Bank Nifty delivered a strong recovery, fully reclaiming the losses from Friday’s fall. The New Moon event, often associated with trend changes, played out perfectly, signaling fresh bullish momentum.

Key Positive Developments:

-

Price Action:

-

Closed above Friday’s High, confirming a strong bullish reversal.

-

Reaffirmed the importance of astro-time cycles in capturing turning points.

-

-

Fundamental Boost:

-

RBI announced a ₹1.25 lakh crore liquidity injection for May.

-

This is extremely positive for Banking and NBFC stocks, potentially driving further upside.

-

️ Technical Outlook for Bank Nifty:

-

Immediate Target:

-

Price is now set to test and potentially break the recent high at 56,098.

-

-

Breakout Confirmation:

-

Sustaining above 55,555 could trigger the next rally leg toward 56,000–56,500 levels.

-

-

Support Zone:

-

55,000–54900 remains the key support for bulls to defend.

-

When Price, Time (New Moon), and Event (RBI liquidity move) align, markets tend to move explosively — today’s Bank Nifty rally is a textbook example of that principle.

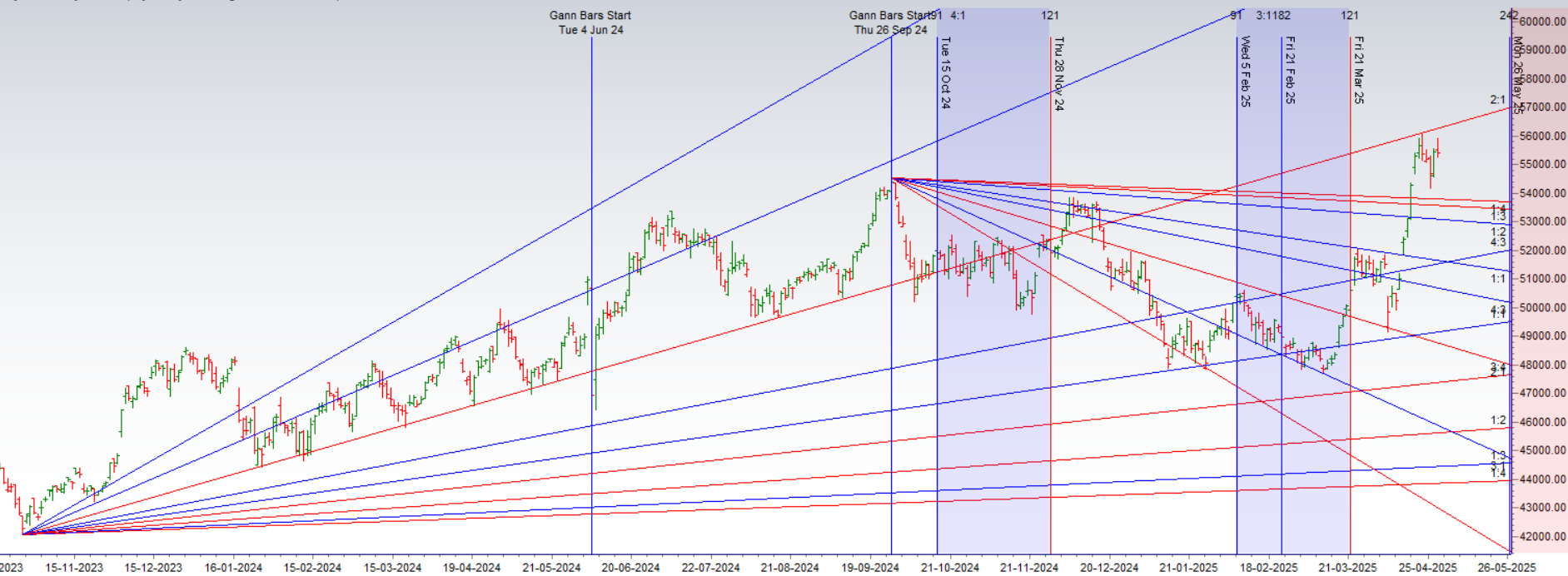

Bank Nifty formed a Doji candle on the charts, signaling indecision as it once again failed to close above the critical 55684 Gann level. This key level has now acted as a barrier for multiple sessions, keeping both bulls and bears on edge.

Key Technical Outlook:

-

Resistance:

-

55684 → Multiple rejections from this Gann resistance zone. A close above is needed for a breakout toward 56000-56444

-

-

Support:

-

55214 → Bears need a close below this level to regain short-term control.

-

-

Doji Formation:

-

Indicates a possible turning point. Watch for follow-through price action in the next session.

-

Astro + Calendar Alignment:

-

Venus Ingress in Aries

→ A significant event known for triggering sharp trend moves, especially in financials and momentum stocks. -

Akshay Tritiya (Tirtha):

→ Considered auspicious for new beginnings in Indian markets. Volumes can be erratic due to the holiday impact. -

Monthly Close Today:

-

Bulls will aim to reclaim and close above 55684 .

-

Bears will push for a close below 55214 to tilt sentiment bearish into May.

-

⚠️ Geopolitical Update – Risk Alert

-

The Prime Minister has given the military “full operational freedom” to respond to the J&K terror attack.

-

Any escalation or response could trigger a knee-jerk sell-off, especially with a trading holiday tomorrow.

️ Strategy Tip:

Buy protective puts if carrying overnight long positions into the break — better to stay hedged than exposed.

Final Thoughts:

-

Volatility is likely to spike post-holiday.

-

Watch for a decisive breakout/breakdown beyond 55684 or 55214 for directional clarity.

-

Stay nimble and avoid aggressive leveraged trades into an event-heavy long weekend.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 55155 for a move towards 55626/56098. Bears will get active below 54686 for a move towards 54219/53755 — Waiting for 55626/56098

Traders may watch out for potential intraday reversals at 09:58,10:58,12:00,12:57,01:28,03:04 How to Find and Trade Intraday Reversal Times

Bank Nifty May Futures Open Interest Volume stood at 23.6 lakh, with liquidation of 0.97 lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closure of LONG positions today.

Bank Nifty Advance Decline Ratio at 04:08 and Bank Nifty Rollover Cost is @55480 closed above it.

Bank Nifty Gann Monthly Trade level :52348 closed above it.

Bank Nifty closed above 200 SMA @52841 ,Trend is Buy on Dips once above 54872

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 53707-55304-56734. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 55500 strike, followed by the 56000 strike. On the put side, the 54500 strike has the highest OI, followed by the 54000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 55000-56000 range.

The Bank Nifty options chain shows that the maximum pain point is at 54500 and the put-call ratio (PCR) is at 0.99 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Trading is not about being right—it’s about managing risk. Doubling down is the arrogance of certainty meeting the brutality of randomness. The market doesn’t care about your conviction; it only respects survival.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 55381 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 55757 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 55464 Tgt 55610, 55811 and 56000 (BANK Nifty Spot Levels)

Sell Below 55250 Tgt 55108, 54900 and 54729 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators