“When outer planets clash, inner markets shake. Timing is everything.” — Astro-Gann Principle

This week is packed with heavyweight astrological configurations, including multiple planetary squares, Mars ingress, a rare YOD aspect, and a Lunar Eclipse echo window. Expect volatility, sudden reversals, and high emotional sentiment across asset classes.

Key Astro Events & Market Implications

| Date | Astro Event | Impact Summary |

|---|---|---|

| 15-Jun-25 | Mars Square Uranus | Sudden, aggressive moves – possible breakout or breakdown. |

| 15-Jun-25 | Jupiter Square Saturn | Expansion vs. restriction – trend change window, policy shock. |

| 17-Jun-25 | Mars Ingress into Virgo | Shift to detail-oriented price action. |

| 17-Jun-25 | Bayer Rule 20 Trigger | High probability intraday reversal in indices. |

| 18-Jun-25 | Jupiter Square Neptune | Market confusion – beware of false breakouts in Gold/Crude. |

| 19-Jun-25 | Mars YOD Saturn | Sudden directional change – major trend shift possible. |

| 19-Jun-25 | Moon Equatorial (δ = 0.0°) | Emotional climax; volatility spike. |

| 19-Jun-25 | Lunar Eclipse Echo Date (216°) | Watch for echo reaction to past eclipse event – reversal zone. |

Gold Forecast

Sentiment: Confused to Bullish (Possible Breakout by Thursday)

-

Jupiter-Neptune square = Foggy outlook → misleading narratives, but could fuel safe-haven buying.

-

Mars ingress Virgo = Shift from speculation to fundamentals.

-

Bayer Rule 20 + Eclipse Echo = Reversal zones near 17–19 June.

Trade Guidance:

-

Accumulate on dips with confirmation near 17–18 June.

-

Avoid overleveraging before Mars-Saturn YOD—expect trend shift.

Weekly Astro-Trading Tips

-

Watch Bayer Rule 20 on 17 June – highly predictive for intraday reversal trades.

-

Jupiter aspects often coincide with macro/policy commentary → monitor headlines.

-

Mars-Saturn YOD (19 June) is a rare pivot aspect → prepare for Friday gap setups.

-

Avoid heavy positions around Moon Equatorial Passage – markets may whipsaw.

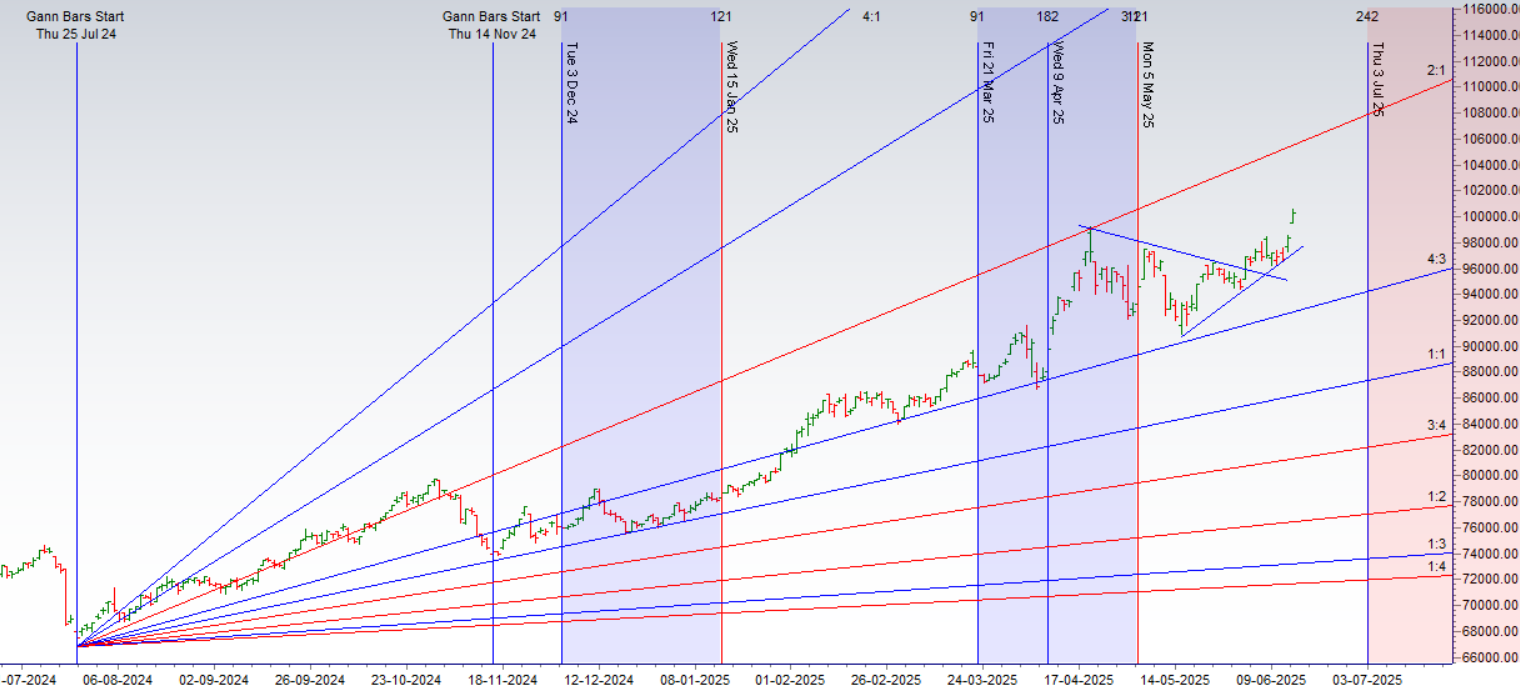

MCX GOLD Gann Angle Chart

Gold has broken traingle on upside heading towards 104K.

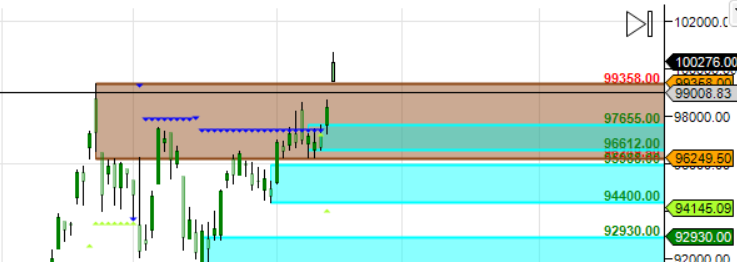

MCX GOLD Supply Demand Zone

MCX GOLD Supply Demand Chart : Demand in range of 99358-99400 , Supply in range of 102700-102800.

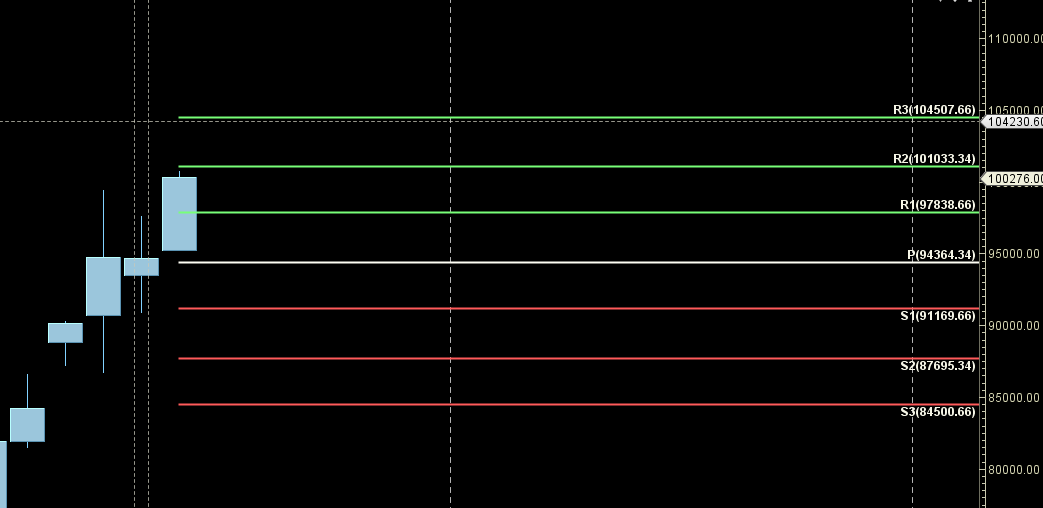

MCX GOLD Harmonic Analysis

SHARK pattern PRZ zone around 105K.

MCX GOLD Weekly

Price has formed Weekly Bullish Candel with AF Resistance Zone.

MCX GOLD Monthly

104507 Monthly Resistance and 101033 Monthly Support.

GOLD Astro/Gann Trend Change Date

16 June Important Gann/Astro Date for Trend Change

GOLD Weekly Levels

Weekly Trend Change Level:100793

Weekly Resistance:101429,102067,102707,103349,103993

Weekly Support: 100159,99527,98897,98269,97643

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.

Call: 09985711341

Email: bhandaribrahmesh@gmail.com

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Trade smartly and safely.