FII Activity: Bullish Sentiment in Bank Nifty Index Futures

Foreign Institutional Investors (FIIs) demonstrated a Bearish stance in the Bank Nifty Index Futures market by Shorting 180 contracts worth ₹297 crores. This activity resulted in an increase of 4160 contracts in the net open interest.

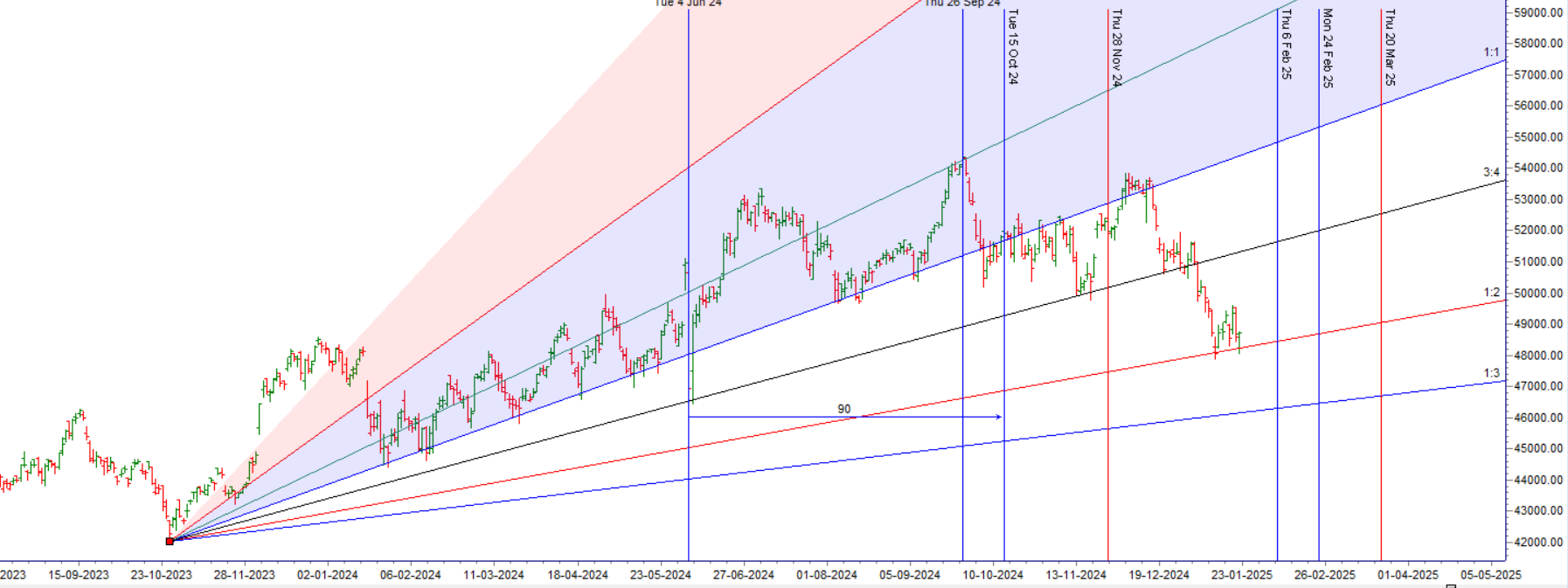

Bank Nifty witnessed a tremendous recovery yesterday, with the price finding support at the Gann angle in the 48,050–48,100 zone. Importantly, the index managed to close above 48,683, which aligns with the low of the Sun Ingress.

Key Stock to Watch:

HDFC Bank will play a critical role in determining the trend of Bank Nifty today. Its movement is likely to guide the broader index’s direction.

Key Levels to Watch:

- For Bulls:

As long as the 48,600–48,680 range is defended, bulls can push Bank Nifty toward 49,225/49,500 levels. - For Bears:

If the price falls below 48,500, bears may gain control, potentially dragging the index to 48,225/48,000 levels.

Traders’ Note:

Monitor HDFC Bank’s performance closely, as it could signal the strength or weakness of Bank Nifty’s trend. Trade cautiously while keeping these critical levels in mind.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 48777 for a move towards 48992/49211/49430.Bears will get active below 48554 for a move towards 48336/48117/47898.

Traders may watch out for potential intraday reversals at 09:15,12:53,01:39,02:30 How to Find and Trade Intraday Reversal Times

Bank Nifty December Futures Open Interest Volume stood at 23 lakh, with liquidation of 0.60 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of SHORT positions today.

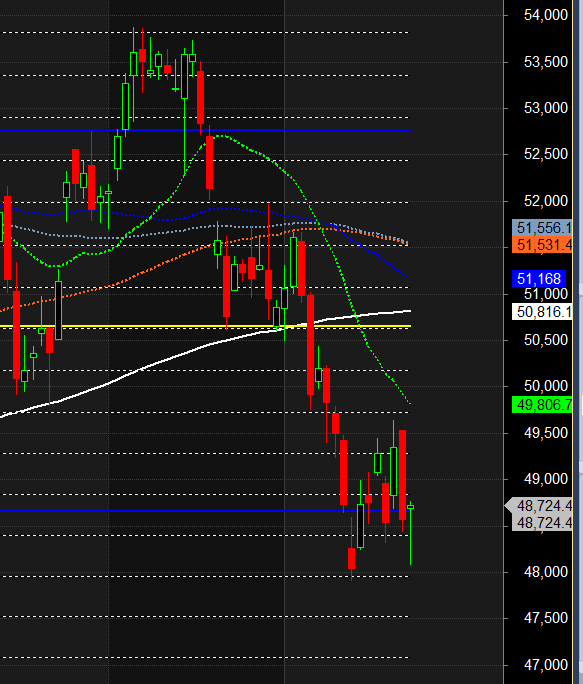

Bank Nifty Advance Decline Ratio at 08:04 and Bank Nifty Rollover Cost is @51689 closed Below it.

Bank Nifty Gann Monthly Trade level :50312 closed below it.

Bank Nifty closed above 377 SMA @48293 ,Trend is Buy on Dips till above 48300.

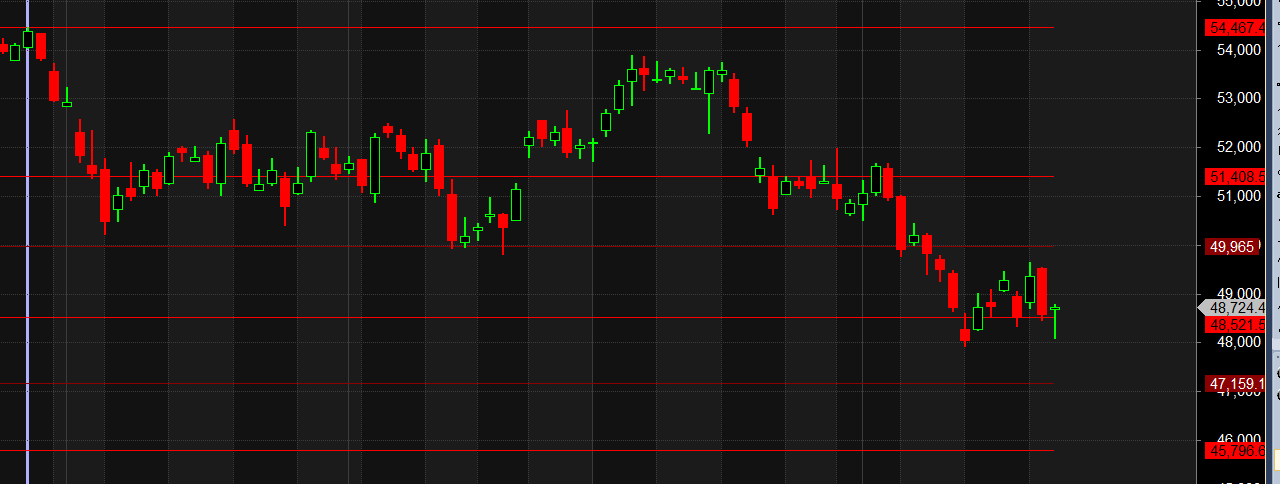

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 51408-49965-48521-47159. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.– Price has closed above 48521

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 49000 strike, followed by the 49500 strike. On the put side, the 48500 strike has the highest OI, followed by the 48000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 48500-49500 range.

The Bank Nifty options chain shows that the maximum pain point is at 48500 and the put-call ratio (PCR) is at 0.75. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Mental Toughness is my business. Make it part of yours. Keep a journal. Feed your mind.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 48932. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 48624 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 48800 Tgt 48950, 49108 and 49225 ( BANK Nifty Spot Levels)

Sell Below 48610 Tgt 48343, 48166 and 48008 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

Dear Sir,

I am not getting your valuable daily ADVICES in my email.

(Just like above)

What to do for it.

Your early reply is highly solicited