FII Activity: Bearish Sentiment in Nifty Index Futures

Foreign Institutional Investors (FIIs) displayed a bearish approach in the Nifty Index Futures market by shorting 14,384 contracts worth ₹898 crores. This activity resulted in a decrease of 4,762 contracts in the net open interest.

FIIs covered 11,388 long contracts and added 3,092 short contracts, reflecting a preference for reducing their long exposure while increasing their short positions in Nifty Futures. The net FII long-short ratio is 0.77, indicating a more bearish stance.

On the other hand, Clients added 25,267 long contracts and covered 2,498 short contracts, indicating positioning for a potential rally.

Current Positioning in Index Futures:

- FIIs: Holding 39% long and 61% short positions.

- Clients: Holding 62% long and 38% short positions.

Analysis:

FIIs have a bearish tilt, with a higher percentage of short positions, while clients appear more optimistic, holding a larger percentage of long positions. This contrast in positioning could shape market trends in the coming sessions.

Nifty experienced a wild ride today, falling nearly 300 points before recovering the entire move and closing 200 points in the green. A similar level of volatility was observed during the 5th December Nifty expiry, and today’s swings coincided with the Sensex Weekly expiry.

The price fluctuations, despite the absence of any major macroeconomic or corporate news, suggest the influence of hedge fund activity in options. This also highlights the lack of depth in our markets, as such wild moves are typically more common in US or European markets. Regulators need to take significant steps to improve the options market structure and reduce such volatility.

Without additional tools, navigating such sharp intraday moves can result in substantial losses. Today’s low was around the Monthly Open of 24,140, which proved to be a strong support level. As Gann always emphasized the importance of the Open price, today was a live example of how these old studies still work perfectly in modern markets.

Now Bulls need to close above 24800 above 24770 which is Octave point as shown in below chart. Any close above 24800 can open gates for rally towards 25000/25147.

There is a possibility of a gap-down opening on Monday, as we have two significant astrological events:

- New Moon

- Mercury Turning Direct

Traders should exercise caution and manage positions effectively in anticipation of further volatility.

Flexibility In Trading

Nifty had a quiet day, as the price reacted from the Gann Octave Point. The index opened lower and traded in a narrow range throughout the day, indicating that the market is undergoing a time correction following Friday’s volatile move.

With two important astrological dates in play today, the Doji formation on such a date often serves as a helpful indicator for capturing the next trade setup.

Key Levels to Watch:

- For Bulls: Momentum will build above 24,780.

- For Bears: A break below 24,601 could trigger a decline.

In between these levels, the price is likely to continue its time correction.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24684 for a move towards 24762/24841. Bears will get active below 24606 for a move towards 24527/24444.

Traders may watch out for potential intraday reversals at 09:30,10:02,11:44,12:30,01:58,02:30 How to Find and Trade Intraday Reversal Times

Nifty December Futures Open Interest Volume stood at 1.08 lakh cr , witnessing addition of 0.20 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of SHORT positions today.

Nifty Advance Decline Ratio at 15:35 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :24406 close above it.

Nifty has closed above its 20 SMA @ 24421 Trend is Buy on Dips till holding 24400.

Nifty options chain shows that the maximum pain point is at 24600 and the put-call ratio (PCR) is at 0.85 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24700 strike, followed by 24800 strikes. On the put side, the highest OI is at the 24400 strike, followed by 24300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24500-24800 levels.

Retail Activity in Options Market: Bullish Bias Indicated

According to today’s data, retail investors have bought 189K Call Option contracts and shorted 169K Call Option contracts. Additionally, they bought 237K Put Option contracts and shorted 527K Put Option contracts, indicating a bullish bias in the market.

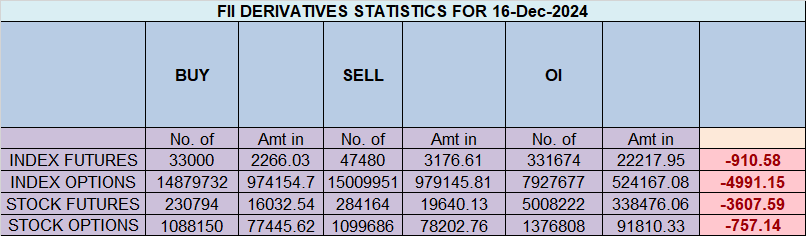

FII Activity in Options Market: Bearish Bias Indicated

Foreign Institutional Investors (FIIs) bought 160K Call Option contracts and shorted 309K Call Option contracts. On the Put side, FIIs bought 83K Put Option contracts and shorted 65K Put Option contracts, suggesting they have shifted to a bearish bias.

In the cash segment, Foreign Institutional Investors (FII) sold 278 crores, while Domestic Institutional Investors (DII) sold 234 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23218-23889-24600-25310 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

You cannot achieve mastery with a mediocre effort. If you want big returns in the stock market, you must make your trading a priority.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24575. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24740, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24700 Tgt 24743, 24785 and 24824 ( Nifty Spot Levels)

Sell Below 24630 Tgt 24600, 24555 and 24500 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

Hi,

The key levels to watch for bulls and bears are wrong I think, Should it be 24780/24601 instead of 23780/23601

aplogies