Price is a shadow of time—when planets speak, commodities respond.

The upcoming week in commodities is brimming with planetary tension and potential breakout energy, particularly with Mercury, Venus, and Mars triggering key astro signatures. Traders should prepare for increased volatility and sudden directional shifts in both Gold and Crude Oil.

Major Astro Events & Their Commodity Impact

1. Mercury Aphelion with Sun

-

Effect: Mercury reaches its farthest point from the Sun; this often reduces volume, followed by a surprise breakout.

-

Gold: Historical backtests show post-aphelion moves often align with trend reversals near key fib retracements.

-

Crude: Typically reacts with a gap up/down within 24–48 hours post-aphelion.

2. Sun Conjunct Mercury (Inferior)

-

Interpretation: A midpoint in Mercury’s retrograde cycle, often called the “eye of the storm.”

-

Gold: Market may react to geopolitical triggers or inflation data during this window.

-

Crude: Volatility picks up around the US Dollar Index, which in turn pressures crude prices.

3. Mercury Conjunct Jupiter (Heliocentric)

-

Impact: Jupiter governs expansion, and Mercury adds speed. Together, they can trigger large moves in inflation-sensitive assets.

-

Gold: Watch for an unexpected surge or decline depending on CPI/inflation data.

-

Crude: May see sharp directional moves in Brent and WTI, especially on OPEC-related headlines.

4. Mercury Square North Node

-

Signal: Mental and directional conflict. Historically brings whipsaws and false breakout signals.

-

Gold: Likely to trap breakout traders—ideal for contrarian intraday strategies.

-

Crude: Could reverse sharply after intraday highs/lows.

5. Mars YOD North Node (Finger of God)

-

Rare Formation: Mars (action) forms a YOD with the karmic node—a time of unavoidable pressure and explosion.

-

Gold: Could signal a long-term breakout from consolidation.

-

Crude: Be ready for large-range days—possibly multi-dollar intraday swings.

6. Solar Eclipse 240° from 2 Oct 2024

-

Effect: Eclipses cast a long shadow. 240° from Oct 2 aligns with echo zones of market structure.

-

Gold: Could revisit a key level marked on 2 Oct candle (support/resistance).

-

Crude: May align with a volatility pocket from previous eclipse geometry.

7. Bayer Rule No. 40: Venus Heliocentric Latitude

-

Zone Triggered: Between 1°50′ and 3°17′, Venus can signal strong trend reversals or final legs of a rally.

-

Gold: Often tops or bottoms within 2–3 days of entering these zones.

-

Crude: Use this in combination with volume spikes to identify final exhaustion or early breakout phases.

Gold Weekly Forecast

-

Astro Sentiment: Choppy start, directional move likely midweek after Mercury-Jupiter helio.

-

Trigger Dates: Watch Wednesday and Friday for intraday reversals.

-

Strategy:

-

Long bias above breakout of [Insert Resistance Level].

-

Sell if price rejects around [Insert Bayer Rule/Helio Timing Levels].

-

-

Caution: Beware of false moves during Mercury square North Node.

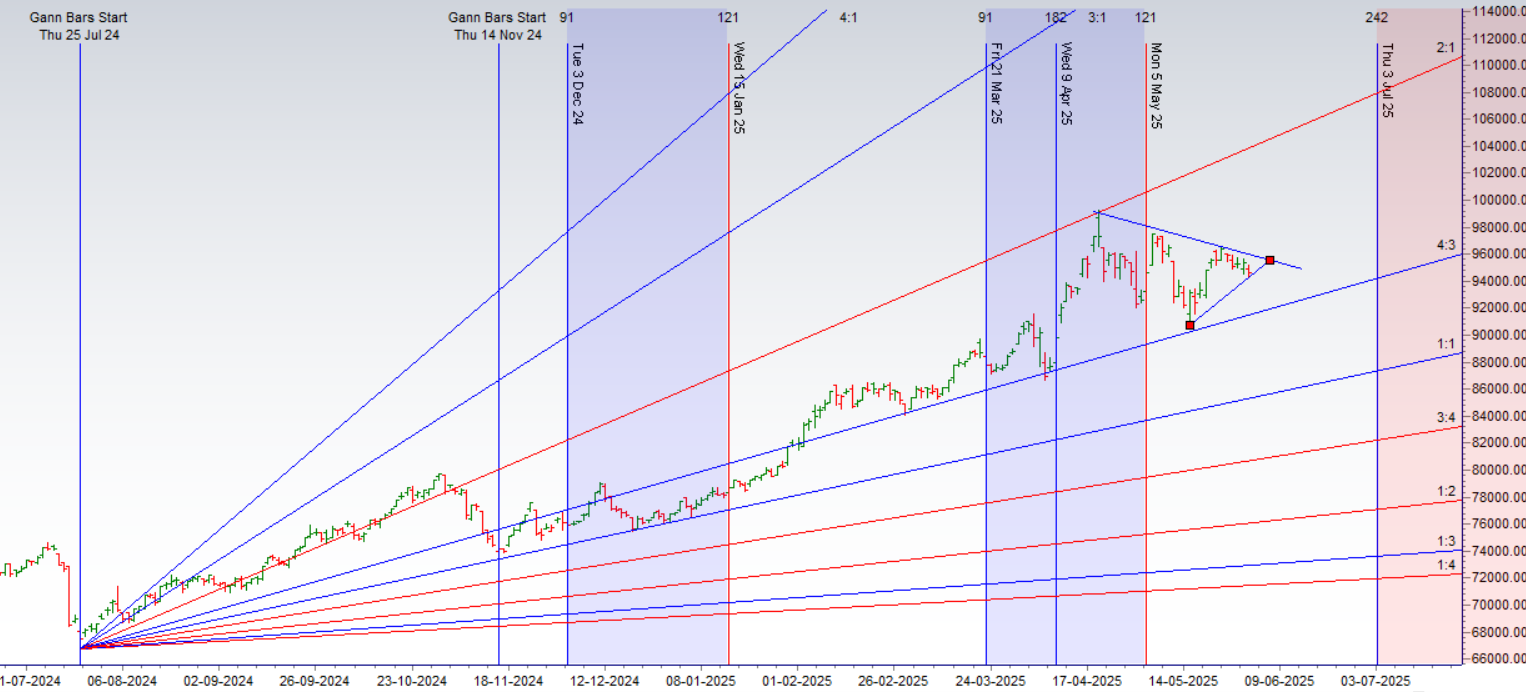

MCX GOLD Gann Angle Chart

Gold is forming a traingle in Gann Angles

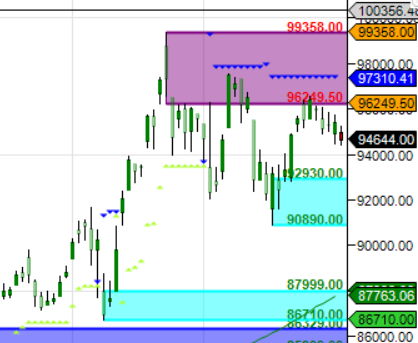

MCX GOLD Supply Demand Zone

MCX GOLD Supply Demand Chart : Demand in range of 94000-93900 , Supply in range of 96250-96300

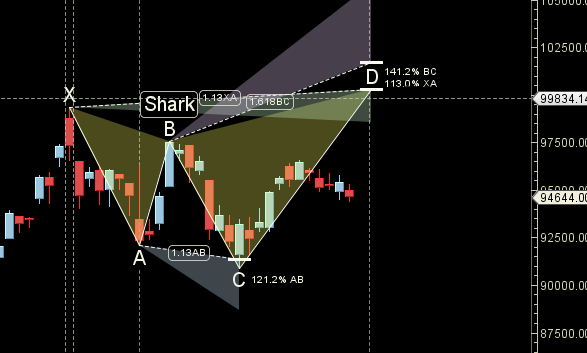

MCX GOLD Harmonic Analysis

SHARK pattern PRZ zone around 98000.

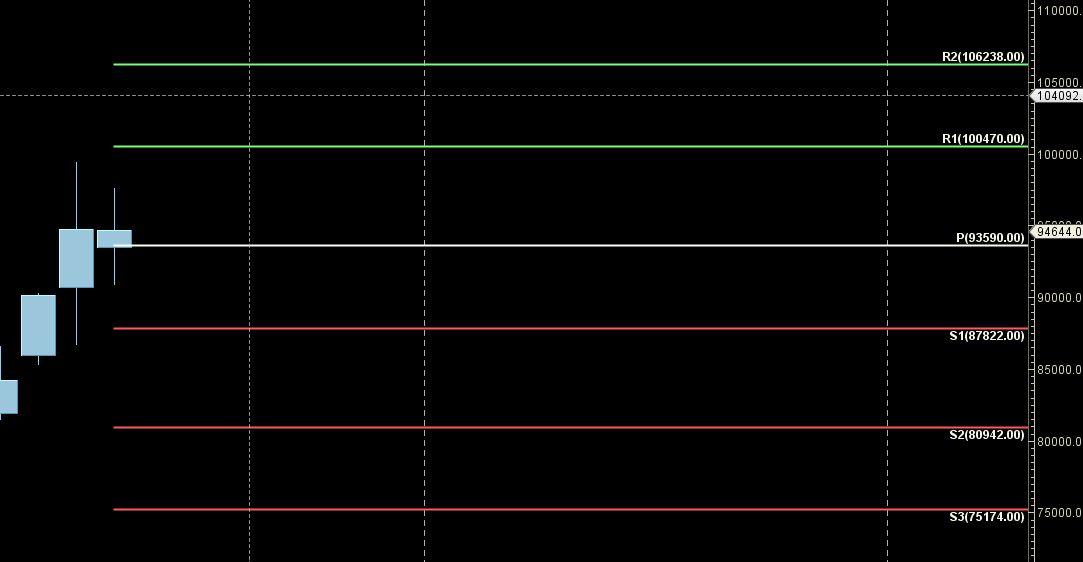

MCX GOLD Weekly

Price has formed Weekly Inside Bar

MCX GOLD Monthly

97000 Monthly Resistance and 93590 Monthly Support.

GOLD Astro/Gann Trend Change Date

02 June Important Gann/Astro Date for Trend Change

GOLD Weekly Levels

Weekly Trend Change Level:94543

Weekly Resistance:95159,95777,96397,97019,97643

Weekly Support: 93929,93317,92707,92099

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.

Call: 09985711341

Email: bhandaribrahmesh@gmail.com

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Trade smartly and safely.