FII Activity: Bullish Sentiment in Nifty Index Futures

Foreign Institutional Investors (FIIs) displayed a bullish outlook in the Nifty Index Futures market, actively buying 14,512 contracts worth ₹322 crores. This activity led to a minor decrease of 6,776 contracts in the net open interest.

Breaking Down FII Activity:

- FIIs added 4,009 long contracts.

- FIIs covered 17,808 short contracts, reducing their short exposure significantly.

Client Behavior:

- Clients covered 5,921 long contracts.

- Clients also covered 479 short contracts.

Current Positioning in Index Futures:

- FIIs: Holding 19% long and 81% short positions, reflecting a strong bearish bias despite recent activity leaning toward long positions.

- Clients: Holding 71% long and 29% short positions, showcasing a more optimistic market outlook.

Analysis:

The data highlights a contrast in sentiment between FIIs and Clients:

- FIIs continue to maintain a strong bearish bias, despite reducing short positions and increasing long exposure.

- Clients appear to remain largely optimistic, with the majority of their positions on the long side.

Traders’ Note:

The reduction in short exposure by FIIs suggests caution in maintaining aggressive bearish positions. However, with FIIs still holding a significant short bias, traders should monitor price action closely for any potential reversal signals.

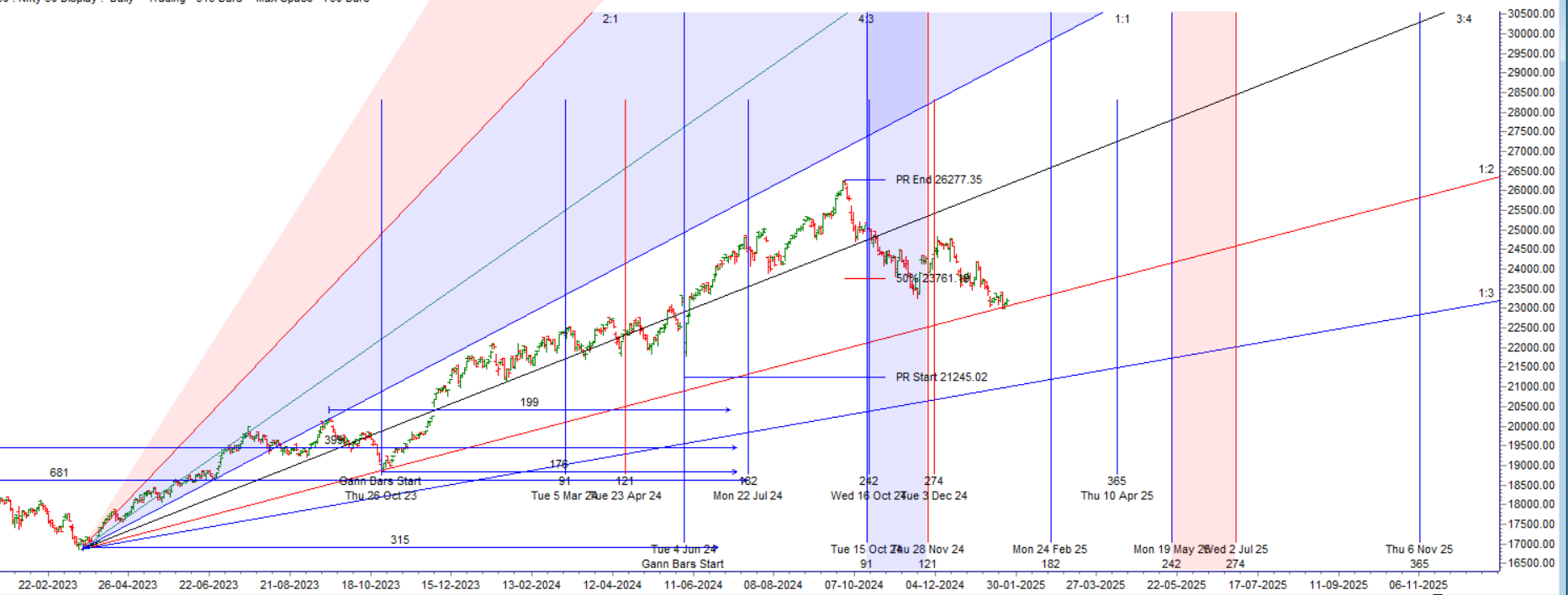

Nifty saw a bounce back from the 22,976–22,981 range, which aligns with the Gann angle support zone. However, it continues to face resistance at the 23,170–23,200 zone, a critical Gann resistance level and the Sun Ingress low.

Key Astrological Aspects Today:

- Mercury Opposition Mars

- Mercury Trine Uranus

Mercury often has a significant influence on Nifty’s price movements, while Mars and Uranus are expected to impact Real Estate and IT stocks, potentially causing heightened activity and volatility in these sectors.

Traders’ Note:

- Watch 23,200 for a breakout or reversal zone.

- Real Estate and IT sectors might exhibit sharp moves, providing trading opportunities.

Stay alert to these key levels and sector-specific impacts to navigate the day’s market effectively.

Yesterday, IT and Real Estate sectors showed positive momentum fueled by the Mars and Uranus Aspect. Today, markets are expected to open gap up, setting the stage for a potential breakout.

Key Levels to Watch:

- For Bulls:

- Bulls need to defend 23,170 (Sun Ingress low) to maintain command.

- A close above 23,300 will confirm a breakout, bringing momentum that could push the index towards 23,385/24,485.

- For Bears:

- Bears will gain control only if the price breaks below 23,108.

Astrological Insight: Bayer Rule 9

As per Bayer Rule 9:

“Big changes in the market are seen when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius, as well as 24 degrees 14 minutes of Capricorn.”

This alignment indicates the potential for significant market moves today.

Weekly Close Importance:

Today being the weekly close, bulls need to secure a close in the 23,275-23,290 range for a bullish setup heading into next week’s expiry.

Traders’ Note:

- Monitor price action closely at the critical levels of 23,300 for breakout confirmation.

- A sustained move above this level could set the tone for further upside next week.

- Bulls should focus on defending 23,170, while bears will only regain control below 23,108.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 23204 for a move towards 23280/23355. Bears will get active below 23108 for a move towards 23982/23898/23800.

Traders may watch out for potential intraday reversals at 09:15,12:07,01:34,02:26 How to Find and Trade Intraday Reversal Times

Nifty December Futures Open Interest Volume stood at 1.36 lakh cr , witnessing liquidation of 4.8 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was covering of SHORT positions today.

Nifty Advance Decline Ratio at 34:16 and Nifty Rollover Cost is @23879 closed below it.

Nifty Gann Monthly Trade level :23721 closed below it.

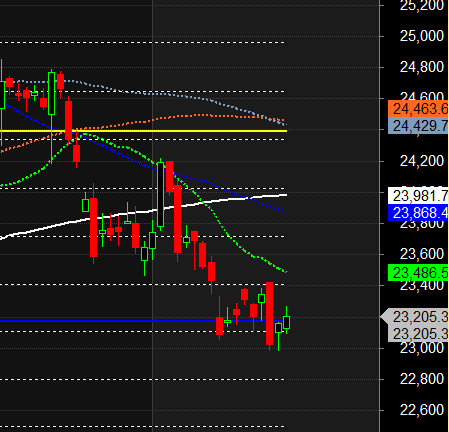

Nifty has closed below its 200 SMA @ 23945 Trend has changed to Buy on Dips till above 23200

Nifty options chain shows that the maximum pain point is at 23200 and the put-call ratio (PCR) is at 0.72.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 23200 strike, followed by 23300 strikes. On the put side, the highest OI is at the 23000 strike, followed by 22900 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 22950-23300 levels.

Retail Activity in Options Market

According to today’s data:

- Retail investors sold 400 K Call Option contracts and shorted 444 K Call Option contracts.

- They also bought 694 K Put Option contracts and covered 461 K Put Option contracts, indicating a bearish bias in the market.

FII Activity in Options Market

- Foreign Institutional Investors (FIIs) added 161 K Call Option contracts and covered 208 K Call Option contracts.

- On the Put side, FIIs added 13.5 K Put Option contracts and shorted 284 K Put Option contracts, suggesting a shift toward a Neutral to Bullish bias.

In the cash segment, Foreign Institutional Investors (FII) sold 5462 crores, while Domestic Institutional Investors (DII) bought 3712 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 22751-23408-24105-24801 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Mental Toughness is my business. Make it part of yours. Keep a journal. Feed your mind.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 23275. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 23256 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 23255 Tgt 23295, 23343 and 23385 ( Nifty Spot Levels)

Sell Below 23170 Tgt 23129, 23085 and 23044 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators