FII Activity: Bullish Shift in Nifty Index Futures with Short Covering

Foreign Institutional Investors (FIIs) maintained a bullish stance in the Nifty Index Futures market, buying 11,321 contracts worth ₹1,918 crore. This activity resulted in a net open interest increase of 1,555 contracts, indicating fresh long additions alongside short covering.

Breaking Down FII Activity

✔ FIIs added 2,347 long contracts, increasing their bullish exposure.

✔ FIIs covered 7,876 short contracts, reducing their bearish bets, signaling a shift in sentiment.

Client Behavior

✔ Clients covered 8,269 long contracts, likely booking profits after the rally.

✔ Clients covered 924 short contracts, showing a shift away from bearish positioning.

Current Positioning in Index Futures

- FIIs: Actively reducing shorts and adding longs, signaling a positive shift in market sentiment.

- Clients: Reducing both long and short exposure, suggesting profit-taking and a neutral outlook.

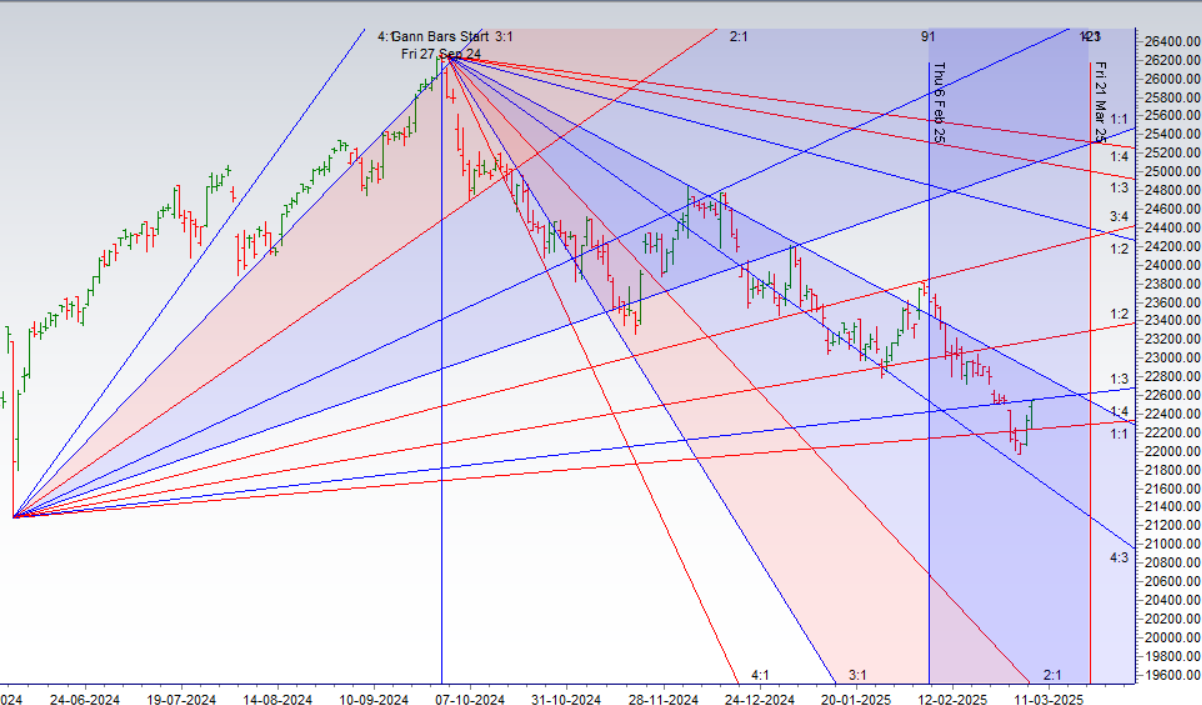

As discussed, Nifty rallied strongly with the Mercury in Aries effect and Mercury’s close proximity to the Sun playing out in the market. Today’s Mercury-Jupiter conjunction further reinforced the bullish sentiment, with price bouncing exactly from the Gann level of 21,952, confirming the confluence of price and time cycles.

Key Levels to Watch for Expiry Day

Bullish Support Zone: 22,250–22,266 → Bulls must hold this range to sustain momentum.

Upside Targets for Expiry:

- 22,444 (first resistance)

- 22,500 (psychological level & key resistance)

Bulls successfully defended the 22,250 level, with today’s low at 22,245, precisely aligning with Mercury Ingress and the Venus Retrograde high. As expected, Nifty rallied to 22,500, confirming the confluence of Gann price levels and astro cycles in identifying the bottom.

Key Levels to Watch for Weekly Close

Bullish Confirmation: A close above 22,666 will strengthen momentum heading into next week.

Strong Support: 22,250–22,300 remains the critical demand zone.

Upside Target: Sustaining above 22,666 can push Nifty towards 22,775–22,820 next week.

With astro and Gann factors aligning, bulls have regained control, but weekly closing above 22,666 is key for sustained upside.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 22544 for a move towards 22618/22693/22767. Bears will get active below 22469 for a move towards 22395/22320.

Traders may watch out for potential intraday reversals at 10:32,11:45,12:31,01:22,02:23 How to Find and Trade Intraday Reversal Times

Nifty March Futures Open Interest Volume stood at 1.81 lakh cr , witnessing addition of 2.78 Lakh contracts. Additionally, the decrease in Cost of Carry implies that there was addition of LONG positions today.

Nifty Advance Decline Ratio at 42:08 and Nifty Rollover Cost is @22724 closed below it.

Nifty Gann Monthly Trade level :22194 closed above it.

Nifty has closed below its 20 SMA @ 22801 Trend has changed to Buy on Dips till above 22331

Nifty options chain shows that the maximum pain point is at 22500 and the put-call ratio (PCR) is at 0.88.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 22600 strike, followed by 22800 strikes. On the put side, the highest OI is at the 22400 strike, followed by 22300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 22300-22600 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 2377 Cr , while Domestic Institutional Investors (DII) bought 1617 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 22094-22751-23408-24105-24801 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Trading can be a lot of fun, but it’s important to remember that it’s also a business. Don’t get too caught up in the excitement and lose sight of your goals. Have fun and enjoy the ride.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 22398. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 22533, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 22575 Tgt 22600, 22630 and 22666 ( Nifty Spot Levels)

Sell Below 22494 Tgt 22475, 22444 and 22412 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators