During the last monthly expiry, Finance Nifty witnessed a move of 2%. Tomorrow, the Mercury Retrograde impact, as discussed in the video below, is expected to bring heightened volatility.

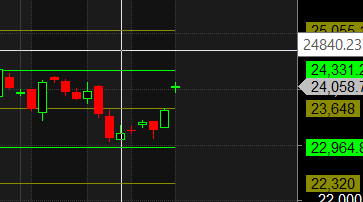

Currently, Finance Nifty is trading near its Octave Point of 24,161, a very crucial level to watch tomorrow.

- Above 24,161: A rally toward 24,389-24,421 is likely.

- Below 24,161: Failure to cross this level could lead to a decline toward 23,901.

Traders should closely monitor these levels to make informed trading decisions.

Fatigue Management for Traders: Sleep Your Way to Peak Performance

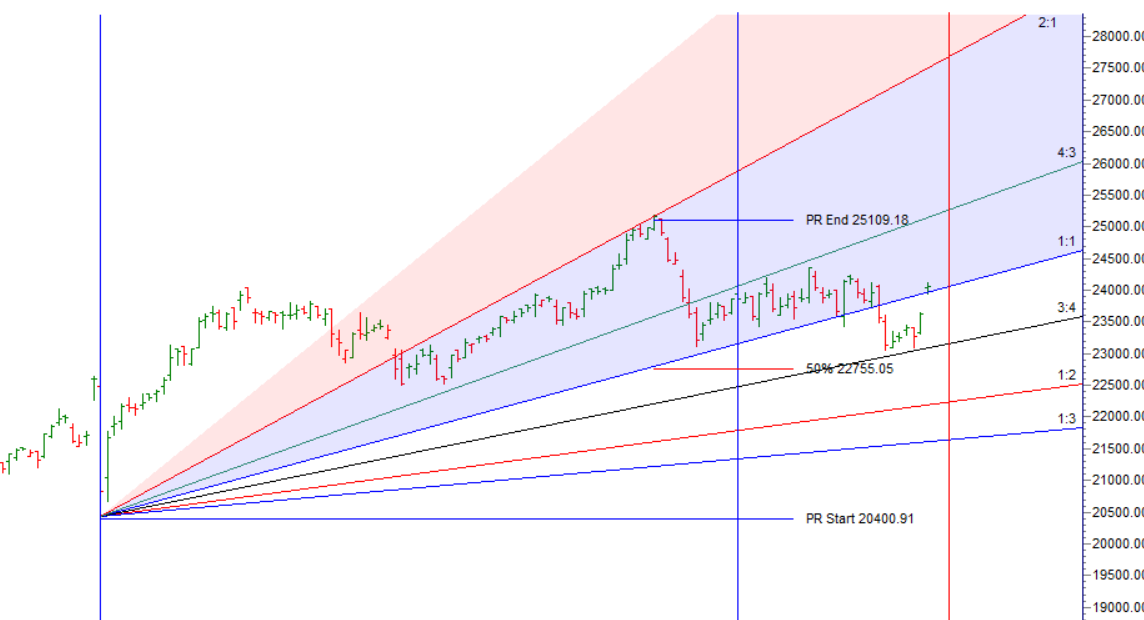

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 24067 for a move towards 24145/24223/24301. Bears will get active below 23911 for a move towards 23833/23755.

Traders may watch out for potential intraday reversals at 10:01,11:22,01:23,02:42 How to Find and Trade Intraday Reversal Times

Finance Nifty September Futures Open Interest Volume stood at 66625 with liquidation of 5000 contracts. Additionally, the increase in Cost of Carry implies that there was a liquidation of LONG positions today.

Finance Nifty Advance Decline Ratio at 17:03, Finance Nifty Rollover Cost is @23628 closed above it

Finance Nifty Gann Monthly Trade level :23858 close above it.

Finance Nifty closed above 20/50/100/200 SMA, Trend is Buy on Dips till above 23950.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 23648-24331-25055-25778. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 24100 strike, followed by the 24200 strike. On the put side, the 24000 strike has the highest OI, followed by the 23900 strike. This indicates that market participants anticipate Finance Nifty to stay within the 23900-24200 range.

The Finance Nifty options chain shows that the maximum pain point is at 24000 and the put-call ratio (PCR) is at 1.02. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

A professional trader isolates himself from the herd and has trained himself to become a predator rather than a victim. He understands and recognizes principles that drive the markets and refuses to be misled by good or bad news, tips, advice, brokers advice and well-meaning friends. When the market is being shaken-out on bad news he is in there buying. When the Herd is buying and the news is good he is looking to sell.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 23840. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24065, Which Acts As An Intraday Trend Change Level.

FIN Nifty Expiry Range

Upper End of Expiry : 24250

Lower End of Expiry : 23865

FIN Nifty Intraday Trading Levels

Buy Above 24075 Tgt 24108, 24144 and 24199 ( FIN Nifty Spot Levels)

Sell Below 24033 Tgt 24000, 23965 and 23920 (FIN Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.