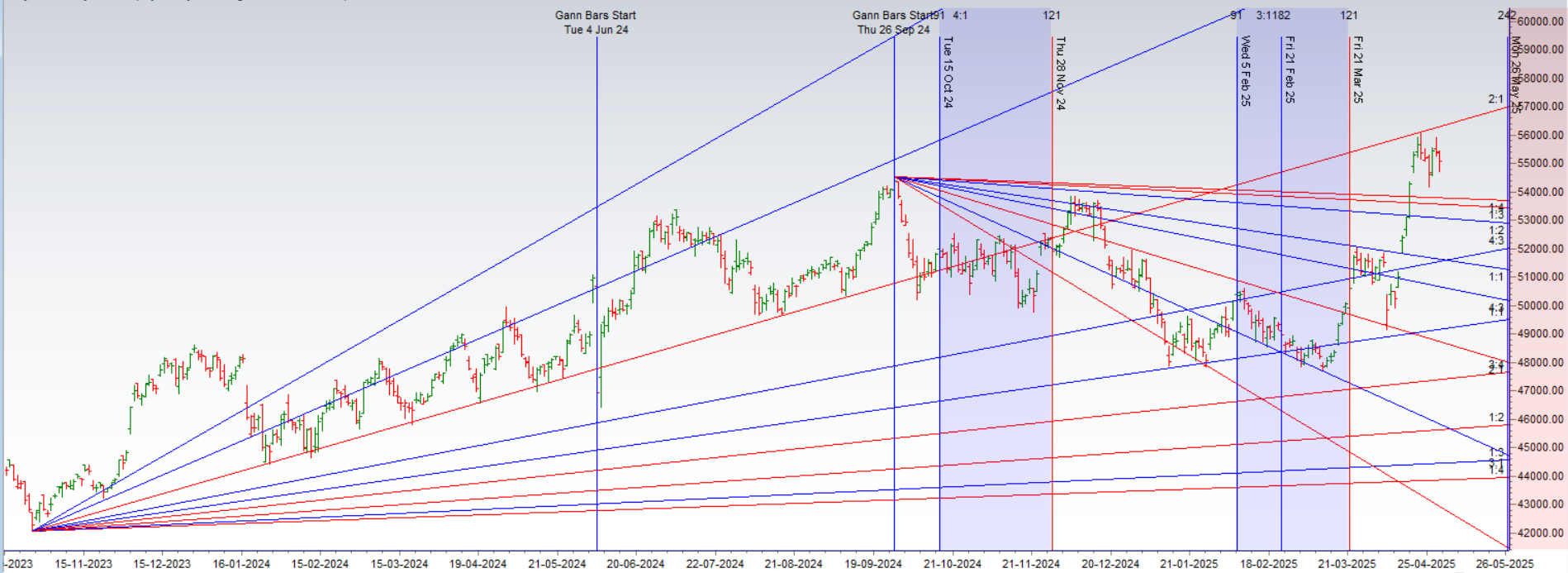

Bank Nifty formed a Doji candle on the charts, signaling indecision as it once again failed to close above the critical 55684 Gann level. This key level has now acted as a barrier for multiple sessions, keeping both bulls and bears on edge.

Bank Nifty witnessed a late-session decline in the last 30 minutes, triggered by geopolitical uncertainty as markets brace for how India may respond to the recent attack. The spike in India VIX reflects rising fear and expectation of volatility in the sessions ahead.

Key Technical Takeaways:

-

Support Held:

-

Price respected the Gann level of 54,872, closing above 55,000, a psychological level and technical support.

-

-

Short-Term Trend:

-

Despite weakness into the close, the index is not yet broken, but fragile sentiment could quickly shift if global or domestic cues worsen.

-

Astro Alerts – Two Bayer Rules in Focus:

-

Bayer Rule 2:

“Trend tends to reverse within 3 days when the speed difference between Mars and Mercury is 59 minutes.”

→ This rule is often associated with sharp and sudden directional moves. -

Bayer Rule 14:

“Venus movements in geocentric longitude using a unit of 1°9’13” tend to mark key reversals.”

→ A powerful setup, especially for financials and banks, which are ruled by Venus.

Why the Next Session Is Critical:

-

Weekly Close + Monthly Open → A powerful time cycle convergence, especially when paired with active planetary influences.

-

Volatility Expected:

-

Astro patterns + rising VIX + geopolitical stress = potential for a big directional move.

-

Be prepared for either a breakout continuation or a sharp correction based on how price behaves around 55,000–54,872.

-

Strategy Outlook:

-

Above 55,343 → Bulls may regain momentum and push toward 56,000+.

-

Below 54,872 → Bears will likely press lower toward 54,000 and 53,500 zones.

-

Use tight stop losses, and hedge overnight trades given the geopolitical overhang.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 55155 for a move towards 55626/56098. Bears will get active below 54686 for a move towards 54219/53755 — Waiting for 55626/56098

Traders may watch out for potential intraday reversals at 10:13,11:01,12:00,01:02,02:22 How to Find and Trade Intraday Reversal Times

Bank Nifty May Futures Open Interest Volume stood at 22.9 lakh, with liquidation of 0.68 lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closure of LONG positions today.

Bank Nifty Advance Decline Ratio at 04:08 and Bank Nifty Rollover Cost is @55480 closed above it.

Bank Nifty Gann Monthly Trade level :52348 closed above it.

Bank Nifty closed above 200 SMA @53017 ,Trend is Buy on Dips once above 54872

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 53548-55141-56734. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 55500 strike, followed by the 56000 strike. On the put side, the 54500 strike has the highest OI, followed by the 54000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 55000-56000 range.

The Bank Nifty options chain shows that the maximum pain point is at 54500 and the put-call ratio (PCR) is at 0.90 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Trading is not about being right—it’s about managing risk. Doubling down is the arrogance of certainty meeting the brutality of randomness. The market doesn’t care about your conviction; it only respects survival.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 55373. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 55341 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 55108 Tgt 55323, 55555 and 55729 (BANK Nifty Spot Levels)

Sell Below 54990 Tgt 54850, 54700 and 54555 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators