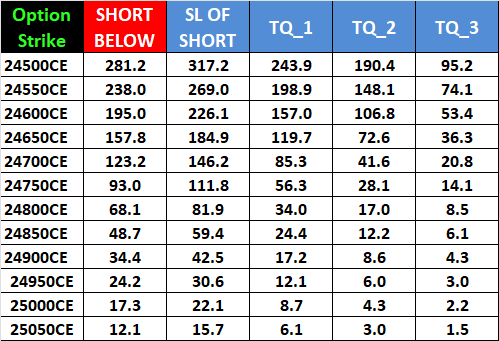

Nifty Call Options for SHORT Trade

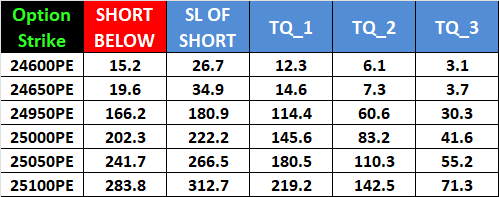

Nifty PUT Options for SHORT Trade

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

hats off.

No words express your expertise.

I am not a trader,but have investments in mutual funds.

still I read your posts

thanks