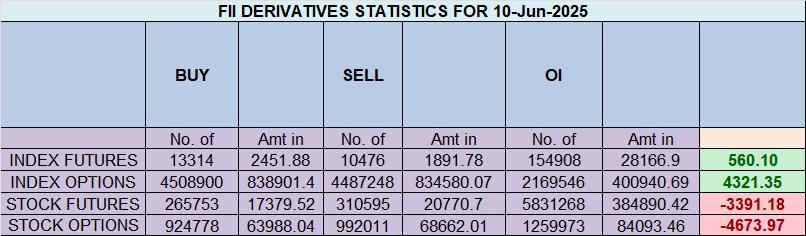

Foreign Institutional Investors (FIIs) maintained their Bullish stance in the Nifty Index Futures market on 10 June 2025, after favourable RBI Policy

Key FII Data Highlights

-

Contracts Bought : 3,912

-

Total Value: ₹737 crore

-

Net Open Interest (OI) Change: -2,183 contracts

The decrease in OI alongside shorting activity signals profit booking in Longs.

Breaking Down FII Activity

-

✔ FIIs covered: 130 long contracts

-

✔ FIIs covered: 2978 short contracts

Client Behavior Snapshot

-

✔ Clients covered: 388 long contracts

-

✔ Clients covered: 2,917 short contracts

Current Positioning in Index Futures

| Segment | Long % | Short % | Long-to-Short Ratio |

|---|---|---|---|

| FIIs | 20% | 80% | 0.25 (strongly bearish) |

| Clients | 61% | 39% | 1.55 (bullish bias) |

Interpretation & Outlook

-

FIIs remain strongly short-biased, despite some mild short covering seen.

-

The divergence in sentiment between FIIs and retail/prop clients highlights a classic institutional caution vs. retail optimism setup.

Master Losses: Your Trading War Journal for Unbreakable Discipline

You can read the Previous Day Analysis by clicking on this link.

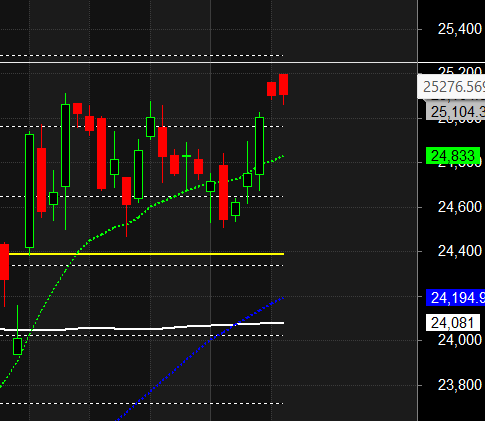

After a strong move post the RBI policy announcement, Nifty has entered a phase of consolidation over the past two trading sessions, marked by a notable decline in India VIX, signaling reduced near-term volatility expectations.

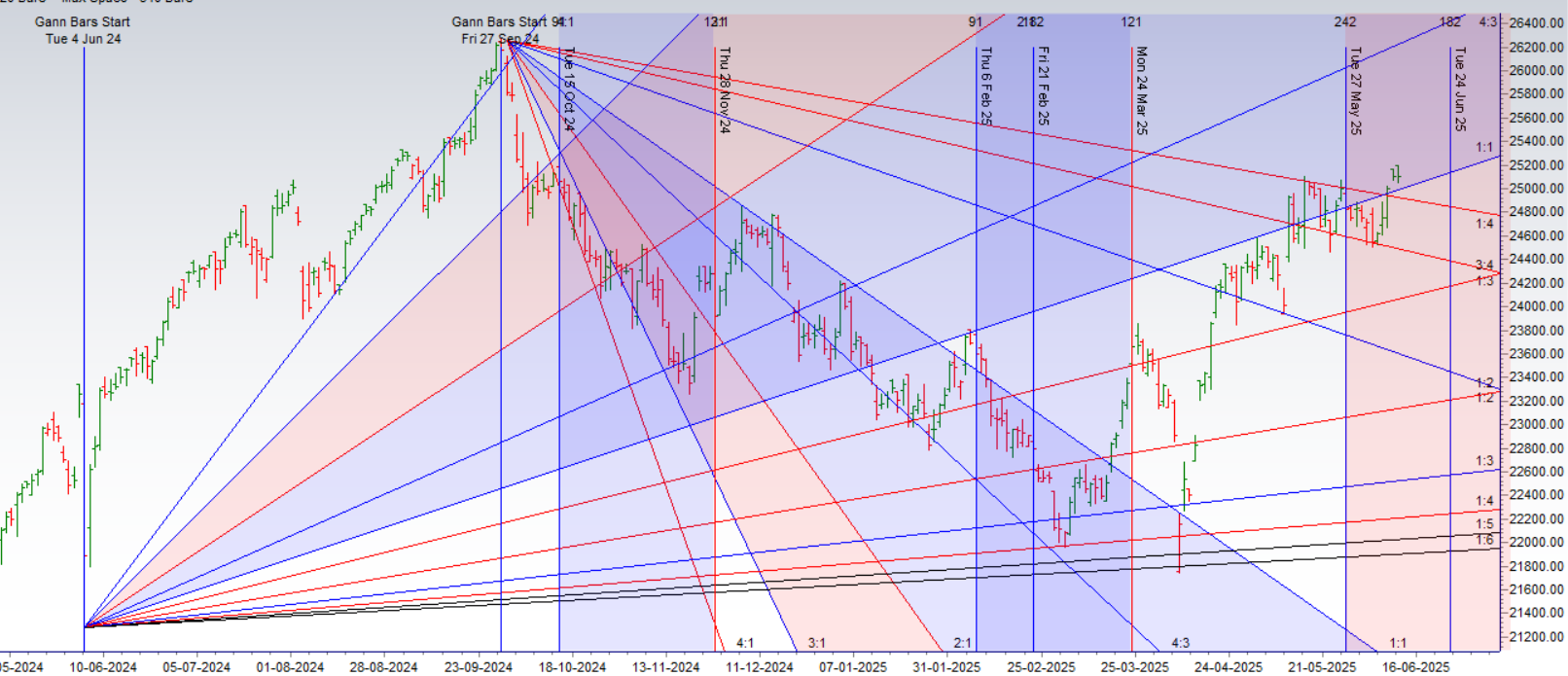

Astro Cycles Align: Mercury, Jupiter Ingress + Lunar Cycle

-

This week has already seen Mercury and Jupiter ingress (Monday & Tuesday), and today brings a significant Lunar cycle.

-

Historically, when prices consolidate into astro time clusters, it often precedes sharp directional moves.

-

A narrow trading range today provides traders with a well-defined setup to place directional bets once the breakout confirms.

Global Macro Watch: US & India Inflation Data

-

US CPI Inflation numbers are due today, which will be a major trigger across global markets.

-

A softer reading could increase expectations of a Fed rate cut, boosting sentiment in equities.

-

A hotter-than-expected number could lead to a risk-off move globally.

-

-

India CPI Inflation will follow tomorrow. While less likely to move the market significantly, a surprise here can influence sentiment in interest-rate-sensitive sectors.

Mutual Fund Flow Report: Liquidity Snapshot

-

The latest mutual fund data shows that:

-

Net inflows have declined for 3 consecutive months, signaling cautious domestic investor sentiment.

-

However, fund houses still hold ₹2.10 lakh crore in cash, which can act as a potential liquidity buffer or trigger for a rally if deployed strategically.

-

️ Risk Management Note

With global volatility triggers lined up and astro + Gann cycles converging, traders are advised to carry overnight positions with proper hedges. Expect higher volatility into the weekend and prepare for breakout setups to activate once the data confirms direction.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25120 for a move towards 25277/25433. Bears will get active below 24964 for a move towards 24807/24651

Traders may watch out for potential intraday reversals at 09:30,10:50,12:06,01:18,02:14 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 1.14 lakh cr , witnessing liquidation of 0.43 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was covering of SHORT positions today.

Nifty Advance Decline Ratio at 28:22 and Nifty Rollover Cost is @24321 closed above it.

Nifty Gann Monthly Buy Level : 24822 — Closed above it

Nifty Gann Monthly Buy Level : 24669

Nifty has closed above its 20 SMA @ 24833 Trend is Buy on Dips till above 25000.

Nifty options chain shows that the maximum pain point is at 25000 and the put-call ratio (PCR) is at 0.86.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 25200 strike, followed by 25300 strikes. On the put side, the highest OI is at the 25000 strike, followed by 24900 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 25000-25300 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 2301 cr , while Domestic Institutional Investors (DII) bought 1113 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134-25860 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Those who succeed big at anything all have the same attitude: You keep going until it happens or you die trying. Quitting is not an option.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24914. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25193 , Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Nifty Intraday Trading Levels

Buy Above 25150 Tgt 25185, 25225 and 25285 ( Nifty Spot Levels)

Sell Below 25108 Tgt 25075, 25025 and 24975 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators