Key Astrological Events & Bayer Rules for April 1-4 2025

Bayer Rule 2: Mars-Mercury Speed Difference (59 Minutes) → Leads to Big Move

-

Historically, this setup has triggered strong downward trends within 3 days after occurrence.

-

If active near expiry, expect high volatility & potential correction in Nifty & Bank Nifty.

Bayer Rule 4: Mercury Retrograde Position of One Year

-

This suggests that past Mercury retrograde positions (same time last year) could act as a time cycle for similar price behavior.

-

Looking at March 2024, we can identify possible repeat trends or reversals.

✨ Venus Conjunct North Node (Rahu) & Mercury Conjunct North Node

-

Venus-Rahu conjunction typically amplifies speculation and brings unexpected swings.

-

Mercury-Rahu can cause high volatility, especially in financial markets, leading to false breakouts or traps.

Mars Trine Saturn

-

This alignment indicates strong trend formation—markets may respect key support/resistance zones and follow a disciplined trend.

Solar Eclipse Effect

-

Solar Eclipses often act as turning points in financial markets. If close to expiry, expect sharp, unexpected moves.

Astro analysis can help identify trends and reversals in the market, and it can be used in combination with other technical analysis methods to improve the accuracy of trading strategies. Gann analysis involves studying charts and identifying support and resistance levels to pinpoint potential trading opportunities.

SENSEX Harmonic Pattern

CYPHER Pattern completed and Price can head back to 76592

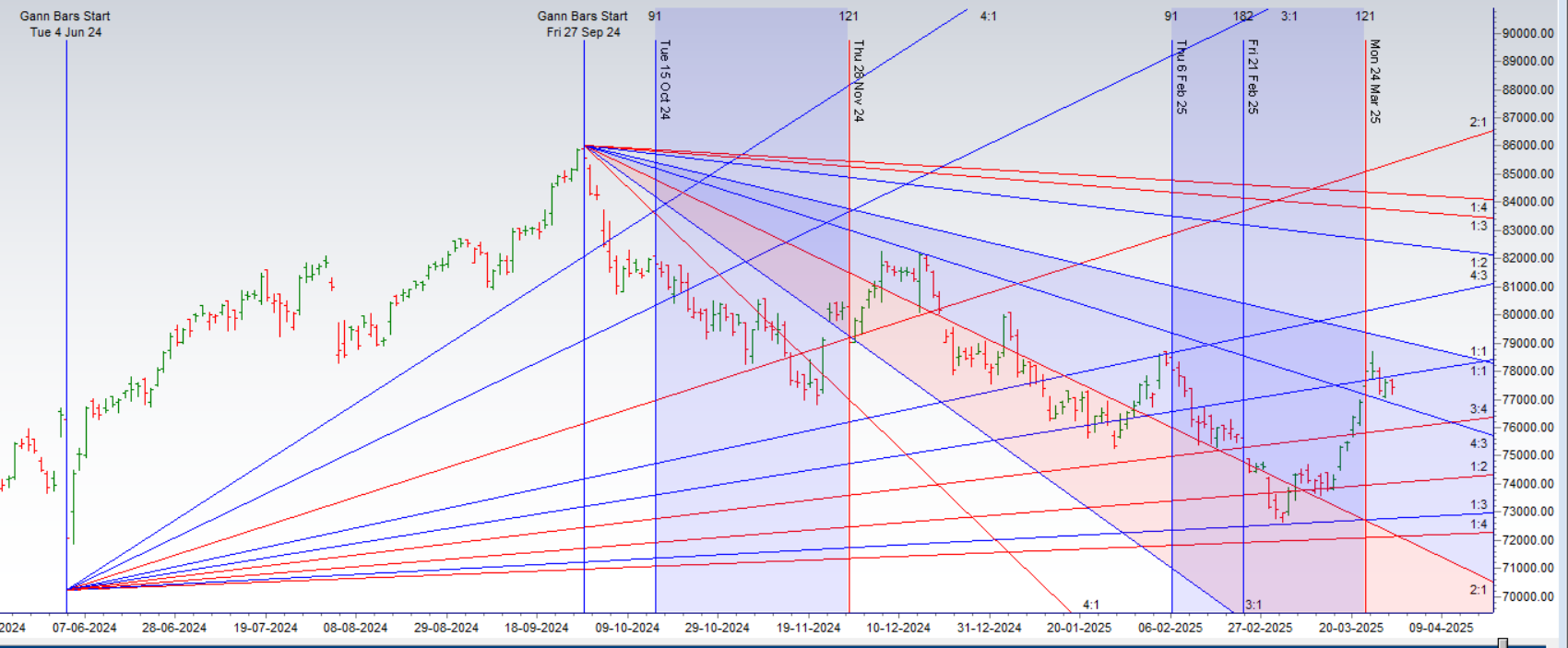

SENSEX Gann Angles

Price is heading towards 3×4 gann angle support

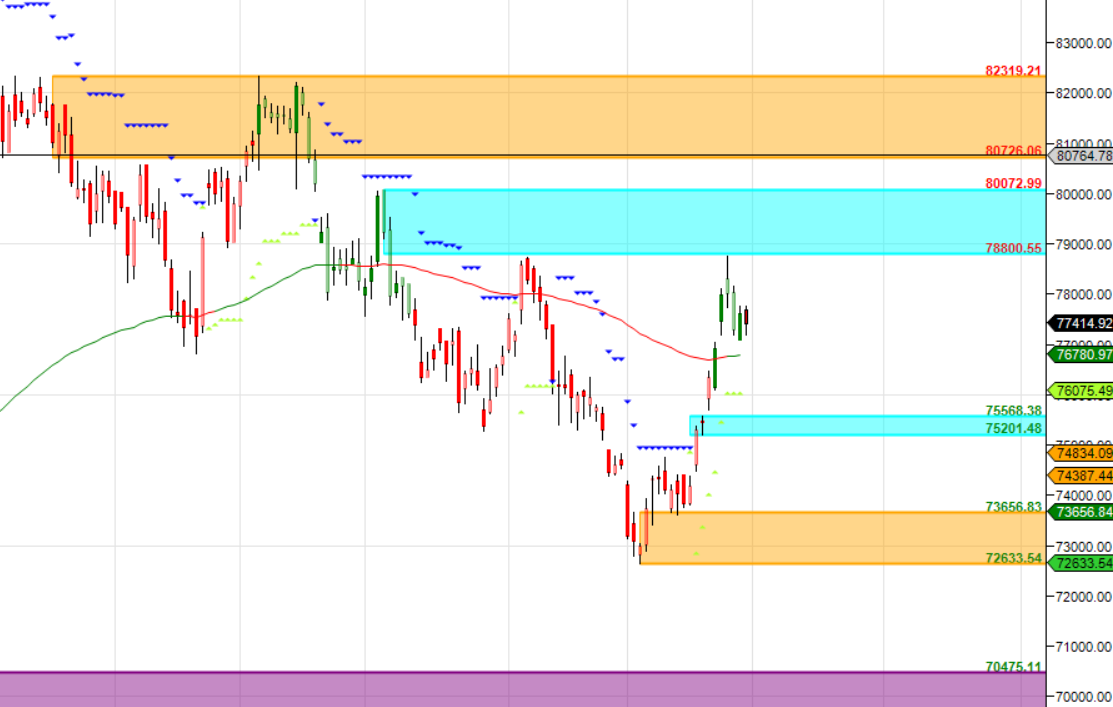

SENSEX Supply and Demand

Self Explanatory Chart

SENSEX Time Analysis Pressure Dates

02 April is the Important Gann/Astro Date for coming week.

SENSEX Weekly Chart

Price has formed Gravestone Doji on Weekly Chart

SENSEX Monthly Charts

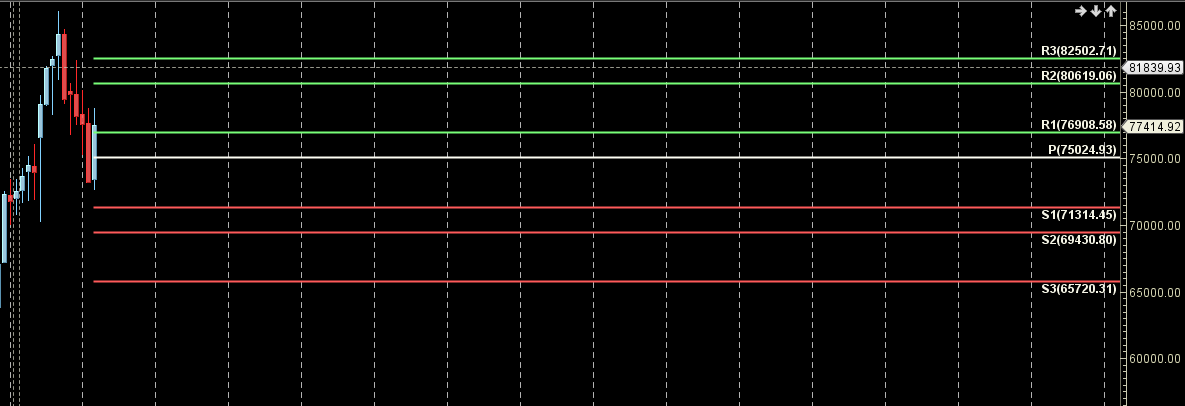

78500 is Monthly resistance zone 76908 is Support zone.