Astro-Trading Outlook for the Week Ahead (Nifty & Bank Nifty)

“When planets align, markets move. The challenge is knowing when and how to act.” – Gann-inspired

This week is packed with high-impact celestial activity — with multiple conjunctions, declination extremes, and a major planetary reversal. Traders should remain alert, as volatility and reversals are expected, especially in the days around April 09 and April 11, with April 10 being a trading holiday (Mahavira Janma Kalyanaka).

Highlighted Astro Events & Their Trading Implications

☿ Mercury Turns Direct (April 07)

-

Mercury retrograde phases typically bring confusion, miscommunication, and false breakouts.

-

When Mercury stations direct, clarity returns—often leading to a sharp reversal in the prevailing short-term trend.

-

Watch for traps around April 07 — especially in stocks related to banking, IT, communication, and logistics.

Bayer Rule #1: “When Mercury changes its motion (retrograde or direct), a change in trend is indicated within 1-2 days.”

Venus Conjunct Saturn (April 08)

-

A tension between desire (Venus) and discipline (Saturn).

-

Often marks a cooling in bullish sentiment, especially in luxury, fashion, auto, and consumer sectors.

-

Can signal topping formations in stocks with overextended rallies.

Pluto Extreme Declination (April 08)

-

Pluto rarely crosses declination extremes – this can trigger long-term trend shifts, especially in PSU Banks, Infrastructure, and Metals.

-

We’ve historically seen major reversals or breakouts within 1–2 days of Pluto’s declination extremes.

Historical Example:

-

Pluto declination extremes in Jan 2008 and March 2020 coincided with long-term tops and bottoms.

☿ Mercury Conjunct North Node (April 09)

-

Amplifies mental energy, sudden news, and market rumors.

-

Watch out for “announcement-based spikes” that quickly reverse.

-

Options premiums may expand suddenly due to surprise news or data leaks.

| Sector | Bias | Stocks to Watch |

|---|---|---|

| Banks (PSU) | ⚠️ Trend reversal | SBI, BOB, PNB |

| IT | Reversal possible | TCS, Infosys, HCL Tech |

| Auto | Top forming | M&M, Maruti, Tata Motors |

| FMCG | Rangebound | HUL, Dabur, Britannia |

| Commodities | ⚡️ Breakout risk | Tata Steel, Hindalco, Vedanta |

Solar Eclipse Effect

-

Solar Eclipses often act as turning points in financial markets. If close to expiry, expect sharp, unexpected moves.

Astro analysis can help identify trends and reversals in the market, and it can be used in combination with other technical analysis methods to improve the accuracy of trading strategies. Gann analysis involves studying charts and identifying support and resistance levels to pinpoint potential trading opportunities.

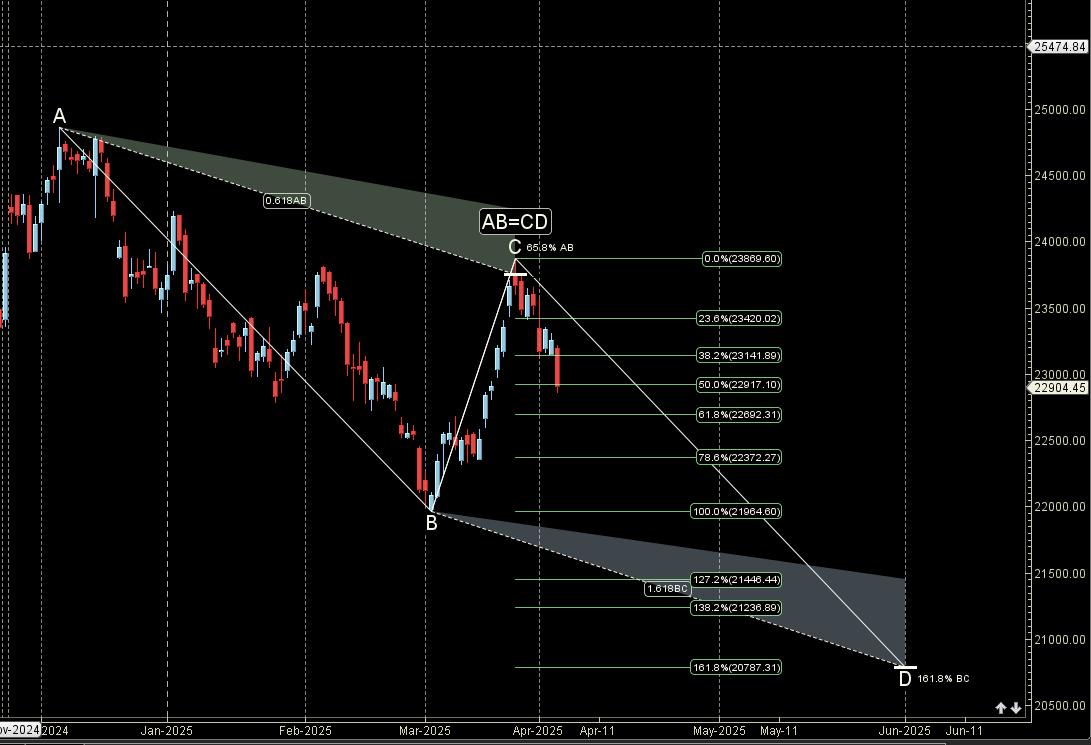

Nifty Harmonic Pattern

Alternate ABCD pattern D leg can lead to a fall towards 23108/22964.

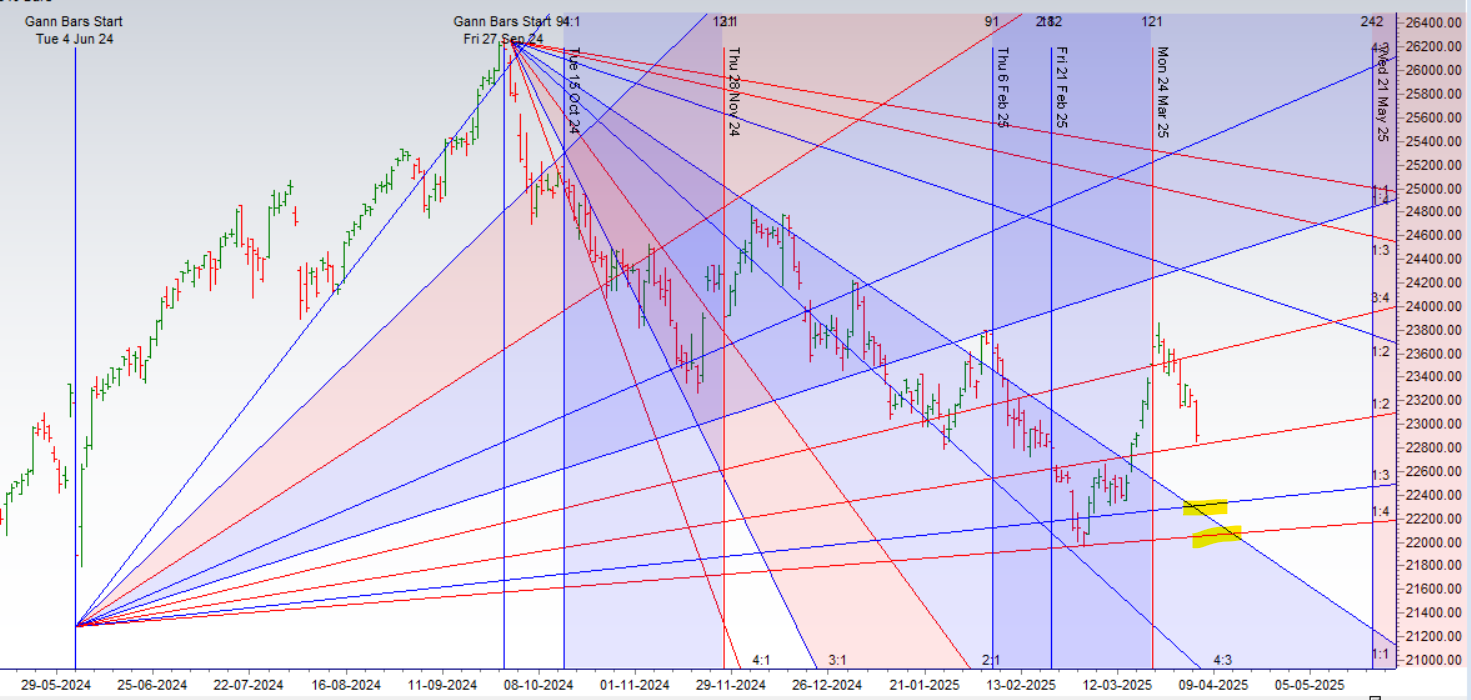

Nifty Gann Angles

As per #GANN Price moves from 1 gann angle to another one.. so first target 1×3 gann angles at 22324 below that 1×4 gann angle at 22055

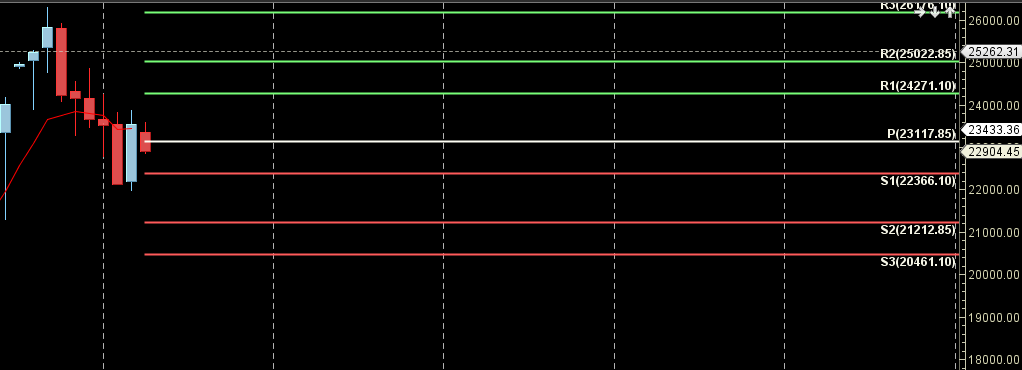

Nifty Supply and Demand

Self Explanatory Chart

Nifty Time Analysis Pressure Dates

07 April is the Important Gann/Astro Date for coming week.

Nifty Weekly Chart

Price formed Weekly Englufing after Weekly Garvestone Doji pattern.

Nifty Monthly Charts

23117 is Monthly resistance zone 22366 is Monthly Support zone.

Nifty Weekly Levels

Nifty Trend Deciding Level: 22341

Nifty Resistance: 23418,23495,23575,23649

Nifty Support: 22264,22187,22111,22034,21952

please check the nifty resistance level????

apologies sir for mistake its corrected..