FII Activity: Bullish Sentiment in Bank Nifty Index Futures with Position Unwinding

Foreign Institutional Investors (FIIs) maintained a bullish stance in the Bank Nifty Index Futures market, actively buying 4,830 contracts worth ₹701 crore. However, the net open interest decreased by 718 contracts, indicating that while FIIs were net buyers, there was position unwinding rather than aggressive fresh long additions.

Key Takeaways from FII Activity

✔ Net Buying of 4,830 contracts suggests FIIs are leaning bullish on Bank Nifty.

✔ Decrease in Open Interest (-718 contracts) indicates positions were squared off, possibly profit booking or rolling over of contracts.

✔ The absence of a major rise in OI means FIIs are buying but not aggressively adding fresh long positions.

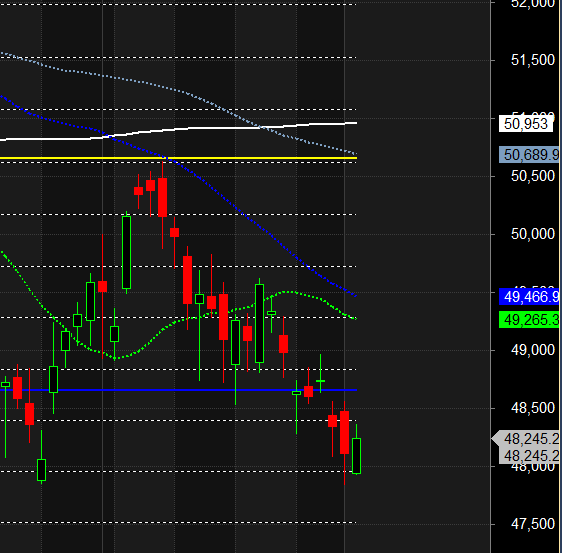

Bank Nifty continues to hold its Gann angle support zone on the daily chart, while forming another Doji on the weekly chart—a sign of indecision and potential reversal.

Adding to the significance:

✔ Three consecutive months of decline on the monthly chart → A key inflection point.

✔ Inside Bar Formation → Signals price contraction, setting up for a breakout.

✔ New Moon Today → Often linked to shifts in market sentiment.

✔ Venus & Mercury Sign Change Over the Weekend → Astro cycle shift could trigger high volatility next week.

Key Levels to Watch

Crucial Battle Zone: 48,500–48,729 → Bulls & Bears will fight for control around this range.

Bullish Breakout Above: 48,729 → Could lead to a strong rally towards 49,242 / 49,700.

Bearish Breakdown Below: 48,500 → Could trigger another wave of selling towards 48,000 / 47,844.

Stay prepared for a trending move—astro, Gann, and technical factors are aligning!

With key support holding, an inside bar breakout pending, and major astro shifts ahead, Bank Nifty is at a critical turning point. A breakout or breakdown is likely in the coming sessions!

Bank Nifty continues to hold its Gann angle support zone, as shown in the chart below. After Trump’s tariff hike, the index formed an Inside Bar candle, signaling a range contraction before a breakout.

Key Technical & Astro Insights

✔ Inside Bar Formation → Suggests a potential breakout or breakdown in the next session.

✔ Holding the Low of Venus Retrograde (Monday’s Low) → Indicates astro support in play (as discussed in the video below).

✔ Strong Demand Zone at 47,800–48,000 → Price has bounced multiple times from this level, making it a key support area.

Key Levels to Watch

Bullish Breakout Above: 48,400 → Could trigger a 500-point rally towards 48,900 / 49,000.

Bearish Breakdown Below: 47,924 → Could lead to a 500-point drop towards 47,500 / 47,400.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 48278 for a move towards 48497/48716/48934.Bears will get active below 48060 for a move towards 47841/47666.

Traders may watch out for potential intraday reversals at 09:15,10:42,11:53,01:49,02:11 How to Find and Trade Intraday Reversal Times

Bank Nifty March Futures Open Interest Volume stood at 30.6 lakh, with liquidation of 2.6 lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closeure of SHORT positions today.

Bank Nifty Advance Decline Ratio at 06:06 and Bank Nifty Rollover Cost is @49026 closed Below it.

Bank Nifty Gann Monthly Trade level :48478 closed below it.

Bank Nifty closed below 20 SMA @49265 ,Trend is Buy on Dips once above 48500.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 51408-49965-48521-47159. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 49000 strike, followed by the 49500 strike. On the put side, the 48500 strike has the highest OI, followed by the 48000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 48000-49000 range.

The Bank Nifty options chain shows that the maximum pain point is at 48000 and the put-call ratio (PCR) is at 0.71. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

When you really believe that trading is simply a probability game, concepts like right or wrong or win or lose no longer have the same significance.” – Mark Douglas

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 48636 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 48428 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 48150 Tgt 48288, 48430 and 48700 ( BANK Nifty Spot Levels)

Sell Below 48000 Tgt 47778, 47610 and 47444 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators