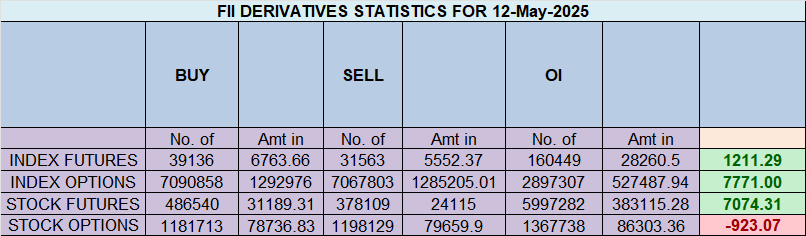

FIIs Add Aggressive Longs in Nifty Futures Despite Low Notional Value – May 14, 2024

Foreign Institutional Investors (FIIs) maintained a bullish undertone in the Nifty Index Futures segment by buying 283 contracts worth ₹45 crore. However, the real insight lies in the sharp rise in open interest (OI) — up by 3,817 contracts, signaling strong long buildup and short covering activity.

FII Activity Breakdown:

-

✔ Longs Added: 3,115 contracts

-

✔ Shorts Covered: 4,458 contracts

-

Net OI Change: +3,817 contracts

-

FII Long-to-Short Ratio: 0.91

-

Current Positioning: 47% Long : 53% Short

Interpretation:

FIIs are increasing net bullish exposure despite a low notional figure, indicating strategic positioning, possibly using lower volumes during consolidation ahead of a breakout or event-based move.

Client Activity Overview:

-

✔ Longs Added: 12,618 contracts

-

✔ Shorts Covered: 10,241 contracts

-

Client Long-to-Short Ratio: 0.84

-

Current Positioning: 50% Long : 50% Short

Interpretation:

Clients are becoming more balanced, closing out bearish bets and aligning their positioning more neutrally. This shift hints at reduced downside conviction and potential preparation for range breakout.

5 Bad Trading Habits That Destroy Profits – How to Fix Them Now

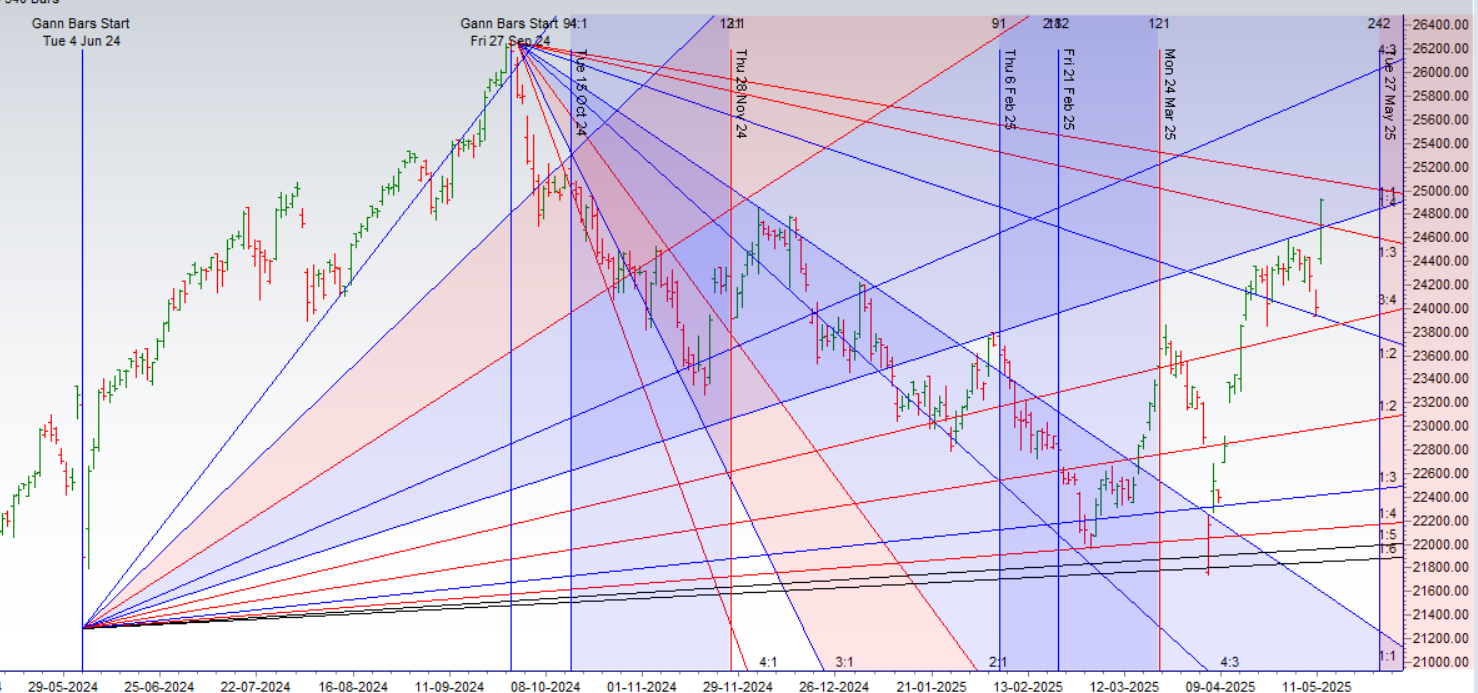

Nifty Holds Gann Support at 23,900 – Mercury Ingress & Full Moon Signal Potential Reversal

Nifty took precise support at the 23,900–23,935 zone, which aligns with a critical Gann angle. Additionally, May 11 marks a powerful confluence of time cycles:

-

Gann Date (11th)

-

Mercury Sign Change (Ingress)

-

Full Moon Event

This combination of price and time suggests a potential trend reversal or accelerated move—especially following the India-Pakistan ceasefire announcement, which could ease geopolitical stress and reduce volatility.

Key Technical Zones:

-

Support:

23,900–23,935 (Gann angle + previous bounce zone)

Break below 23,900 → Fresh shorts may get active for 23,750–23,666 downside. -

Upside Trigger:

Above 24,166 → Fast retracement possible toward 24,323–24,444.

Intraday Strategy:

-

Watch the first 15-minute high and low — they’ll likely define the directional bias for the day.

-

Gap-up open + breach of 24,166 may result in short covering and index leadership by banks and heavyweights.

-

Carry hedged positions through the weekend, especially with planetary reversals in play.

Nifty delivered a strong 3.3% rally, marking its biggest one-week gain in the past four years, driven by a powerful confluence of Gann and Astro time cycles, as discussed in our latest weekly video.

The index also respected key Gann angle support, triggering a sharp upward move and affirming the relevance of time–price alignment in directional shifts.

Key Level to Watch: 24,700–24,729

-

This zone marks the intersection of two major Gann angles, making it a high-value support area.

-

Any pullback toward 24,700–24,729 should be seen as a buying opportunity, with a tight stop-loss of 50 points.

-

A sustained hold above this zone could set the stage for a continuation toward 24,900–25,050.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25003 for a move towards 25159/25315 Bears will get active below 24847 for a move towards 24691/24535.

Traders may watch out for potential intraday reversals at 09:42,11:37,12:32,02:44 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 1.26 lakh cr , witnessing addition of 0.24 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of LONG positions today.

Nifty Advance Decline Ratio at 48:02 and Nifty Rollover Cost is @24321 closed above it.

Nifty Gann Monthly Trade level :24211 closed above it

Nifty has closed Above its 200 SMA @ 24044 Trend is Buy on Dips till above 24389

Nifty options chain shows that the maximum pain point is at 24500 and the put-call ratio (PCR) is at 1.18.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 25000 strike, followed by 25100 strikes. On the put side, the highest OI is at the 24800 strike, followed by 24600 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24800-25100 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 1246 Cr , while Domestic Institutional Investors (DII) bought 1448 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Trading is not about being right—it’s about managing risk. Doubling down is the arrogance of certainty meeting the brutality of randomness. The market doesn’t care about your conviction; it only respects survival.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24420. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24793, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24950 Tgt 25000, 25055 and 25108 ( Nifty Spot Levels)

Sell Below 24830 Tgt 24785, 24729 and 24666 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators