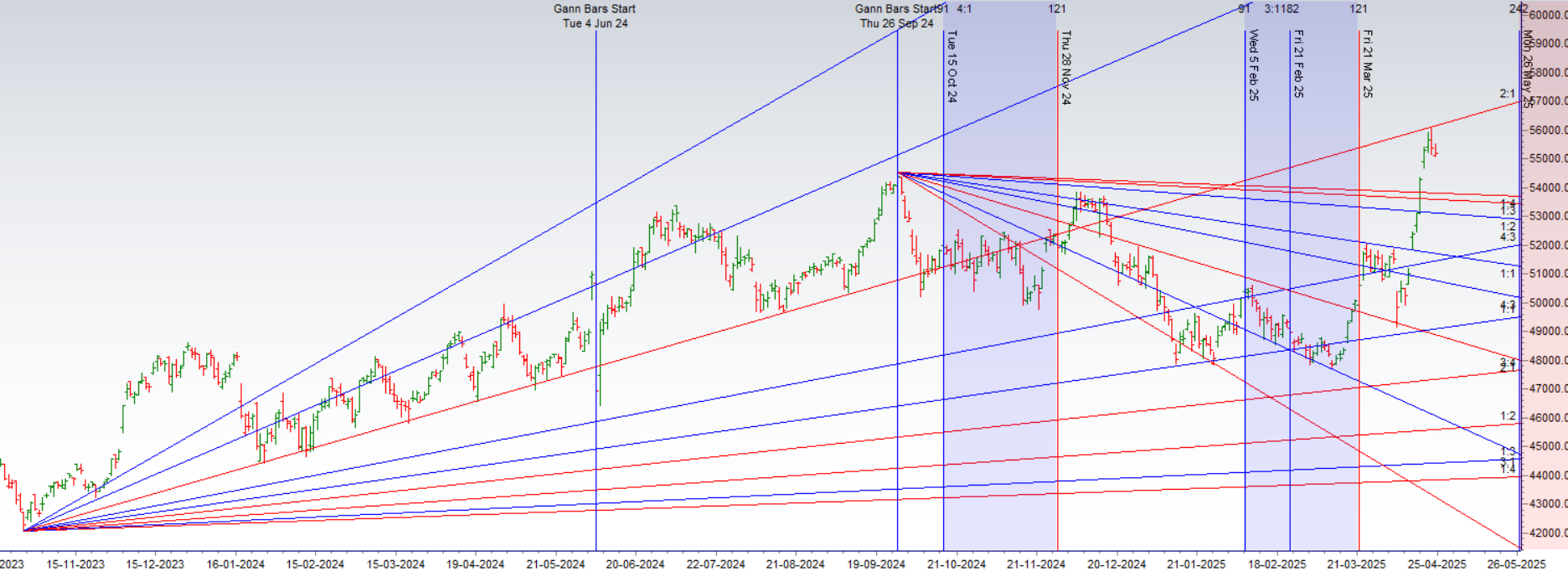

Bank Nifty faced resistance at the 2×1 Gann angle and formed an Outside Bar pattern on the daily chart — a strong technical signal that often precedes trend reversals or sharp pullbacks, especially after extended rallies.

April Expiry Recap

-

February Expiry Close: 51,575

-

April Expiry Close: 55,370

-

Total Gain: 3,795 points

This marks one of the strongest monthly expiry performances in recent times, fueled by aggressive short covering, positive global cues, and strong astro + Gann confluences.

Technical Insight – Outside Bar Pattern

An Outside Bar occurs when the current day’s high and low exceed the previous day’s range, signaling increased volatility and potential trend shift. The pattern, especially after a steep rally, calls for caution:

-

A close below the Outside Bar low can trigger short-term correction.

-

Sustaining above today’s high would invalidate the reversal signal and point to continued bullishness.

Key Levels to Watch Going Forward

-

Support Zone: 54,900 – 55,000

→ Breakdown below this could open the path toward 54,300 / 53,750 -

Resistance Zone: 55,600 – 55,750

→ A move above this range could signal further upside toward 56,300+

Conclusion

-

April expiry delivered a massive upside, but signs of exhaustion are starting to appear.

-

Traders should tighten stops and avoid aggressive longs until price confirms strength above resistance.

-

The Outside Bar + Gann angle rejection makes it critical to watch Thursday opening levels and first 15-minute range.

Tomorrow marks a high-impact astro date as multiple celestial alignments converge — a setup that often precedes trend shifts and sharp volatility, especially in sensitive instruments like Bank Nifty.

Key Astro Events in Focus:

-

New Moon – Typically signifies emotional extremes and trend changes.

-

Lunar Eclipse Degree Activation – Known for triggering sharp directional moves, especially near significant levels.

-

Venus at Extreme Declination – Historically aligned with financial market reversals.

-

Venus Conjunct ♄ Saturn – A powerful aspect influencing banking, debt, and structure-related sectors.

Bank Nifty Technical Setup

-

Bank Nifty has formed an Outside Bar pattern — a strong reversal signal if the low is breached.

-

Today’s Close: Just 40 points above the Outside Bar low, showing signs of indecision.

Break below 55,162

→ May trigger a swift decline toward key supports at 54,700 and 54,200.

→ Sustaining above this on weekly close may extend the rally.

Geopolitical Risk & Trading Strategy

Geopolitical Risk & Trading Strategy

-

With rising border tensions, the risk of a gap-down event cannot be ruled out.

-

Holding overnight long positions without protection could be risky.

-

️ Prudent to buy protective Puts as insurance, especially ahead of:

-

An astro-heavy date,

-

A weekly close,

-

Heightened geopolitical sensitivity.

-

Strategy Checklist:

-

Watch first 15-min high/low tomorrow for intraday trend confirmation.

-

Be prepared for volatility spikes — avoid over-leveraging.

-

Adjust stops and consider hedged positions if holding through the weekend.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 55889 for a move towards 56363 Bears will get active below 55417 for a move towards 54948/54480

Traders may watch out for potential intraday reversals at 09:15,10:16,12:09,01:18,02:25 How to Find and Trade Intraday Reversal Times

Bank Nifty May Futures Open Interest Volume stood at 26 lakh, with addition of 4.7 lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a addition of LONG positions today.

Bank Nifty Advance Decline Ratio at 05:07 and Bank Nifty Rollover Cost is @55480 closed above it.

Bank Nifty Gann Monthly Trade level :52348 closed above it.

Bank Nifty closed above 200 SMA @51100,Trend is Buy on Dips till above 54872

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 53707-55304-56734. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 56000 strike, followed by the 56500 strike. On the put side, the 55500 strike has the highest OI, followed by the 55000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 55500-56500 range.

The Bank Nifty options chain shows that the maximum pain point is at 55200 and the put-call ratio (PCR) is at 1.07 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

It is very difficult for the mind to just watch the market unfold. Our minds, egos, left hemispheres, must get into the act no matter now many times they have been proven to be painfully incapable of doing the job consistently.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 55450 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 55450, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 55320 Tgt 55471, 55729 and 55933 (BANK Nifty Spot Levels)

Sell Below 55200 Tgt 55009 , 54818 and 54610 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators